Executive Summary:

Infrastructure: Three ethane projects on three continents reveal the different regional challenges facing the petrochemical industry.

Exports: Combined LPG and ethane exports increased 2.0% W-o-W to 2,754 Mb/d, driven entirely by rising LPG volumes, while total ethane exports remained unchanged.

Rigs: The total US rig count increased during the week of July 6 to 525. Liquids-driven basins increased by 1 W-o-W from 400 to 399.

Flows: US natural gas volumes averaged 70.6 Bcf/d in pipeline samples for the week ending July 20, up 1.1% W-o-W.

Calendar: HESM, HES, AM and AR Earnings 7/31

Infrastructure:

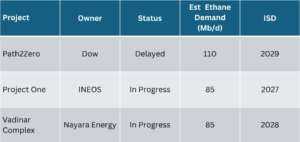

US ethane has quietly powered the next generation of plants feeding the global plastics boom — cheap, abundant and unchallenged. But today, the feedstock once seen as untouchable is being stress-tested in a fragmented market. Three projects on three continents reveal the different regional challenges facing the petrochemical industry.

North America: Dow’s Strategic Retreat

Dow (DOW) in April delayed its Path2Zero ethane cracker in Fort Saskatchewan, Alberta, originally slated to begin major construction in 2025. Dow cited macroeconomic challenges and weak global demand for the decision. The world’s first net-zero Scope 1 and 2 ethylene complex, Path2Zero is designed to add 1.8 mtpa of ethylene capacity using low-carbon Canadian ethane.

The delay will reduce Dow’s 2025 Capex by $1B, from $3.5B to $2.5B, as part of a broader $6B cash conservation strategy. Dow still describes the project as a “first-quartile asset” in terms of returns, but even top-tier ethane projects are being deferred in the current environment.

For North American ethane, this is a material hit: a major demand source is now off the table until market signals improve. Until then, export docks and domestic pipelines will remain long, and ethane will stay cheap.

Europe: INEOS Bets Against the Grain

While many European crackers are shutting down, INEOS is building. Project One in Antwerp will be the region’s only new ethylene unit this decade, running on US ethane and aiming for half the emissions of older naphtha plants.

Europe isn’t a growth market, but INEOS faces a shrinking field of competitors from legacy plants fueled by naptha. For example, Dow recently announced it will shut down three petrochemical plants in Germany and the UK in 2026-27, including an ethylene cracker in Bohlen, Germany.

It’s a calculated gamble: that scale, efficiency and feedstock arbitrage can beat regulatory and energy cost headwinds. If INEOS succeeds, it could reset the region’s ethane trajectory. If not, it will stand as a cautionary tale.

Asia: India Grows Under a Geopolitical Shadow

In India, Nayara Energy is expanding the Vadinar complex — a sign of the broader petrochemical buildout underway across Southeast Asia. The project highlights two forces shaping the next era of ethane: growing regional demand and rising geopolitical risk.

While India builds out its own plastics supply chains, it’s also navigating pressures from sanctions tied to Russian ownership. That dynamic creates an uncertain bridge between growing ethane demand and the global feedstock trade — especially if future policy shifts limit access to US volumes or shipping routes.

These projects don’t all point in the same direction — and that’s the point. Ethane is not a one-path story. Global demand is fractured. Contracts are evolving. Infrastructure decisions must account for volatility, policy risk, and a multipolar trade world. The winners won’t just have the cheapest molecule. They’ll have the most flexible strategy.

Exports:

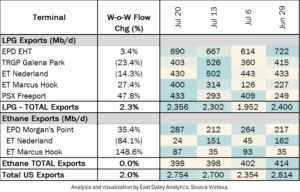

Combined LPG and ethane exports increased 2.0% W-o-W to 2,754 Mb/d, driven entirely by rising LPG volumes, while total ethane exports remained unchanged.

LPG: Total LPG exports rose 2.3% W-o-W to 2,356 Mb/d, as strong gains at Marcus Hook (+27%) and Freeport (+48%) more than offset a 23% drop at Galena Park.

Ethane: Ethane exports held flat at 398 Mb/d. A steep 84% drop at Nederland fully offset by gains at Morgan’s Point (+35%) and Marcus Hook (+149%).

Rigs:

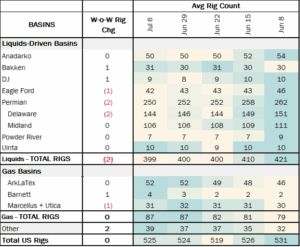

The total US rig count increased during the week of July 6 to 525. Liquids-driven basins increased by 1 W-o-W from 400 to 399.

- Permian (-2):

-

- Delaware (-2): EOG Resources, ConocoPhillips

- Eagle Ford (-1): Grit Oil & Gas Management

- Bakken (+1): Exxon

- Denver-Julesburg (+1): Vessels Tom

Flows:

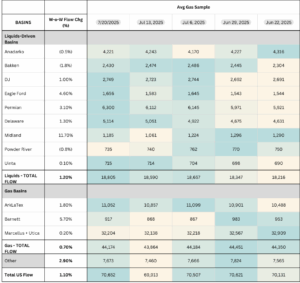

US natural gas volumes averaged 70.7 Bcf/d in pipeline samples for the week ending July 20, up 1.1% W-o-W from 69.9 Bcf/d the previous week.

Gas basins gained 0.7% W-o-W to average 44.1 Bcf/d. The Haynesville sample gained 1.8% to 11 Bcf/d. The Marcellus+Utica gained 0.2% to 32.2 Bcf/d. The Eagle Ford sample rose 4.6% to 1.66 Bcf/d.

Calendar: