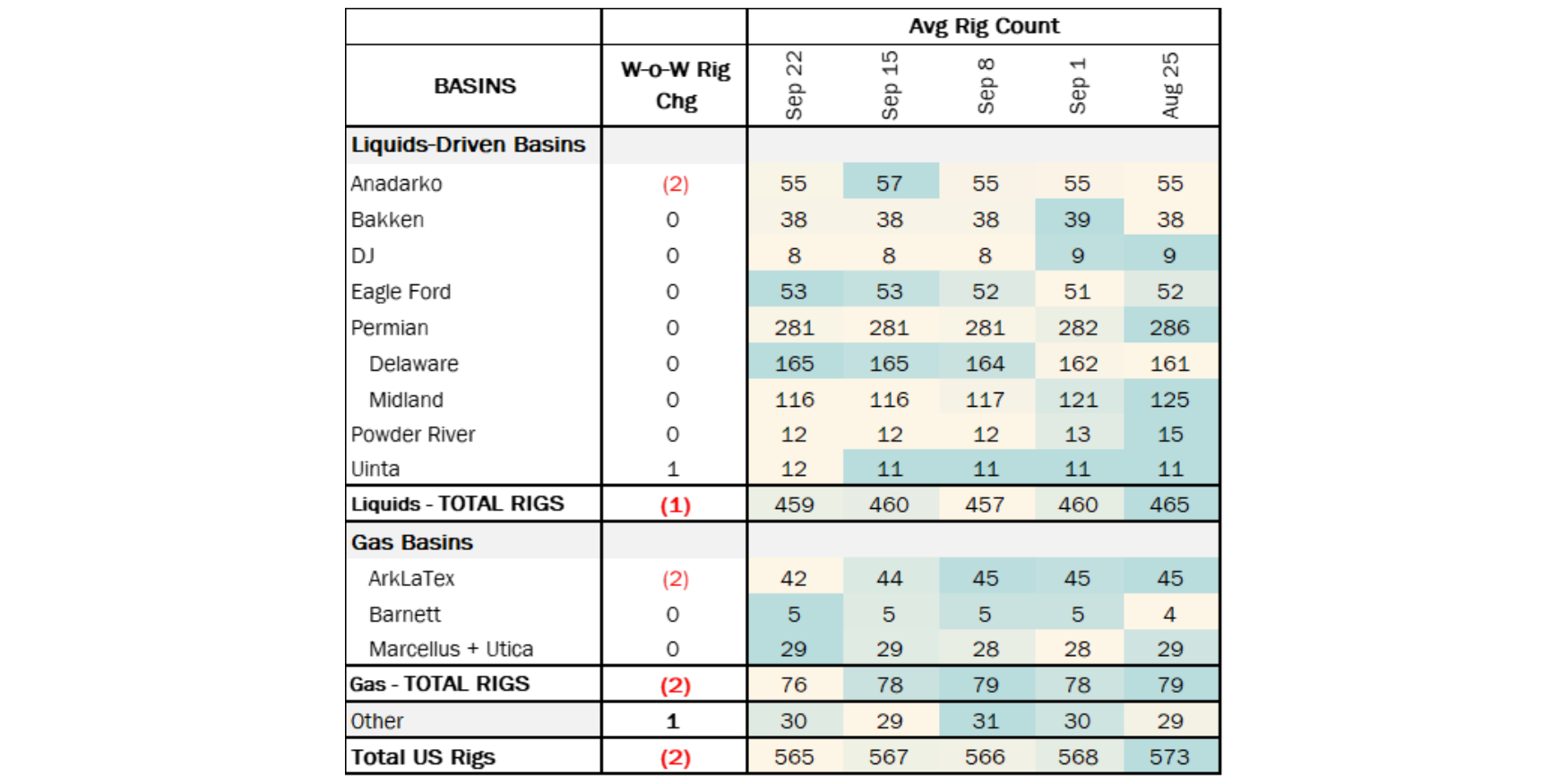

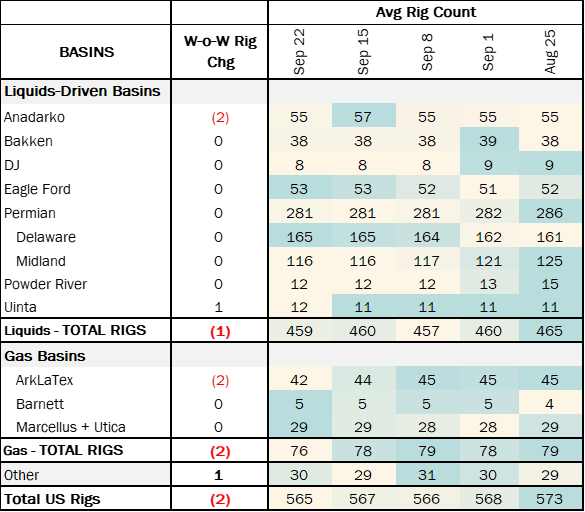

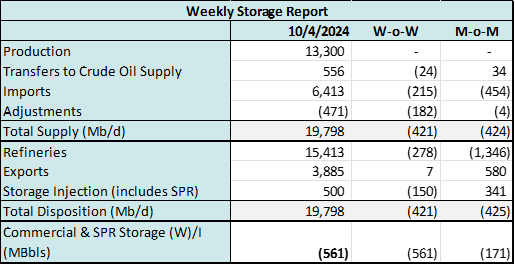

Executive Summary: Rigs: The total rig count decreased by 2 for the September 22 week, down to 565 from 567. Infrastructure: South Bow Corp. (SOBO) began operating as a new pipeline company on October 1 following its spinoff from TC Energy (TRP). Storage: East Daley expects a 500 Mbbl injection in commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending October 4.

Rigs:

The total rig count decreased by 2 for the September 22 week, down to 565 from 567. Liquids-driven basins declined by 1 rig W-o-W.

- Anadarko (-2): Devon Energy and Mewbourne Oil (-1) each.

- Uinta (+1): Koda Resources (+1)

Infrastructure:

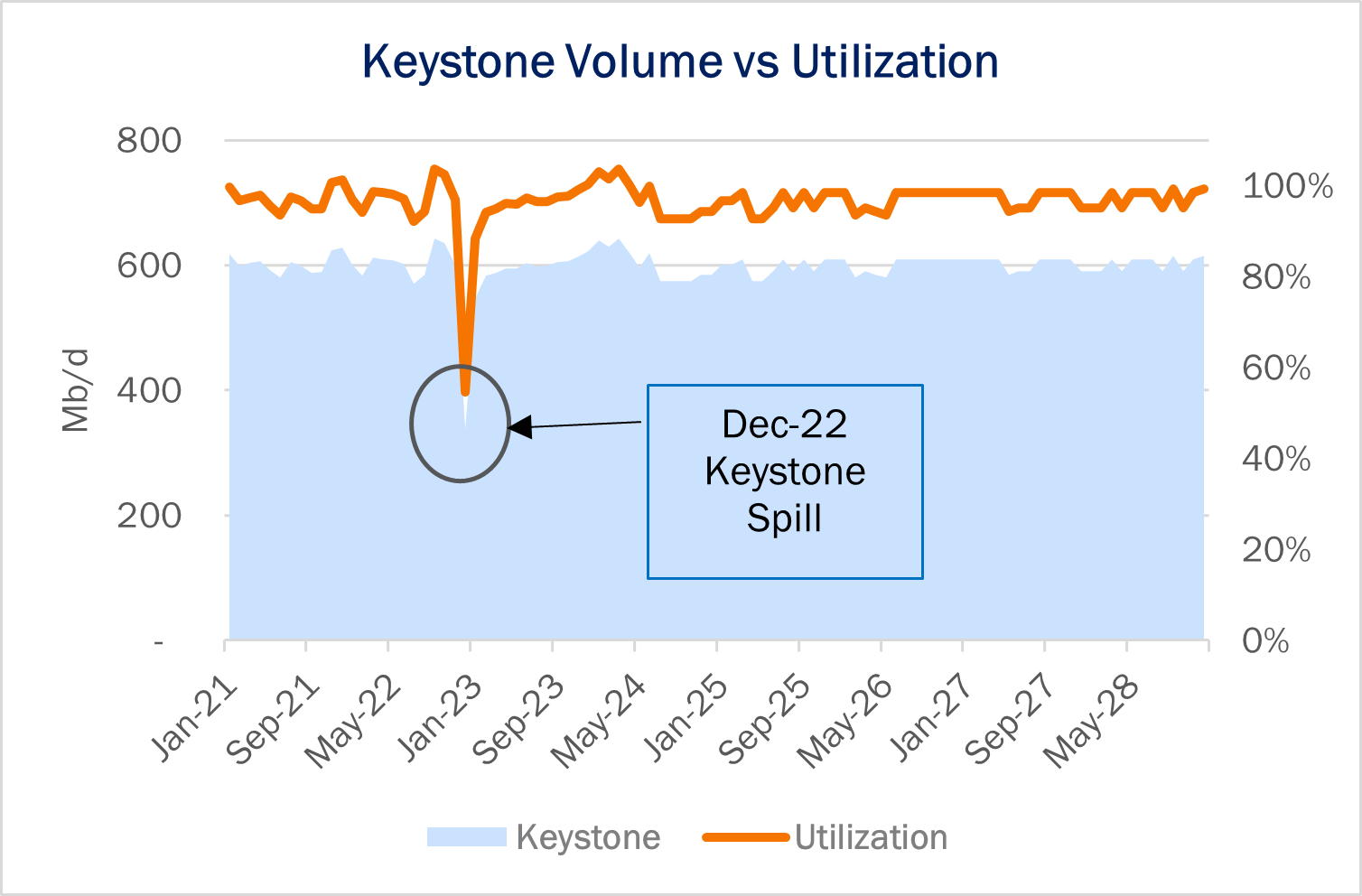

South Bow Corp. (SOBO) began operating as a new pipeline company on October 1 following its spinoff from TC Energy (TRP). In the separation, SOBO took the liquids-focused assets while TRP retains its natural gas, power, and energy operations. Notably, SOBO owns and operates the Keystone Pipeline System, which transports Western Canadian Sedimentary Basin (WCSB) crude production to PADD 2 and the Gulf Coast, along with pipes in Alberta such as Grand Rapids and White Spruce.

SOBO is strategically positioned in the oil midstream thanks to the Keystone system. Keystone provides significant flexibility to deliver WCSB crude to Midwest (PADD 2) refiners, the Cushing hub, and to Gulf Coast markets in Houston, Port Arthur and Port Neches.

The Keystone Pipeline System includes the Keystone and Marketlink pipe assets. Keystone (620 Mb/d capacity) moves WCSB production to the Wood River and Patoka refining hubs, or to Cushing in Oklahoma. Marketlink, a capacity lease on Keystone infrastructure, extends connectivity from Cushing to various delivery hubs along the Gulf Coast.

Keystone is the cornerstone of SOBO’s asset portfolio, generating stable earnings from high utilization rates that historically exceed 90%. The pipeline is also backed by minimum volume commitments (MVC) above 85% that protect downside. In contrast, Marketlink’s performance has been more variable, with historical utilization averaging around 67%, but rising to ~88% in 2023 and 2024.

Despite these strengths, Keystone’s safety track record may give some investors pause. Over the last 13 years, Keystone has experienced seven safety incidents. The most recent, in December 2022, was the largest oil spill in the US since 2014. A fatigue crack caused the release of 14 Mb/d of crude near Washington, KS, leading to a 21-day shutdown and cleanup costs estimated at ~$480MM, in addition to repair and operational losses. While a workhorse asset, Keystone also brings some operational risk for SOBO.

Storage:

East Daley expects a 500 Mbbl injection in commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending October 4. We expect total US stocks, including the SPR, will close at 799 MMbbl.

The US natural gas pipeline sample, a proxy for change in oil production, increased 1% W-o-W across all liquids-focused basins. Samples increased 9.5% in the Gulf of Mexico, 6.9% in the Anadarko Basin, and 2.5% in the Eagle Ford. The Barnett and Williston decreased 10.7% and 2.9%. The Williston, Rockies and Gulf of Mexico have a high correlation between gas volumes and crude oil volumes, whereas the Permian Basin basins correlation is less than 45%. We expect US crude production to remain flat at 13.3 MMb/d.

According to US bill of lading data, US crude imports decreased by 215 Mb/d W-o-W to 6.4 MMb/d. More than 60% of the supply originated from Canadian pipelines into the US, with the remainder largely coming from ships carrying crude from Mexico, Venezuela and Canada’s Westridge Marine Terminal in Vancouver.

As of October 4, there was ~1273 Mb/d of refining capacity offline, including downtime for planned and unplanned maintenance. EDA expects gross crude inputs into refineries to decrease by ~278 Mb/d W-o-W, coming in at 15.4 MMb/d.

Vessel traffic monitored by EDA along the Gulf Coast increased W-o-W. There were 22 vessels loaded for the week ending October 4 and 22 the prior week. EDA expects US exports to be 3.9 MMb/d.

The SPR awarded contracts for 3.3 MMbbl to be delivered in October 2024. The SPR has 381 MMbbl in storage as of October 4, 2024.