Executive Summary:

Infrastructure: The EIA revised upward its 2024 ethane data, confirming that supply growth was stronger than previously reported.

Exports: Ethane exports dropped 11.2%, with weaker volumes across all ports except Enterprise’s Neches River.

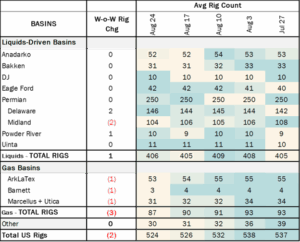

Rigs: The US rig count decreased during the week of Aug. 24 to 524. Liquids-driven basins increased by 1 rig W-o-W from 405 to 406

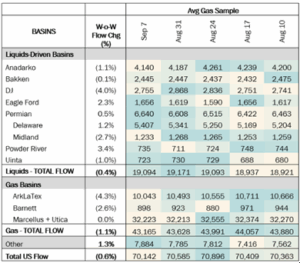

Flows: US natural gas volumes averaged 70.1 Bcf/d in pipeline samples for the week ending Sept. 7, down 0.4% W-o-W.

Infrastructure:

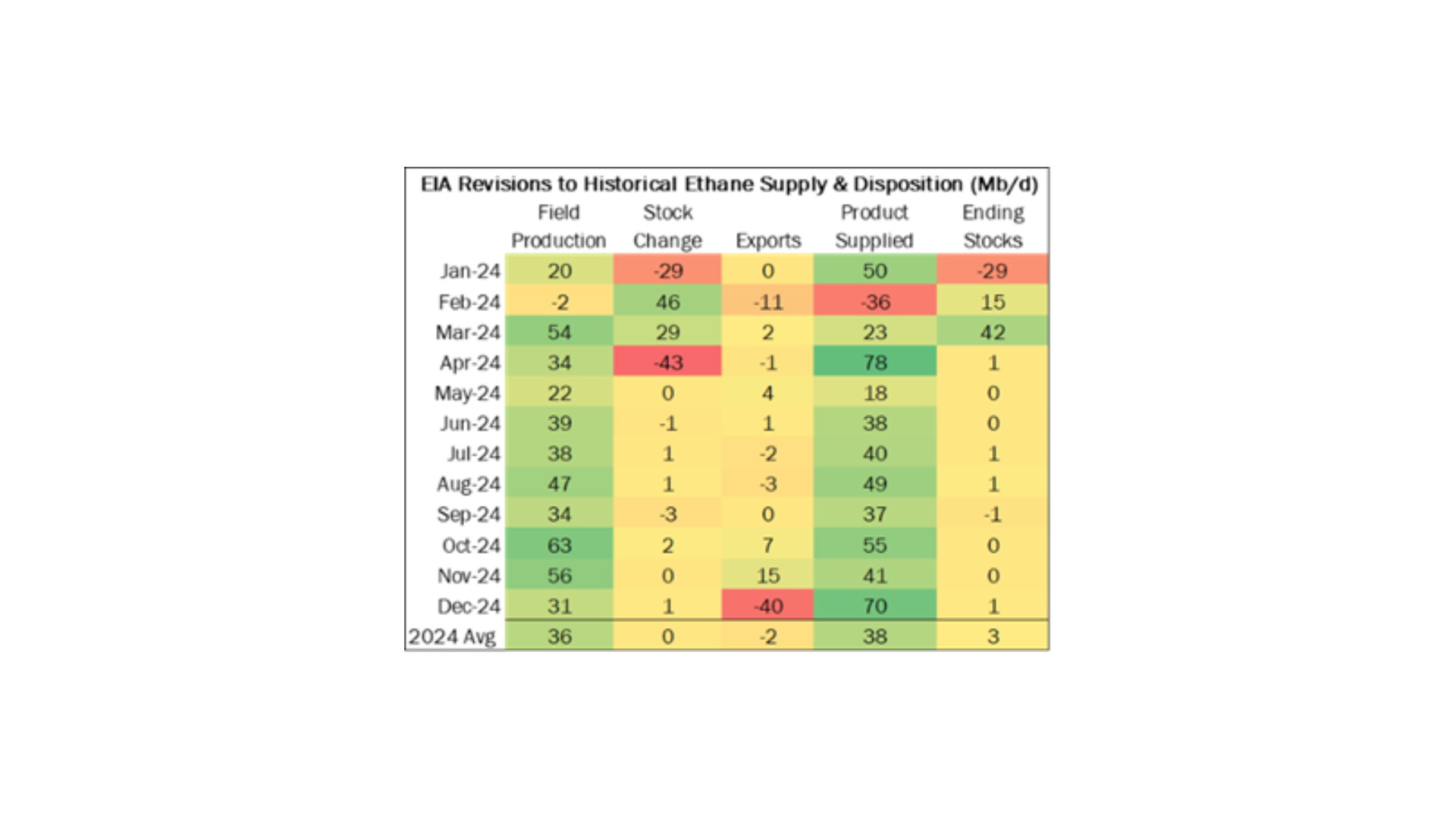

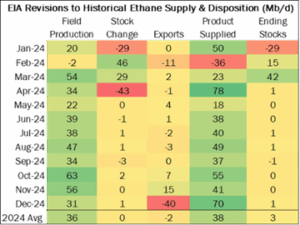

: The Energy Information Administration (EIA) has revised upward its 2024 ethane data, confirming that supply growth was stronger than previously reported. Field production averaged +36 Mb/d higher across the year, with notable gains in Oct ‘24 (+63 Mb/d) and Nov ‘24 (+56 Mb/d). The updates point to a more robust market for ethane, and increased competition between US consumers and exporters.

EIA released the revisions at the end of August as part of its monthly gas processing data series. Only Feb ’24 data showed a small downward revision. The supply gains translate directly into higher product supplied, which rose +38 Mb/d on average in 2024 vs prior estimates (see table).

While data revisions are inherently backward-looking, the updates have implications for the current market. The increased “product supplied” points to stronger-than-reported domestic consumption by Gulf Coast steam crackers, even before the next wave of export capacity ramps. At the same time, new docks at Energy Transfer’s (ET) Flexport and Enterprise Products’ (EPD) Neches River Phase 1 add incremental outlet capacity, ensuring barrels will continue to flow overseas.

This sets up a competitive dynamic: domestic petrochemical companies and exporters are increasingly fighting for the same barrels. The Neches River terminal, in particular, is connected to the AEGIS Pipeline, the same line that delivers ethane to Gulf Coast petrochemical plants. That overlap creates a direct tug-of-war for supply.

East Daley expects this competition to place upward pressure on ethane prices as both markets bid for marginal volumes. In such an environment, supply response becomes critical. The Anadarko/Midcontinent region is best positioned to increase recovery given its proximity to Gulf Coast demand centers and flexible processing infrastructure. Elevated pricing should incentivize incremental recovery from Midcon producers, reinforcing East Daley’s bullish outlook for US supply growth into 2025.

The takeaway: EIA’s revisions confirm stronger ethane supply, but the real story is demand. Domestic petchems are pulling harder, exporters are ramping fast, and the barrels are finite. The resulting competition should tighten balances, lift prices and pull more ethane into recovery — a bullish setup for producers and midstream operators alike.

Exports:

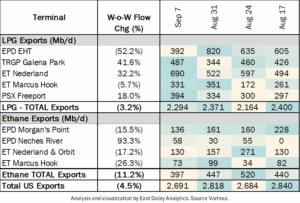

Total NGL exports declined 4.5% for the Sept. 7 week.

- LPG exports fell 3.2%, driven by a 52% decline in Enterprise’s EHT volumes.

Ethane exports dropped 11.2%, with weaker volumes across all ports except EPD’s Neches River, which surged 93% W-o-W from 30 Mb/d to 58 Mb/d. This equates to ~50% utilization of its 120 Mb/d Phase 1 capacity.

Rigs:

The total US rig count decreased during the week of Aug. 24 to 524. Liquids-driven basins increased by 1 rig W-o-W from 405 to 406.

- Delaware (-2): TRP Operating, Diamondback Energy

- Midland (+2): Diamondback Energy, Alleder Inc.

- Powder River (+1): Sandridge

Flows:

US natural gas volumes averaged 70.1 Bcf/d in pipeline samples for the week ending Sept. 7, down 0.6% W-o-W.

Major gas basin samples declined 1.1% W-o-W to 43.1 Bcf/d. The Haynesville sample decreased 4.3% to 10.0 Bcf/d, and the Marcellus+Utica sample held steady at 32.2 Bcf/d.

Samples in liquids-focused basins declined 0.4% W-o-W to 19.1 Bcf/d. The Eagle Ford sample rose 2.3% to 1.7 Bcf/d, while the DJ sample declined 4.0%.

Calendar: