Exec Summary

Market Movers: Chevron could be a seller of Bakken assets after closing the $53B acquisition of Hess.

Estimated Quarterly Volumes: The Targa – Delaware system is up 7% from 2Q25. ****NEW****

Calendar: Post-call model update has been released for KNTK.

Market Movers:

Chevron (CVX) on July 18 completed the $53B acquisition of Hess Corp., giving the oil major a 37.8% stake in Hess Midstream (HESM). CVX has been coy about its plans for Hess, but the industry is rife with talk of a potential sale of the Bakken assets.

Hess brings a diverse portfolio, including deepwater leases offshore Guyana and the Gulf of America, plus 465,000 acres and the HESM position in the Bakken. The Guyana leases were widely considered the prize of the deal, and the Gulf acreage is complementary to CVX’s existing operations. The Bakken in North Dakota would be a new foray for the company. Chevron has guided to $10-15B in asset divestments by 2028, fueling speculation that it could eventually put the Bakken assets up for sale.

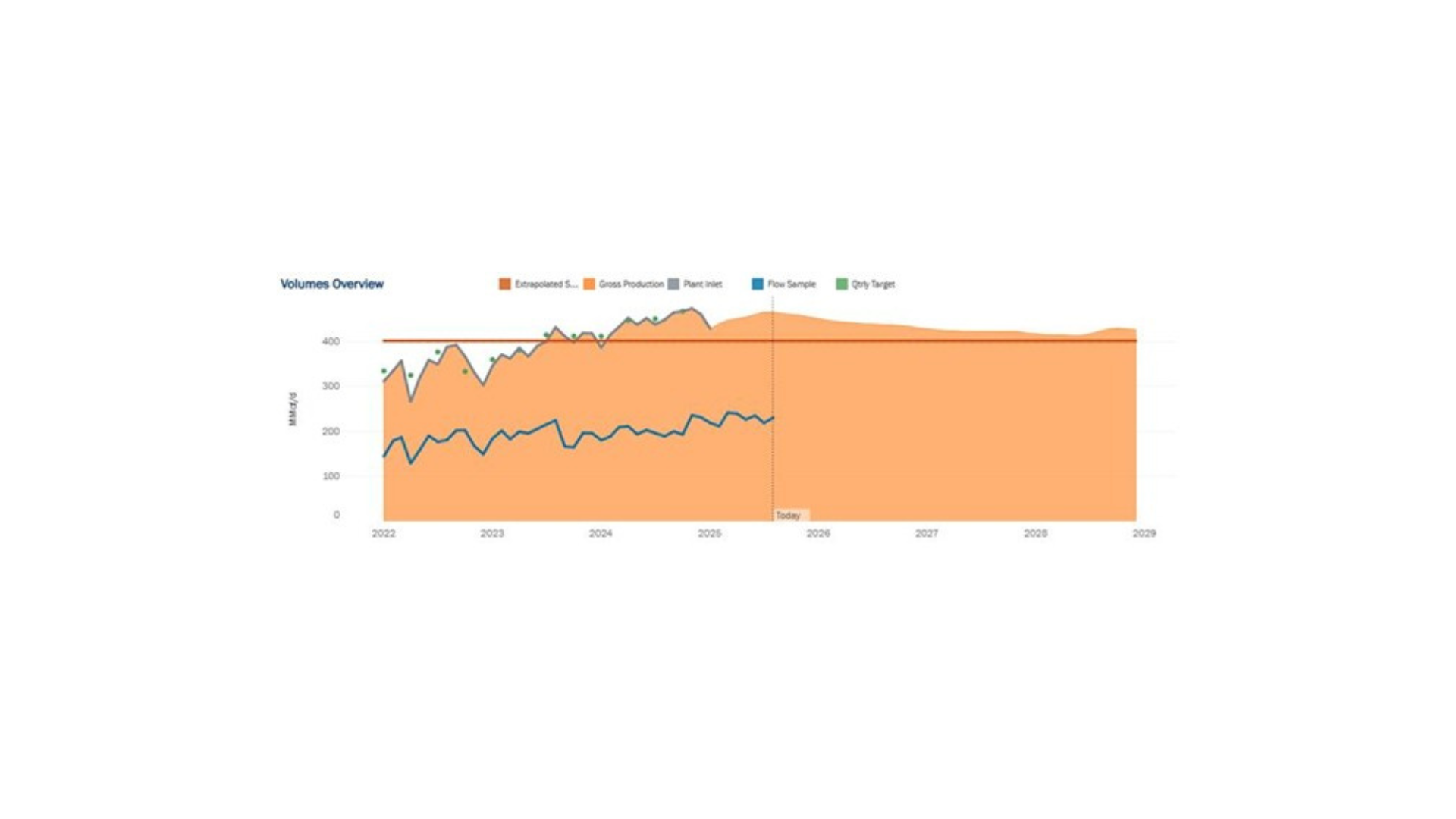

Among HESM’s assets, the 400 MMcf/d Tioga plant is the Bakken flywheel. Asset data in Energy Data Studio shows plant volumes of ~475 MMcf/d in June ‘25, including ~90 MMcf/d of rich gas delivered on the 12-inch Alliance Tioga Lateral to Alliance Pipeline. The lateral has 126 MMcf/d of capacity and gives HESM unique optionality for managing flows at the Tioga plant.

HESM guides to ~10% growth in gas volumes in 2026 and ~5% in 2027. East Daley’s Williston Basin outlook is for roughly flat production, so HESM is outperforming its peers. Drilling activity on the Tioga G&P system recently peaked at 9 rigs in February, though counts have declined with lower oil prices. There were 3-4 rigs running in July, according to East Daley’s system rig allocations in Energy Data Studio. The top producers behind the system by volume are CVX (27%; legacy Hess), Chord Energy (CHRD; 15%), Devon Energy (DVN; 14%), ConocoPhillips (COP; 10%) and Continental (10%).

Several factors support stable cash flows from the Tioga assets. HESM’s minimum volume commitments (MVCs) are set annually at 80% of Hess’ nominations on a three-year rolling basis, and those agreements were extended through 2033. Gas-to-oil ratios (GOR) are also rising in the Bakken, so gas recovery should continue to increase even if oil production holds flat.

HESM is also expanding the Tioga system to capture more market in the Bakken. The company is adding compression on the gathering footprint in 2025 and marketing its services to nearby producers to pull in more volumes. A planned ~125 MMcf/d processing plant north of the Missouri River, targeted for 2027, extends the runway for growth.

Management’s 2025 outlook implies system-wide gas volumes of ~455–465 MMcf/d and assumes 4 rigs on the footprint. EDA projects less growth in Energy Data Studio because we model fewer rigs on the system than management.

Tioga is already operating at high utilization, but it can continue growing throughput in a flat-oil outlook for the Williston by capturing more market, with the 125 MMcf/d processing expansion providing headroom for growth.

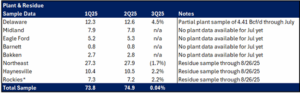

Notes: 3Q25 is expressed as Q-o-Q growth from 2Q25. Rockies is the sum of Big Horn, DJ, Green River, Piceance, Powder River, San Juan, Uinta, Wind River.

- Delaware plant inlets are up 4.5% through July. The Targa – Delaware system is up 7% and the PSX – Delaware asset is up 3% from 2Q25. The Delaware sub-basin is forecast to grow 2.1% from 2Q to 3Q25. Targa’s Moose plant began operations in 1Q25 and Bull Moose II in the Delaware is expected online in 4Q25. Chevron (CVX) is one of the largest producers behind the system and has guided to 5-6% growth from 2025-26.

- Northeast meter point samples are down 1.7% through July. The MPLX – Marcellus WV system is down 13% and the WMB – Marcellus system is down 11% from 2Q25. We forecast flat Northeast region volumes from 2Q to 3Q25. Antero Resources (AR) is one of the largest producers behind the MPLX – Marcellus system and has guided to flat production in 2025-26.

Calendar: