Exec Summary:

Market Movers: ExxonMobil will acquire a 40% joint interest in Enterprise Products’ Bahia NGL pipeline, a deal that changes the competitive landscape in the Permian Basin.

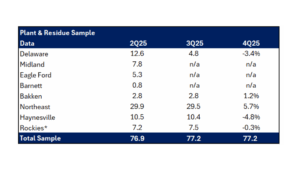

Estimated Quarterly Volumes: Northeast meter point samples are up 5.7% from 3Q25, led by gains from Williams’ Bradford Supply Hub and MPLX’s Mobley plant.

Calendar: Model updates will be released Friday, Dec. 12.

Market Movers:

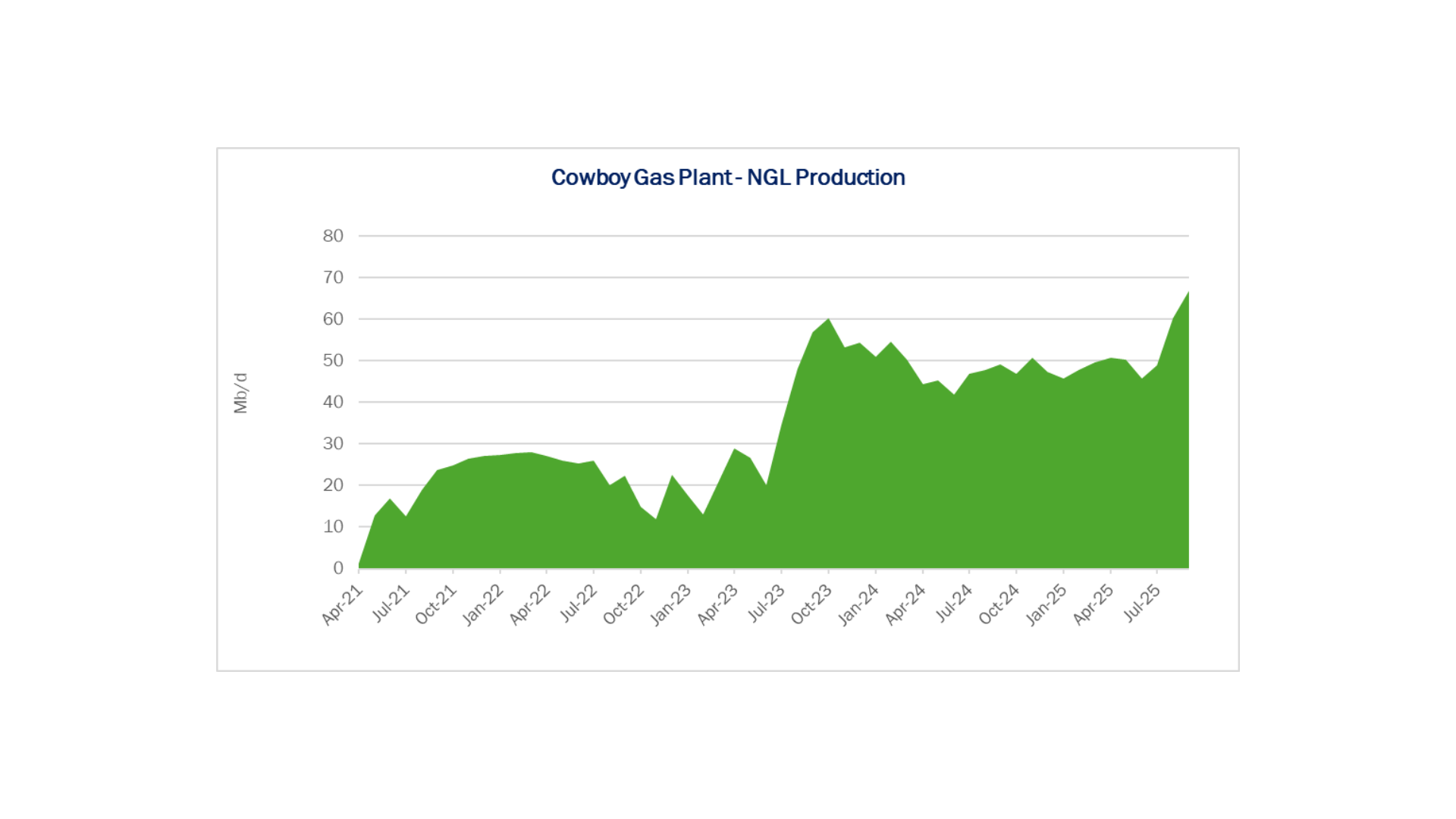

ExxonMobil (XOM) has agreed to acquire a 40% joint interest in Enterprise Products’ (EPD) Bahia NGL pipeline, sealing a deal that changes the competitive landscape in the Permian Basin. The two companies plan to expand Bahia from 600 Mb/d to 1 MMb/d and build a 92-mile lateral directly to XOM’s Cowboy gas plant in Eddy County, NM.

The companies expect to complete the Bahia expansion and extension, called the Cowboy Connector Pipeline, in 4Q27. Exxon will invest $650MM under the agreement, according to Reuters.

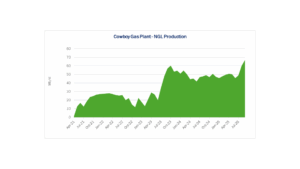

East Daley’s “G&P System Analysis” dashboard in Energy Data Studio shows the Cowboy plant running effectively full at its 600 MMcf/d of processing capacity and producing ~60 Mb/d of NGLs (see figures below). According to the NGL Hub Model, all the barrels currently flow on EPD’s Mid-America Pipeline (MAPL) system.

While the deal doesn’t shift NGLs to a different pipeline owner, it is strategically meaningful in how it reshapes Exxon’s broader commercial incentives. By partnering with Enterprise and co-sponsoring the Bahia expansion, Exxon is effectively tying its long-term Permian NGL strategy deeper into the EPD network. That matters because XOM is one of the largest upstream contributors to Energy Transfer (ET), accounting for ~18% of its Permian gas processing volumes.

The Permian Basin at a Crossroads: Download Why This Pipeline Boom is Different

The Permian’s next big buildout is already taking shape — but this time, the drivers aren’t producers chasing oil. East Daley’s latest white paper reveals how gas demand from AI data centers, LNG exports, and utilities is rewriting the midstream playbook. Over 9 Bcf/d of new capacity and $12 billion in investments are reshaping flows, turning the Permian into a gas powerhouse even as rigs decline. Read Part II: Why This Pipeline Boom is Different

Cowboy itself poses no direct risk to Energy Transfer, but the new alignment with EPD creates a stronger pull for Exxon’s other barrels and future growth volumes, meaning discretionary NGL flows could migrate toward EPD instead of ET. This is the emerging competitive risk for Energy Transfer, small today but potentially material over time across its pipe, frac, storage and export chain.

This shift highlights a widening philosophical divide among the Permian’s major NGL operators. EPD and Targa Resources (TRGP) are taking bold, offensive positions by investing in long-haul systems, in TRGP’s case the recently announced Speedway Pipeline. The companies have made the commitments despite a nearly 1.5 MMb/d overbuild in Permian NGL takeaway, according to the NGL Hub Model. The strategy is clear: the winners in the next cycle will be those operators that control the molecules, not the ones that wait for perfect utilization.

Energy Transfer, by contrast, is signaling caution. In its 3Q25 earnings, ET executives discussed converting an NGL pipeline to gas service, at the same time its competitors are expanding. ET isn’t structurally weak; its asset base is deep and integrated, but the company is being pressured into a strategic reckoning as the competitive board tilts toward operators willing to take risk to secure barrels.

The outcome is far from settled. Boldness could pay off for EPD and TRGP, or their expansions could deepen pressure on rates in an already crowded market. ET’s discipline could prove prudent, or it could watch competitors reshape the Permian NGL landscape around them.

What is clear is this: The competitive question is no longer about overbuild – it’s about who is positioning to capture market share. EPD and Targa are playing offense. ET must decide whether to match that posture, or risk losing control of the barrels that drive the value chain.

Estimated Quarterly Volumes:

Notes: 4Q25 is expressed as Q-o-Q growth from 3Q25. Rockies is the sum of Big Horn, DJ, Green River, Piceance, Powder River, San Juan, Uinta and Wind River.

- Northeast meter point samples are up 5.7% from 3Q25. The WMB–Bradford Supply Hub is up 3.71% from 3Q25 and MPLX–Mobley is up 12.5% from 3Q25. EQT is the largest producer behind the Mobley system, responsible for 90% of the volumes.

- Haynesville meter point samples are down 4.8% from 3Q25. The KMI–KinderHawk system is down 7.49% from 3Q25 and the ET–East Texas system is down 1.2% from 3Q25. Zarvona Energy is the largest producer behind the ET system, responsible for 12% of the volumes.

Calendar: