Executive Summary:

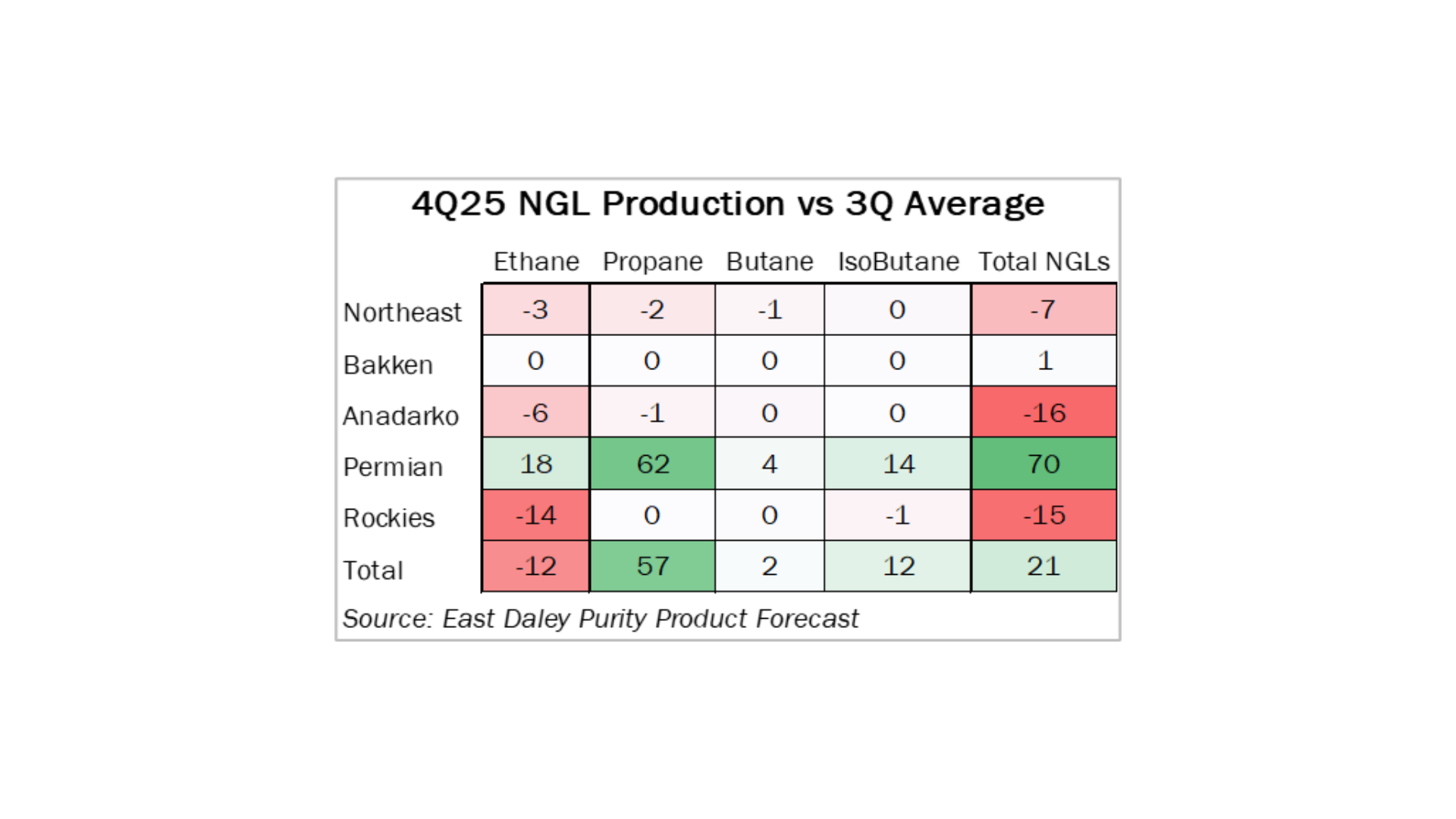

Infrastructure: East Daley expects US NGL supply to rise modestly this winter, up ~21 Mb/d in 4Q25 from 3Q levels, according to the Purity Product Forecast.

Exports: EPD’s Neches River facility averaged 150 Mb/d in flows for the week – about 25% above its 120 Mb/d nameplate capacity – indicating stronger-than-expected utilization.

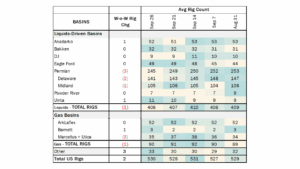

Rigs: The total US rig count increased during the week of Sept. 28 to 530. Liquids-driven basins decreased 1 rig W-o-W from 407 to 406.

Flows: US natural gas volumes averaged 68.9 Bcf/d in pipeline samples for the week ending Oct. 12, down 0.7% W-o-W.

Infrastructure:

East Daley Analytics expects US NGL supply to rise modestly this winter, up ~21 Mb/d in 4Q25 from 3Q levels, according to the Purity Product Forecast. The Permian Basin drives nearly all of the gains. We forecast NGL output in the Permian to climb ~70 Mb/d, led by a 62 Mb/d jump in propane and an 18 Mb/d gain in ethane production.

Colder weather and weaker frac spreads are prompting ethane rejection across swing basins such as the Anadarko and Rockies, contributing to a 12 Mb/d decline in US ethane production. However, there is upside potential for ethane recovery given stronger pricing. Ethane has risen from a low of $0.21/gal in August to $0.28/gal as of Oct. 9, meaning natural gas prices would need to rise further to maintain rejection economics.

In the Permian, East Daley does not expect frac spreads to materially affect supply as the basin remains in full ethane recovery mode. This reflects the vertical integration of major midstream operators such as Targa (TRGP), Enterprise (EPD) and Energy Transfer (ET), who have both the infrastructure and commercial incentive to maximize recovery. Any residual rejection is structural, stemming from older gas plants that lack the refrigeration capacity to achieve full recovery, even during periods of negative Waha pricing.

Butane production is steady Q-o-Q in our latest forecast.

Overall, the winter supply story is one of divergence. Permian propane and ethane volumes are growing, reinforcing the basin’s role as the core of the US liquids complex, while other regions are flat to declining amid seasonal rejection and lower gas processing rates.

The Permian Basin at a Crossroads: Download the Latest White Paper

The Permian Basin is the heart of the US energy industry, supplying half of crude oil and NGL production and nearly 20% of natural gas. Yet market pressures are forcing changes, prompting billions in new pipeline investments and reorienting how operators approach the storied basin. East Daley’s new white paper, The Permian Basin at a Crossroads, is the first of a 3-part series looking at the shifts underway in the Permian. In this series, we reveal how LNG demand and AI data centers could transform Permian gas into a primary revenue driver. We also review the multi-billion-dollar infrastructure needed to unlock this shift, and what’s at stake for oil, gas and midstream operators. — Click here to download the The Permian Basin at a Crossroads white paper!

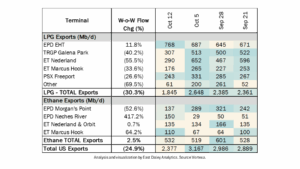

Exports:

Total US NGL exports fell 25% for the week ending Oct. 12. LPG export docks saw broad W-o-W declines, averaging a 30% drop across facilities. The exception was Enterprise Products’ (EPD) Houston Ship Channel terminal (EHT), which bucked the trend with a 12% W-o-W increase.

Ethane exports rose 2.5% W-o-W, showing mixed performance by terminal. Notably, EPD’s Neches River facility averaged 150 Mb/d in flows for the week – about 25% above its 120 Mb/d nameplate capacity – indicating stronger-than-expected utilization.

Rigs:

The total US rig count increased during the week of Sept. 28 to 530. Liquids-driven basins decreased 1 rig W-o-W from 407 to 406.

- Permian:

- Delaware (-2): Mewbourne Oil, ConocoPhillips

- Midland (-1): Basin Oil & Gas

- Anadarko (+1): RJM Co.

Uinta (+1): SM Energy

See East Daley Analytics’ weekly Rig Activity Tracker for more information on rigs by basin and company.

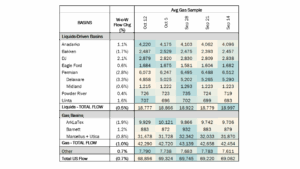

Flows:

US natural gas volumes averaged 68.9 Bcf/d in pipeline samples for the week ending Oct. 12, down 0.7% W-o-W.

Major gas basin samples decreased 1.0% W-o-W to 42.3 Bcf/d. The Haynesville sample declined 1.9% to 9.9 Bcf/d, while the Marcellus+Utica sample decreased 0.8% to 31.5 Bcf/d.

Samples in liquids-focused basins declined 0.5% W-o-W to 18.8 Bcf/d. The Permian sample fell 2.8% to 6.1 Bcf/d, while the Anadarko sample increased 1.1%.

Calendar: