Executive Summary:

Infrastructure: LNG Canada appears on track to deliver its first cargo in mid-2025.

Rigs: The US rig count decreased by 10 for the May 31 week to 527.

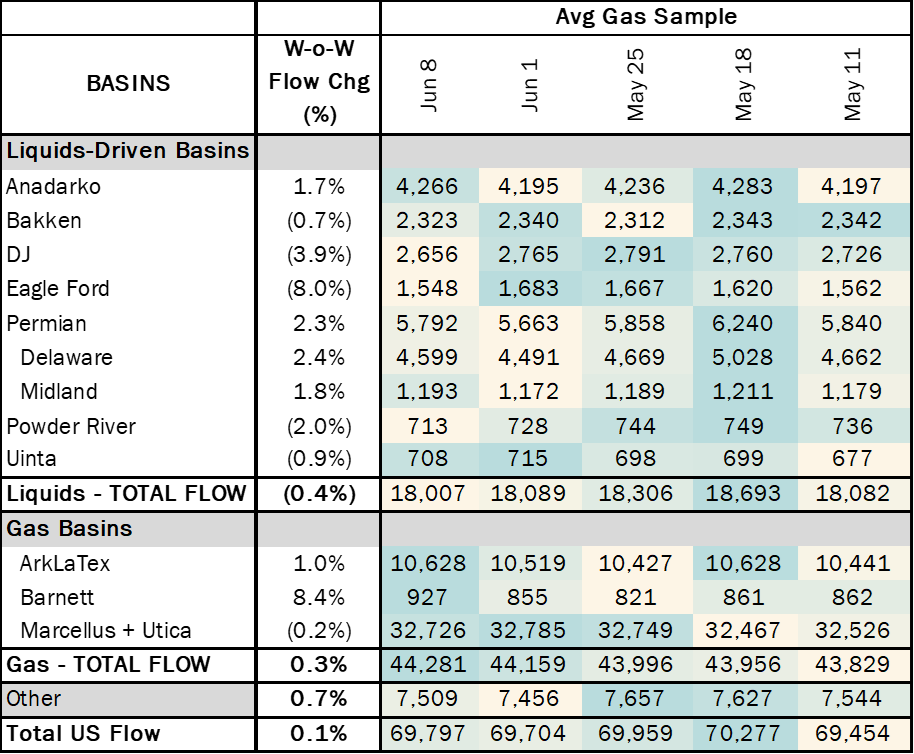

Flows: US natural gas pipeline samples averaged 69.8 Bcf/d for the week ending June 8, up 0.1% W-o-W.

Storage: Traders expect the EIA to report a 107 Bcf injection for the week ending June 6.

Infrastructure:

LNG Canada appears on track to deliver its first cargo in mid-2025 following the receipt of a cooldown cargo in early April. Startup would mark Canada’s entry into the global LNG trade.

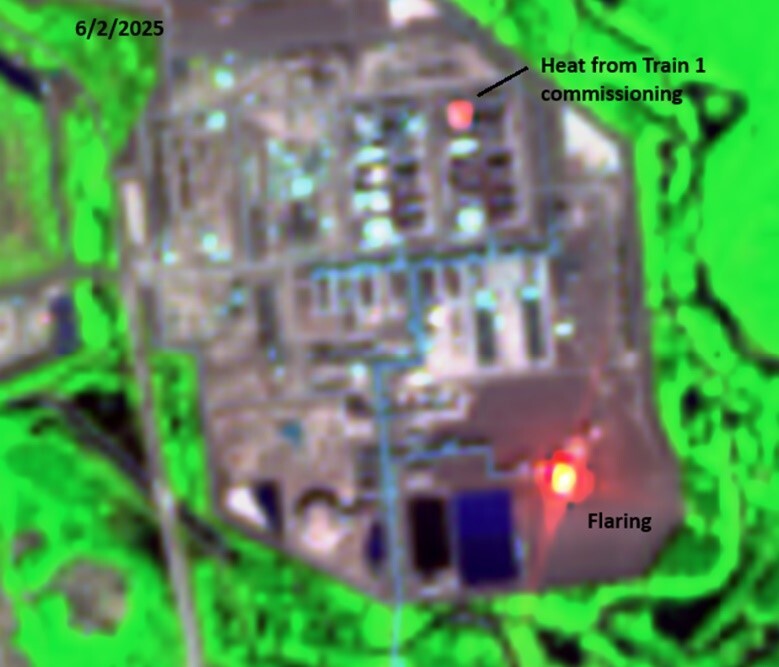

Train 1 at the project in Kitimat, BC is undergoing commissioning work. In a May 15 press release, the company warned the local community to expect increased flaring from startup activities until July 31, providing a prospective date for when Train 1 may complete commissioning. Historically, LNG trains of this size typically require about three months to enter service following commissioning. LNG Canada has not disclosed when it expects to begin commissioning at Train 2.

Infrared imaging taken June 2 at the LNG Canada site shows heat from the Train 1 commissioning work and an active flare stack (see picture).

As Train 1 enters service, the increased demand could put upward pressure on AECO prices. However, operators in the Western Canadian Sedimentary Basin (WCSB) are believed to have increased production in anticipation of LNG Canada coming online, decreasing the risk of significant price increases or reduced volumes into the US. However, even if prices are pushed upward, AECO basis is expected to remain negative, which would likely see minimal impacts on US import volumes.

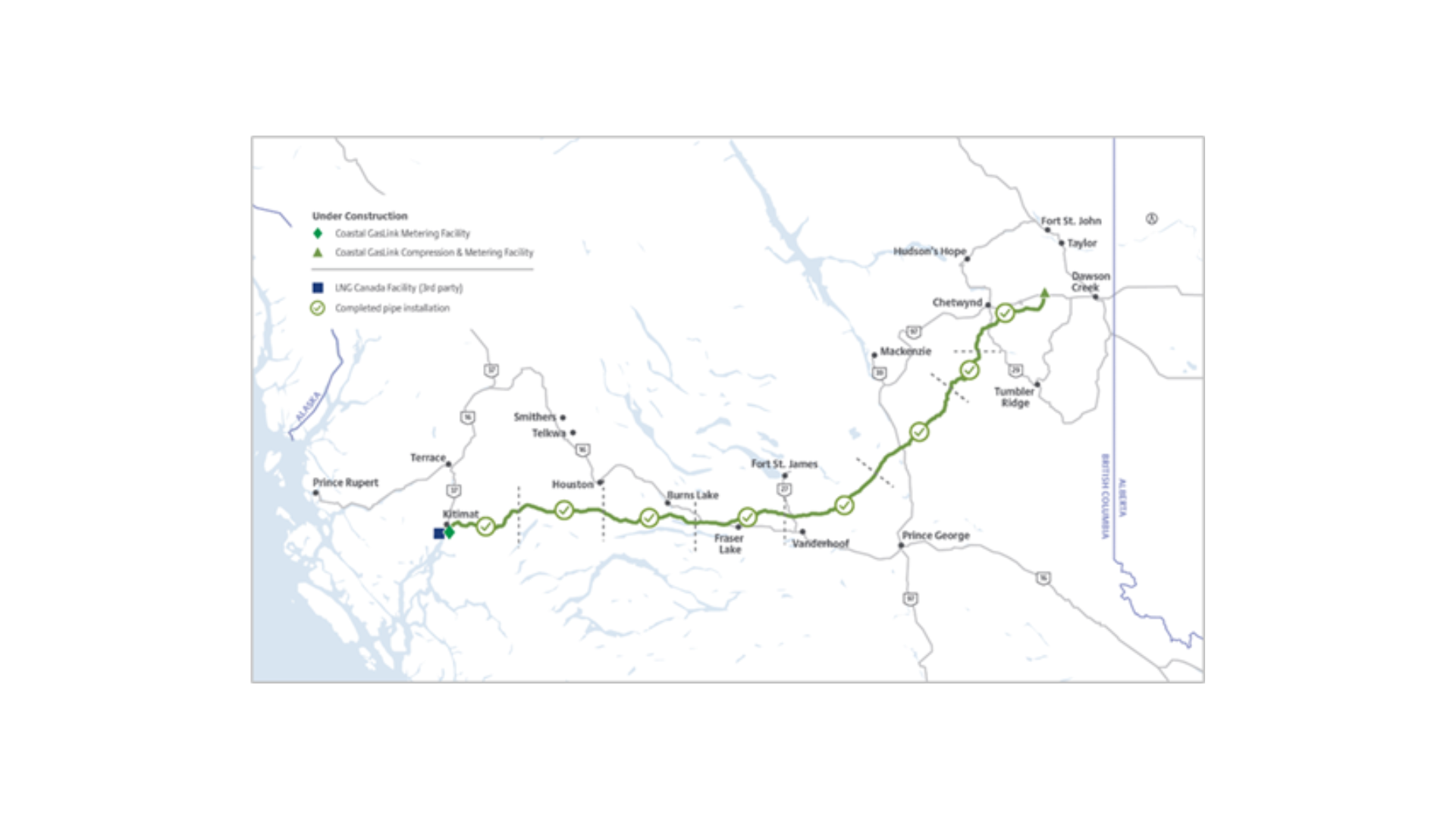

Phase 1 of TC Energy’s (TRP) Coastal GasLink pipeline, which will supply LNG Canada with WCSB gas, entered service in 4Q24 (see map). The pipeline has been sporadically receiving gas from the NOVA system since October ’24, totaling ~500 MMcf over eight months.

Coastal GasLink can supply LNG Canada with up to 2.1 Bcf/d, but could be expanded to 5.0 Bcf/d if Phase 2 were constructed. The pipe expansion is necessary if LNG Canada moves ahead with Phase 2, which would double liquefaction capacity from 14 mtpa (~1.85 Bcf/d) to 28 mtpa (~3.7 Bcf/d). The company has made no announcement regarding FID on Phase 2, though multiple partners in the joint venture (Shell, Petronas, PetroChina, Mitsubishi, and Koreas Gas) have said the expansion is still being evaluated.

Rigs:

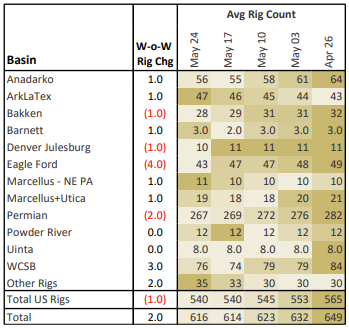

The US rig count decreased by 10 for the May 31 week to 527. The Bakken (-1), Anadarko (-2) and Permian (-3) lost rigs while other basins were flat W-o-W.

On the midstream side, Enterprise Products (EPD) is down 6 rigs net with losses on its Permian and Eagle Ford systems. Phillips 66 (PSX) is down 3 rigs total on its Permian systems.

See East Daley’s weekly Rig Activity Tracker for more information.

Flows:

US natural gas volumes averaged 69.8 Bcf/d in pipeline samples for the week ending June 8, up 0.1% W-o-W from 69.7 Bcf/d the previous week.

Gas-driven basins rose 0.3% W-o-W to average 44.3 Bcf/d. The Haynesville sample increased 1.0% to 10.6 Bcf/d. The Marcellus+Utica fell 0.2% to 32.7 Bcf/d.

Liquids-driven basins decreased 0.4% to 18.0 Bcf/d. The Eagle Ford sample declined 8.0% W-o-W to 1.5 Bcf/d, and the DJ average fell 3.9% to 2.7 Bcf/d.

Storage:

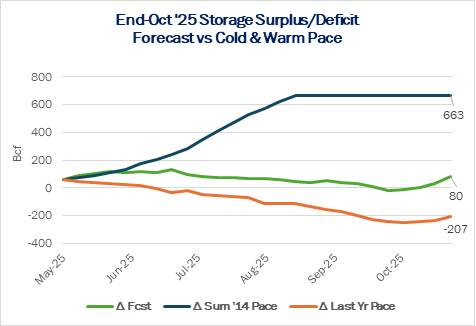

Traders and analysts expect the Energy Information Administration (EIA) to report a 107 Bcf injection for the week ending June 6. An injection of 107 Bcf would be 20 Bcf greater than the 5-year average, pushing the surplus to 137 Bcf. This would mark the largest surplus since the week ending January 3. The storage deficit to last year would fall by 30 Bcf to 258 Bcf.

With the market facing seventh straight weeks of triple-digit injections, prompt-month gas prices have finally started to wear down. The July ’25 Henry Hub contract lost ground on Monday, Tuesday and Wednesday this week to settle below $3.50/MMBtu.

There is also the possibility of an eighth consecutive 100+ Bcf injection for the week ending June 13. This would set a new record for the injection season, surpassing the seven consecutive triple-digit weeks seen in 2014. Early forecasts for the June 13 week call for a 105 Bcf injection, though estimates could swing based on this week’s print. With prompt gas retreating closer to balance of the month and cash prices this week, it seems the market is slowing reaching a consensus that the oversupply situation in storage trumps any short-term cooling degree demand swings. For the balance of summer, LNG demand will be the primary driver as Corpus Christi Stage 3 and Plaquemines Phase II begin to ramp.

Calendar:

Subscribe to East Daley’s The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices, and EDA research likely to affect markets in the short term.