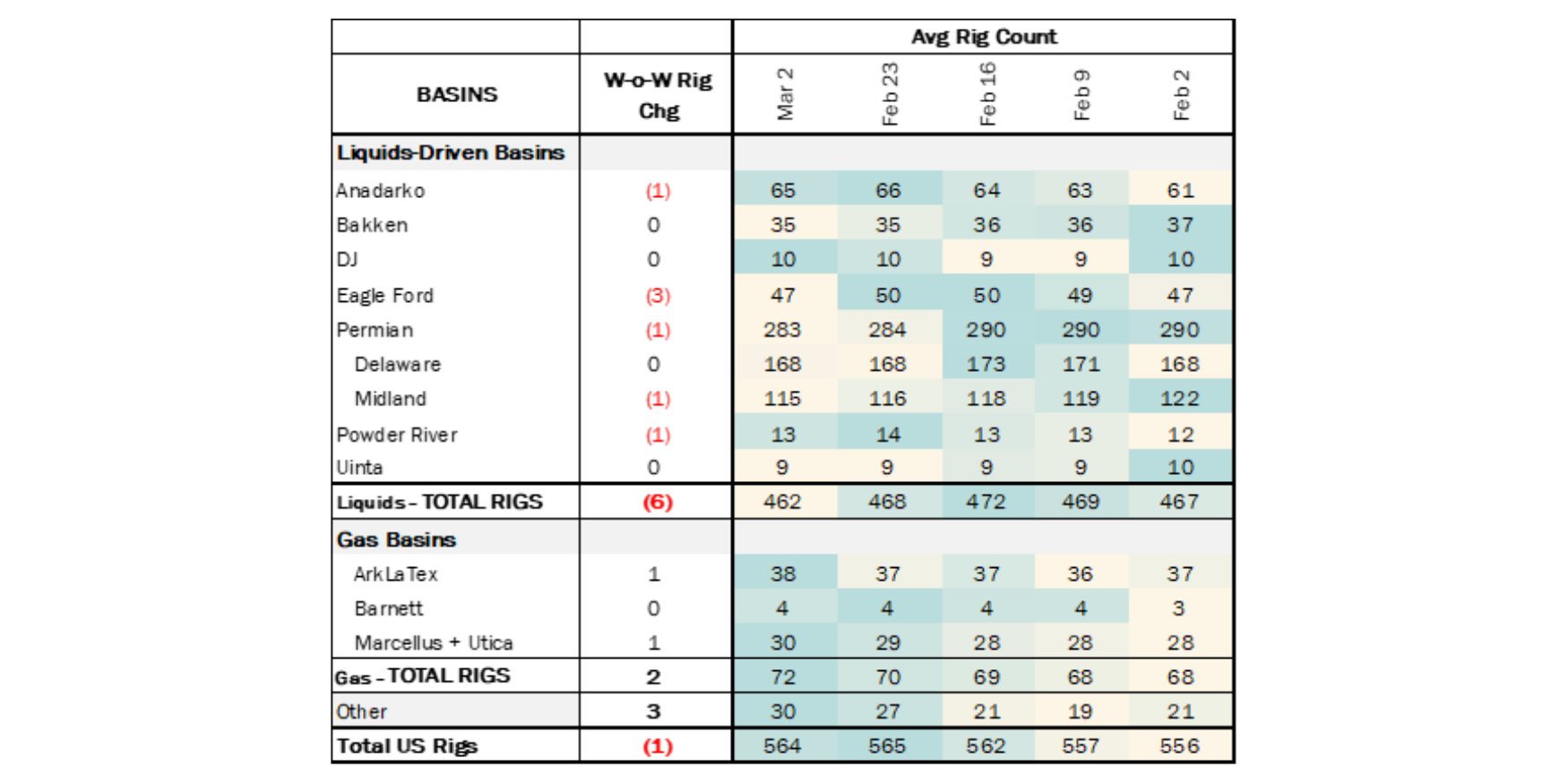

Executive Summary: Rigs: The total US rig count decreased by 1 rig W-o-W, and liquids-driven basins decreased by 3 rigs for the February 25 week. Flows: As of March 10, the US interstate gas sample dropped 1% W-o-W, mainly driven by gas-focused basins. Infrastructure: The Houston Ship Channel (HSC) is working around the clock to keep LPG cargoes moving thanks to a recent change in operations. Purity Product Spotlight: Another source of spare capacity is a recent decline in propane exports.

Rigs:

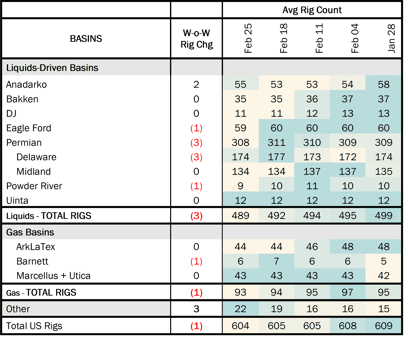

The total US rig count decreased by 1 rig W-o-W, and liquids-driven basins decreased by 3 rigs for the February 25 week. The Permian Basin saw the most activity with the Delaware Basin losing 3 rigs, while the Powder River and Eagle Ford each lost 1 rig. The Anadarko Basin was the only basin to see an increase, gaining 2 rigs.

In the Anadarko Basin, Castle Resources and Mack Energy each added 1 rig. EOG Resources (EOG) dropped a rig in the Powder River Basin, and Blackbrush Oil & Gas shed 1 rig in the Anadarko. In the Delaware, Permian Resources, Devon and APA Corp. each dropped 1 rig.

Flows:

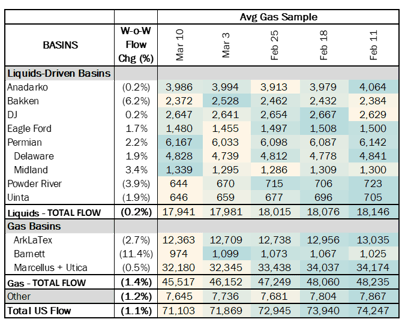

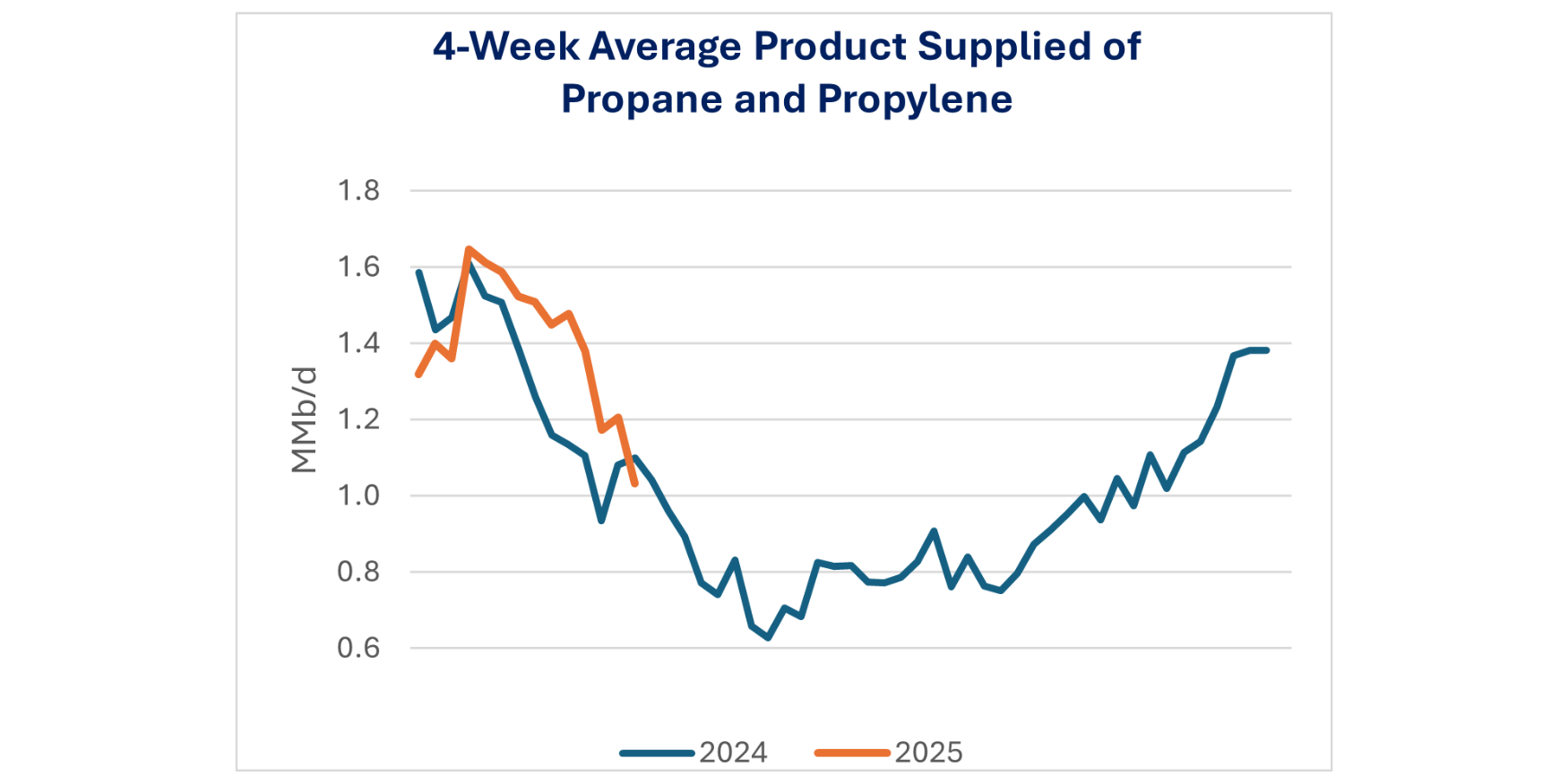

As of March 10, the US interstate gas sample dropped 1% W-o-W, mainly driven by gas-focused basins. Natural gas prices are trading under $2/MMBtu, and the effects of low prices are starting to show up in samples for gas basins. In the Northeast and ArkLaTex, producers like EQT and Chesapeake (CHK) are curtailing production and delaying the start of new wells.

The Bakken sample also dropped 6% W-o-W. The decline in the Bakken sample could be related to weather or related to the high heat content of gas sent to Northern Border Pipeline, although we are uncertain of the driving force.

Infrastructure:

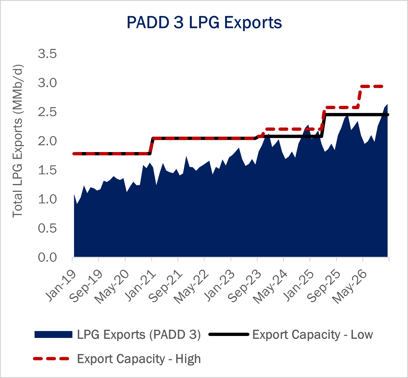

The Houston Ship Channel (HSC) is working around the clock to keep LPG cargoes moving thanks to a recent change in operations. Several midstream names are benefiting as LPG exports hit new records.

In November 2023, the Houston Pilots Association, the organization representing marine pilots who ferry boats through the HSC, amended its navigation safety guidelines. The group struck its “no night transit” restriction previously imposed on LPG tankers, allowing all-night pilotage services.

Targa Resources (TRGP) and Enterprise Products (EPD) will gain the most from the new working hours, according to East Daley’s NGL Network Model. During 4Q23, TRGP shipped 435 Mb/d of LPGs from its export dock, operating at ~98% utilization. EPD shipped almost 700 Mb/d in 4Q23 at its Enterprise Hydrocarbons Terminal (EHT) vs capacity of 835 Mb/d, or 84% utilization.

There is some ambiguity around the true operational capacity of LPG docks. Targa notes its monthly export capacity is dependent on propane and butane demand and vessel size, for example. What we know is that capacity is very tight. LPG exports out of PADD 3 (the blue-shaded area in the figure) have been running strong and approached dock capacity (the black line in the figure) in 2H23. The result is high spot loading fees for dock owners, and downside risk to propane prices if US NGL supplies cannot reach international demand.

The ability to move LPG vessels 24 hours a day helps mitigate the insufficient dock capacity. Targa said the change to piloting hours will increase the effective capacity of its own dock by 5-10%. Enterprise also acknowledged the ability to move more vessels after the pilots lifted the nighttime restrictions. A 7.5% increase in dock capacity (see the red dashed line in figure) would add ~100 Mb/d of capacity for TGRP and EPD on a combined basis and alleviate temporary dock tightness next winter before EPD and Energy Transfer (ET) finish expansions.

Purity Product Spotlight:

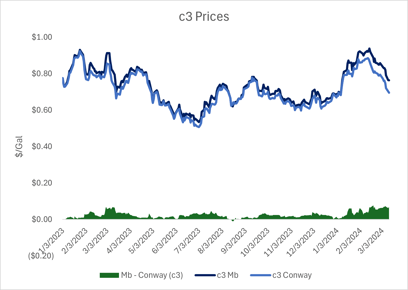

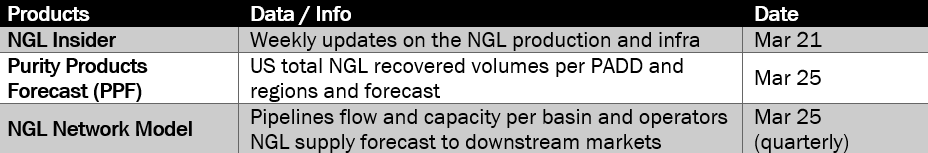

Another source of spare capacity is a recent decline in propane exports. Propane prices have cooled off, down almost 20% at Mont Belvieu and Conway since mid-February ‘24. International demand for propane has also tapered off, as signaled by the EIA Weekly U.S. Exports of Propane & Propylene. The weekly data is down 4% so far in 1Q24 vs 4Q23 data.

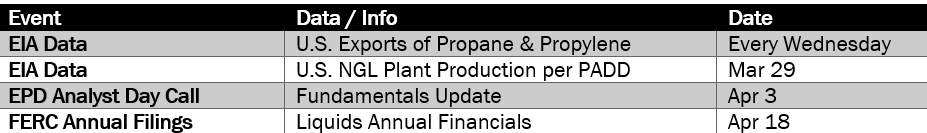

Upcoming Data Points:

Upcoming NGL / LPG Products Releases:

-1.png)

-1.png)

-3.png)