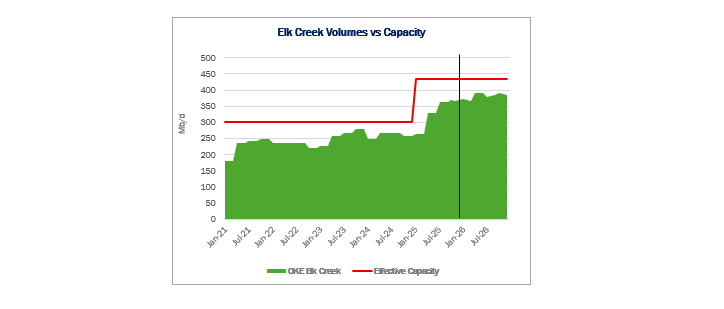

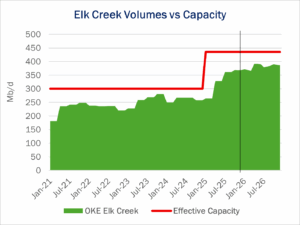

ONEOK (OKE) continues to rapidly fill its expanded Elk Creek Pipeline, diverting more ethane from its legacy Bakken pipeline to the Conway hub.

OKE completed an Elk Creek expansion at the start of 2025, building new pump stations to add 135 Mb/d of capacity. The 900-mile pipeline runs from eastern Montana in the Bakken to Bushton, KS.

OKE completed an Elk Creek expansion at the start of 2025, building new pump stations to add 135 Mb/d of capacity. The 900-mile pipeline runs from eastern Montana in the Bakken to Bushton, KS.

Filings show Elk Creek volumes jumped nearly 100 Mb/d through September 2025, from a combination of pipeline diversions and increased output from Bakken gas processing plants.

Elk Creek NGL throughput increased 64 Mb/d Q-o-Q in 2Q25 and gained another 33 Mb/d in 3Q25, the latest Federal Energy Regulatory Commission (FERC) filings show.

Ethane is driving the gains. East Daley Analytics’ Purity Product Forecast estimates significant resources of Bakken ethane remain in rejection mode, providing ample runway to fill Elk Creek.

Increased ethane extraction at processing plants accounted for a good share of the Q-o-Q growth in 2Q25, but data for 3Q points to a different scenario.

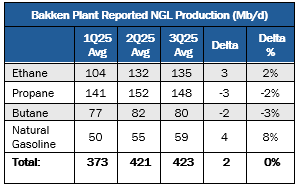

Notably, the latest reported Bakken plant data shows virtually no supply growth in 3Q25 (see table at right). Total NGL production rose by just 2 Mb/d in the basin and remained broadly flat across products. The gains on Elk Creek therefore likely came from redirected flows by plant operators or local fractionators.

Notably, the latest reported Bakken plant data shows virtually no supply growth in 3Q25 (see table at right). Total NGL production rose by just 2 Mb/d in the basin and remained broadly flat across products. The gains on Elk Creek therefore likely came from redirected flows by plant operators or local fractionators.

OKE appears to mostly be diverting ethane away from its legacy Bakken pipeline. NGL volumes declined 8 Mb/d on the Bakken pipeline in 3Q25, following a 14 Mb/d Q-o-Q drop in 2Q.

See East Daley Analytics’ Ethane Supply & Demand Report for more details. Ethane flows on Vantage Pipeline to Alberta also declined 7 Mb/d Q-o-Q in 3Q25. While the Vantage drop cannot be directly linked to Elk Creek movements, the offsets on systems suggest that up to ~15 Mb/d may have been redirected toward Elk Creek from other pipelines. – Sam Chen Tickers: OKE.

The Permian Basin at a Crossroads: Why This Pipeline Boom is Different

The Permian’s next big buildout is already taking shape, but this time the driver isn’t oil. East Daley Analytics’ latest white paper reveals how gas demand from AI data centers, utilities and LNG exports is rewriting the midstream playbook. Over 10 Bcf/d of new capacity and $12 billion in investments are reshaping flows, turning the Permian into a gas powerhouse even as rigs decline. Read Part II: Why This Pipeline Boom is Different

Meet Daley, the Best AI Tool in Energy

Meet Daley, the newest member of our energy team. Our new AI assistant is live and available to all East Daley Analytics clients. Early feedback has been phenomenal. Daley is platform-specific and only pulls from East Daley’s own proprietary data and content. It’s not open-source or generic AI, but built to understand our structure, language and analytics. Whether you’re looking for a specific metric, forecast or explanation, Daley can get you there quicker. — Reach out to learn more about Daley!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.