Executive Summary: Rigs: The total rig count decreased by 10 for the week of October 20 from 571 to 561. Flows: The Permian Basin gas sample increased 2% W-o-W to 6.1 Bcf/d. Infrastructure: The widening of terminaling fees to $138 per metric ton ($0.27/gal) – shown in the green shaded area in the graph below – and high LPG vessel loadings in 3Q24 have led to outsized earnings for midstream LPG dock owners like Targa Resources (TRGP). Purity Product: The early 3Q24 earnings data suggests ethane supply in the Northeast stayed flat despite a very low July ’24 supply print of 259 Mb/d.

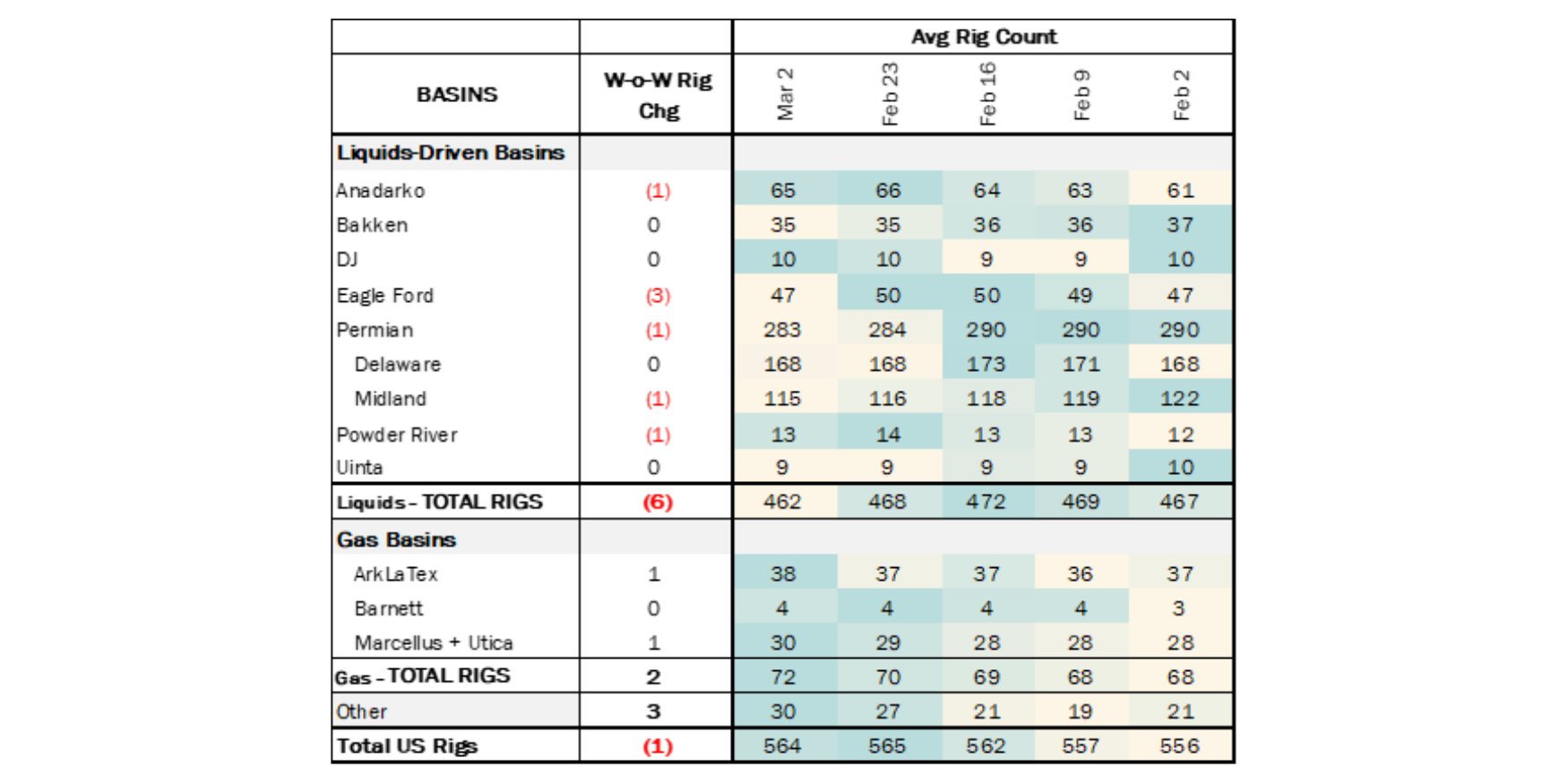

Rigs:

The total rig count decreased by 10 for the week of October 20 from 571 to 561. Liquids-driven basins declined by 4 rigs W-o-W. Rigs classified as “Other” are rigs not allocated to a specific basin listed in this table.

- Permian – Delaware (-6): Devon Energy (-1), EOG Resources (-1), Chevron (-1), Matador Resources (-1), Circle-S Energy (-1), Lario Oil and Gas (-1).

- Bakken (-1): Phoenix Capital Group (-1).

- Anadarko (+1): Stephens & Johnson Operating Co. (+1).

- DJ (+1): Prairie Operating Co. (+1).

- Eagle Ford (+1): Hurd Enterprises (+1).

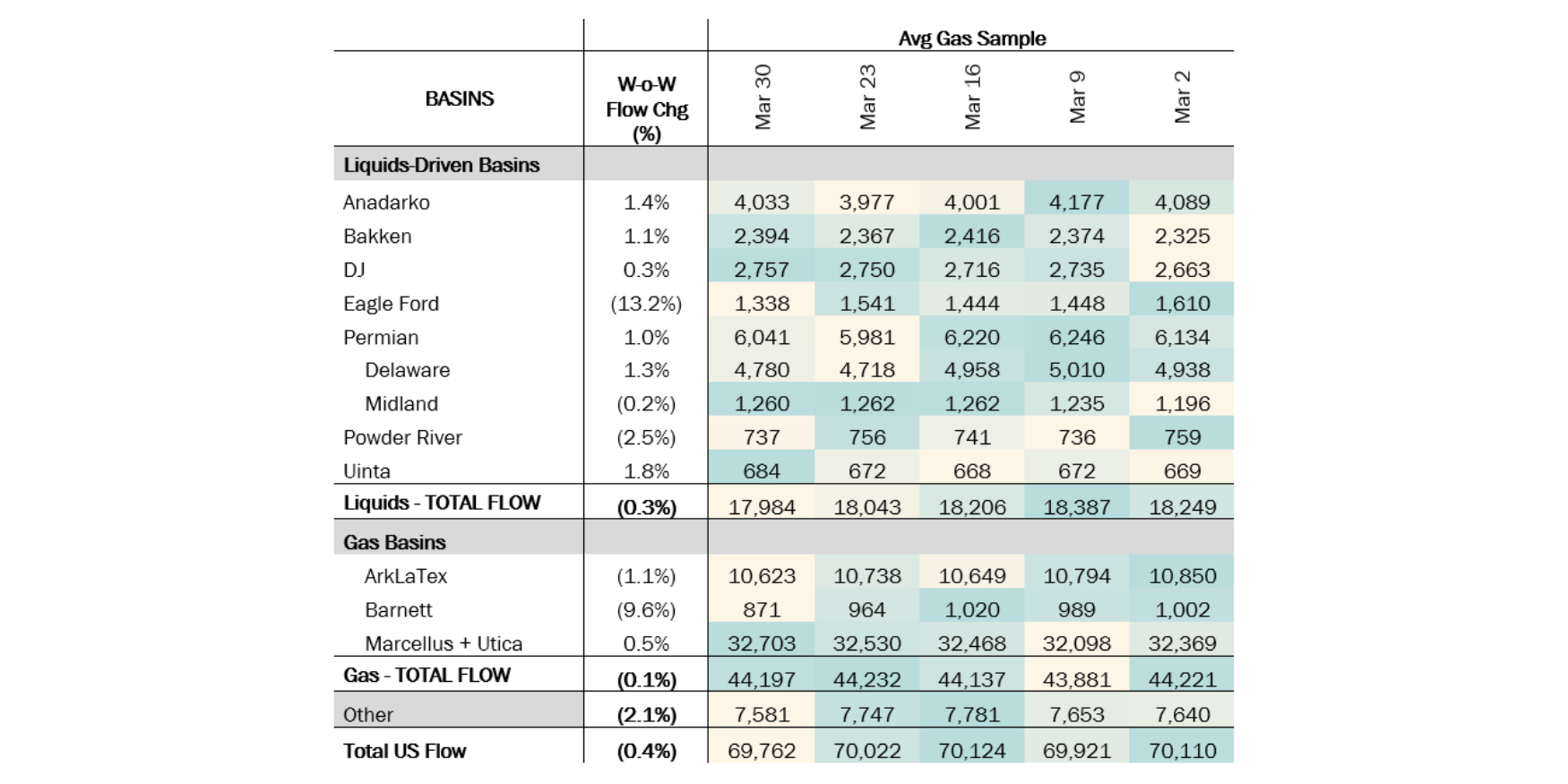

Flows:

The Permian Basin gas sample increased 2% W-o-W to 6.1 Bcf/d. Multiple pipelines (GCX, PHP, EP) have been under maintenance, and critical notices are expected to remain effective until the end of November. Waha prices remain negative even with Matterhorn coming online, as gas has quickly filled the new capacity – volumes on interconnecting pipelines have increased to an average of 1.5 Bcf/d.

*W-o-W change is for the two most recent weeks.

The ArkLaTex Basin gas sample increased 3% W-o-W to 10.5 Bcf/d. The weekly flows are back to early September levels, a partial recovery from hurricane season and prior gas-price induced curtailments.

Infrastructure:

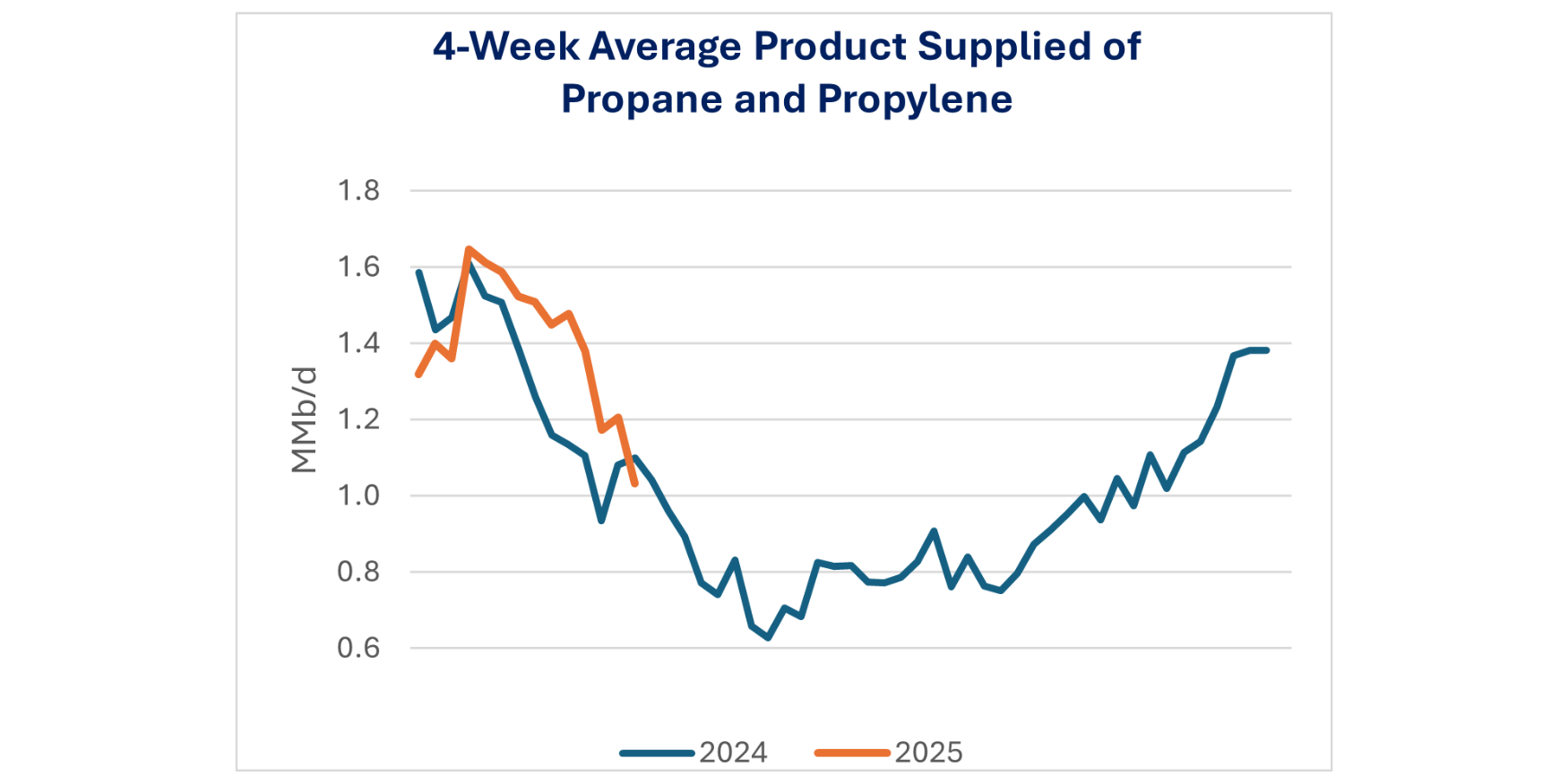

The widening of terminaling fees to $138 per metric ton ($0.27/gal) – shown in the green shaded area in the graph below – and high LPG vessel loadings in 3Q24 have led to outsized earnings for midstream LPG dock owners like Targa Resources (TRGP).

East Daley covered this topic less than a month ago, noting upside to dock owners such as Enterprise Products (EPD), Energy Transfer (ET) and Targa Resources (TRGP). The dynamic is expected to persist ahead during the winter months and ahead of announced dock expansions outlined in EDA’s monthly Propane Supply & Demand Report.

Purity Product Spotlight:

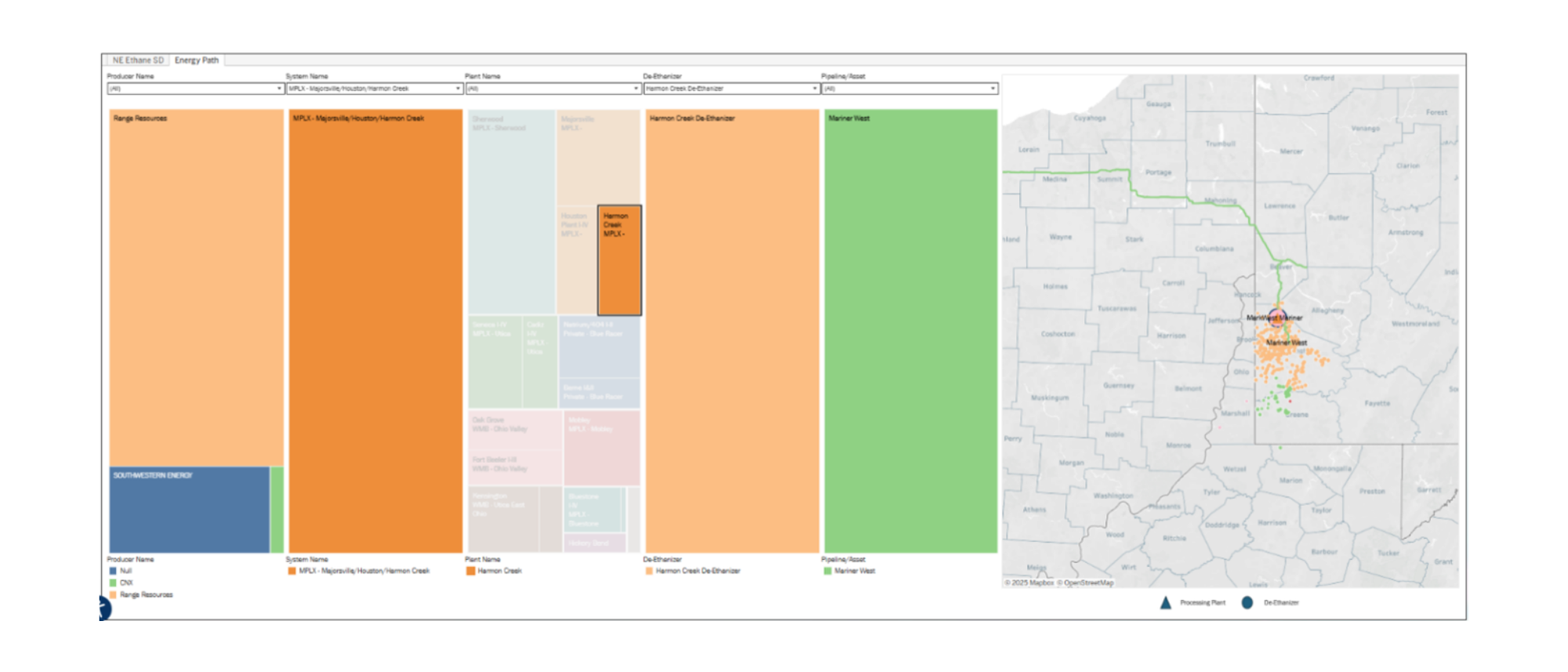

The early 3Q24 earnings data suggests ethane supply in the Northeast stayed flat despite a very low July ’24 supply print of 259 Mb/d. The implication is a sharp – perhaps historic – rebound in supply in September, which could near 400 Mb/d for the EIA-defined Appalachian region.

Large Northeast producers have reported 3Q24 earnings showing flat ethane production from Range Resources (RRC), Antero Resources (AR) and EQT. These three producers generate almost 60% of Marcellus and Utica ethane supply, with a high correlation to final data (refer to the chart below). This means the downward slope to EDA’s ethane supply forecast will be revised up in our next Purity Product Forecast, set to be released on November 21. The new forecast will likely follow the shape of producer ethane supply through the end of September. See East Daley’s Ethane Supply & Demand Report for more information.

-1.png)

-1.png)

-3.png)