Exec Summary

Market Movers: MPLX will sell its Rockies G&P assets in the Green River and Uinta basins to Harvest Midstream for $1.0B in cash but retain the NGLs from the systems.

Estimated Quarterly Volumes: Bakken plant inlets are up 6.7% through July with 41% of plants reporting. ****NEW****

Calendar: Post-call model update has been released for KNTK.

Market Movers:

MPLX on Aug. 27 reached a deal to sell its Rockies G&P assets in the Green River and Uinta basins to Harvest Midstream for $1.0B in cash. The deal helps MPLX right-size its portfolio ahead of a strategy pursuing NGL exports on the Gulf Coast.

The assets sold include:

- Uinta Basin – G&P assets include 700 miles of gathering and 345 MMcf/d of processing capacity at the Ironhorse and Stagecoach plants.

- Green River – G&P assets include 800 miles of gathering and 500 MMcf/d of processing capacity at the Black Forks and Vermillion plants. The Green River assets also include 10 Mb/d of fractionation capacity.

- As part of the transaction, Harvest agreed to dedicate 12 Mb/d of NGLs from the two systems to MPLX for seven years beginning in 2028, following the expiration of a pre-existing commitment.

The Strategy: This deal is all about portfolio rebalancing. EDA estimates the assets sold generate $135MM in annual EBITDA, or less than 2% of MPLX’s forecasted EBITDA. In contrast, its Permian and Northeast assets drive almost the entire G&P segment EBITDA and almost one-third of total company EBITDA.

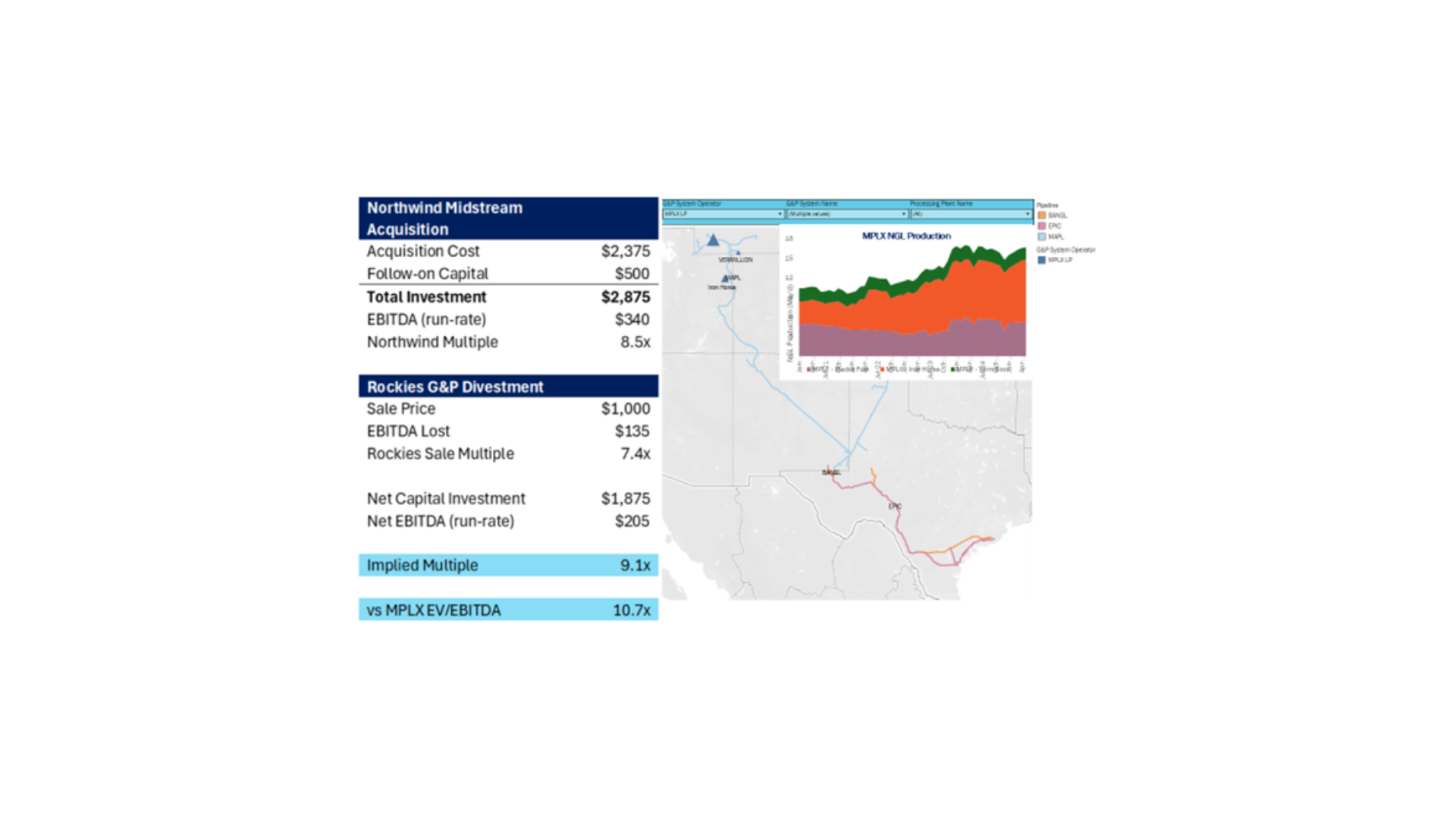

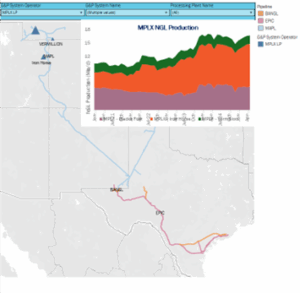

MPLX is focusing its efforts on the Permian and the Marcellus wellhead-to-water strategy. That is why the NGL dedication of 12 Mb/d is more than a footnote. Those NGL barrels will likely make their way to the Gulf Coast via Enterprise Products’ (EPD) MAPL NGL pipeline, where they will be fractionated and exported via the MPLX/ONEOK JV. East Daley Analytics wrote about the MPLX/OKE JV here. Refer to the map and NGL production below for the amount of NGLs produced from the plant and the route they will take to get to the MPLX/OKE JV on the Gulf Coast.

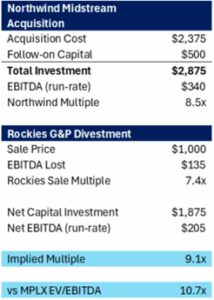

The Verdict: East Daley believe this is a good deal for MPLX for two reasons.

- The deal allows MPLX to focus on its wellhead-to-water strategy linking growing supply basins to growing international demand.

- Deal accretion. As shown in the table below, MPLX’s recent investment in Northwind Midstream and divestment of the Rockies G&P assets yields a net EBITDA multiple of 9.1x. This compares to the MPLX EV/EBITDA multiple of 10.7x. Net growth was purchased for a bargain compared to current company cost of capital. Of course, this paper accretion depends on MPLX’s ability to grow Northwind volumes and associated cash flows over the next few years.

Estimated Quarterly Volumes:

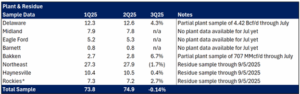

Notes: 3Q25 is expressed as Q-o-Q growth from 2Q25. Rockies is the sum of Big Horn, DJ, Green River, Piceance, Powder River, San Juan, Uinta, Wind River.

- Bakken plant inlets are up 6.7% Q-o-Q through July with 41% of plants reporting. The KMI – Bill Sanderson system is up 13.1% and the KMI – Bakken system is up 4% from 2Q25. The Bakken is forecast to grow 0.8% from 2Q to 3Q25. Continental Resources is one of the largest producers behind the system and has guided to growth of 3-6% from 2025-26.

- Northeast meter point samples are up 1.7% Q-o-Q through August. We forecast flat Northeast region volumes from 2Q to 3Q25. The WMB – Bradford Supply Hub system is down 1.5% and the WMB – Susquehanna Supply Hub system is down 5.8%. Coterra Energy and Expand Energy are the largest producers behind the systems and have guided to 5% and 6% growth 2025-26. The Northeast remains a stable region, but future growth is primarily constrained by limited egress capacity to move production out.

Calendar: