Natural gas prices have fallen below $3/MMBtu as hopes fade for a summer rally. Traders are grappling with the reality that power demand lacks the same punch as last season.

The September Henry Hub contract first traded below $3 on Aug. 4, settling the day at $2.93/MMBtu. Prices struggled to hold the $3 price level for several days, then broke decisively lower on Aug. 7. The front month has been on a downward slide since, trading on Tuesday (Aug. 19) near $2.74. A bearish 56 Bcf storage injection reported by the Energy Information Administration (EIA) last Thursday (Aug. 14) has contributed to the dogpile of negative sentiment.

Disappointing power burn accounts for much of the recent weakness. The summer so far has passed with a whimper, in contrast to the record generation demand in the 2024 season. The summer of 2024 was the perfect storm for natural gas power demand, including low prices, ample supply and record heat. The combination led to low storage injections for the season, including a rare 6 Bcf storage withdrawal for the week ending August 9, 2024.

Disappointing power burn accounts for much of the recent weakness. The summer so far has passed with a whimper, in contrast to the record generation demand in the 2024 season. The summer of 2024 was the perfect storm for natural gas power demand, including low prices, ample supply and record heat. The combination led to low storage injections for the season, including a rare 6 Bcf storage withdrawal for the week ending August 9, 2024.

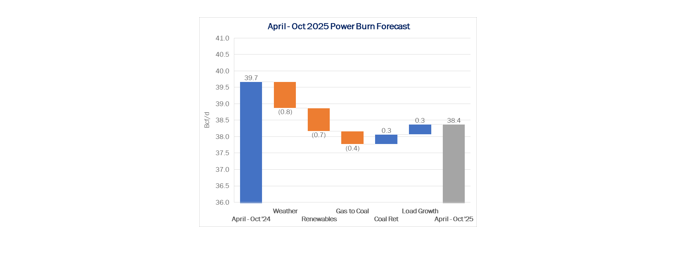

Nearly all those factors have been inverted this summer. Natural gas prices have been ~$1.50/MMBtu higher, renewables are a larger factor in the generation dispatch stack, and temperatures overall have been much cooler. In the monthly Macro Supply & Demand Report, East Daley Analytics anticipates power burn to average 38.4 Bcf/d from April to October, or 1.3 Bcf/d less than the 2024 injection season.

Despite the headwinds, this season’s power burn should still eclipse summer 2023 and go down as the second largest in history. Looking ahead, we project the summer of 2026 will be a force to be reckoned with. In the Macro Supply & Demand Report, East Daley forecasts power demand to average 39.4 Bcf/d from April-October 2026, assuming normal weather. Our outlook includes 1.5 Bcf/d of baseload demand from data centers. We also do not see gas-fired power demand receding, given some delayed plant retirements and the addition of nearly 6 GW of new gas-fired capacity, according to EIA. Long live summer! – Jack Weixel.

Get the FERC Intrastate Pipeline Data

East Daley Analytics’ FERC 549D Intrastate Contract Data delivers contract shipper data for intrastate pipelines — scrubbed and ready to use. Use the 549 data to identify which intrastate pipelines have available capacity, understand pipeline rate structures, gain insights into shippers, and spot contract cliffs and opportunities for higher rate renewals. Reach out to East Daley to learn more.

NEW – The Burner Tip

The Burner Tip provides East Daley’s weekly coverage of natural gas markets. Every Thursday, The Burner Tip brings you our expert perspective on drivers shaping prices and flows in North America — including production trends, infrastructure dynamics, and forward-looking fundamentals — all grounded in EDA’s proprietary data and models. Whether you’re trading, investing, or managing risk, The Burner Tip delivers the insights you need to drive smarter strategy. Subscribe now to The Burner Tip!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.