East Daley Analytics is watching the Texas natural gas market closely for signs of activity from Matterhorn Express Pipeline. Whitewater Midstream could begin service on the new 2.5 Bcf/d pipe as early as July, as we assume in our Macro and regional models.

EDA forecasts ~500 MMcf/d of linefill volumes in July ’24 from Matterhorn, with flows ramping to the full 2.5 Bcf/d by September ‘24. Our outlook is based on a construction schedule published in September ‘22 by Gulf Companies, the construction manager for the Matterhorn project, targeting an in-service date in July ‘24.

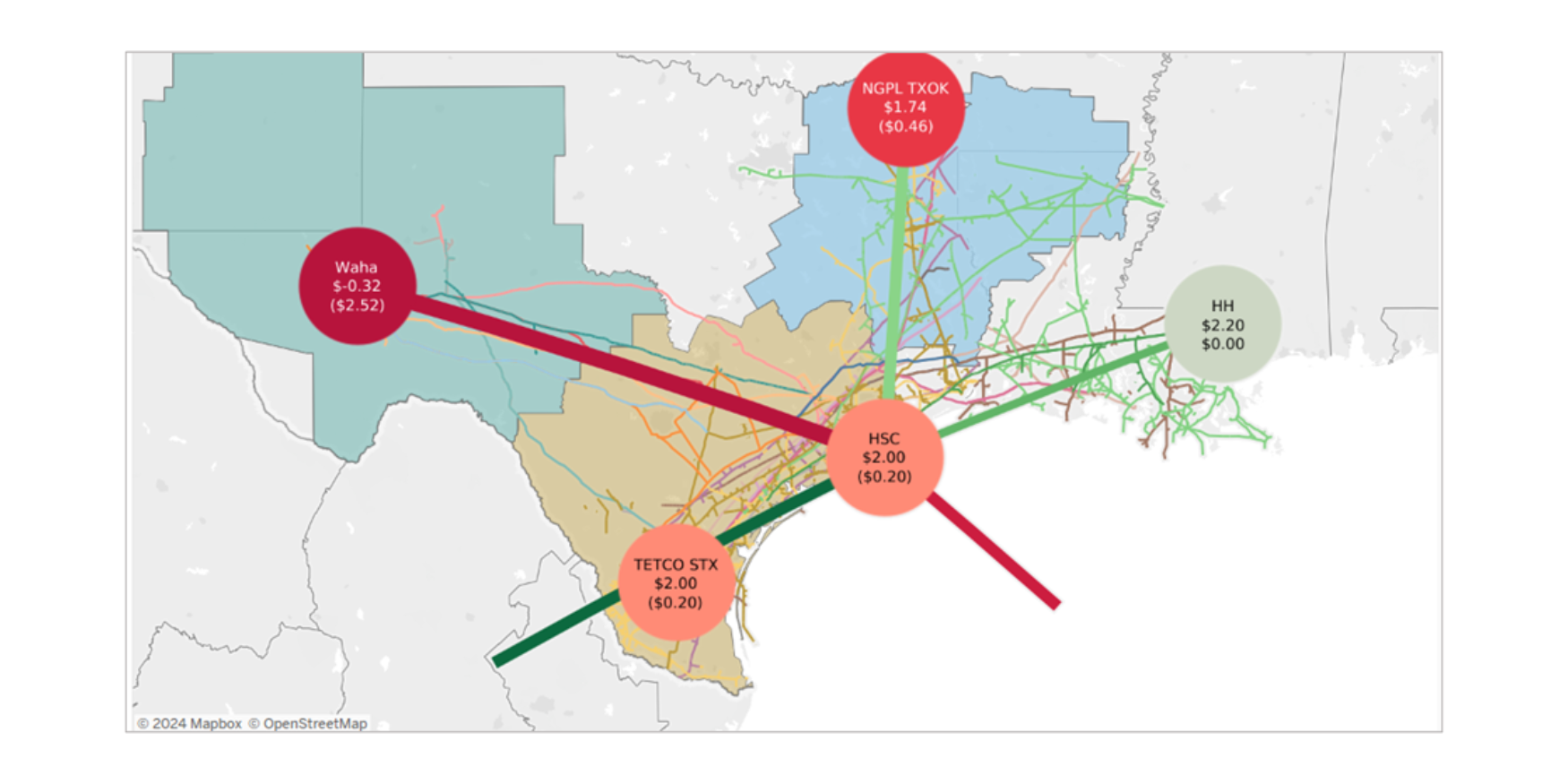

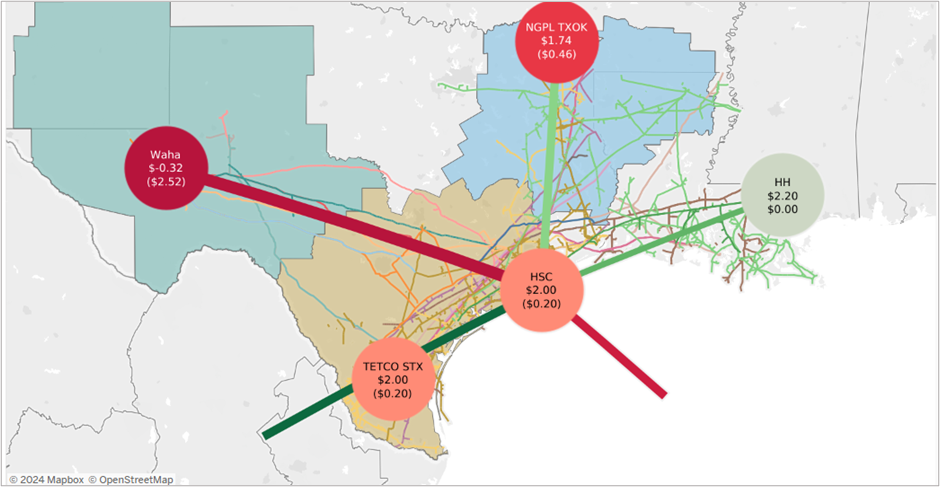

Permian flows have saturated the South Texas market in recent years, and Matterhorn will continue this trend. EDA breaks down the dynamic in the Houston Ship Channel Supply & Demand Report. Pipeline capacity from the Permian Basin to South Texas increases to 12 Bcf/d in 3Q24 after Matterhorn comes online, more than triple capacity of just 3.4 Bcf/d in early 2019.

As this new Permian supply floods into South Texas, we expect to see downward pressure on Houston Ship Channel basis. Demand growth in the region is limited in 2024, so we expect additional inbound flows from the Permian to displace inbound supply from the Carthage market.

In the Houston Ship Channel Report, we reduce flows from Carthage to Houston by 2-3 Bcf/d from 2024-28 to balance the South Texas market, indicating Houston will trade at a discount to Henry Hub. Later, we expect Carthage to provide swing supply in 2029 and 2030 as LNG demand in South Texas comes online and additional pipeline capacity from Texas to Louisiana is available to support LNG projects at the TX/LA border.

See our Houston Ship Channel Supply & Demand Report for more information. An interactive dashboard is coming soon on Energy Data Studio – see the figure for an early peek. – Oren Pilant.

Propane Supply and Demand Report and Data Set: Coming Soon

Propane Supply and Demand is a Data File & Report that includes historical and forecasted supply and demand components for propane including gas plant propane production, refinery propane production, domestic demand from steam crackers and other consumption, plus propane (LPG) exports. Learn more about the Propane Supply and Demand Report and Data Set.

Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact [email protected].

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.