Exec Summary

Market Movers: Sour gas development in the Delaware Basin depends on efficient integration and proximity to acid gas injection sites.

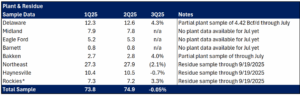

Estimated Quarterly Volumes: Haynesville samples are still down 0.7% Q-o-Q through September, though we believe the declines are misleading.****NEW****

Calendar:

Market Movers:

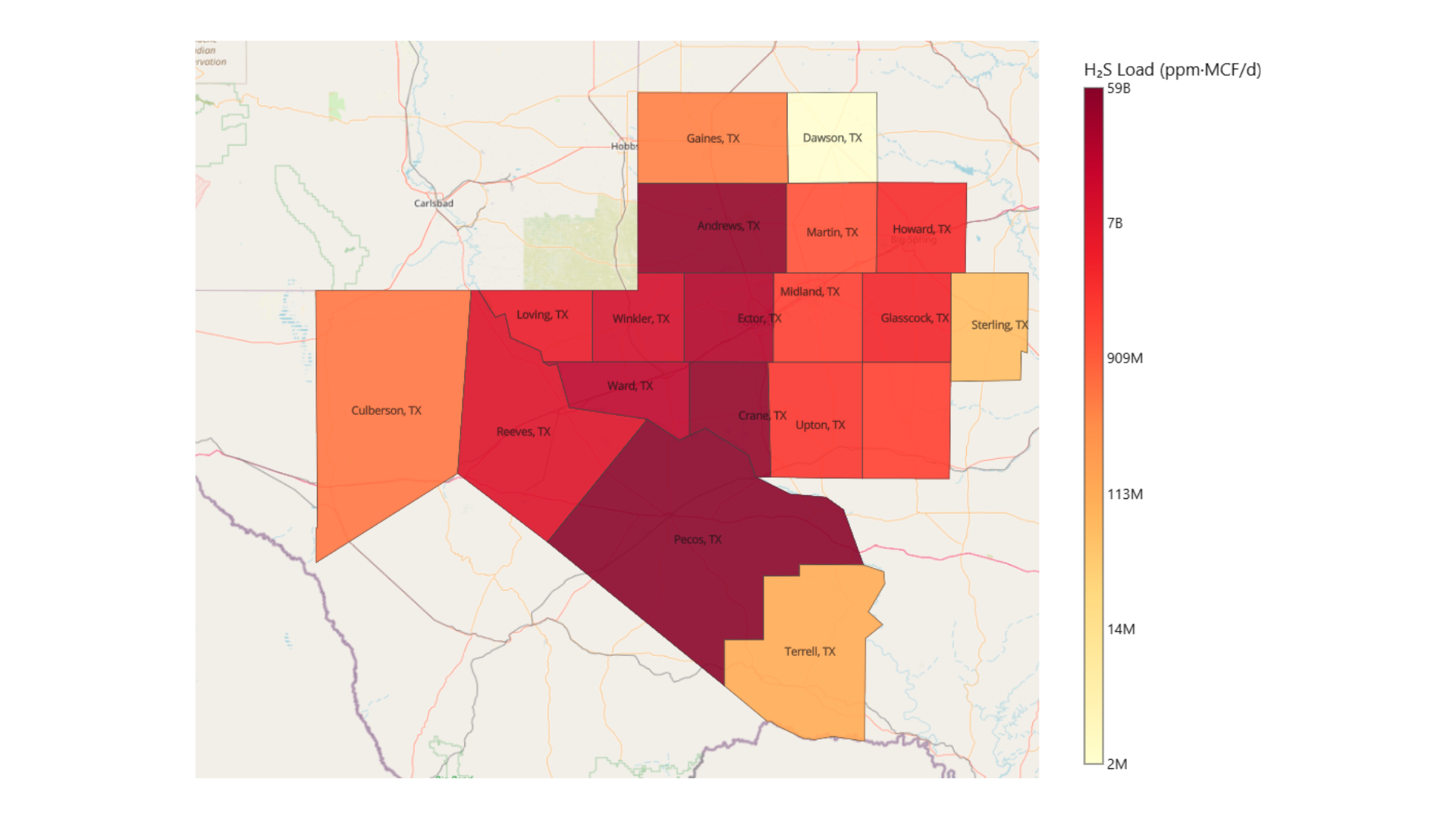

Sour gas development is a leading trend in the Delaware Basin and, as East Daley Analytics highlighted last week, acid gas injection (AGI) wells are the key hurdle to development. Who can integrate targets the fastest and cheapest? Our review finds several companies on the cutting edge.

New data sharpens the lens. Hydrogen sulfide (H₂S) readings of gas on the Texas side of the Delaware skew into the low‑thousands parts per million (ppm), with a meaningful >10,000‑ppm tail. Integration value therefore hinges on the distance that acid gas must be hauled (by pipe or truck) to an AGI storage well and on available AGI storage headroom, not just cryogenic plant processing capacity.

East Daley has surveyed midstream operators in the Delaware to find good acquisition candidates for sour gas expansions. Our review finds Salt Creek Midstream and Vaquero Midstream are the most logical bolt-ons given they have no publicly disclosed AGI wells. Producers Midstream also operates a smaller sour‑ready platform that could fold into a G&P system anchored by AGI disposal wells.

Several companies could be natural integrators. On the Texas side of the Delaware, Kinetik (KNTK) plans to start the Kings Landing plant in mid‑2025 and has operations adjacent to Reeves and Culberson counties. KNTK still lacks disclosed Texas‑side AGI, so near‑term tolling into third‑party wells bridges the gap. Targa Resources (TRGP) brings basin‑wide gathering and treating capacity and owns the Red Hills AGI complex, acquired as part of the $3.55B Lucid Energy deal, just across the state line.

On the New Mexico side, MPLX’s $2.375B Northwind acquisition transforms the company into a major sour gas player. The Northwind assets give MPLX two AGI wells (a third is approved), and Northwind is scaling treating toward ~440 MMcf/d by 2H26. Delek Logistics (DKL) has two permitted AGI wells and is building an amine unit at the Libby plant, targeting startup in 2H25.

Several factors are relevant for evaluating assets for sour gas expansions: their proximity to injection nodes, measurable headroom at AGI wells, and those with the fewest miles to haul acid gas from pads producing high‑H₂S gas.

East Daley is watching for two trends over the next 12 months: (1) AGI‑backstopped tolling agreements. These contracts would target flows to the acquirer’s wells under long‑dated fees, with volume ratchets and optional revenue sharing from Section 45Q CO₂ credits. (2) Node‑for‑grid JVs. Under these agreements, one company would provide AGI/treating headroom, and a partner contributes dedications on a G&P system, with step‑ups tied to injection expansions. Near‑term operating levers are amine debottlenecks where loading is the main constraint; every mile of avoided acid hauling lowers Opex and reduces outage risk.

We anticipate that buyers who already inject (or hold firm access) and have residue optionality will monetize sour pads first and at the lowest marginal cost.

Estimated Quarterly Volumes:

- The Haynesville head fake continues. Meter point samples are still down 0.7% Q-o-Q through September. EDA forecasts 12% growth in regional Haynesville volumes from 2Q to 3Q25. We believe the start of Louisiana Energy Gateway (LEG) has diverted some dry gas in Louisiana and East Texas from interstate to intrastate pipelines, accounting for the lower Haynesville samples.

- Rockies meter point samples are up 3.3% Q-o-Q through September. The WES – Denver Julesburg system is up 2.5% and the PSX – DCP Denver Julesburg system is up 1.1

Calendar: