Executive Summary: Rigs: The total rig count decreased by 1 for the October 27 week, down to 559 from 560. Liquids-driven basins declined by 4 rigs W-o-W. Flows: In the aftermath of storm Rafael, over 26% of US Gulf of Mexico oil production and 13% of natural gas output remained shut in. Infrastructure: Sentiment for LPG export demand remains bullish.

Rigs:

The total rig count decreased by 1 for the October 27 week, down to 559 from 560. Liquids-driven basins declined by 4 rigs W-o-W.

- Permian (-2):

- Delaware (-1): Chevron (-1)

- Midland (-1): Exxon (-1)

- Anadarko (-1): Staghorn Petroleum LLC (-1)

- Bakken (-1): Hess Corp. (-1)

- Powder River (-1): Rockies Resources Holdings LLC (-1)

- Eagle Ford (+1): 1776 Energy Operators, LLC (-1)

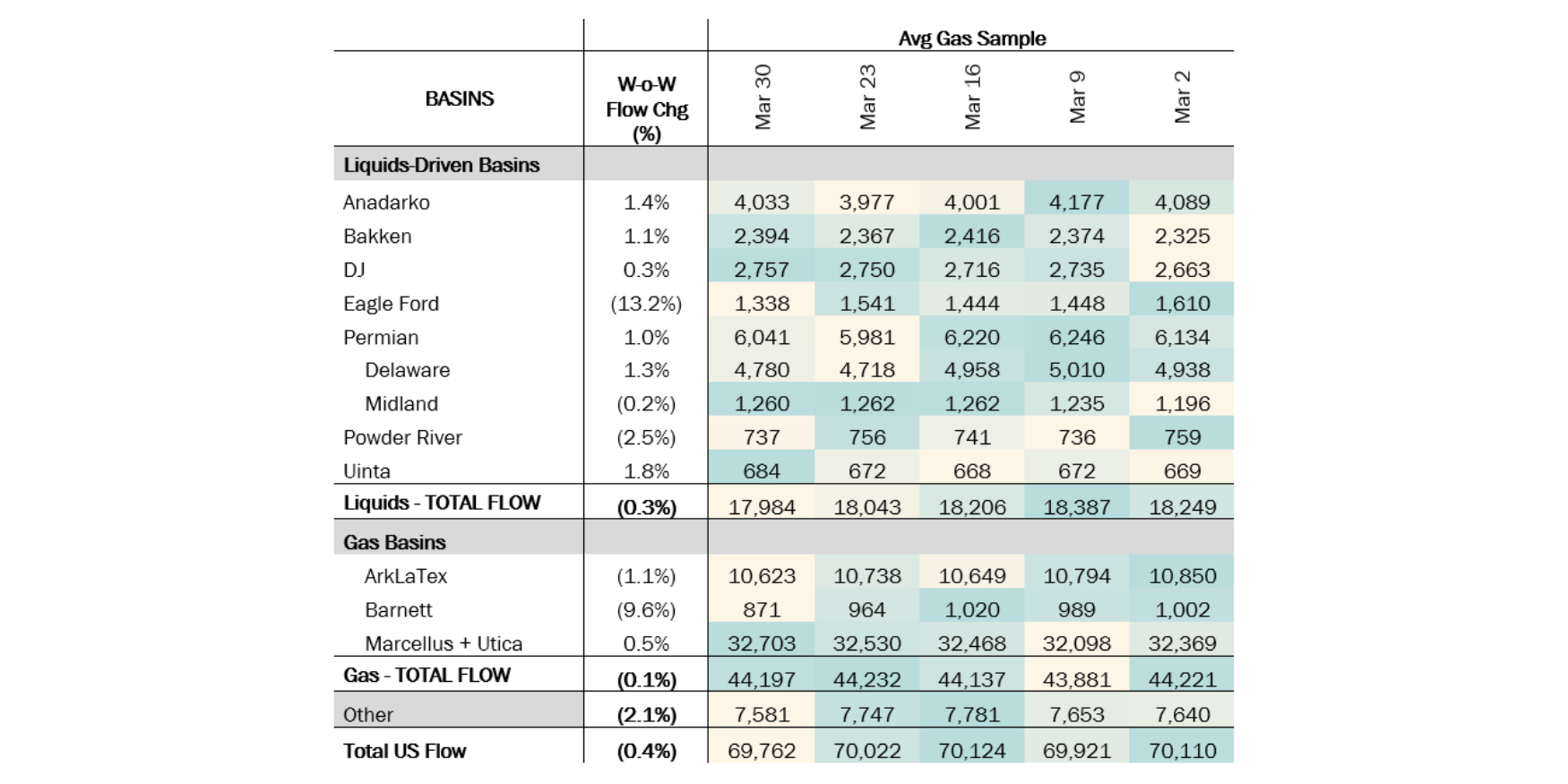

Flows:

- In the aftermath of storm Rafael, over 26% of US Gulf of Mexico oil production and 13% of natural gas output remained shut in. As of Monday, 6% of the production platforms and 17% of the rigs remain evacuated. Total shut-in production losses from Rafael have reached 449 Mb/d of oil and 243 MMcf/d of natural gas.

- Permian Highway Pipeline (PHP) is temporarily reducing pipeline capacity for year-end compressor inspections at several locations. The work will reduce PHP operating capacity to 1.48 Bcf/d from November 5-9, to 1.45 Bcf/d from November 10-14, and to 2.16 Bcf/d from November 15-19. PHP can normally move 2.5 Bcf/d of gas. PHP plans to resume full service on November 20, 2024. The W-o-W flow sample on the basin decreased 1.3% to 6,049 MMcf/d.

*W-o-W change is for the two most recent weeks.

Infrastructure:

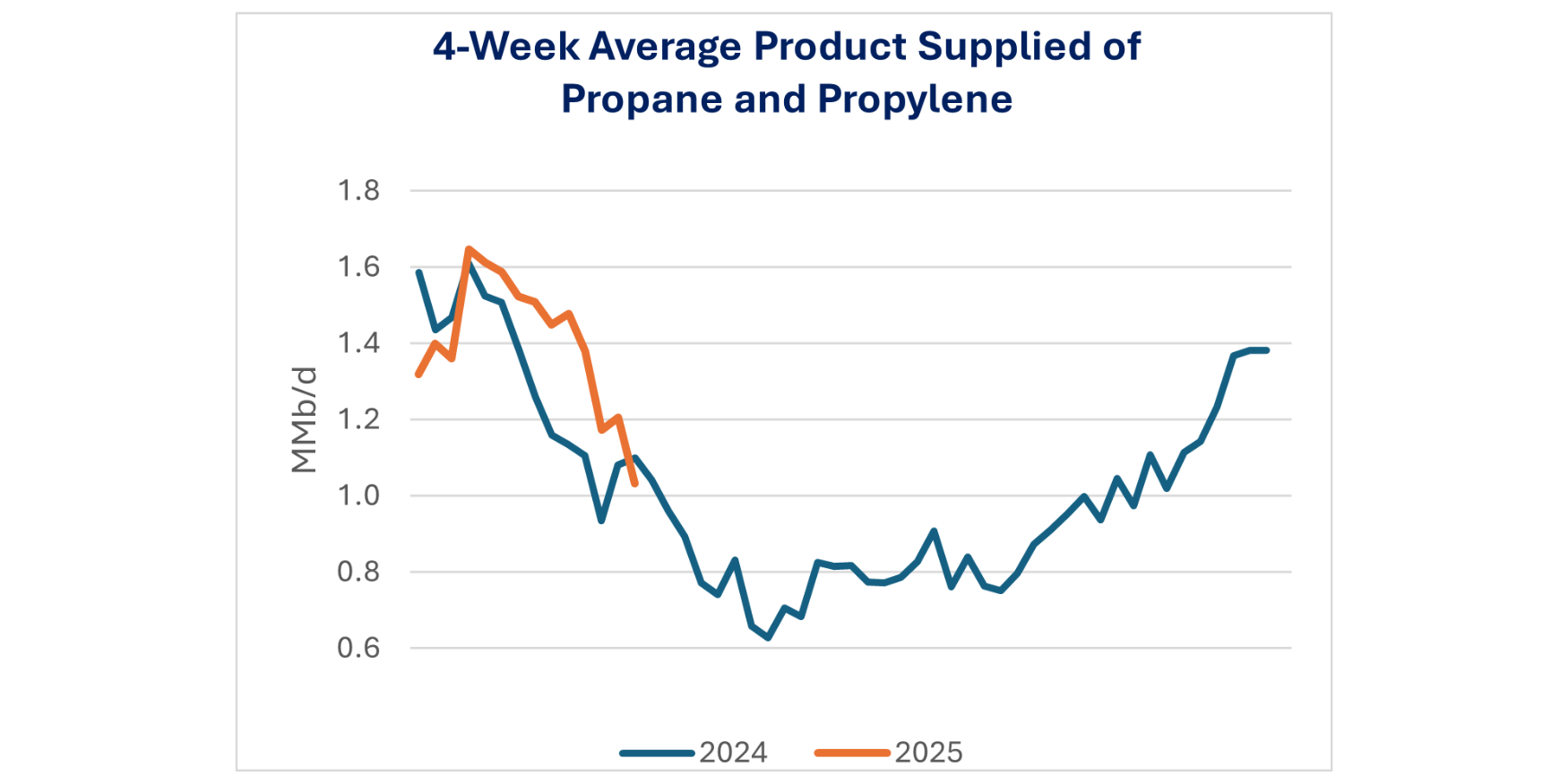

Sentiment for LPG export demand remains bullish. Energy Transfer (ET), Targa Resources (TRPG) and Enterprise Products (EPD) have LPG expansions of 250 Mb/d, 21 Mb/d and 300 Mb/d that are expected to become operational in mid-’25, 4Q25 and EOY26. Total LPG expansion capacity balloons from 571 Mb/d to 931 Mb/d if you consider EPD’s flex propane export capacity at Neches River.

Based on PDH facility expansions in eastern and southern China as well as Kallo, Belgium, there is almost 250 Mb/d of new propane demand now through 2025 from known newbuilds alone. On top of these FID’d LPG expansions, Targa and ET are eyeing even more dock capacity growth. On its 3Q24 earnings call, ET said it is bullish on the Nederland facility expansions and “we will definitely be expanding beyond what we are doing today.” Targa is evaluating a $350MM capital project to add pipe and refrigeration to its Galena Park facility, enabling more export capacity there.

Data Points and Product Release Calendar:

-1.png)