The Denver-Julesburg Basin continues to lose steam as multiple operators have laid down rigs in the second half of 2024. The latest to pull back is Chevron (CVX), now the largest oil and gas producer in Colorado.

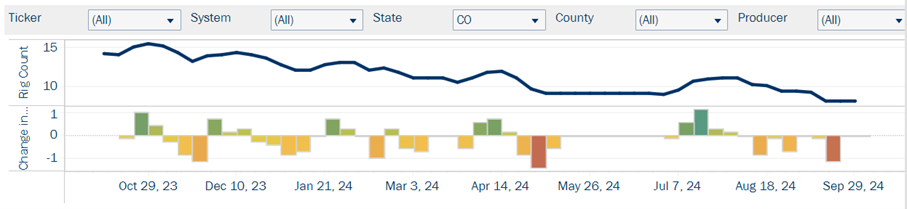

The DJ in eastern Colorado and Wyoming has lost 5 rigs so far in 2024, a nearly 40% decline, according to rig data in East Daley’s Energy Data Studio. The basin rig count totaled 8 in early October, down from 13 rigs at the start of 2024 (see figure from Energy Data Studio). Operators CVX, Civitas (CIVI), Verdad Resources, and Bayswater E&P have all elected to drop rigs this year.

In the case of Chevron, the company became the top operator in Colorado after completing the $6.3B acquisition of PDC Energy in August ’23. East Daley saw the deal for PDC as an endorsement of the DJ, and CVX appears to be playing the long game. The oil major is running an ad campaign in Colorado reminding residents of its new leading role in the state.

Spending on media may be on the rise, but CVX is slowing investments in the field. Chevron laid down another rig the first week of September ‘24, bringing its total DJ rig count to 2. CVX was running 4 rigs in the DJ through 1H24 and an average of 5 rigs in 2023, but has reduced activity in recent months.

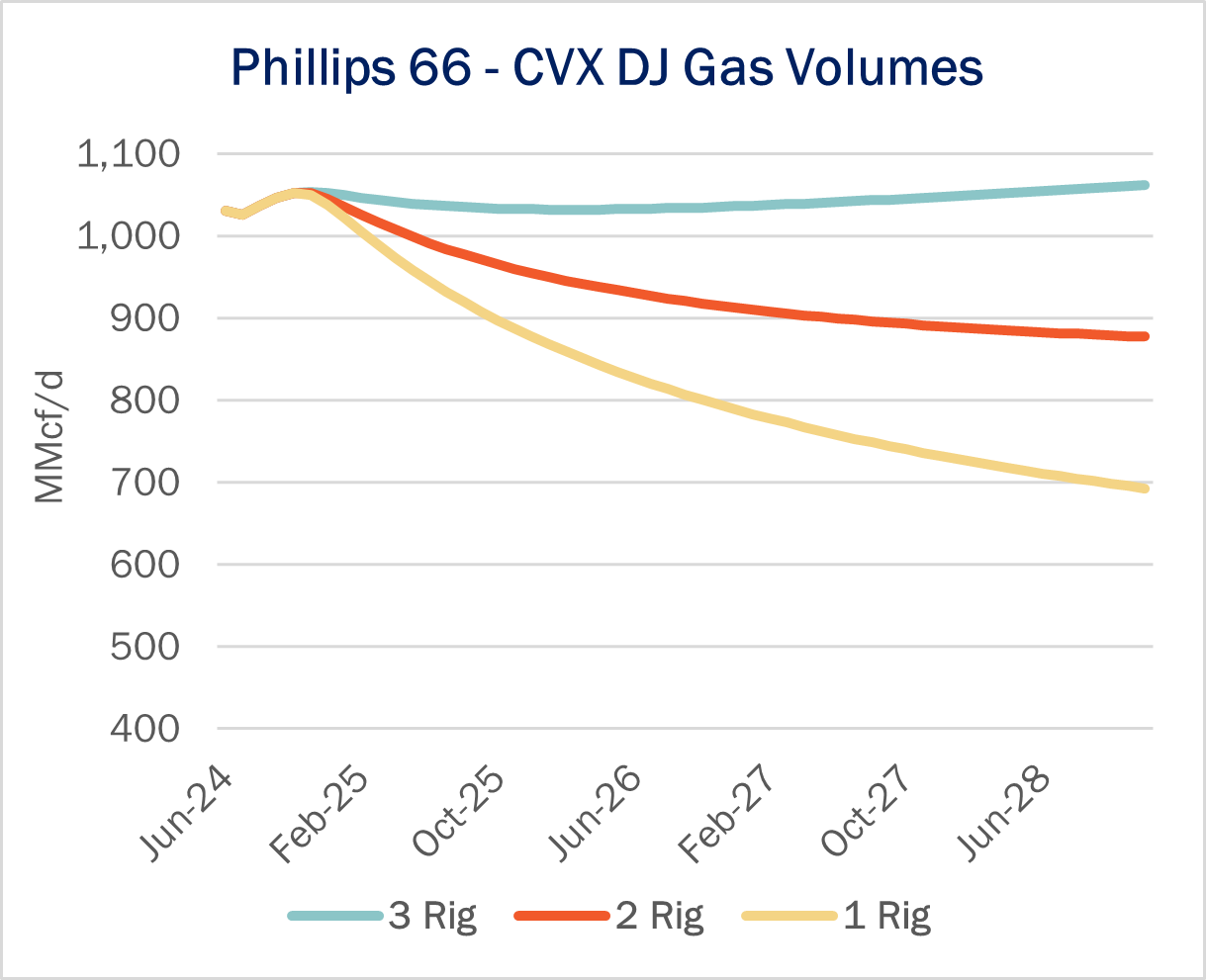

Data from Energy Data Studio highlights that Phillips 66’s (PSX) DJ system, acquired from DCP Midstream in 2023, gathers and processes over 75% of CVX’s produced volumes in the basin. The slowdown by CVX will inevitably drag on the system. East Daley estimates that if CVX maintains a 2-rig program, its volumes to PSX would decline 17% by the end of 2028. If CVX drops another rig and only uses 1 rig in the DJ, gas volumes would drop by 42% from current levels (see figure). We estimate CVX needs to run 3 rigs to keep gas volumes flat through 2028. – James Taylor Tickers: CIVI, CVX, PSX.

Dirty Little Secrets 2025: Commodity Ties Create an Abundance of Opportunity – 2-Part Series

Part 1 – Don’t Balk at the Bakken. Part 1 of this exclusive series will explore the Bakken as an example of how to view the entire U.S. energy value chain. The commodity market may be out of step, but equity markets are on target. Relying on just one could be a costly mistake. If you can anticipate what’s unfolding in the Bakken, you’ll be positioned to profit across the US energy sector. Join East Daley November 6 at 10 am MST. Register here to join us.

Sign Up for the NGL Insider

East Daley NGL Insider provides weekly updates on the US NGLs market including supply and demand fundamentals, basin-level views, and analysis of market constraints and infrastructure proposals. We explore sub-basin dynamics and provide market insights on NGL flows, infrastructure, and purity products. Sign up now for the NGL Insider.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.