Natural Gas Weekly: November 16, 2023

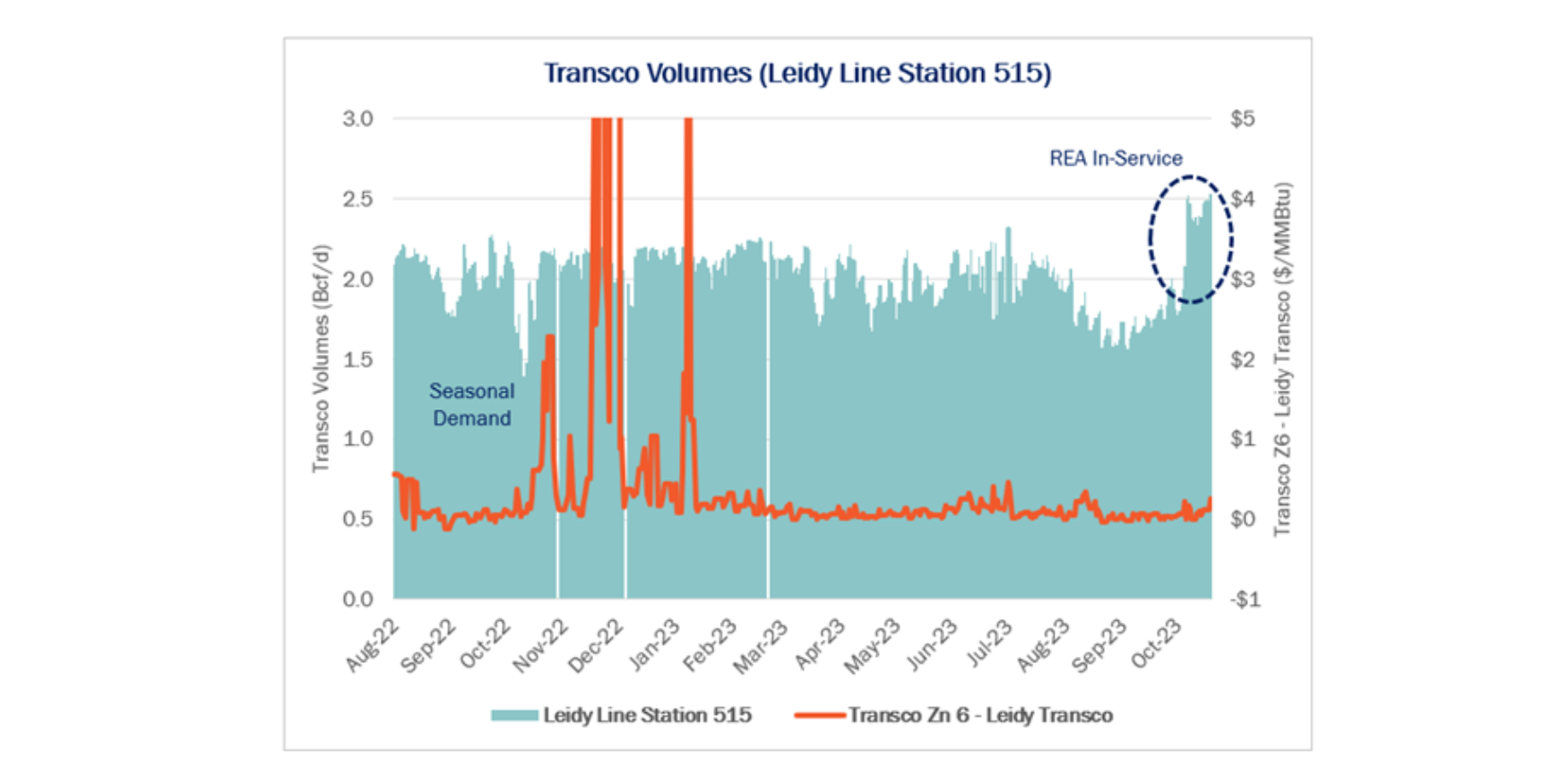

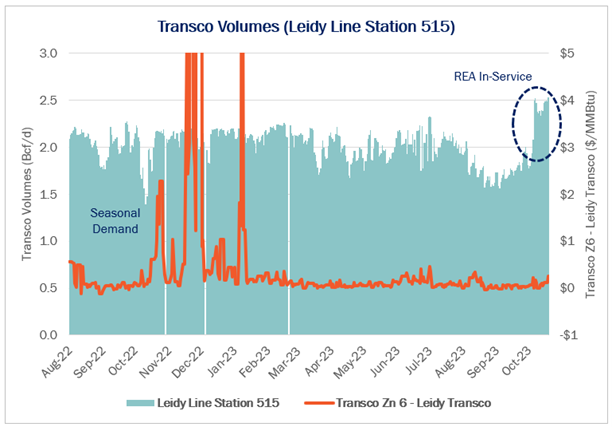

Infrastructure – Williams WMB) has started partial service of the Regional Energy Access (REA) expansion of the Transcontinental Gas Pipe Line (Transco). The project was placed in service during the last week of October, adding 450 MMcf/d of capacity along the Liedy line into the Transco Zone 6 market. WMB will place the remaining 379 MMcf/d from the project into service in 4Q24.

Pipeline samples in the Northeast show production from the Marcellus and Utica shales is up 1% M-o-M (~0.4 Bcf/d) in November. The REA project is contributing to this increase by allowing more gas to access a premium market.

Transco Zone 6 prices historically trade at a premium to Leidy in the winter, with the Leidy-Zone 6 spread pushing upwards to a $1.00/MMBtu. Last year, weather-related demand caused the spread between Transco Zone 6 and Leidy to widen to over $30.

Flows through Station 515 of the Leidy line have increased by about 0.5 Bcf/d Y-o-Y, averaging 2,444 MMcf/d so far in November vs 1,946 MMcf/d in November 2022. Downstream at Station 505, Leidy volumes have averaged 2,273 MMcf/d this November vs 1,924 MMcf/d in November 2022. Flows are lower at Station 505 as more natural gas is delivered along the route.

The increase in flows into Pennsylvania and New Jersey should soften the seasonal premium this winter. Looking ahead, EDA expects the Leidy-Transco Zone 6 spread to narrow this heating season as a result of REA. Start-up of the second phase will bring more gas into the Zone 6 market prior to next year’s heating season.

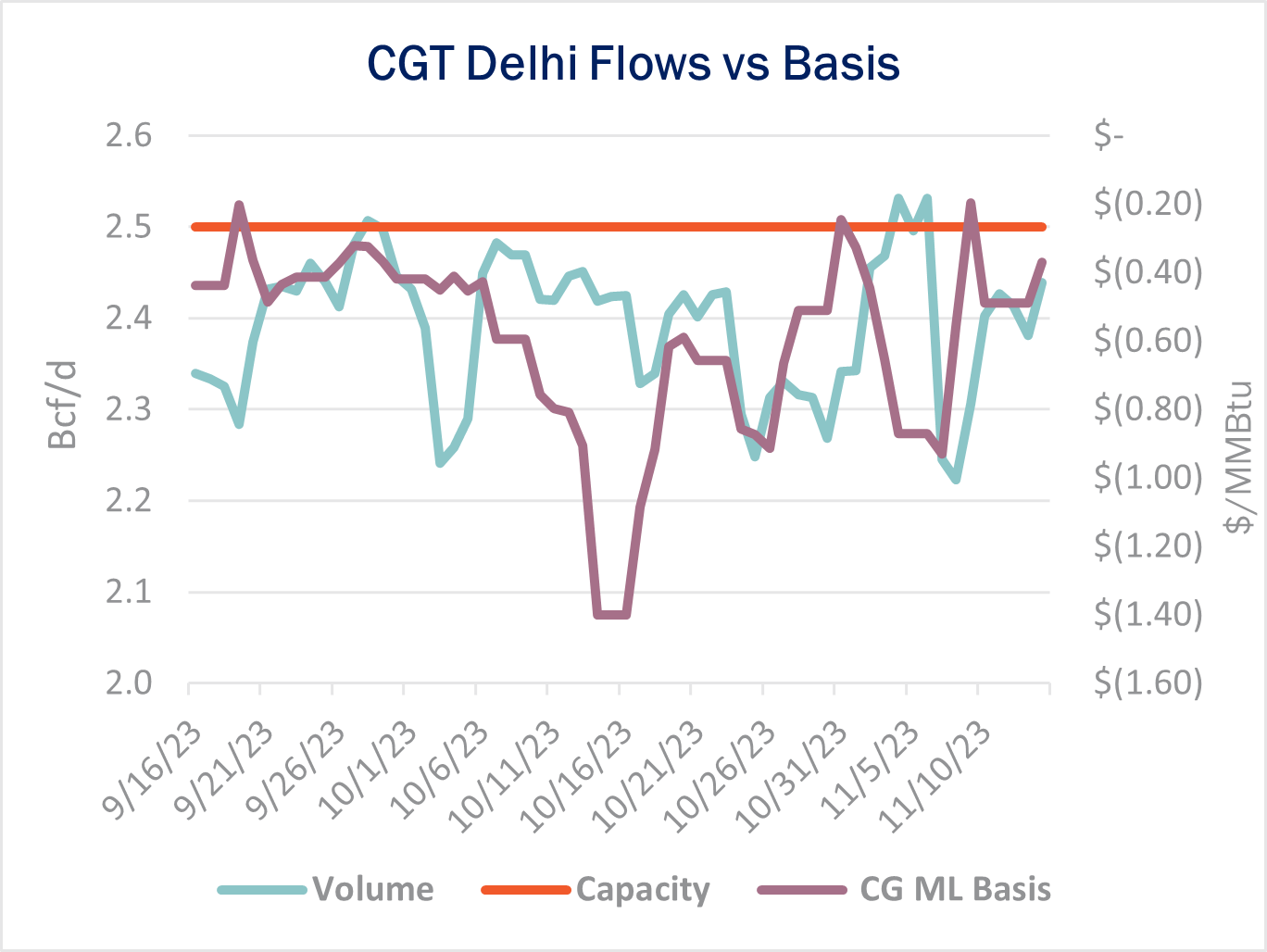

Flows: TC Energy’s (TRP) Columbia Gulf Transmission is undergoing scheduled maintenance projects at various points along the pipeline, leading to price volatility at the Columbia Gulf Mainline pricing hub in northern Mississippi.

Recent flows and pricing data suggest the maintenance has been restricting flows further south into Louisiana. Instead of basis to the Henry Hub weakening due to the downstream constraint, it has been strengthening.

When southbound flows are restricted on Columbia Gulf, basis at the CG Mainline has strengthened from almost a $1 discount to the Henry Hub (when flowing at nameplate capacity) to ~$0.30. EDA believes this price movement is a result of maintenance backing out cheaper Appalachian gas from Dominion South, which strengthens the CG ML basis. Looking ahead Columbia Gulf has planned maintenance with potential impact to scheduled volume from November 14 – 17, December 26 – January 8, and April 1 to May 1.

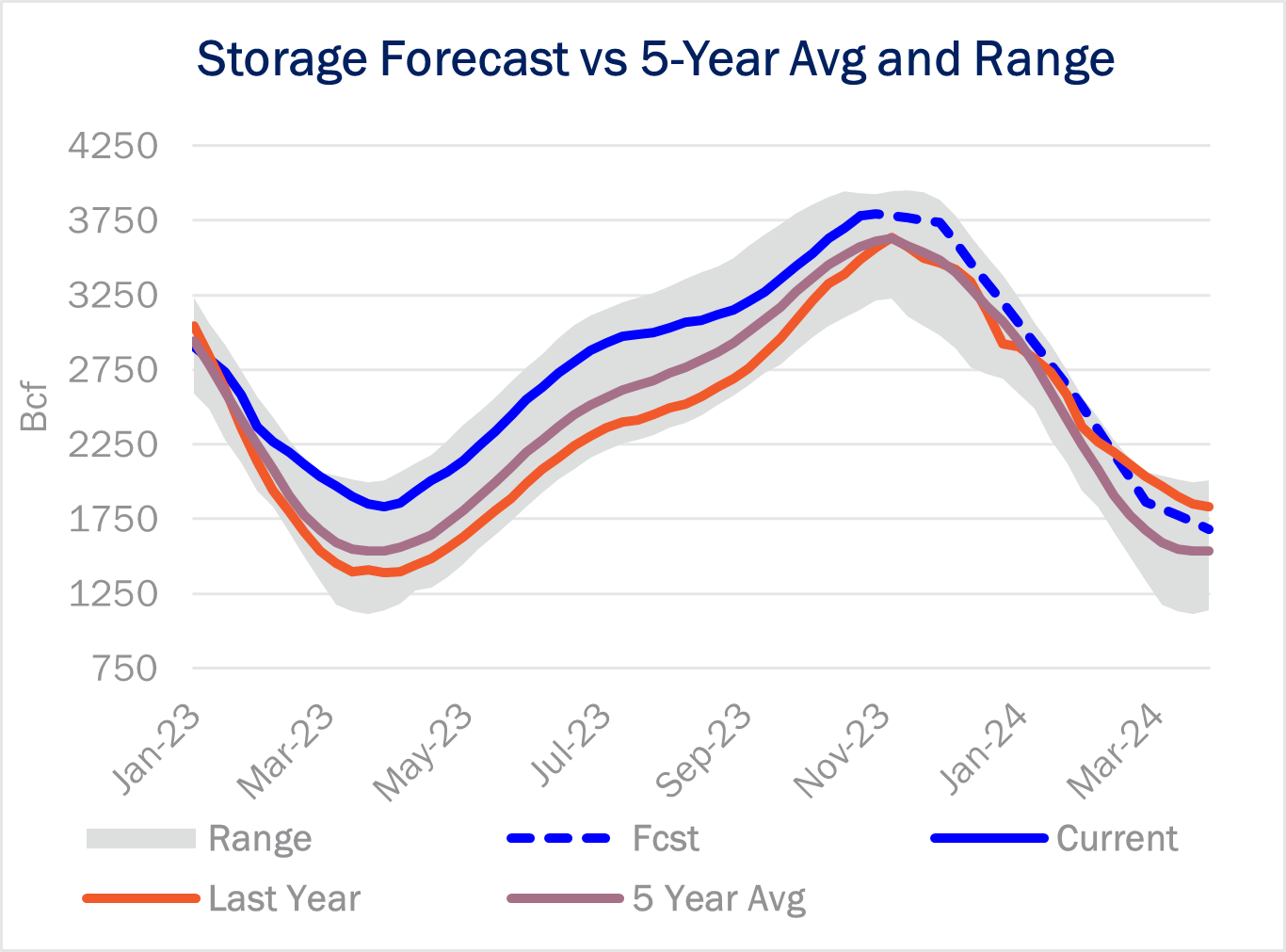

Storage – With the Energy Information Administration (EIA) posting two weeks of storage data on Thursday morning (November 16), market consensus is pretty wide on how much natural gas remains in the ground after variable weather for the November 2 and November 9 weeks. The period includes the winter’s first major cold front into the Lower 48, followed by a widespread warm-up.

Expectations are for a -3 Bcf withdrawal for the week ending November 2, with a low degree of confidence. A survey by The Desk has a range of estimates for a -20 Bcf withdrawal to a + 36 Bcf injection, one of the widest ranges in recent memory. For the week ending November 9, the market expects a net injection of +46 Bcf, with a range from +24 Bcf to +66 Bcf.

It is a tale of two distinct weeks, with cold weather predominant the last few days of October leading into November, followed by a warming trend from a dominant high-pressure system over the November 9 week. Those bearish conditions haves persisted for the past 10 days. One thing that has not changed is stubbornly high production levels, which should lead to an abnormally high mid-November injection for the second week. The 5-year average injection for the week ending November 9 is +20 Bcf.

In the latest October Macro Supply and Demand Forecast, East Daley expects inventories to total 3,795 Bcf on November 1, or 26 Bcf higher than levels reported for the October 26 week. While the injection season historically ends at the start of November, above-normal temperatures are likely to extend injections into the month. Accounting for both weekly estimates, storage could stand at 3,822 Bcf as of the November 9 week, which would be 192 Bcf above the 5-year average. Net storage injections are likely to extend to the November 16 week, which would cause the surplus to grow to 275 Bcf before the switch to net withdrawals.

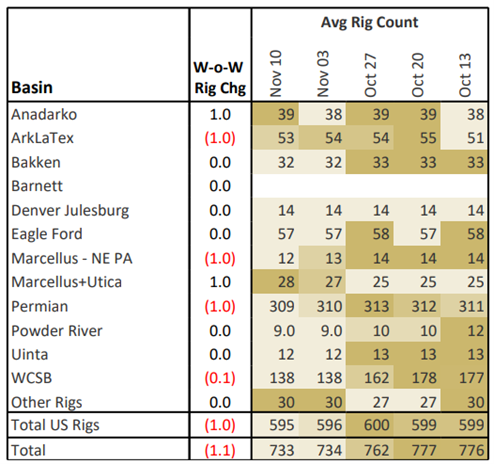

Rigs – US rigs decreased by 1 W-o-W to bring the total count to 595. The Permian, ArkLaTex and Marcellus NE PA are each down 1 rig. The Anadarko and Marcellus + Utica gained 1 rig.

On the midstream side, Enterprise Products (EPD) is up 4 rigs total with additions on its Permian and Eagle Ford G&P systems. Targa Resources (TRGP) is up 3 rigs in with additions on its Permian and Anadarko systems. Energy Transfer (ET) lost 2 rigs on its Permian and ArkLaTex systems. EnLink Midstream (ENLC) is down 2 rigs total with losses on its Midland and Anadarko systems.