Enterprise Products (EPD) wasted no time putting its new Bahia pipeline to use, reporting robust flows in its 4Q25 earnings. Early Bahia utilization meaningfully increases confidence in EPD’s 2026–27 growth outlook while raising competitive risk across the Permian NGL network.

Enterprise disclosed that Bahia and Shin Oak are running at ~80% utilization out of the Permian Basin, or throughput of roughly 960 Mb/d, shortly after Bahia entered service in December. In a competitive takeaway environment, this early fill materially de-risks EPD’s near-term EBITDA growth and supports the larger step-change expected in 2026–27 as downstream assets scale.

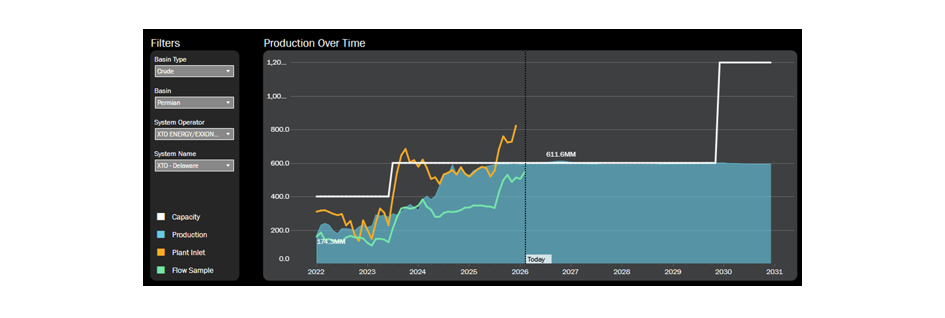

The composition of those volumes matters. ExxonMobil (XOM) provides long-cycle durability following its joint interest acquisition in Bahia, adding exposure to one of the fastest-growing producers in the Delaware Basin. The figure above, taken from the “G&P Tools” dashboard in East Daley Analytics’ Energy Data Studio, shows plant inlet and flow sample volumes on Exxon’s Delaware G&P system. East Daley’s G&P tools indicate Occidental (OXY) is most likely the other anchor. Together, XOM and OXY pair balance-sheet stability with growth velocity, an advantaged mix for early utilization.

Rising gas-to-oil ratios in Permian wells continue to provide a structural supply tailwind for NGLs, but EPD’s 4Q25 results show that commercial alignment is determining which systems capture incremental volumes first.

Importantly, higher-than-expected utilization on Enterprise’s NGL pipes implies displacement elsewhere. East Daley sees heightened downside risk to NGL pipeline volumes for Targa Resources (TRGP) and Energy Transfer (ET), as Exxon and Occidental are meaningful producers behind competing routes. To the extent those volumes are preferentially aligned with Enterprise’s integrated system, TRGP and ET pipes face incremental volume risk at the margin.

We also see elevated risk for Phillips 66’s (PSX) Delaware system, where Exxon accounts for roughly 17% of operated rigs. As Exxon consolidates NGL egress through Bahia and downstream Enterprise infrastructure, competing Delaware takeaway systems become more exposed to underutilization risk.

Bottom line: Bahia’s early success is not just additive for Enterprise, it is redistributive. Stronger alignment with Exxon and likely Occidental increases our confidence in EPD’s growth targets while heightening volume risk for competing Permian and Delaware NGL systems. In the jockeying for Permian NGL volumes, EPD seems to have captured an early-mover advantage that solidifies its NGL strategy to soak up crucial barrels.

See East Daley Analytics’ NGL Hub Model for more information on the Permian NGL outlook. – Julian Renton Tickers: EPD, ET, OXY, PSX, TRGP, XOM.

Download Part II of East Daley’s Permian Basin White Paper Series

Download Part II of East Daley’s Permian Basin White Paper Series

The Permian Basin’s next big buildout is already taking shape, but this time the driver isn’t crude oil. In The Permian Basin at a Crossroads: Why This Pipeline Boom is Different, East Daley Analytics’ latest white paper reveals how gas demand from AI data centers, utilities and LNG exports is rewriting the midstream playbook in the leading US basin. Over 10 Bcf/d of new capacity and $12 billion in investments are reshaping flows, turning the Permian into a gas powerhouse even as rigs decline. Read Part II: Why This Pipeline Boom is Different

Meet Daley, the Best AI Tool in Energy

Meet Daley, the newest member of our energy team. Our new AI assistant is live and available to all East Daley Analytics clients. Early feedback has been phenomenal. Daley is platform-specific and only pulls from East Daley’s own proprietary data and content. It’s not open-source or generic AI, but built to understand our structure, language and analytics. Whether you’re looking for a specific metric, forecast or explanation, Daley can get you there quicker. — Reach out to learn more about Daley!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.