Natural Gas Weekly: March 10, 2023

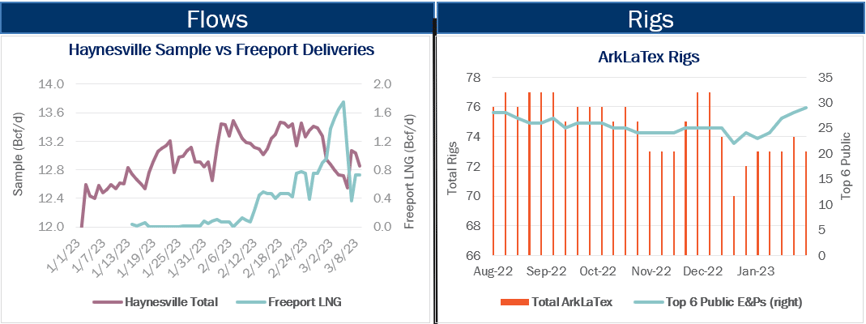

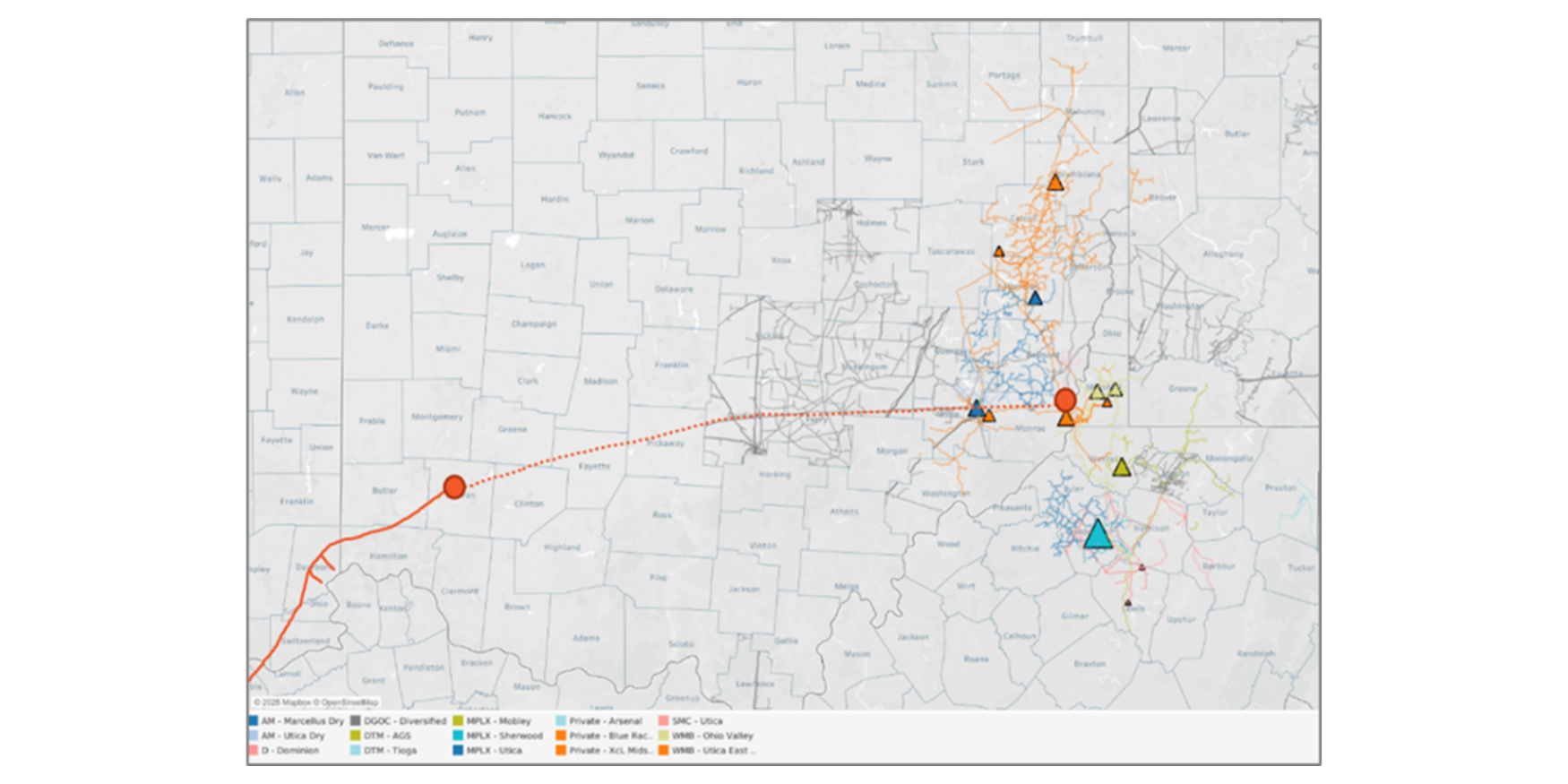

Flows - Market watchers who rely on pipeline scrapes may have noticed a big change recently in the ArkLaTex Basin, where daily samples show falling nominations. Monthly pipeline flows in East Texas and northern Louisiana were at an all-time high in February, but samples show that receipts trailed off at the end of the month and remain much lower in March. ArkLaTex samples declined by nearly 900 MMcf/d from Feb. 22 to March 6, sparking some speculation that producers have started to shut-in wells in response to lower gas prices.

Color us skeptical of the shut-in theory. East Daley believes declining samples are linked to start-up of Freeport LNG on the Texas Gulf Coast. Pipeline deliveries to Freeport LNG jumped by ~1 Bcf/d between Feb. 27 and March 5, coinciding with the lower Haynesville samples. Houston Ship Channel (HSC) prices have strengthened along with the additional demand from nearby Freeport, trading recently at a $0.14/MMBtu discount to the Henry Hub. The Carthage hub has been trading $0.23 behind the Henry Hub, creating a healthy spread between East Texas and Houston prices.

With the restart of Freeport, we think gas at Carthage is being redirected south on Texas intrastate pipelines rather than flowing east to Perryville in northeastern Louisiana. The shift of volumes from interstate to intrastate systems, which do not appear in daily pipe scrapes, creates the illusion of declining supply. We anticipate ArkLaTex gas production continues to run at a record pace, and will eventually require some pullback to balance the Macro market this year.

Rigs - Several private operators have dropped rigs recently in the ArkLaTex, responding more quickly than their public counterparts to falling natural gas prices.

ArkLaTex rig counts totaled 73 for the Feb. 24 week, down slightly from a recent high of 77 rigs in December 2022. East Daley has documented lower 2023 guidance from top public Haynesville shale producers after gas prices fell to the $2/MMBtu level. Comstock Resources (CRK), Chesapeake Energy (CHK) and Southwestern Energy (SWN) have outlined plans to run fewer rigs, amounting to a combined 6-7 rigs in the basin.

These operators may emphasize restraint, yet our review finds public producers are holding rigs steady in the ArkLaTex, and in some cases have even increased activity this year. The top 6 pubic producers were running 29 rigs in the latest Feb. 24 count, up from 25 rigs at YE22. Instead, private operators have been responsible for the recent declines in Haynesville rigs. Rockcliff Energy (-3 rigs), Paloma Natural Gas (-2 rigs) and GEP Haynesville (-2 rigs) are among the private operators dialing back drilling recently.

With the gas market headed towards oversupply, East Daley expects the ArkLaTex to play an important role in restoring balance. The latest rig counts confirm our thesis that private operators will lead the pullback in the basin.

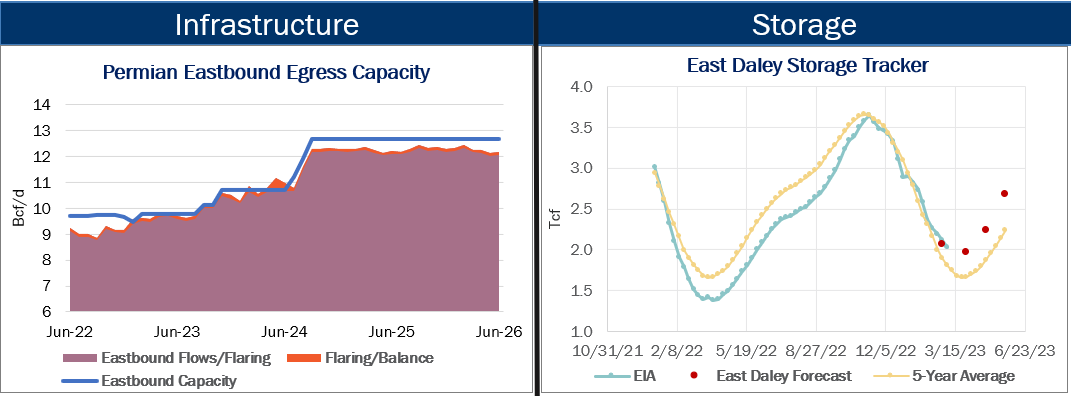

Infrastructure - Gulf Coast Express is planning maintenance in mid-April, which is likely to lead to volatility in Permian Basin gas prices. In a critical notice this week, GCX informed shippers of upcoming compressor maintenance that will reduce available transport. Throughput capacity will be reduced to 1.2 Bcf/d on April 11-12 and to 1.6 Bcf/d on April 13-14, GCX said. The pipeline, operated by Kinder Morgan (KMI), normally moves 2 Bcf/d of gas to the Agua Dulce hub in South Texas.

East Daley expects pipeline takeaway out of the Permian to run nearly full for most of 2023, so the restrictions will put downward pressure on Waha prices. Similar maintenance events on GCX in October 2022 crushed Waha spot prices, leading some producers to pay other shippers to take their gas. In our Permian Basin Supply and Demand Forecast, East Daley forecasts Permian pipeline egress to run at 97% of effective capacity in April. The GCX capacity reductions would result in effective basin egress running at ~101% of capacity for the four days of maintenance, a recipe for volatility.

Storage - EIA reported an 84 Bcf storage withdrawal for the March 3 week, putting working gas inventories at 2,030 Bcf. In our Macro Supply and Demand Forecast, we estimate storage inventories end March at 1,965 Bcf. Storage is 359 Bcf above the 5-year average after the latest EIA report.

Methodology Note: As of Jan. 30, 2023, East Daley Analytics is switching to WellDatabase for wellhead production data and rig information. East Daley uses a data aggregator, BlackBird BI, to collect and organize raw data published by WellDatabase. As part of the change in data providers, East Daley’s active rig estimates will now reconcile with the weekly Baker Hughes rig publication. The biggest change in rig counts is a reduction in vertical rigs in areas like the Anadarko, ArkLaTex and Barnett, which is not expected to impact the production outlook. Please direct any methodology questions to Ryan Smith (rsmith@eastdaley.com). Additionally, we are happy to introduce you to our new data vendors if there is any interest.

Natural Gas Weekly

East Daley Analytics' Natural Gas Weekly provides a weekly update to our monthly Macro Supply and Demand Forecast. The update covers rigs, flows, production, prices and capacity constraints that materially change our view on supply and demand. This update highlights what investors and traders need to monitor in natural gas to ensure they are on the right side of the market. Subscribe to the Natural Gas Weekly.

-1.png)