Less than three weeks in operation, Matterhorn Express Pipeline is already shaking up Texas energy markets. Natural gas flows have ramped quickly, faster than East Daley had anticipated, fueling optimism for supply growth from the Permian Basin in 4Q24.

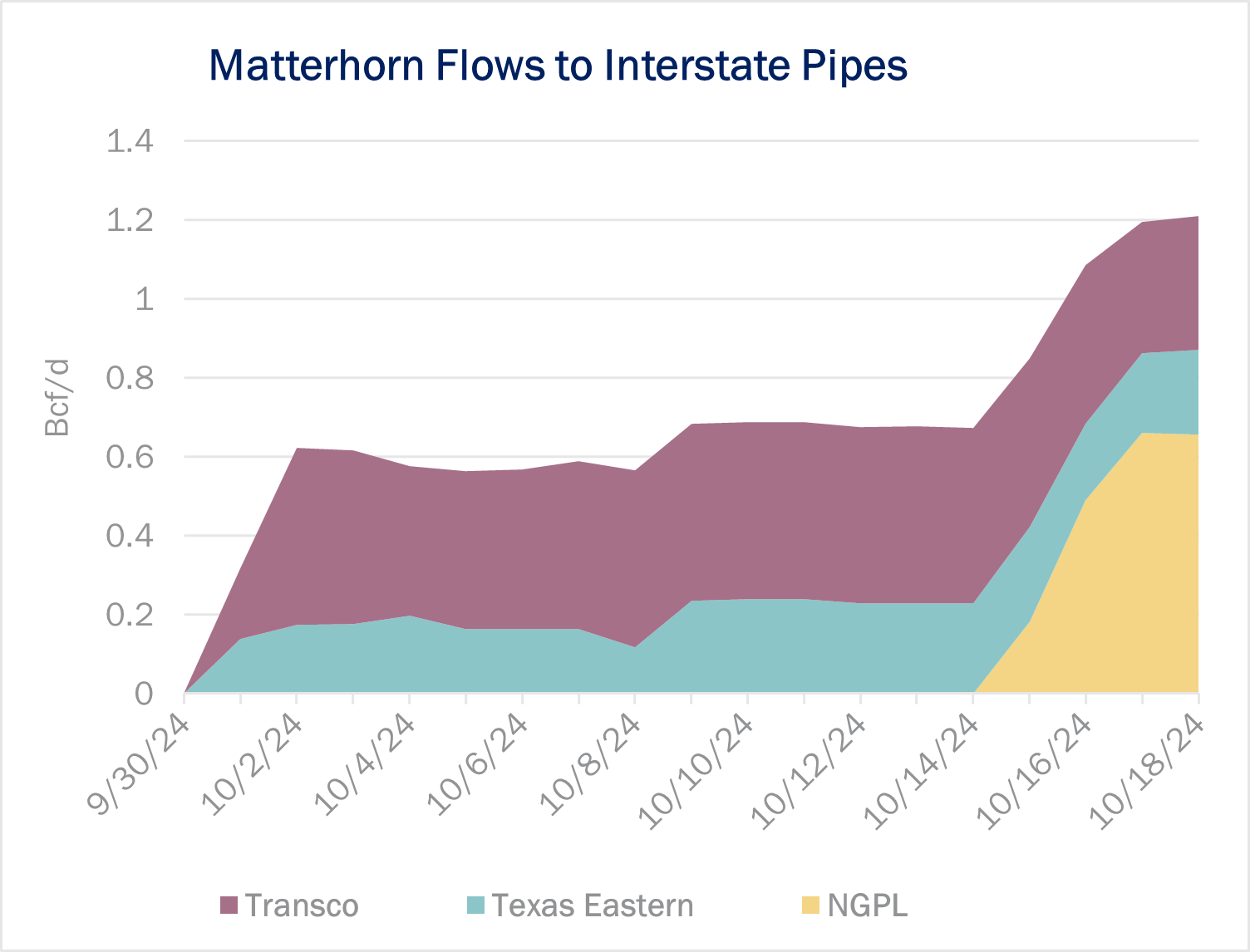

Last week, Natural Gas Pipe Line of America (NGPL) received gas from Matterhorn for the first time, posting initial flows of 165 MMcf/d on Tuesday (October 15). NGPL joins Transcontinental (Transco) and Texas Eastern (Tetco) as the third interstate pipeline to receive gas from Matterhorn. Flows to all three pipes passed 1.2 Bcf/d last Friday (October 18). The three interconnects have a little over 1.4 Bcf/d of total capacity, accounting for ~57% of Matterhorn’s 2.5 Bcf/d potential capacity.

The ramp on Matterhorn is happening at a faster clip than EDA modeled in the Permian Supply & Demand Forecast. Notably, northbound flows from the Permian have only decreased 200 MMcf/d since Matterhorn began delivering gas on October 1, based on pipeline electronic bulletin boards we monitor. Producers will continue to fill the 42-inch pipeline from the start-up of new wells, supporting growth in oil, gas and NGLs.

Moreover, EDA may be undercounting Matterhorn deliveries. On October 1, Gulf South’s Costal Bend (Enterprise) interconnect jumped nearly 120 MMcf/d. Flows through mid-October averaged 462 MMcf/d, up ~190 MMcf/d from September’s daily average of 271 MMcf/d and an increase of over 175 MMcf/d from the October ’23 average. The Gulf South/Enterprise interconnect registered a new all-time max delivery of 567 MMcf/d on October 18.

We suspect Enterprise’s (EPD) Texas Intrastate system is also taking gas from Matterhorn. Gulf South doesn’t connect with Matterhorn directly, but the strong October numbers at the Coast Bend point suggest higher volumes on the EPD system that coincide with the Matterhorn start.

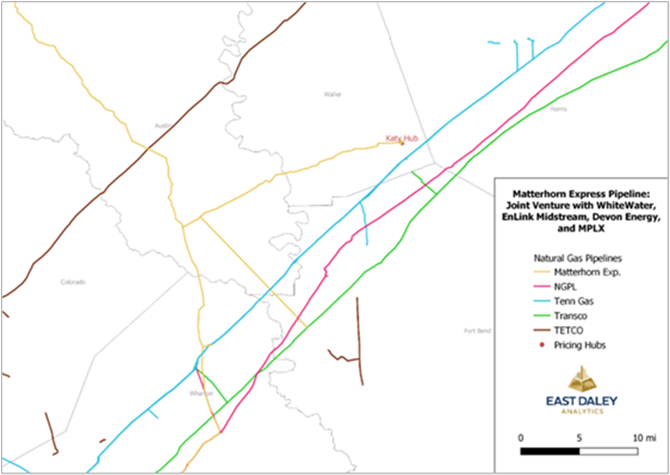

Transco, Tetco and NGPL for now are the only interstate pipes to list interconnects with Matterhorn, but more could be in the works. Maps from owner WhiteWater Midstream show a small lateral off Matterhorn’s southern leg that is still under construction. That lateral branches eastward in northern Wharton County, TX for less than five miles to a terminus near Tennessee Gas Pipeline, suggesting an interconnect with the pipe.

A second lateral, also under construction, will branch from Matterhorn’s southernmost terminus. We expect that this lateral will connect with Enbridge’s (ENB) Tres Palacios storage system, which interconnects with several interstate pipes as well as a salt storage field (see map).

The quick ramp in Matterhorn deliveries is good news for ENB, Kinder Morgan (KMI) and Williams (WMB), owners of the three interstate systems. It’s also good for the Permian industry at large, lending confidence in our forecast for oil and gas growth. East Daley expects a 150-200 Mb/d crude oil ramp in 4Q24 as Matterhorn spurs more development, and more growth to follow in 2025 (~350 Mb/d). – Ian Heming Tickers: ENB, KMI, WMB.

Dirty Little Secrets 2025: Commodity Ties Create an Abundance of Opportunity – 2-Part Series

Part 1 – Don’t Balk at the Bakken. Part 1 of this exclusive series will explore the Bakken as an example of how to view the entire U.S. energy value chain. The commodity market may be out of step, but equity markets are on target. Relying on just one could be a costly mistake. If you can anticipate what’s unfolding in the Bakken, you’ll be positioned to profit across the US energy sector. Join East Daley November 6 at 10 am MST. Register here to join us.

Sign Up for the NGL Insider

East Daley NGL Insider provides weekly updates on the US NGLs market including supply and demand fundamentals, basin-level views, and analysis of market constraints and infrastructure proposals. We explore sub-basin dynamics and provide market insights on NGL flows, infrastructure, and purity products. Sign up now for the NGL Insider.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.