Targa Resources (TRGP) last week announced the Speedway NGL Pipeline, a new Permian-to-Mont Belvieu system, alongside the Yeti gas plant and Buffalo Run Midland-Delaware residue interconnect. The new pipeline is likely to exacerbate an industry fight for NGL barrels and result in significant spare capacity out of the Permian Basin.

Management framed the new projects as the next steps in its “wellhead-to-water” strategy as Targa’s existing NGL pipelines to Mont Belvieu approach capacity limits. The 30-inch Speedway will span roughly 500 miles and have initial capacity of ~500 Mb/d, expandable to ~1.0 MMb/d. TRGP is targeting in-service in 3Q27 at an estimated cost of $1.6B.

Targa points to ~961 Mb/d of NGLs already moving to Mont Belvieu in 2Q25 on its pipes, essentially at system nameplate, and highlights 1.4 Bcf/d of new Permian gas processing under construction that could add ~200 Mb/d of incremental NGL supply by Speedway’s startup. The company is also advancing downstream fractionation expansions to handle those volumes, including Trains 11 (150 Mb/d, 2Q26) and 12 (150 Mb/d, 1Q27) in Mont Belvieu, as well as LPG export debottlenecks through 3Q27.

The Speedway build recalls the trajectory of Grand Prix, which ramped to ~1 MMb/d at Mont Belvieu in six years after its startup in 3Q19. That ramp was enabled by construction in 2024 of the 400 Mb/d Daytona line that twinned Grand Prix from the Permian. For Speedway, Targa projects baseload throughput of 210–240 Mb/d from its announced Permian plants, meaning the line could run half full at the start of operations. If TRGP sustains the ~140 Mb/d annual NGL growth it achieved during the Grand Prix/Daytona buildout, Speedway’s initial 500 Mb/d could be filled within about two years post-startup, around 2029. With Grand Prix and Daytona essentially maxed out today, Speedway provides much-needed headroom, though TRGP must carefully sync fractionation and LPG export expansions to avoid system bottlenecks.

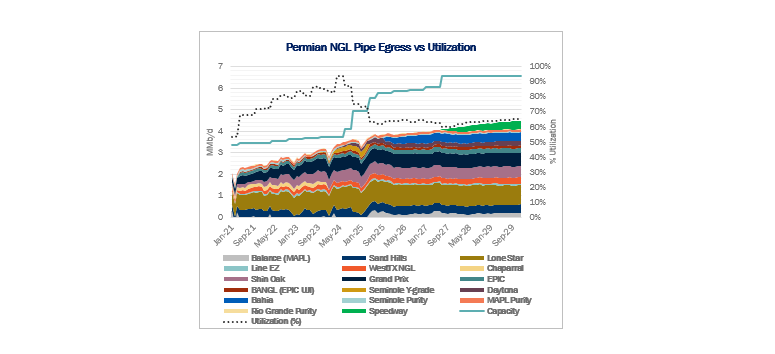

The gains for Targa are likely to come at the expense of others in the NGL space. From a market perspective, Speedway adds to an already overbuilt Permian NGL pipe grid. East Daley Analytics’ NGL Hub Model shows ~2.27 MMb/d of spare capacity today out of the Permian Basin — equivalent to 4.5 Speedways. When Speedway enters service, basin-wide utilization will dip to ~60% and remain under 70% for the rest of the decade (see figure).

In this context, the rationale for another NGL pipe is less about fee maximization and more about volume capture. Targa is uniquely positioned among peers: according to East Daley’s Permian Energy Path, TRGP produces ~200 Mb/d more NGLs than its nearest competitor. Speedway ensures those incremental NGL barrels stay captive on Targa assets from the wellhead to the dock.

This strategy will further tighten the squeeze on competitors like Phillips 66 (PSX), ONEOK (OKE) and MPLX, who are struggling for NGL barrels relative to pipe space. By locking in its own growth volumes, TRGP reinforces its integrated model and furthers its leading position in the Permian NGL value chain.

The main uncertainty in our outlook is the pace of supply growth. Developers have reached final investment decisions on several major Permian gas pipelines recently, including Desert Southwest by Energy Transfer (ET) and Eiger Express by the Matterhorn JV. East Daley anticipates significant spare egress capacity for Permian natural gas once these are built. However, if producers target more gas-focused acreage to fill them, NGL production will also increase. Faster supply growth would lift all boats and ameliorate the competitive pressures we anticipate for the industry to secure NGL barrels.

Bottom line: Speedway is less about market balance and more about control. Targa is building for itself, not the market, and in doing so will extend its advantage in the Permian from processing plants through fractionation and export. To learn more, see East Daley Analytics’ NGL Hub Model in Energy Data Studio. – Julian Renton and Jaxson Fryer Tickers: ET, MPLX, OKE, PSX, TRGP.

Meet Daley, the Best AI Tool in Energy

Meet Daley, the newest member of our energy team. Our new AI assistant is live and available to all East Daley Analytics clients. Early feedback has been phenomenal. Daley is platform-specific and only pulls from East Daley’s own proprietary data and content. It’s not open-source or generic AI, but built to understand our structure, language and analytics. Whether you’re looking for a specific metric, forecast or explanation, Daley can get you there quicker. — Reach out to learn more about Daley!

Get the FERC Intrastate Pipeline Data

East Daley Analytics’ FERC 549D Intrastate Contract Data delivers contract shipper data for intrastate pipelines — scrubbed and ready to use. Use the 549 data to identify which intrastate pipelines have available capacity, understand pipeline rate structures, gain insights into shippers, and spot contract cliffs and opportunities for higher rate renewals. Reach out to East Daley to learn more.

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.