Executive Summary: Infrastructure: Propane storage fell sharply in January, lowering the risk of an oversupplied market in ‘25. Rigs: The total rig count held steady for the week of January 26 at 531. Flows: US pipeline samples averaged 70.5 Bcf/d for the February 9 week, the first weekly flows over 70 Bcf/d since Mar ’24. Calendar: Several NGL-heavy earnings calls are next week including TRGP, EQT, RRC, and MTDR

Infrastructure:

- Propane storage saw a significant drawdown in January, partially aided by Winter Storm Enzo and the coldest January in the US since 1988. According to NOAA, Jan ’25 was almost 1 degree colder than average and included 6-10” of snow in eastern Texas and the Florida Panhandle.

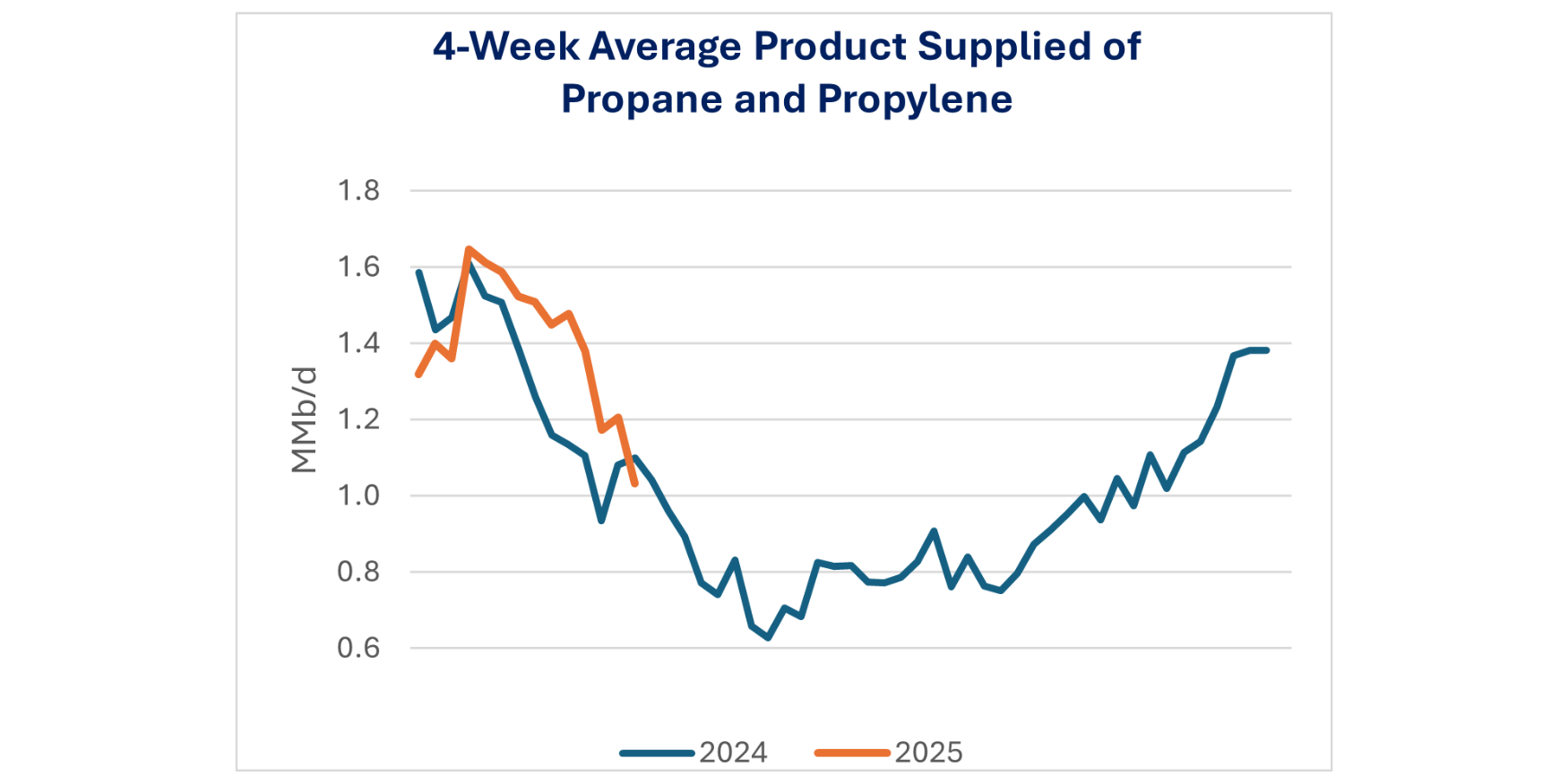

- The frigid temperatures and strong LPG exports – +9% Y-o-Y Jan ’24 to Jan ’25 and +1% M-o-M Dec ’24 to Jan ’25 – have reduced the risk of a heavily oversupplied propane market for 2025. EDA’s prior forecast reflected inventories eclipsing 100 MMbbl in Sep and Oct ’25. Our revised outlook will be more balanced and resemble something closer to the graph below.

- East Daley still expects significant propane growth from the Permian Basin. If LPG export demand grows by less than 5% Y-o-Y, there remains risk of an oversupplied market. Permian supply is headed towards the Gulf Coast, ready or not. China specifically, and international markets generally will be the variables to watch. EDA’s updated oil, gas and NGL supply outlook – as well as our Propane Supply & Demand report – will be available the week of February 24.

Rigs:

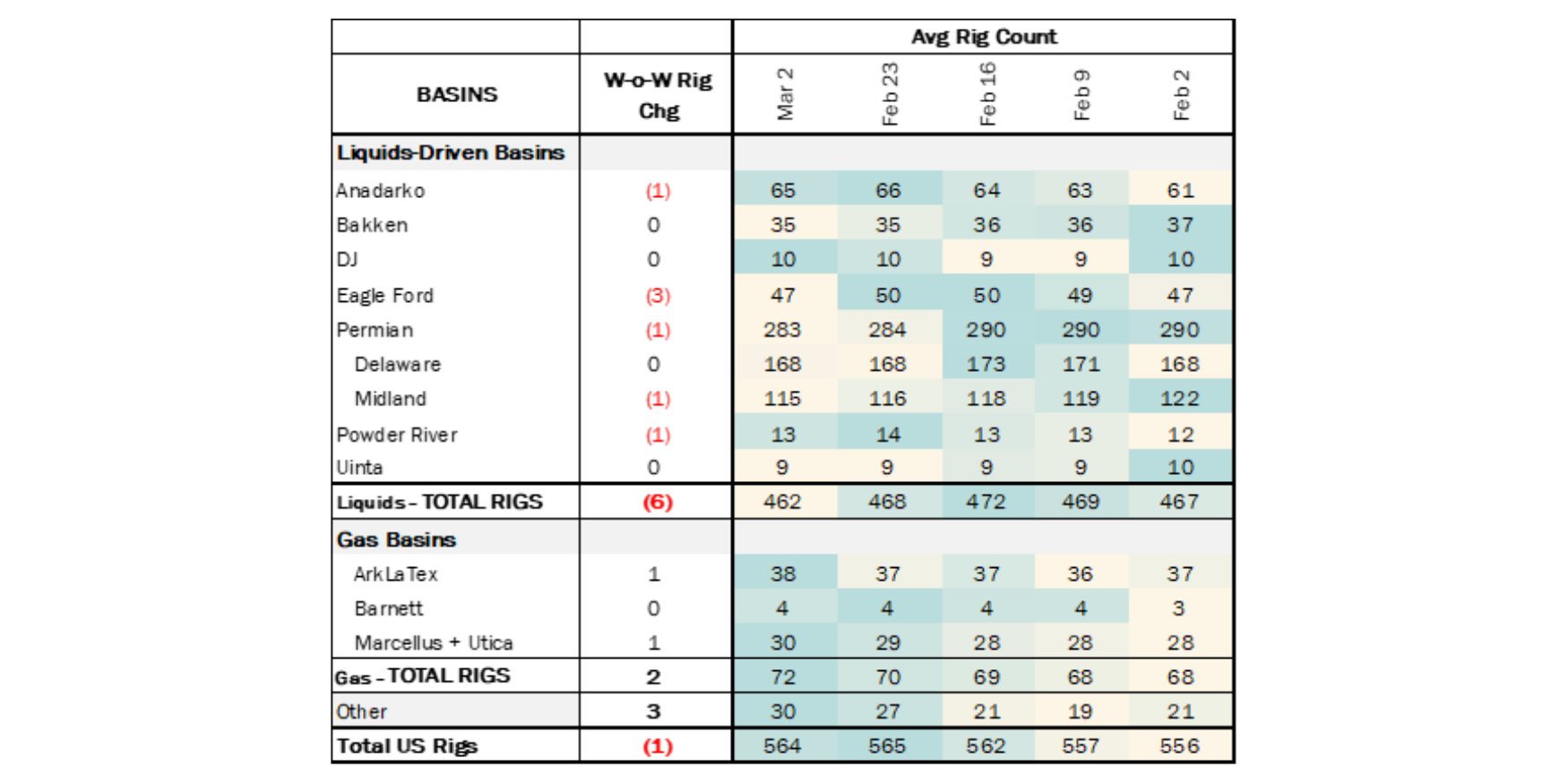

The total rig count held steady for the week of January 26 at 531. There was no change in liquids-driven basins at 446 rigs.

- Permian (-4):

- Delaware (-3): BP, Devon, Permian Resources

- Midland (-1): Mewbourne Oil

- Eagle Ford (+1): Pillar Oil & Gas

- Anadarko (+3): Nadel and Gussman LLC, ARP Operating LLC, Rockhound Petroleum LLC

Flows:

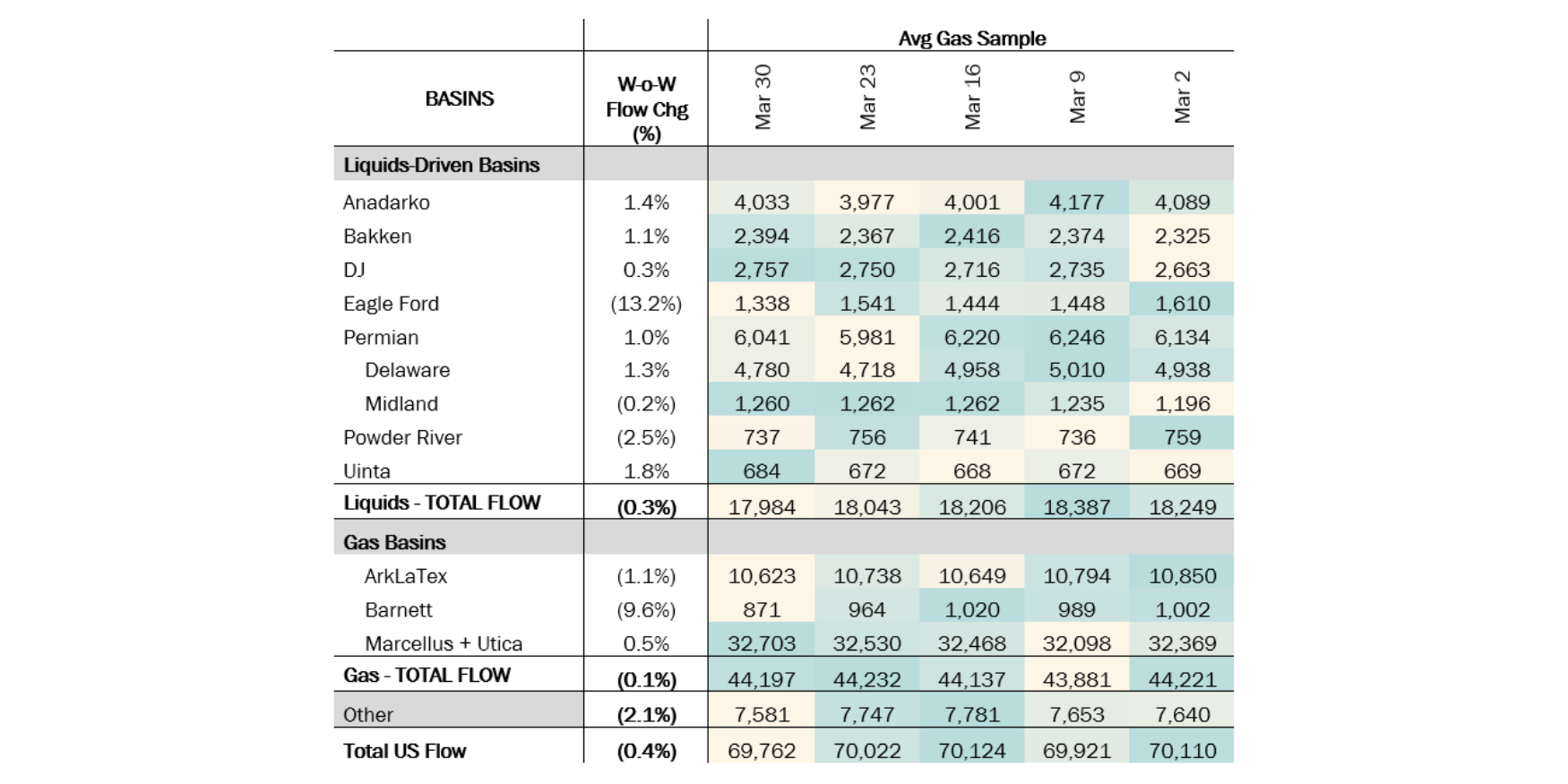

US pipeline samples increased 520 MMcf/d (+0.8%) to average 70.5 Bcf/d for the February 9 week. This marks the first weekly average over 70 Bcf/d since Mar ’24 in EDA’s sample coverage. The Eagle Ford (+6.1%), ArkLaTex (+1.0%) and Marcellus+Utica (+1.4%) drove the W-o-W gains.

Flows continue to rebound off lows in mid-January, when frigid weather from Winter Storm Enzo disrupted some operations. Higher gas prices may also have prompted some producers to restart shut-in wells.

*W-o-W change is for the two most recent weeks.

Data Points and Product Release Calendar:

Come See Us at OPIS NGL Summit!

We're heading to OPIS NGL Summit March 10th and 11th in Charlotte Harbor, Florida. Request a meeting with us here.

-1.png)

-1.png)

-3.png)