The Daley Note: November 29, 2022

Refracs in the Barnett shale are rejuvenating the mature North Texas gas play, in the process boosting volumes for several midstream operators.

E&Ps in the Barnett are recompleting older wells with modern fracturing technologies. Recently, private North Texas operator BKV Corp. announced that it successfully refractured over 200 wells in the Barnett shale in 2021, the most by any US producer.

Previously a basin in decline, the Barnett could see production stabilize due to well refracs, assuming natural gas prices stay above the economic threshold to continue these programs. Data from East Daley’s Energy Data Studio shows an increase in both plant inlets and residue pipeline samples starting in late 2021 (see figure). While the Barnett has seen an uptick in rigs with higher natural gas prices, volumes have far exceeded what the 10 rigs currently operating in the Barnett could provide.

A successful refrac can boost output from an old well near its original initial production (IP) rate, though production tends to fall off quickly. BKV, which on Nov. 18 filed for an initial public offering, noted that refracs allow the producer to maintain flat to slightly growing production in the Barnett, in addition to running a one-rig drilling progam.

A successful refrac can boost output from an old well near its original initial production (IP) rate, though production tends to fall off quickly. BKV, which on Nov. 18 filed for an initial public offering, noted that refracs allow the producer to maintain flat to slightly growing production in the Barnett, in addition to running a one-rig drilling progam.

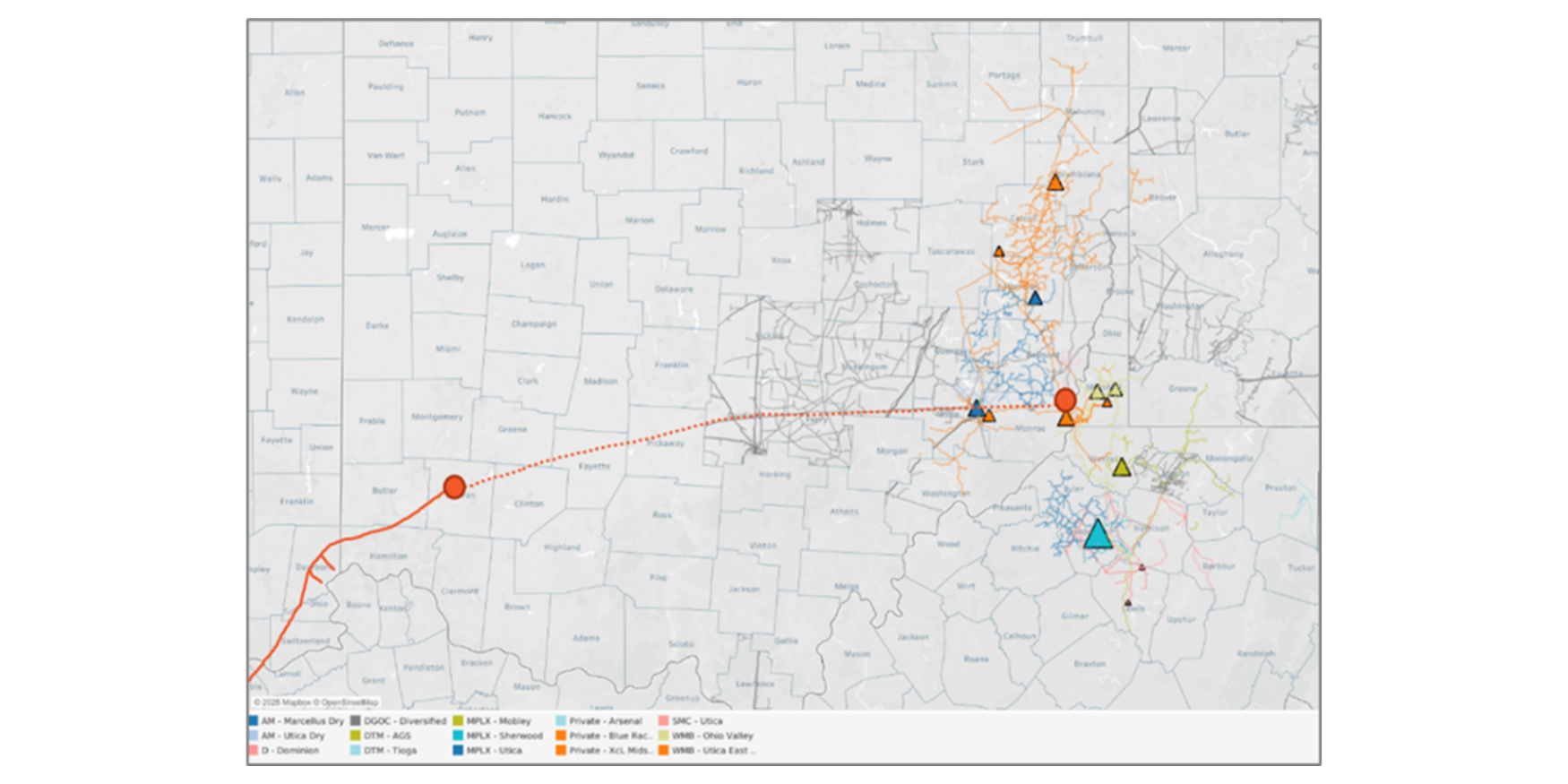

Midstream operators that stand to benefit from the recent uptick in refrac activity include EnLink Midstream (ENLC) and Targa Resources (TRGP). Both companies provide G&P services to BKV on its North Texas acreage. Based on East Daley's system-level allocation models, BKV accounts for ∼65% of volumes for ENLC - Bridgeport (474 MMcf/d) and ∼2% (3 MMcf/d) of volumes on TRGP – North Texas.

East Daley believes the Barnett drilling rebound is sustainable. We forecast an average of 10 Barnett rigs in 4Q22 and 1Q23 at prevailing oil and gas prices. While activity is modest, the ENLC and TRGP systems are expected to maintain their share of rigs within the basin. – James Taylor & Maria Paz Urdaneta Tickers: ENLC, TRGP.

Dirty Little Secrets 2023 – Is Another Infrastructure Wave Ahead?

Is Midstream on the cusp of another infrastructure wave? East Daley will explore the potential in our annual Dirty Little Secrets market report on December 14 at 10:30 MST.

Sign up to view the 2023 Dirty Little Secrets Webinar

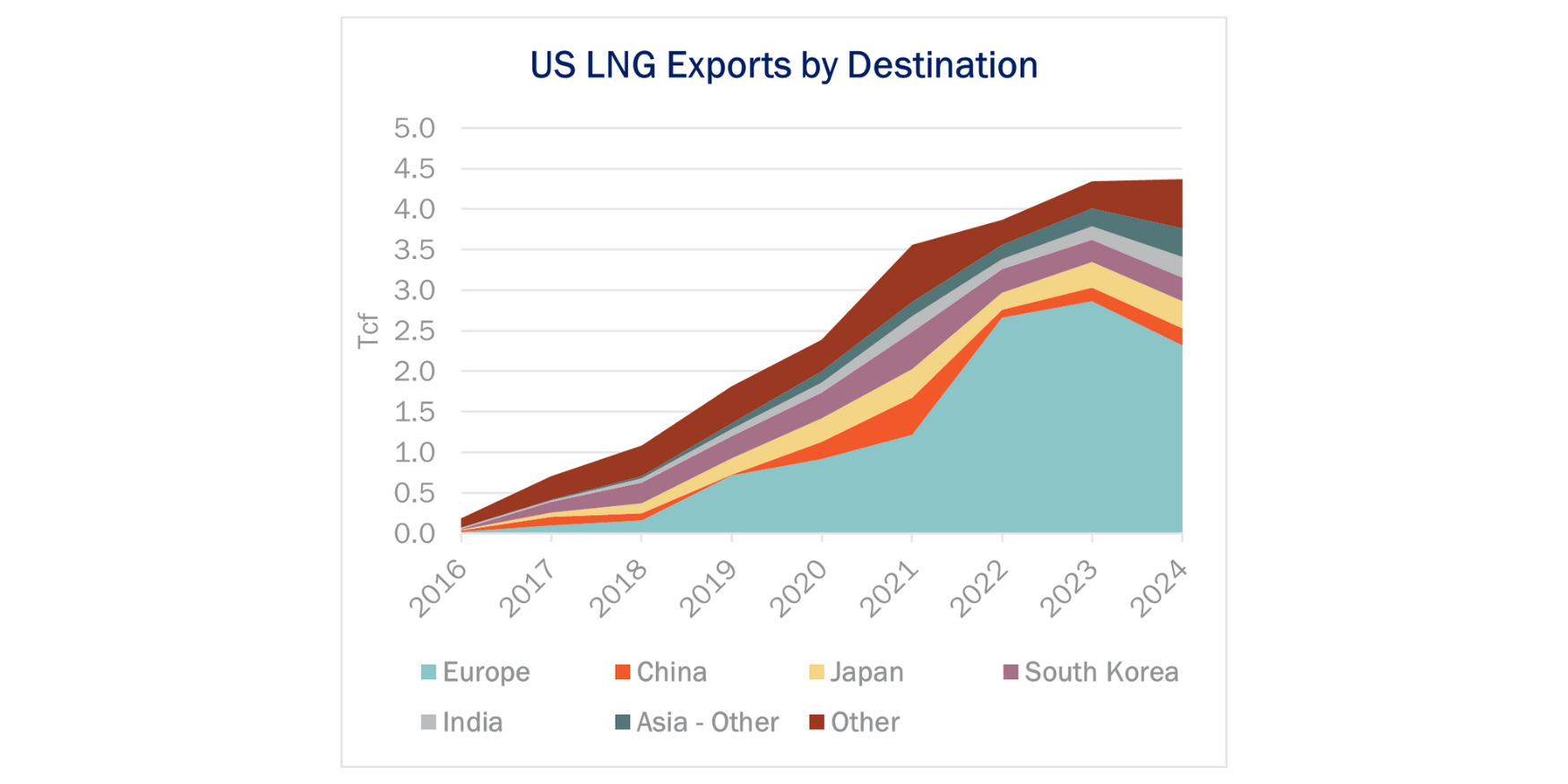

The Russia-Ukraine conflict has pushed commodity prices higher and spurred greater global demand for US energy products. Meanwhile, more disciplined growth from the upstream has infrastructure finally filling up across commodities. Will exports power the next infrastructure boom?

Dirty Little Secrets is East Daley’s annual report on energy markets and the road ahead for Midstream. We share our macroeconomic outlooks for US oil, natural gas and NGLs, highlight key infrastructure opportunities, update on the state of the Energy Transition, and share our view on Midstream’s future role in energy.

For updates on the 2023 Dirty Little Secrets report, please click here.

3Q22 Earnings Previews and Earnings Reviews Now Available

East Daley has published a complete group of 3Q22 Earnings Previews and Blueprint Financial Models for midstream companies within our coverage. We also are publishing 3Q22 Earnings Reviews as companies report comparing our forecasts vs results. Quarterly Earnings Previews and Blueprints are now available for Antero Midstream (AM), Crestwood Equity (CEQP), Enbridge (ENB), EnLink Midstream (ENLC), Enterprise Products (EPD), Energy Transfer (ET), Equitrans Midstream (ETRN), Kinder Morgan (KMI), Kinetik Holdings (KNTK), Magellan Midstream (MMP), MPLX (MPLX), ONEOK (OKE), Plains All American (PAA), Summit Midstream (SMLP), Targa Resources (TRGP), TC Pipelines (TRP), Western Midstream (WES) and Williams (WMB).

Our Earnings Previews include quarterly earnings forecasts compared to Street consensus, a detailed list of the top assets that will impact the quarter, analysis of near- and long-term risks to future earnings, along with forecasts for Adj. EBITDA by segments. Please log in to access these reports.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.

-1.png)