Executive Summary: Rigs: The US total rig count increased by 1 rig for the July 21 week, up to 560 from 559. Flows: The total interstate gas meter sample is up slightly W-o-W. Infrastructure: Backed by strong demand for ethane, Enterprise Products (EPD) is expanding its Enterprise Hydrocarbons Terminal. Purity Product: Propane and propylene exports have bounced back post-Hurricane Beryl, signaling continued strong international demand

Rigs:

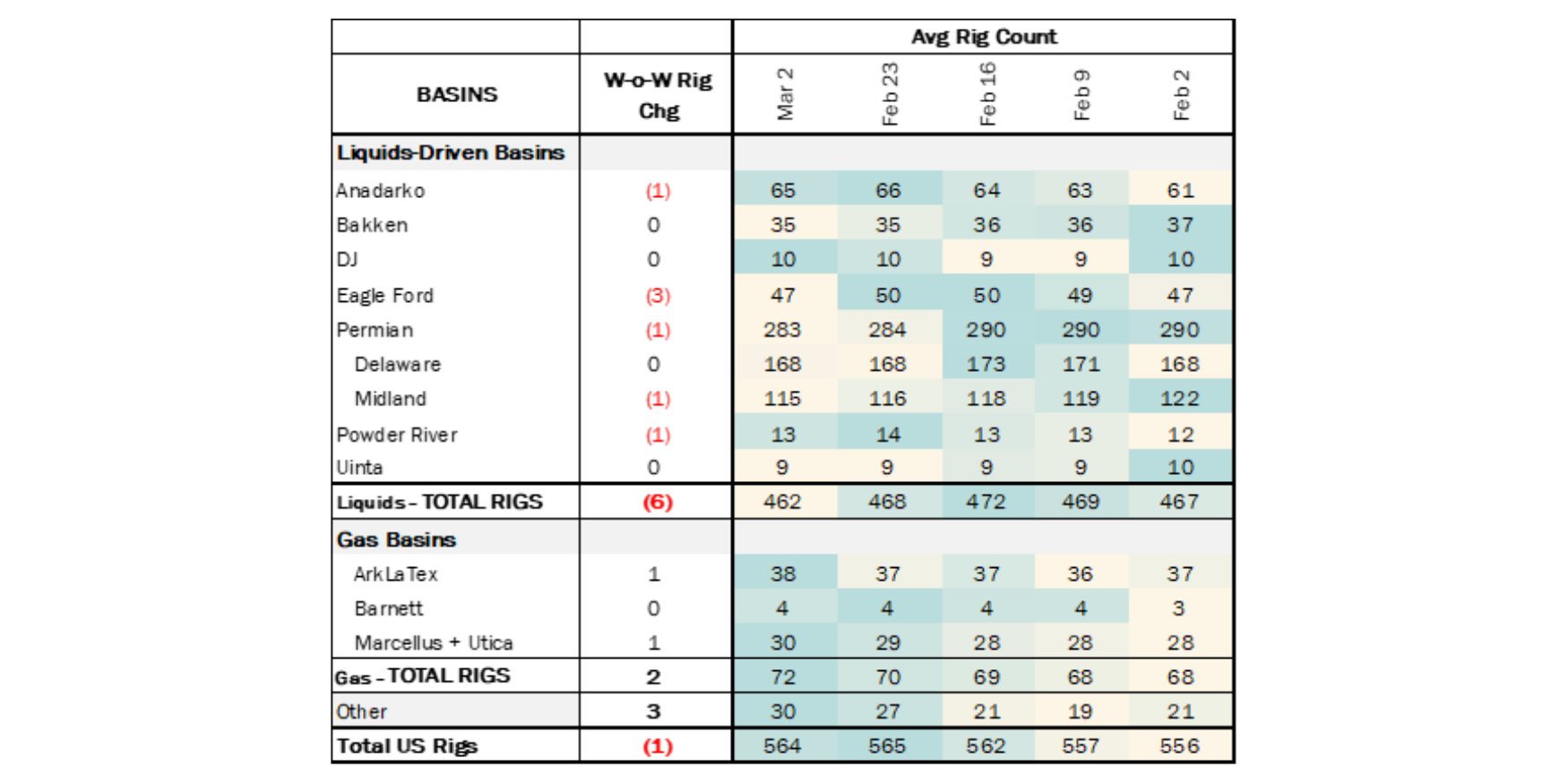

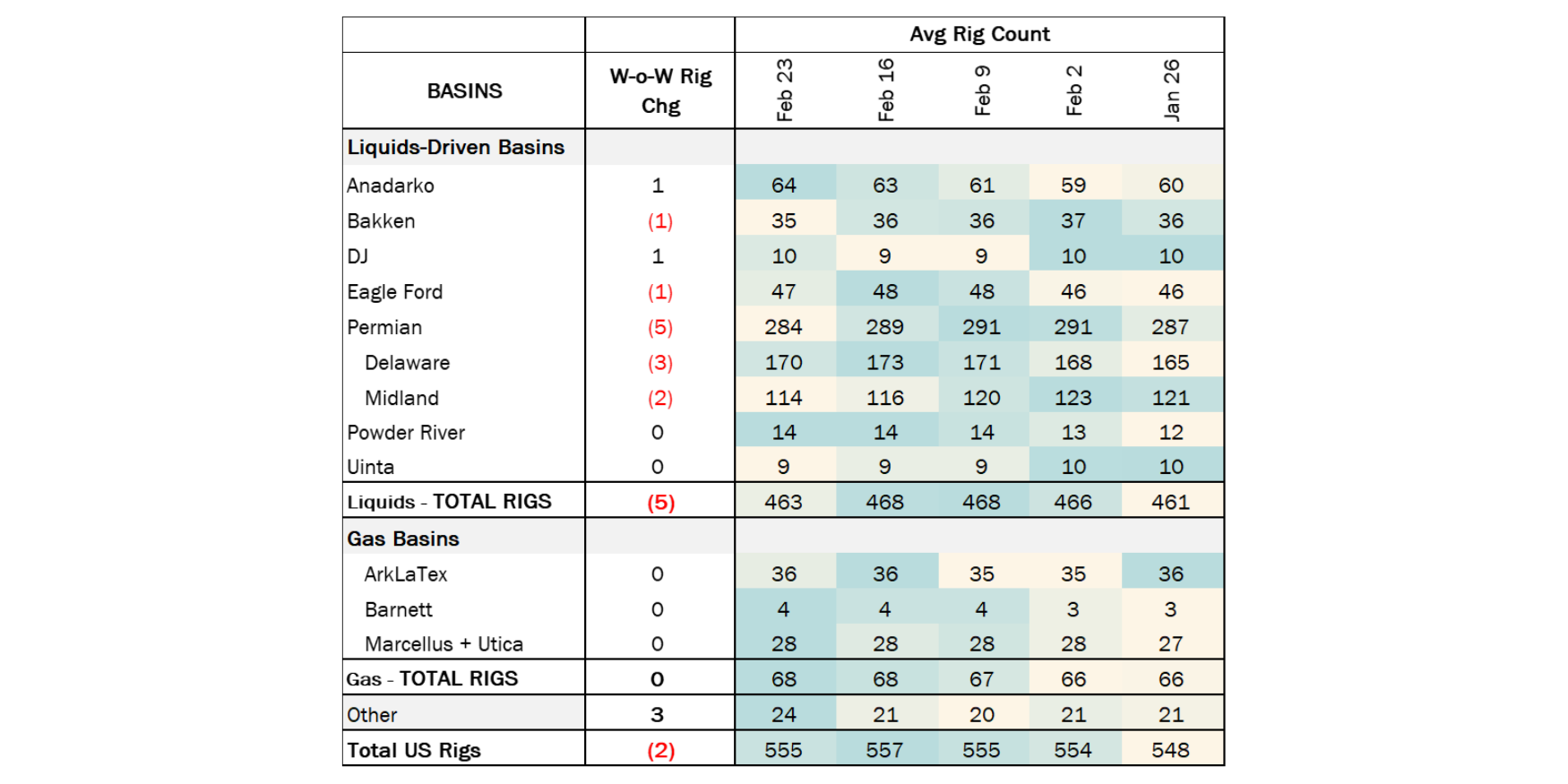

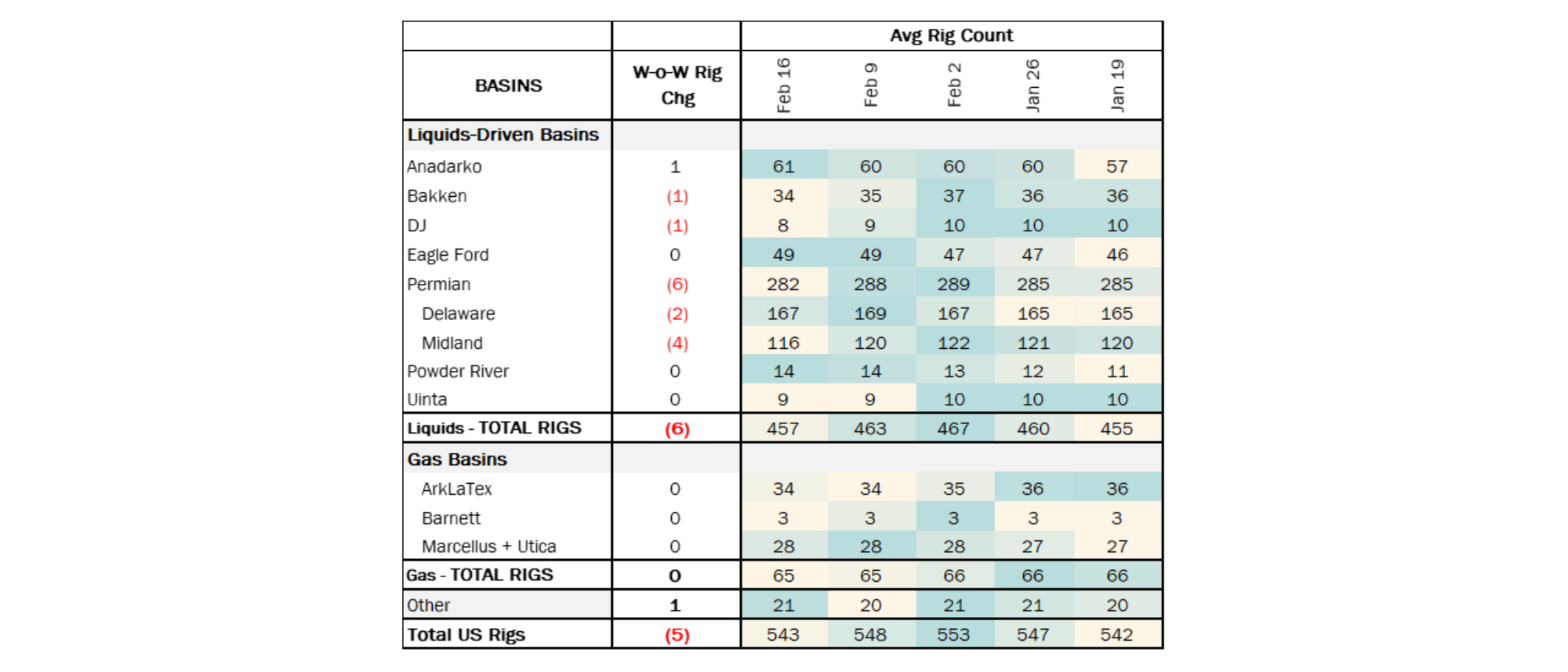

The US total rig count increased by 1 rig for the July 21 week, up to 560 from 559. Liquids-driven basins saw an increase of 2 rigs, moving the count from 454 to 456. The Anadarko, Eagle Ford and Uinta basins each gained 1 rig while Permian rig count increased by 2. However, the Bakken basin lost 3 rigs.

In the Anadarko Basin, operator Gulf Exploration added 1 rig. In the Eagle Ford, Ballard Exploration increased its rig count by 1. In the Delaware basin, operators Permian Resources and ConocoPhillips (COP) each added a 1 rig. Finally, in the Uinta Basin, operator Morning Gun Exploration ran 1 more rig.

Flows: The total interstate gas meter sample is up slightly W-o-W. Liquids-focused basins are up 1% with the biggest outlier being recovery of volumes in the Bakken. The Alliance Pipeline has been experiencing reduced capacity from third-party plant issues, affecting flows from the Bakken, though volumes are rebounding over the past week and the pipeline will be fully operational by August 8. The Anadarko is down slightly due to planned outages on the ANR Pipeline. In the Permian, the Targa Road Runner plant was shut down on August 6, leading to a temporary halt in volumes to the Double E Pipeline, but flows are expected to be back to normal by August 7.

Next week, maintenance on the Mountain Valley Pipeline in the Northeast will cut flows by 510 MMcf/d from August 8-12 compared to flows this week.

Infrastructure:

Backed by strong demand for ethane, Enterprise Products (EPD) is expanding its Enterprise Hydrocarbons Terminal. The project, targeted for in-service by YE26, will add refrigeration to increase propane and butane export capacity by 300 Mb/d.

Successful ethane export contracting is partly responsible for this LPG expansion project. As East Daley noted in our 2Q24 webinar on ethane supply and demand, EPD is likely to use the Neches River facility predominately for ethane exports as a result of ethane contracts it has booked totaling 450 Mb/d.

We expect LPG export capacity to be tight through the upcoming winter season, with Gulf Coast (PADD 3) dock utilization nearing 100%. Tight dock capacity will cause propane prices to fall and widen LPG price spreads from Mont Belvieu to East Asia.

Long-term LPG export capacity is on the way with several expansion projects in the hopper (refer to the figure below). In the chart, we ignore the 360 Mb/d of LPG capacity from Neches River; we believe EPD instead will commit that dock space primarily for 180 Mb/d of ethane capacity.

The amount of demand at the end market will depend on utilization rates at Propane Dehydrogenation (PDH) facilities in east and south China. Newbuild PDH facilities will bring on more than 500 Mb/d of propane demand capacity by the end of 2025. East Daley will address that demand variable in our monthly Propane Supply & Demand product and during our 3Q24 NGLs webinar on Aug 28.

Purity Product Spotlight:

Propane and propylene exports have bounced back post-Hurricane Beryl, signaling continued strong international demand. Incredibly, exports were up almost 3% Y-o-Y in July ’24 according to EIA data, suggesting Berly had minimal impact on vessel loadings during the month. At the same time, propane and propylene storage edged up only 0.5 MMbbl to 87.9 MMbbl for the week ending August 2.

Data Points & Product Release Calendar: