Executive Summary: Rigs: The total rig count decreased by 9 for the week ending December 29, down to 522 from 531. Flows: The pipeline sample from Jan 6 to Jan 12 decline by 4% (2.6Bcf/d), impact on production could continue as another artic blast might affect the central and eastern US. Infrastructure: NGL production hit yet another record in Oct ’24, following prior record production in March, April, May and September of the year.

Infrastructure:

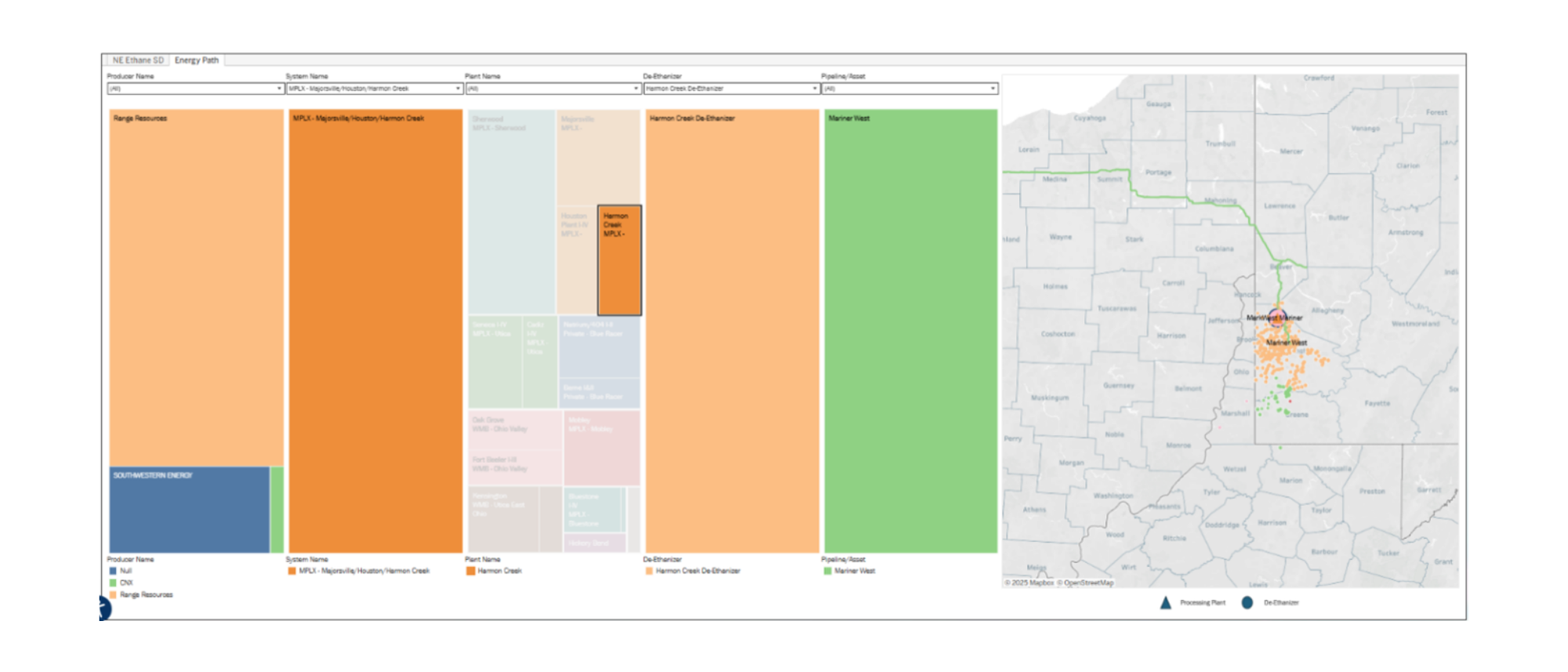

NGL production hit yet another record in Oct ’24, following prior record production in March, April, May and September of the year. Much of the growth in 1H24 came from the biggest component of the NGL barrel (ethane), and East Daley has covered the topic several times in our monthly Ethane Supply & Demand product.

This time, the growth is also coming from the “heavies” – propane, butane and natural gasoline. In fact, 93% of the PADD 3 NGL production growth from 2Q24 to 3Q24 is from c3+. What’s enabled growth in the NGL “heavies” is the early in-service of Targa’s Daytona NGL pipeline from the Permian to Mont Belvieu east of Houston (refer to the map below).

The map shows Targa’s access to Energy Transfer’s (ET) Sendero plant, which is where Daytona receives much of its NGL volumes in New Mexico. This is where most of the growth on Targa’s Grand Prix has come from, as shown in the throughput by state (refer to the orange-shaded bar graph below). Some of Grand Prix’s growth has come from the DJ Basin via Grand Prix’s Oklahoma lateral, but most has come from New Mexico. The jump in throughput corroborates management’s comment that the pipeline was needed to alleviate constraints, especially in the Permian.

With a full quarter of Daytona throughput, Targa’s new Train 10 fractionator (as well as the restart of Gulf Coast Fractionators) and extremely tight LPG exports markets creating upside on spot exports, EDA expects Targa will book record earnings in 4Q24. EDA’s Targa model will be updated by mid-Jan’25 ahead of earnings.

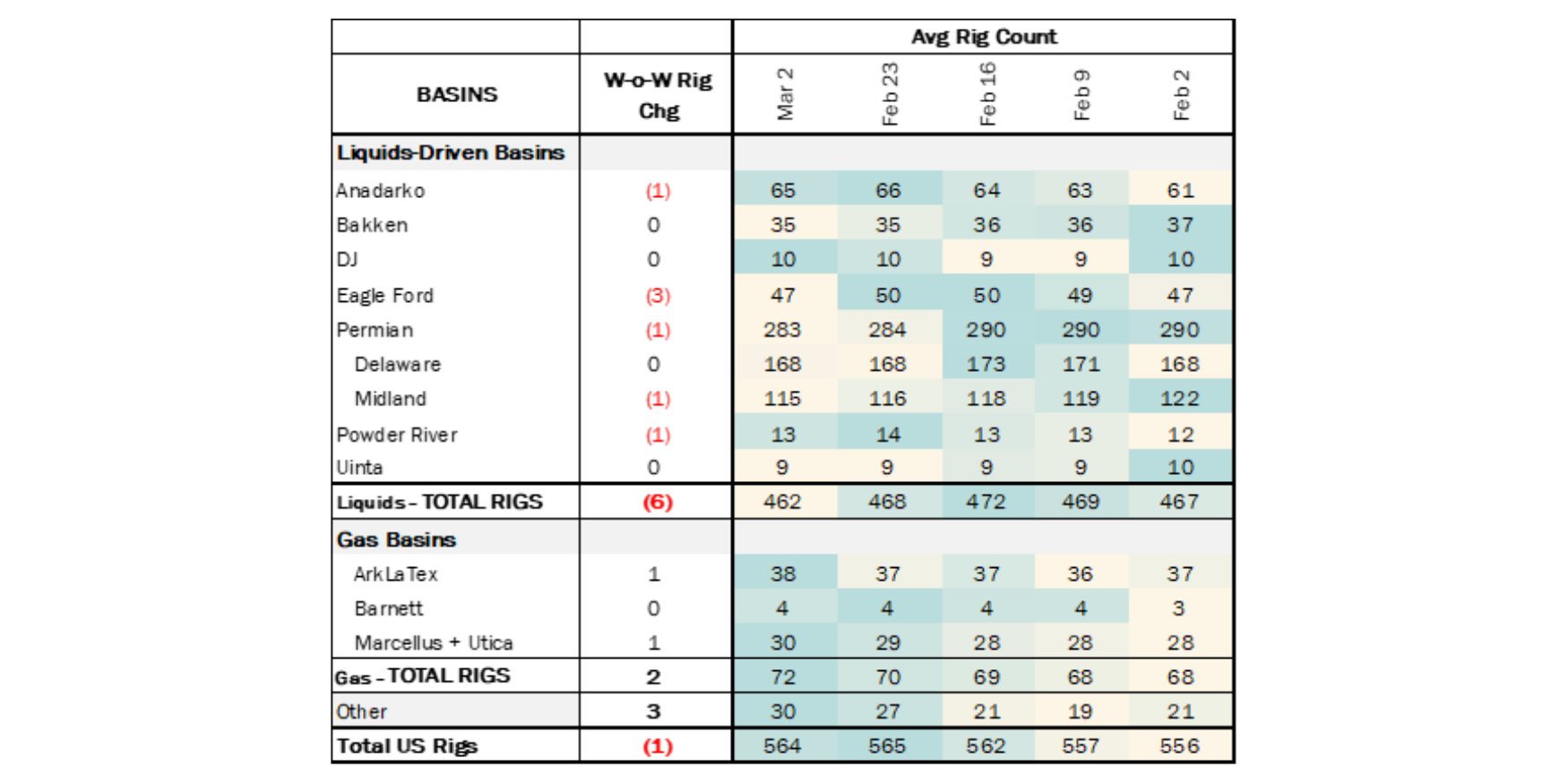

Rigs:

The total rig count decreased by 9 for the December 29 week, down to 522 from 531. Liquids-driven basins declined by 11 rigs W-o-W.

- Bakken (-4): Continental Resources, Hess Corporation, Kraken Resources, Petro-Hunt

- Permian – Delaware (-2): Devon Energy, Riley Exploration Permian

- Eagle Ford (-2): Pursuit Oil & Gas, Formentera Partners

- Anadarko (-1): Downing-Nelson Oil

- Powder River (-1): Peak Powder River Resources LLC

- Uinta (-1): Crescent Energy Co.

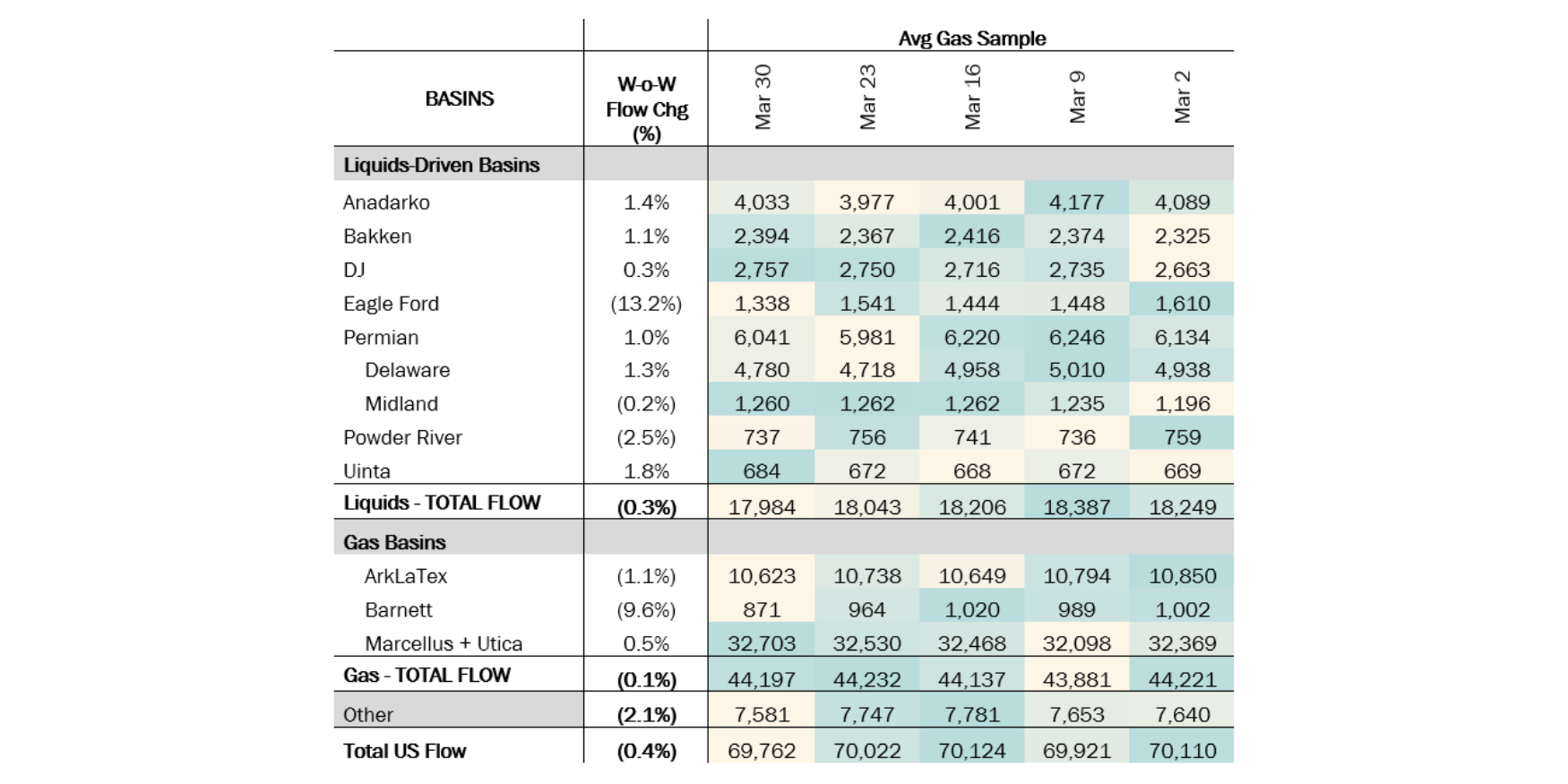

Flows:

- Winter storms across much of the US curtailed some natural gas production from Jan. 5-12. The largest declines occurred in the Anadarko, Appalachian, Permian and ArkLaTex basins. Production started falling last Monday (January 6) as wellheads and equipment froze in freezing temperatures. Regional pipe samples declined by 2.6 Bcf/d from the week of Dec 30 – Jan 5 vs Jan 6–12 (see table). The Appalachian (-1.0 Bcf/d), Haynesville (-0.4 Bcf/d), and Permian (-0.4 Bcf/d) basins saw the largest declines in samples.

- We expect a larger impact next week, when a powerful Arctic blast is forecast to bring frigid temperatures to the Midwest and eastern US. This cold wave will plunge temperatures significantly below average, affecting regions from the northern Plains to the Gulf Coast. The Northeast and Great Lakes areas may experience increased snowfall due to this Arctic outbreak.

- While production freeze-offs are a concern during cold weather, the impact on storage inventories could be more serious. With less produced gas and elevated Res/Com demand, storage withdrawals are likely to be significant.

Data Points & Product Release Calendar

-1.png)

-1.png)

-3.png)