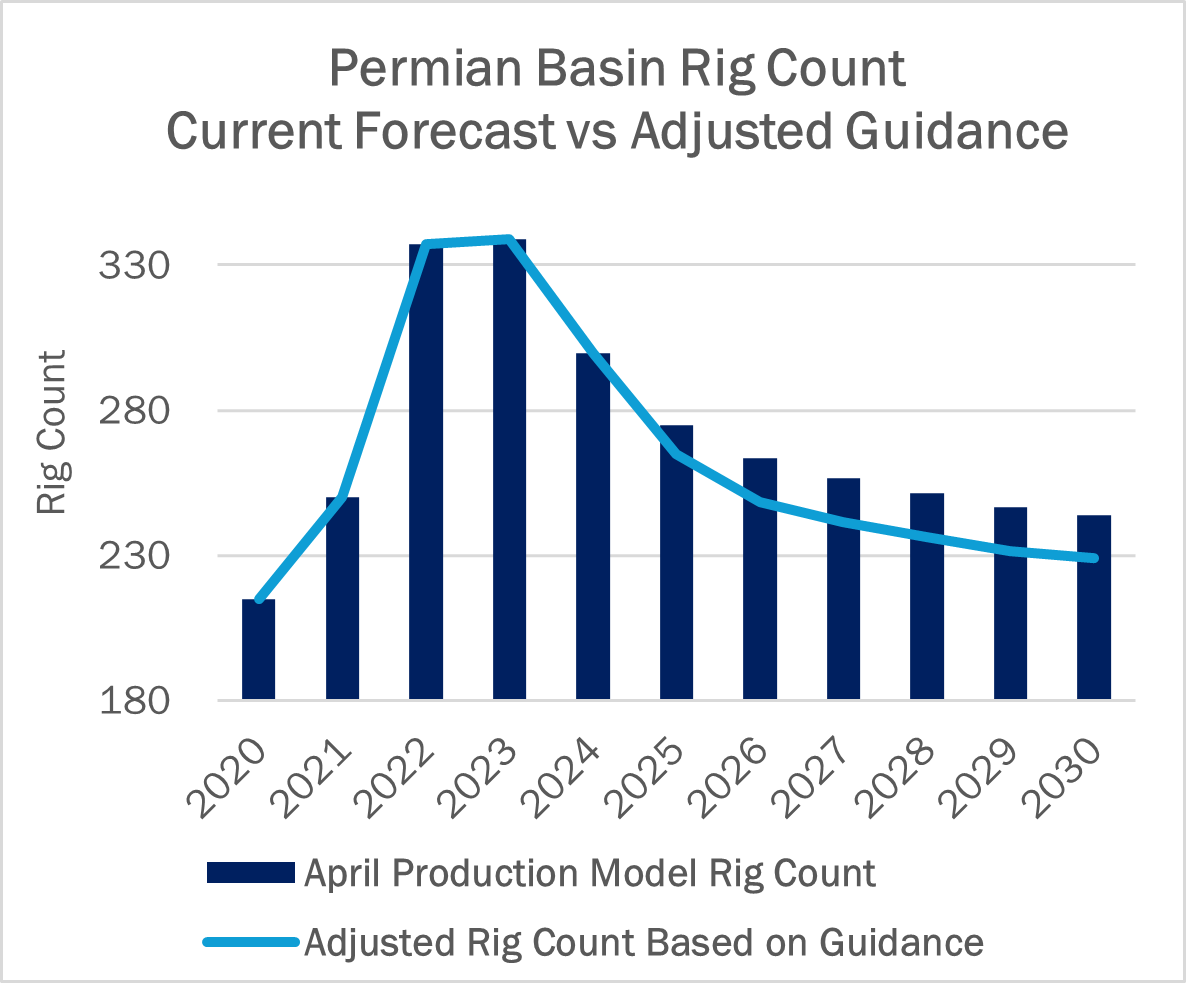

After years of steady gains, the Permian Basin is entering a more tempered growth phase as producers recalibrate spending plans. Several intend to pull back on drilling activity and have revised guidance lower after the recent drop in oil prices to $60/bbl.

Diamondback Energy (FANG) set the tone for 1Q25 earnings updates, trimming its 2025 capital budget by $400MM and unveiling plans to drop 3 rigs and a frac crew from the Permian in 2Q25. Management made it clear: growth is viable at $60/bbl WTI, but anything below that price level puts the basin in maintenance mode — with potential for activity to stall around $50 WTI.

Coterra Energy (CTRA) followed suit, dropping its Permian guidance from 10 to 7 rigs and lowering capex to $2.0–2.3B. The producer has left the door open for deeper cuts if prices weaken further. Devon Energy (DVN) surprised to the upside, beating oil guidance thanks to strong Delaware performance. Still, DVN shaved $100MM off its capital plan and doubled down on a $1B optimization strategy to boost free cash flow without sacrificing output.

EOG Resources (EOG) reported $1.3B in free cash flow and production above forecasts, but also reduced capex guidance by $200MM. Even Matador Resources (MTDR) is tapping the brakes. The Delaware-focused producer plans to drop 1 rig mid-year, citing a need for discipline even as its capital guidance holds steady for now.

Taken together, the updates tell a cohesive story: the Permian is no longer on a breakneck growth trajectory. Instead, producers are embracing capital discipline in a $60/bbl price environment with more downside risk.

Moderating activity will inevitably ripple through the G&P landscape. Systems that have seen consistent volume growth may now face slower ramps or even volume declines. Infrastructure developers and midstream operators will need to reassess assumptions tied to basin-level growth and reoptimize for a flatter profile in 2025.

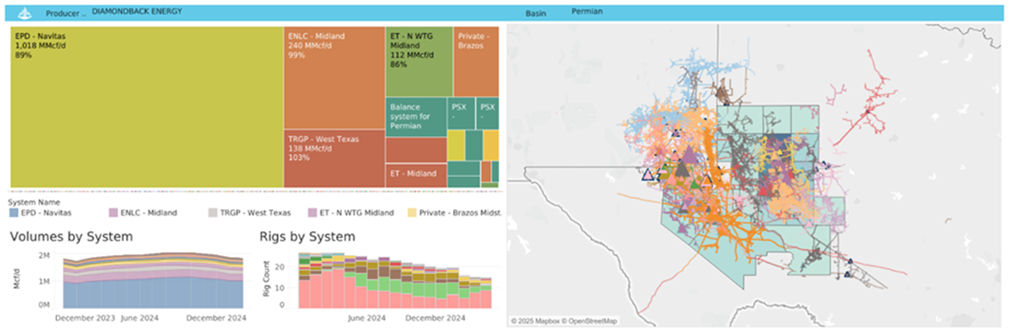

This is where East Daley Analytics’ Producer to System dashboard becomes a powerful tool. The database in Energy Data Studio helps bridge the gap between upstream activity and midstream exposure by showing how changes to production guidance directly connect to individual G&P systems.

Diamondback, for example, did not specify where it intends to cut rigs, but the Producer to System dashboard for FANG (pictured above) shows its core operations are in the Midland Basin, particularly in Martin, Midland and Howard counties. These areas are likely to feel the brunt of the cutbacks. FANG delivers gas to G&P systems in the area owned by Enterprise (EPD), ONEOK (OKE) and Energy Transfer (ET), according to the dashboard, so these assets could be vulnerable to a slowdown in volumes.

Infrastructure – In its 1Q25 earnings release, TC Energy (TRP) announced the Northwoods project on ANR Pipeline, a 400 MMcf/d expansion to serve burgeoning data center load and broader economic growth across the Midwest.

The $900MM project was underwritten at a 6.0x build multiple and is expected to enter service in late 2029. Given ANR’s historical EBITDA margin of roughly 82%, this implies a transportation rate of about $1.25/Mcf-day — a level that signals a distinctly price-inelastic shipper profile, one that likely needs uninterruptible gas supply for power generation applications.

East Daley has observed similar rate dynamics on recent expansions, including Transco’s Southeast Supply Enhancement (~$0.85/Mcf-day) and the South System Expansion 4 on Southern Natural Gas (~$1.45/Mcf-day). The rapid growth in power demand has driven transportation rates higher, and EDA forecasts that the upward pressure on midstream rates will persist through the next cycle.

On the data center front, TRP noted that it is actively engaging counterparties behind 25 GW of prospective load — equivalent to roughly 6 Bcf/d of gas requirements. By comparison, East Daley’s Data Center Demand Monitor identifies 133 projects within 50 miles of the TRP footprint, totaling 58 GW of estimated capacity. The robust project docket underscores that TRP has an opportunity set with upside.

However, powering 25 GW on 6 Bcf/d implies a heat rate of about 10.3 MMBtu/MWh, significantly above EDA’s base assumption of 6.825 MMBtu/MWh for combined-cycle generation. TRP confirms that the bulk of these engagements are for front-of-meter, utility-scale solutions that typically run at more efficient heat rates. The elevated implied heat rate suggests developers may lean on less-efficient units in the near term, reflecting anecdotal reports of supply-chain constraints pushing out deliveries of large-frame gas turbines until 2030.

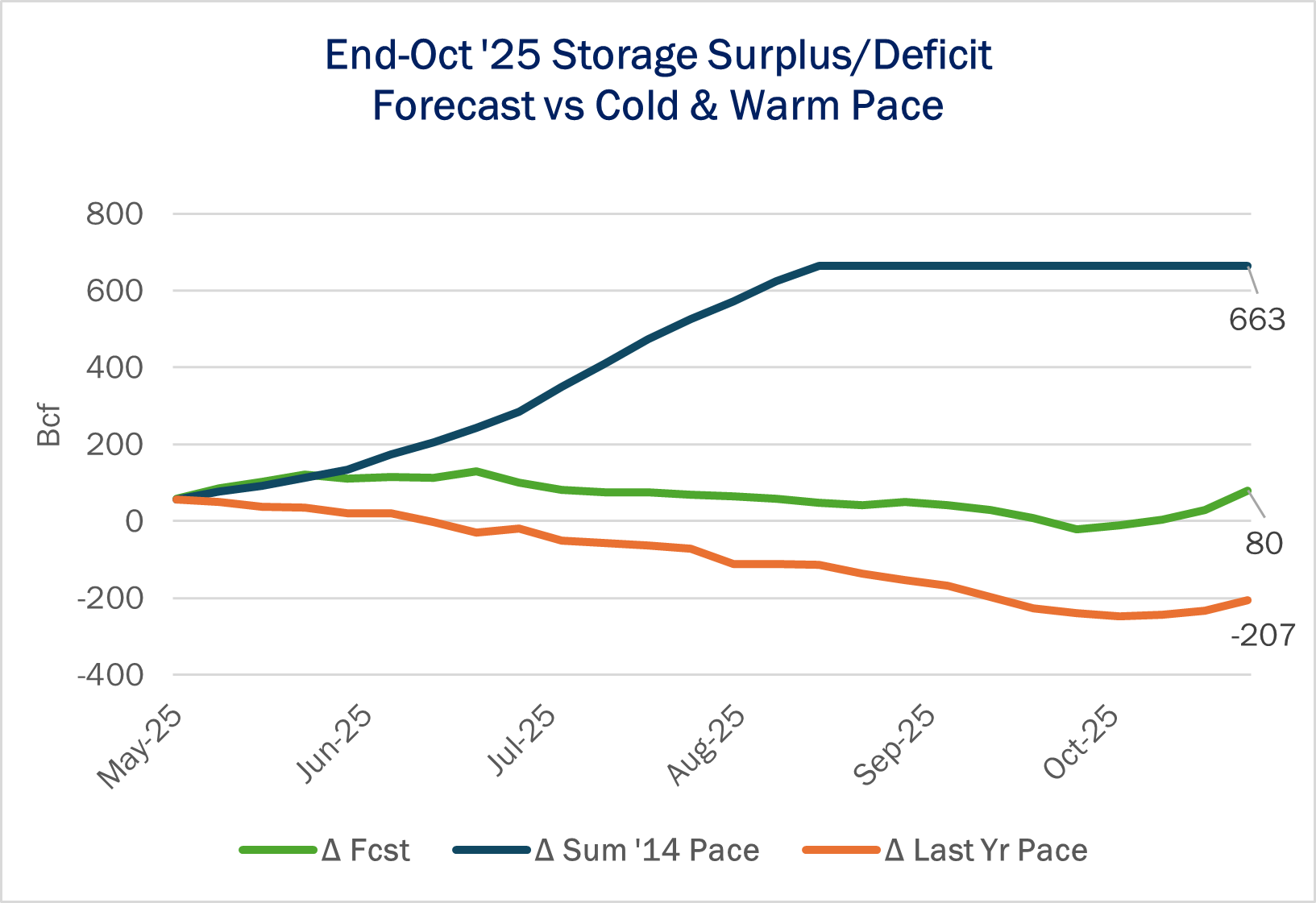

Storage – Traders and analysts expect the Energy Information Administration (EIA) to report a 99 Bcf injection for the week ending May 23. A 99 Bcf injection would be just 1 Bcf greater than the 5-year average, bumping the surplus to 91 Bcf. The storage deficit to last year would fall by 15 Bcf to 318 Bcf.

Injection estimates for Thursday’s report range from 79 Bcf to 109 Bcf, according to a survey by John Sodergreen’s The Desk, so the prospect of a fifth consecutive triple-digit injection is still in play. The surplus to the 5-year average could also grow to 100 Bcf if the injection comes in above 108 Bcf. That would mark the longest consecutive tiple-digit streak since the 2019 injection season.

Looking ahead to the end of the injection season, East Daley’s base case forecasts an 80 Bcf surplus to the 5-year average by the end of October. Summer 2014 was the coldest summer in the past 10 years; should injections follow that year’s pace, excess supply would curtail production at the end of August once the surplus exceeds 650 Bcf. Summer 2024 was the hottest meteorological summer in the Lower 48, and storage would end at a significant deficit of 207 Bcf if it were to repeat. See the Macro Supply & Demand Report for more information on the market outlook.

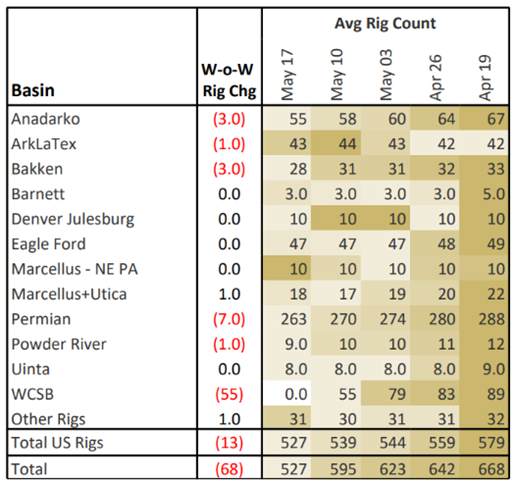

Rigs – The US rig count decreased by 13 for the May 17 week, standing at 527. The Anadarko (-3), Bakken (-3) and Permian (-7) lost rigs while the Barnett and Appalachia each gained 1 rig.

On the midstream side, Enterprise Products (EPD) is down 2 rigs net with losses on its Permian and Eagle Ford systems. Kinetik (KNTK) is up 2 rigs total on its Permian systems. The apparent decline in WCSB rig activity does not indicate actual market conditions, but rather is a result of data loading issues with CAODC rig reports.

East Daley’s weekly Rig Activity Tracker monitors rig activity by basin and by gathering and processing (G&P) system to better understand midstream impacts. We allocate rigs and monitor flows through 150+ public and privately owned G&P systems in every North American basin. Reach out for more information on the Rig Activity Tracker.

The Daley Note

Subscribe to East Daley’s The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices, and EDA research likely to affect markets in the short term.