Limited normally by inadequate natural gas pipeline takeaway, operators in the Permian Basin now face an open field. New investments that solve for the gas egress problem are likely to advance the time when constraints arrive moving Permian crude oil.

Matterhorn Express Pipeline began delivering gas on October 1 to pipelines near Katy, TX, marking start-up of the 2.5 Bcf/d pipeline. WhiteWater Midstream’s next 2.5 Bcf/d project, Blackcomb Pipeline, is expected online in 2026. In the near term, East Daley Analytics expects Matterhorn to spark growth in Permian crude oil production.

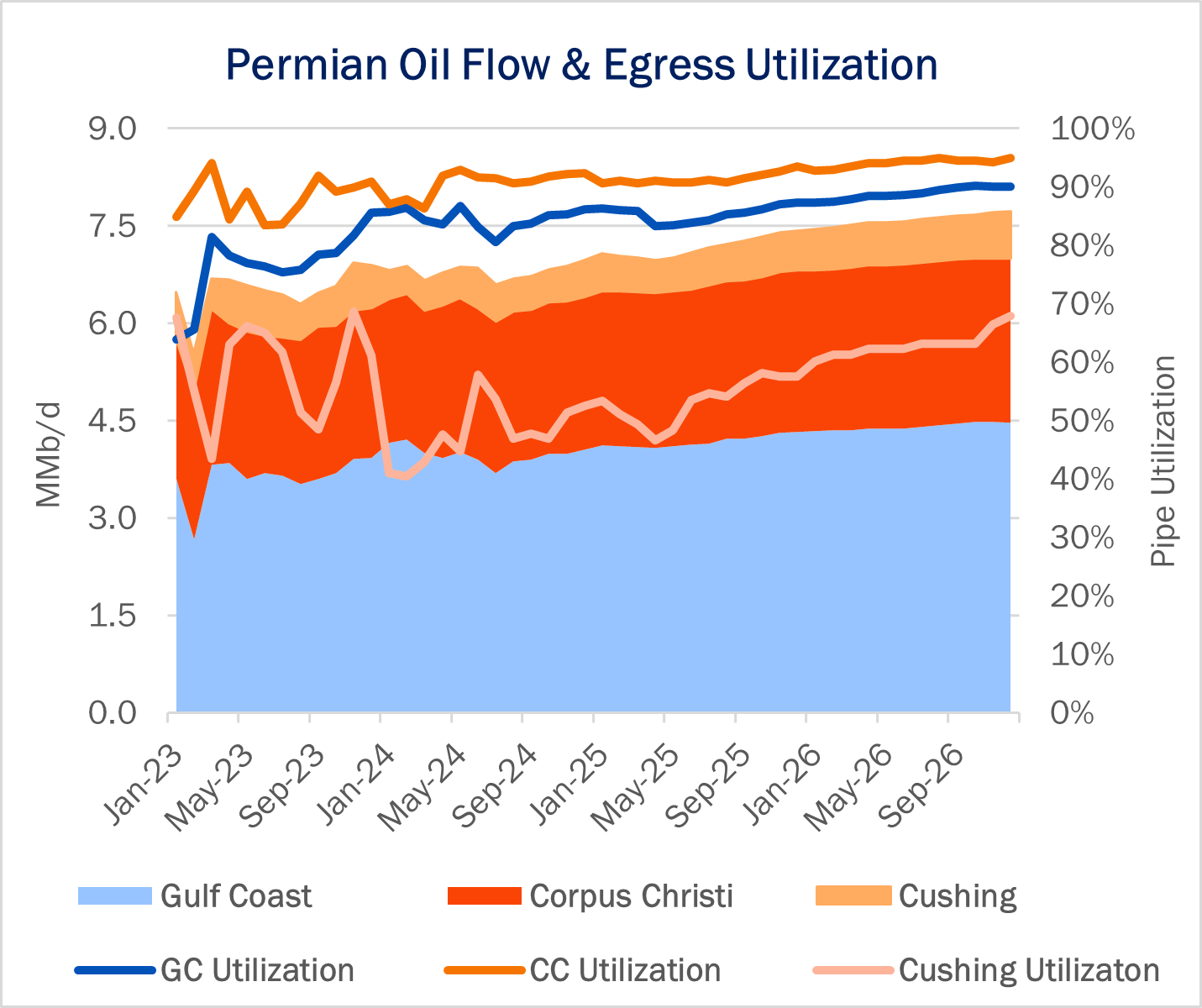

Gas infrastructure constraints have been a big point of concern when considering Permian crude oil supply. In Energy Data Studio, East Daley forecasts Permian oil production to grow 3.8% (240 Mb/d) through February ‘25 as the start of Matterhorn prompts operators to start more wells. By the time Blackcomb comes online, we model Permian oil production grows to 6.96 MMb/d by YE26, up 15% from August ’24 production of 6.04 MMb/d.

As Permian output grows, egress pipelines becomes increasingly full in our Crude Hub Model. By YE26, we forecast pipelines to Corpus Christi reach 95% utilization, and flows on pipes to Houston/Nederland reach 90% of capacity.

With utilization in the 70% range, only the route to Cushing has flexibility for Permian shippers in our outlook. EDA expects flows to Cushing will trail the eastbound routes due to the added cost to move barrels north and then south again to the Gulf Coast. Additionally, a Permian barrel often will lose its premium quality/neat designation once it moves to Cushing and is then priced at WTI.

The effects of a tight market will be most visible in increased price volatility. The crude market will have limited capacity to manage unexpected outages, resulting in exaggerated price swings. East Daley forecasts the price spread from WTI Midland to MEH to widen as egress tightens.

Despite the warning signs, we don’t expect any movement on new pipelines from the Permian until a new offshore terminal moves ahead. Industry has proposed four deepwater projects still working towards a final investment decision (FID). Enterprise Products’ (EPD) SPOT is the furthest along; SPOT received its full permits in April but has yet to reach FID. Energy Transfer’s (ET) Blue Marlin is also a front-runner but has yet to receive an environmental impact statement (EIS). Until developers have more clarity where to send new supply, it makes sense to wait on pipeline projects.

Aside from the offshore export terminals, the obvious expansion opportunity for the Permian is the EPIC Crude pipeline. East Daley believes EPIC is able to expand another ~200 Mb/d for deliveries to Corpus Christi. This makes the most sense, as Corpus Christi will remain a top export market. The port gives operators the ability to load very large crude carriers (VLCCs), and the location in South Texas has easy access to the Permian. – Kristine Oleszek Tickers: EPD, ET.

NEW Webinar – The Volatility Super-Cycle: How Natural Gas Will Behave Over Next 18 Months

Join East Daley and IIR Energy for our latest natural gas webinar on October 10th at 10 am MT. In “The Volatility Super-Cycle: How Natural Gas Will Behave Over Next 18 Months,” we will look at the causes for gas volatility:

- Where US operators are cutting production and which regions are declining the most.

- Growth in LNG exports and power generation demand

- Gain insights into the outlook for 4Q24 and beyond.

Register here to join us.

New Updates to Bakken-Guernsey-DJ Crude Oil Supply & Demand Report

East Daley is excited to announce new updates for our Bakken-GSNY-DJ Crude Oil Supply & Demand report. Updated monthly, this product now features an interactive dashboard and includes our forecast for the Uinta Basin. This report uniquely visualizes crude oil supply, demand and flows in the Bakken and Rockies regions. Learn more about the Bakken-Guernsey-DJ Crude Oil Crude Oil Report.

Sign Up for the Crude Oil Edge

East Daley’s Crude Oil Edge provides weekly updates on the US crude oil market including supply and demand fundamentals, basin-level views, and analysis of market constraints and infrastructure proposals. We explore sub-basin dynamics and provide market insights on crude oil flows, production growth, and import and export characteristics. Sign up now for the Crude Oil Edge.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.