Executive Summary: Rigs: The total US rig count increased by 2 rigs for the May 19 week, up from 570 to 572. Infrastructure: East Daley is updating our supply outlook in the Rocky Mountain region based on diverging aboveground trends in the Powder River and Denver-Julesburg basins. Storage: East Daley expects a withdrawal of 3.5 MMbbl in commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending May 31.

Rigs:

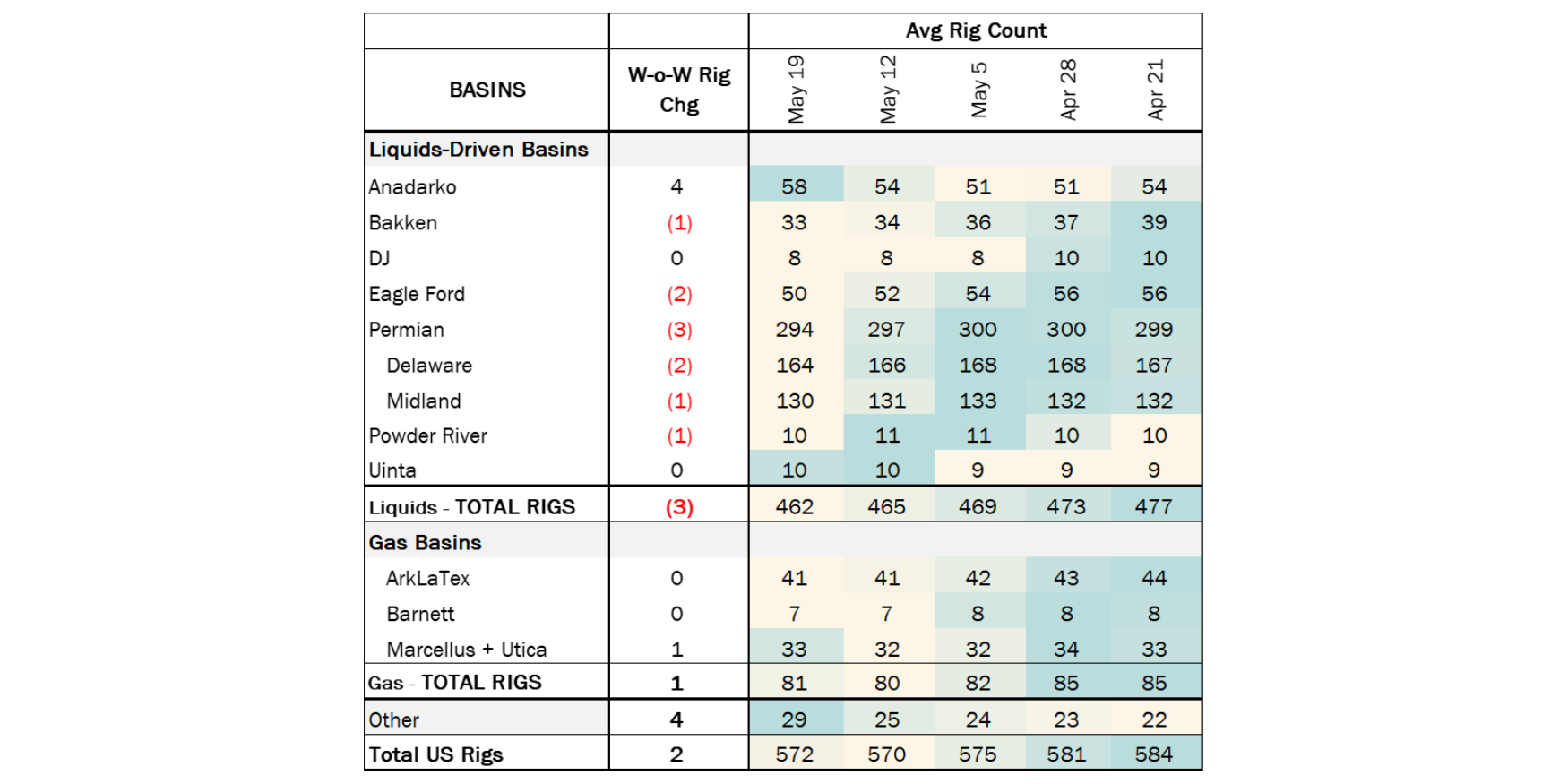

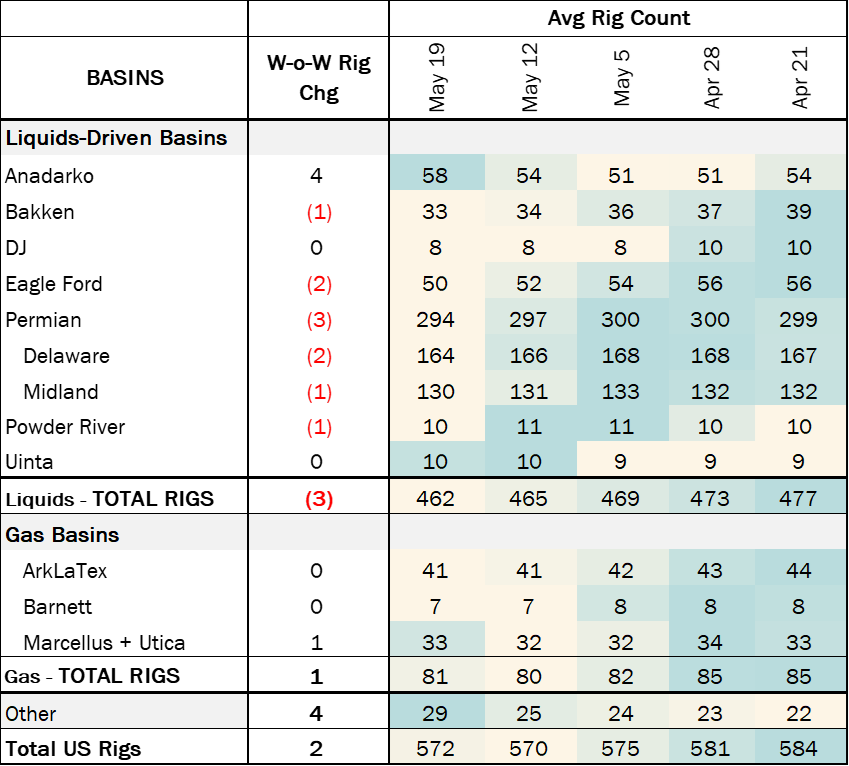

The total US rig count increased by 2 rigs for the May 19 week, up from 570 to 572. This is despite liquids-driven basins losing 3 rigs W-o-W, decreasing the rig count from 465 to 462. The Anadarko Basin gained 4 rigs, and the Bakken lost 1 rig. The Eagle Ford lost 2 rigs, decreasing the rig count from 52 to 50. The Permian lost 3 rigs, 2 rigs from Delaware and 1 rig from Midland. The Powder River Basin rig count also decreased by 1.

In the Anadarko, Downing-Nelson Oil and AGV Corp. each added 1 rig. Anadarko Basin operators DDD Exploration and Sanguine Gas Exploration LLC also added a rig each. In the Bakken basin, Enerplus removed 1 rig for a total of 33 rigs. There were 2 rigs lost In the Eagle Ford, as operators Texas American Resources and Overton Park Oil & Gas each dropped 1 rig. In the Permian, Delaware operators Marathon Oil and VTX Energy Operating each lost 1 rig and Midland operator De IV Operating also dropped a rig. In the Powder River, the total rig count fell from 11 to 10 as Devon Energy dropped a rig.

Infrastructure:

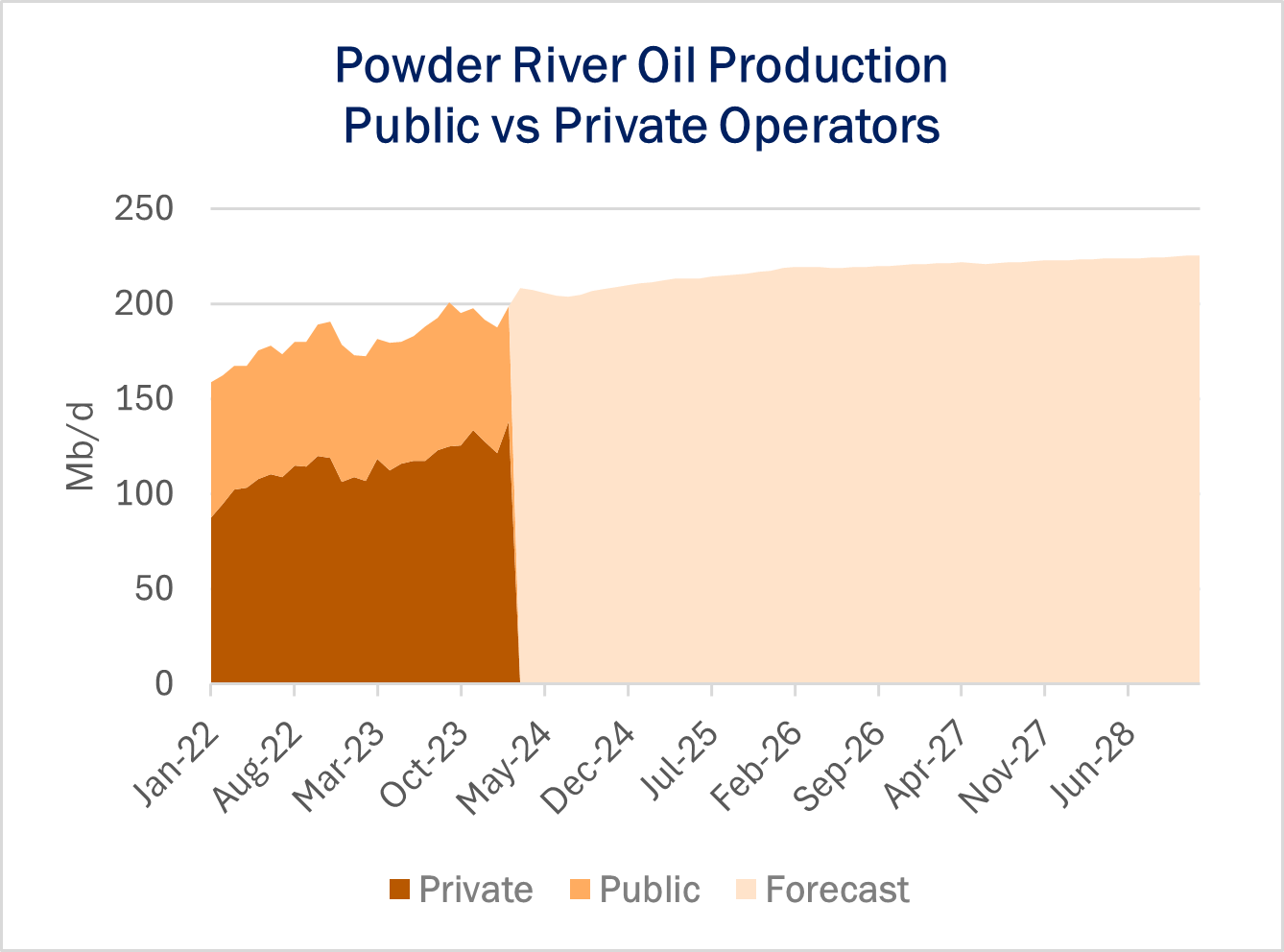

East Daley is updating our supply outlook in the Rocky Mountain region based on diverging aboveground trends in the Powder River and Denver-Julesburg basins.

In our latest basin updates, we forecast crude oil production from the Powder River will start ticking up in June ’24 and continue to grow. Production in the Powder River peaked at 224 Mb/d in December 2019 but fell sharply during Covid lockdowns, dropping 22% by 4Q22. Since then, Powder River output has steadily increased M-o-M. East Daley’s Production Scenario Tools forecast that basin production will reach new record highs by March 2028.

Conversely, in the DJ Basin, another key area within the Niobrara formation, EDA forecasts a gradual decline in oil production. Like the Powder River, DJ output peaked in 4Q19 at 564 Mb/d and fell sharply in the 2020-21 downturn. Production in the DJ has consistently risen since then, hitting 522 Mb/d in December ‘23.

In the Powder River, private operators, particularly Anschutz, are driving growth. As of February ‘24, production from the Wyoming basin stood at 199 Mb/d, with private E&Ps contributing 138 Mb/d (69%) of the total. Anschutz, the largest producer in the Powder River, has grown its production by 38% in the latest eight months, from 32 Mb/d in June 2023 to 44 Mb/d in Feb-24. EOG Resources (EOG) is also active in the Powder River.

We have lowered our outlook for the DJ primarily due to merger and acquisition (M&A) activity. Major players like Occidental (OXY) and Chevron (CVX) hold significant positions in the basin and are moderating spending to align with corporate discipline. OXY acquired Anadarko Petroleum in 3Q19, while Chevron purchased Noble Energy in 4Q20 and PDC Energy in 3Q23. Another top producer in the DJ Basin, Civitas Resources (CIVI), is focusing more on expanding its footprint in the Permian Basin.

Storage:

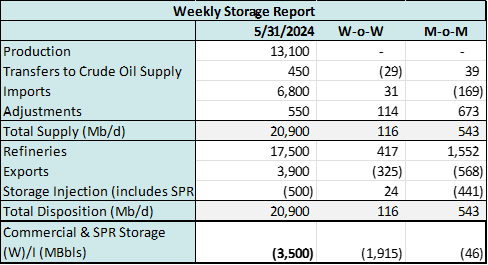

East Daley expects a withdrawal of 3.5 MMbbl in commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending May 31. We expect total US stocks, including the SPR, will close at 820 MMbbl.

The US natural gas pipeline sample, a proxy for change in oil production, increased ~0.19% W-o-W across all liquids-focused basins. Samples increased 4.56% in the Williston Basin and 5.39% in the Gulf of Mexico. The increases were offset by a .21% decline in the Permian. The Williston Basin has a very high correlation between gas volumes and crude oil volumes, whereas the Permian’s correlation is less than 45%. We expect US crude production to remain flat at 13.1 MMb/d.

According to US bill of lading data, US crude imports increased by 31 Mb/d W-o-W to 6.8 MMb/d. More than 60% of the supply originated from Canadian pipelines into the US, with the remainder largely coming from ships carrying crude from Mexico, Venezuela and Argentina.

As of May 17, there was ~75 Mb/d of refining capacity offline, including downtime for planned and unplanned maintenance. EDA expects gross crude inputs into refineries to increase by ~417 Mb/d W-o-W, coming in at 17.5 MMb/d.

Vessel traffic monitored by EDA along the Gulf Coast decreased W-o-W. There were 19 vessels loaded for the week ending May 31 and 22 the prior week. EDA expects US exports to be 3.9 MMb/d.

The SPR awarded contracts for 2.95 MMbbl to be delivered in June 2024. The SPR has 370 MMbbl in storage as of May 31, 2024.

Regulatory and Tariffs:

Presented by ARBO

Tariffs:

North Dakota Pipeline Company LLC North Dakota Pipeline Co. established a joint tariff on NDPL pipeline and Bakken US Pipeline for uncommitted movements from certain receipt points in North Dakota to the International Boundary near Portal, North Dakota to be effective July 1, 2024. (FERC No 6.0.0 IS24- 600, filed May 31, 2024)

Grand Mesa Pipeline, LLC Grand Mesa has increased the committed and uncommitted tariff rates in accordance with the Notice of Annual Change in the Producer Price Index for Finished Goods. Effective July 1, 2024 tariff rates will increase by 1.2647%. (FERC No 2.10.0 IS24- 150.000, filed May 31, 2024)

The above information is provided by ARBO’s Oil Pipeline Tariff Monitor. For more information on regulatory proceedings or tariff rates, please contact please contact Corey Brill via email at [email protected] or phone at 202-505-5296. https://www.goarbo.com/