Exec Summary

Market Movers: Permian Basin rigs fell by 34 in 2Q25, pulling activity lower on certain G&P systems.

Flows: The KMI flow sample is trending upward for the third consecutive week.

Calendar: Post-call model updates for ET, EPD, KNTK, MPLX, PBA, TRGP, SOBO, WES, WMB this week.

Market Movers:

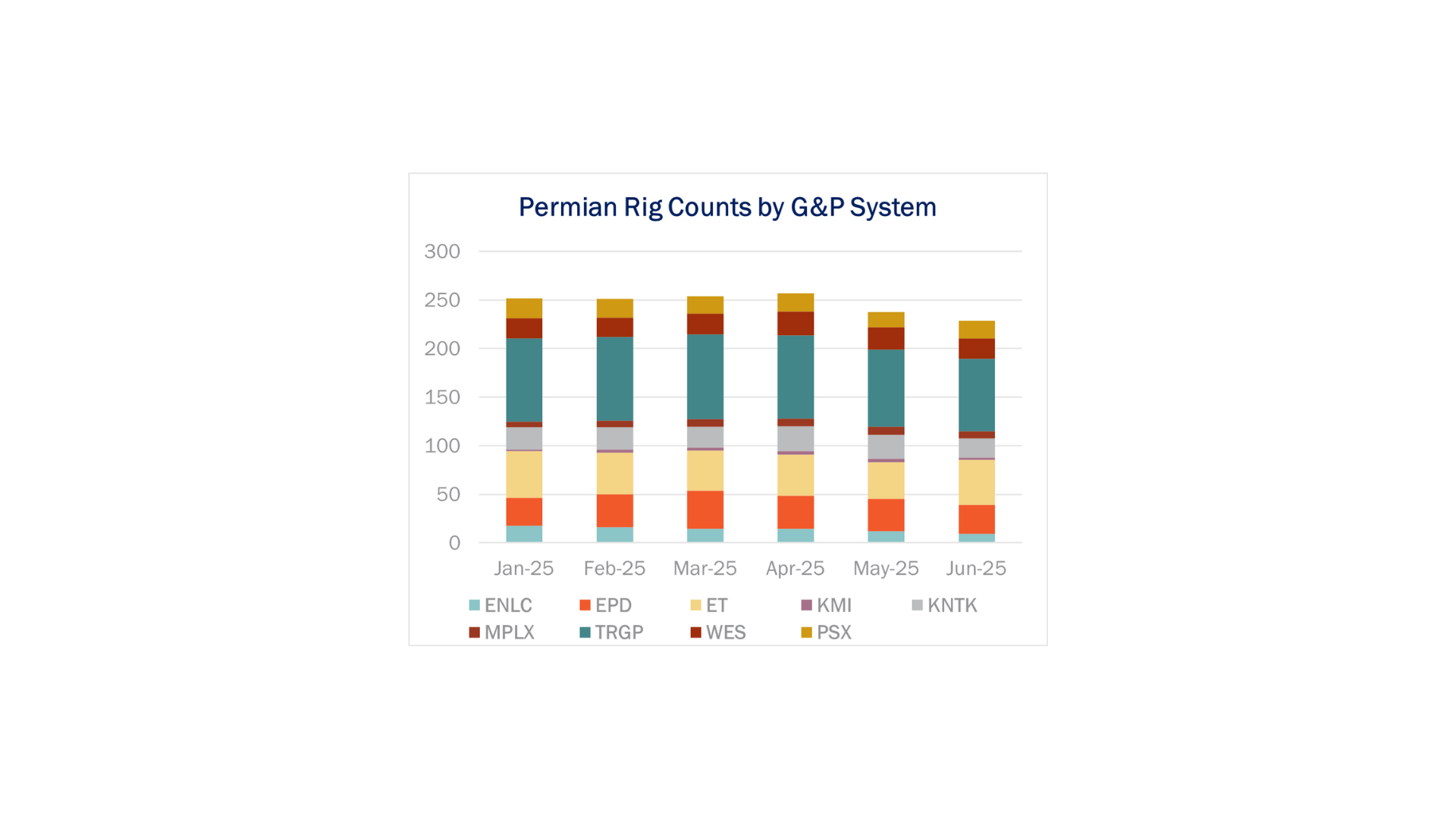

Drilling in the Permian Basin fell by 34 rigs in 2Q25, a 12% Q-o-Q decline, as softer oil prices and upstream consolidation take a toll on activity. The impacts of fewer drill bits at work aren’t hitting equally, splitting the midstream into haves and have-nots, according to East Daley’s Rig Activity Tracker.

Combined rigs in the Delaware and Midland sub-basins fell from an average of 292 in March to 258 in June. The Delaware bore the brunt of the declines, losing 24 rigs as counts fell from 173 to 148 (–14.2%). The Midland lost 10 rigs (-8.3%) from March to June, tumbling from 120 to 110.

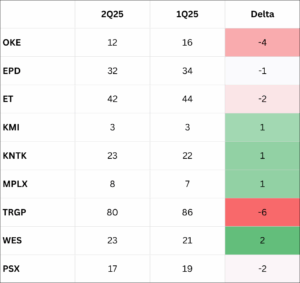

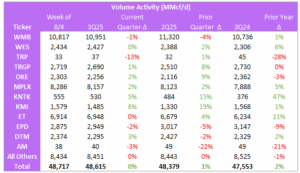

Midstream Exposure: The table shows rig changes from March to June by Permian G&P system, according to allocations in the Rig Activity Tracker.

We estimate Targa Resources (TRGP) lost 6 rigs and ONEOK (OKE) 4 rigs, the largest declines in our coverage. Energy Transfer (ET) and Phillips 66 (PSX) each lost 2 rigs over the three months. These declines point to potential volume headwinds for their respective G&P systems.

By contrast, East Daley believes Kinetik (KNTK), Kinder Morgan (KMI), ONEOK (OKE) and MPLX bucked the trend and gained rigs on their Permian systems from March to June.

Who’s throttling back? Counterparty data in Energy Data Studio reveals which Permian producers are idling rigs. A concentrated set of E&Ps drove the downturn in 2Q:

- Diamondback Energy (FANG) dropped 5 rigs.

- Coterra Energy (CTRA) and CrownQuest Operating each cut 3 rigs.

- Chevron (CVX), Continental Resources, BP and SM Energy (SM) each pared 2 rigs

Together, these seven E&Ps account for 19 of the 34 rigs dropped in 2Q25.

East Daley has updated Financial Blueprints and Earnings Previews for these companies ahead of 2Q25 earnings to incorporate the changes in Permian activity. By mapping movements from the upstream through midstream financials, of the volumes. The acquisition further entwines Coterra and MPLX, as CTRA currently provides 70% of the volumes on MPLX’s Delaware G&P system (see counterparty data below from Energy Data Studio).

Flows:

- The KMI flow sample is trending upward for the third consecutive week, primarily due to sustained growth on the KinderHawk system. This trend is consistent with EDA’s Haynesville growth projection for YE25.

- The EPD flow sample is down, driven by declines on the Meeker and Acadian G&P systems.

Calendar: