Mountain Valley Pipeline (MVP) and the Transcontinental Gas Pipe Line (Transco) are locked in a bruising fight for market in North Carolina, pitting MVP’s Southgate against Transco’s Southeast Supply Enhancement (SESE) project.

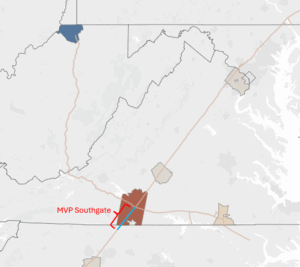

The Federal Energy Regulatory Commission (FERC) rang the starting bell in February when the agency asked Transco to provide documentation on the overlap between its SESE project and MVP’s Southgate. The pipeline, owned by Williams (WMB), provided FERC with maps detailing the nearly identical routes of Transco and Southgate (see pipeline map from East Daley Analytics’ Data Center Demand Monitor). Many places along the routes showed the two pipelines sharing easements and crossing paths.

MVP initially filed its amended Southgate application on Feb. 3, three days before FERC requested the route maps from Transco. MVP called out the SESE expansion in the application, stating that it “would not meet the purpose and need of the Amendment Project of diversifying the natural gas supply in the region or the requests of Mountain Valley and Transco to provide separate pipelines to each serve their customer requirements.” MVP further said that SESE “would not meet several of the Amendment Project objectives that Foundation Shippers considered prior to contracting for capacity,” such as resiliency, operational flexibility and risk diversification.

MVP initially filed its amended Southgate application on Feb. 3, three days before FERC requested the route maps from Transco. MVP called out the SESE expansion in the application, stating that it “would not meet the purpose and need of the Amendment Project of diversifying the natural gas supply in the region or the requests of Mountain Valley and Transco to provide separate pipelines to each serve their customer requirements.” MVP further said that SESE “would not meet several of the Amendment Project objectives that Foundation Shippers considered prior to contracting for capacity,” such as resiliency, operational flexibility and risk diversification.

Transco punched back in mid-March, filing a motion to intervene on the Southgate project. In the motion, Transco called MVP’s statements “a mischaracterization” of its SESE project that “attempts to support Southgate at the expense of facts.” Now the second round had begun.

The following month, FERC issued an environmental information request (EIR) from Transco seeking details about the Southgate/SESE overlap and how both companies were evaluating alternatives together for segments of the projects that might need line adjustments.

Transco’s strongest punch came on May 7 in its filed response. Transco said SESE could be modified to incorporate the volumes from Southgate into its own project, an outcome that would allow Transco to maintain its near-monopoly on gas service in North Carolina. Adding insult to injury, Transco on June 20 included its EIR responses in a comment on the Southgate docket. Five days later, FERC requested MVP Southgate file an EIR that included a response to Transco’s comment.

Round three began on June 26, when FERC requested that Transco explain how SESE could be modified to accommodate Southgate. Transco filed its explanation on July 7.

MVP then hit back, turning to its foundation shippers, Duke Utilities and the Public Service Company of North Carolina (PSNC), for support of the Southgate expansion. In comments, the two utilities reiterated the value of supply diversity and directly attacked Transco.

PSNC stated that there has been a “rapid rise of daily Operational Flow Orders (‘OFOs’) … that often significantly limit PSNC’s service options in both directions on the pipeline. In fact, for the last several years, it has become common practice to see Transco issue OFOs covering more than 200 days each year.” PSNC also detailed emergency actions and delivery pressure concerns related to Transco. While Duke’s comments weren’t as critical of Transco, they still highlighted the increased fuel security of a second supply source.

FERC continues to actively review both projects. It’s unclear how the agency will rule on this case, or if more rounds await the two parties. FERC’s current schedule for the Southgate project has the Environmental Assessment being issued in October, with the final authorization decision occurring before Jan. 1, 2026. – Ian Heming Tickers: WMB.

Attend Our September Production Webinar

East Daley will host our next monthly Oil & Gas Production Webinar on Sept. 17. This month we’ll unpack:

- Gas egress and infrastructure from the Permian Basin

- How our latest forecasts stack up for crude oil, natural gas and NGLs

- Scenarios that stress-test capacity and identify market winners and losers

Join us Sept. 17 at 10 AM MST for the latest information on energy production trends. — RSVP here to attend the Oil & Gas Production Webinar!

Meet Daley, the Best AI Tool in Energy

Meet Daley, the newest member of our energy team. Our new AI assistant is live and available to all East Daley Analytics clients. Early feedback has been phenomenal. Daley is platform-specific, and only pulls from East Daley’s own proprietary data and content. It’s not open-source or generic AI, but built to understand our structure, language and analytics. Whether you’re looking for a specific metric, forecast or explanation, Daley can get you there quicker. — Reach out to learn more about Daley!

Get the Data Center Demand Monitor

The Data Center Demand Monitor is your go-to source for tracking data center projects and demand. Available as part of the Macro Supply & Demand Report, East Daley monitors and visualizes nearly 500 US data center projects. Use the Data Center Demand Monitor to forecast demand, identify pipeline corridors and track data center projects. — Request your demo now of the Data Center Demand Monitor!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.