Operators in the Permian will soon have options for their natural gas. The start-up of Matterhorn Express Pipeline will have big impacts on gas flows from the basin, and for a brief window shift market leverage from pipelines to shippers. East Daley expects volumes to redirect and some systems to lose business once the new 2.5 Bcf/d pipeline starts, as we identify in the Permian Supply and Demand Forecast.

The 42-inch Matterhorn is expected to be completed in mid-September ’24, according to the contractor building the pipeline. Start-up will open new capacity from Waha to the Katy hub outside Houston, providing better access for Permian producers to LNG export growth on the Gulf Coast.

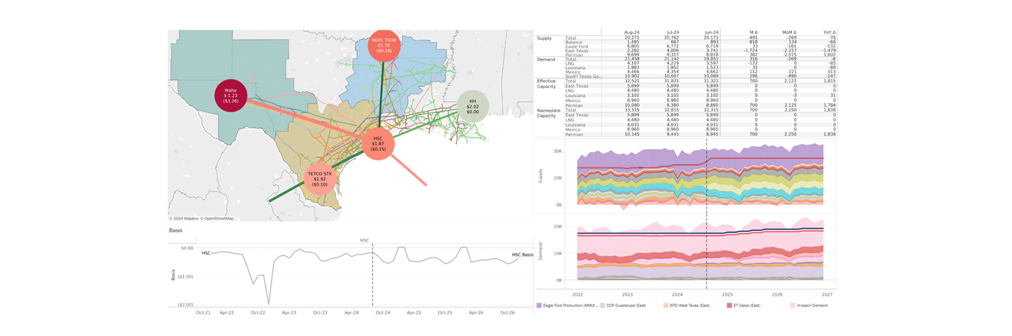

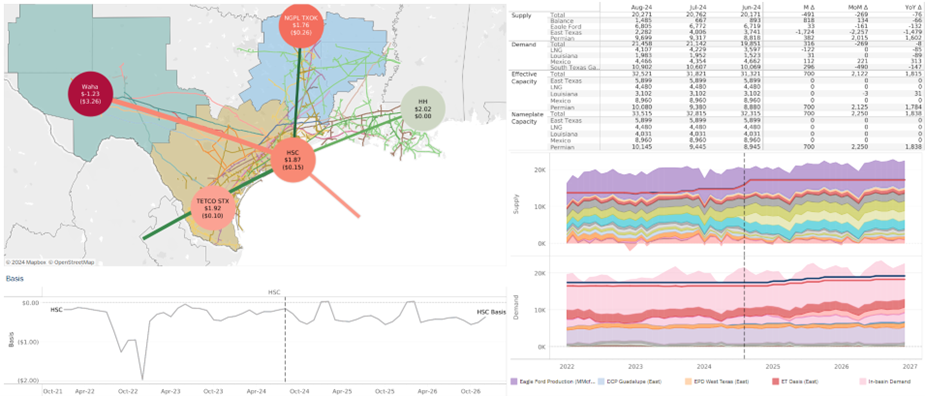

Matterhorn will also relieve pressure on Permian gas prices caused by the takeaway bottleneck. Permian pipes have run effectively full since the spring, causing spot prices to turn negative at times in the basin. For example, Waha traded at -$1.23/MMBtu this week (shown in the Houston Ship Channel Supply and Demand dashboard in Energy Data Studio), likely due to ongoing maintenance on Kinder Morgan’s (KMI) El Paso system. EDA expects gas production to ramp once Matterhorn starts, but it will take time for shippers to fill all the capacity.

In EDA’s Permian Supply and Demand Forecast, Matterhorn causes volumes to shift from other pipelines to Katy. Early flows are primarily displaced from northbound pipes to the Midcontinent, including Berkshire Hathaway’s Northern Natural and KMI’s Natural Gas Pipe Line of America (NGPL). These systems historically have served as a relief valve when Permian production outgrows pipeline takeaway. The Midwest is well-supplied by several US basins plus imports from Western Canada, and so Permian volumes are not critical to meet demand in these markets.

In South Texas, the dynamic will be different. Permian flows have saturated the regional market, and Matterhorn will continue this trend. EDA breaks down the outlook in the the Houston Ship Channel Supply and Demand Report. Pipeline capacity from the Permian Basin to South Texas increases to 12 Bcf/d in 4Q24 after Matterhorn comes online, more than triple capacity of just 3.4 Bcf/d in early 2019.

As this new Permian supply floods into South Texas, EDA anticipates downward pressure on Houston Ship Channel basis. Limited demand growth is set to come online in 2024, so we expect additional inbound flows from the Permian will displace inbound supply from the Carthage market.

When will Gulf Coast demand catch up with the new inbound supply? And how long before producers fill the new pipe and crash Permian gas prices again? We will have more detail in new model updates over the next few weeks. Clients can review the interactive dashboard in Energy Data Studio for the latest Permian forecast – Maria Paz Urdaneta Tickers: KMI.

Join East Daley’s Next Webinar – NGLs Heading into a Super-Volatility Cycle

Don’t miss this exclusive webinar diving into trends in NGL markets. We will look at:

- NGLs & commodity ties: Gas, NGLs and Crude – One constraint will constrain all

- Permian back on the board in 4Q24 and what it means for supply

- Activity afoot in the Bakken – Double H impact to the NGL market & the long game

Join us on August 28 at 10 AM MST. Register here.

Sign Up for the Crude Oil Edge

East Daley’s Crude Oil Edge provides weekly updates on the US crude oil market including supply and demand fundamentals, basin-level views, and analysis of market constraints and infrastructure proposals. We explore sub-basin dynamics and provide market insights on crude oil flows, production growth, and import and export characteristics. Sign up now for the Crude Oil Edge.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.