Executive Summary:

Infrastructure: Propane has fallen victim to the US-China trade conflict, and this may affect the trajectory of exports over the long term.

Exports: Enterprise’s Neches River terminal has successfully loaded its first ethane cargo, marking a key milestone.

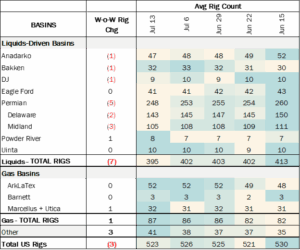

Rigs: The total US rig count decreased during the week of July 13 to 523. Liquids-driven basins decreased by 7 W-o-W from 402 to 395.

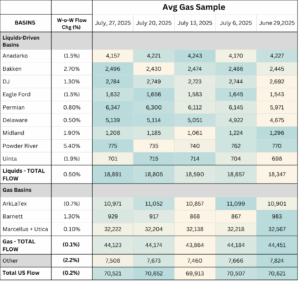

Flows: US natural gas volumes averaged 70.5 Bcf/d in pipeline samples for the week ending July 27, down 0.2% W-o-W from 70.7 Bcf/d the previous week.

Calendar: OKE & WMB Earnings 8/4 | MPLX Earnings 8/5 | ET Earnings 8/6 | TRGP, EOG & PPL Earnings 8/7 | Bakken & Northeast S&Ds, KEY Earnings 8/8

Infrastructure:

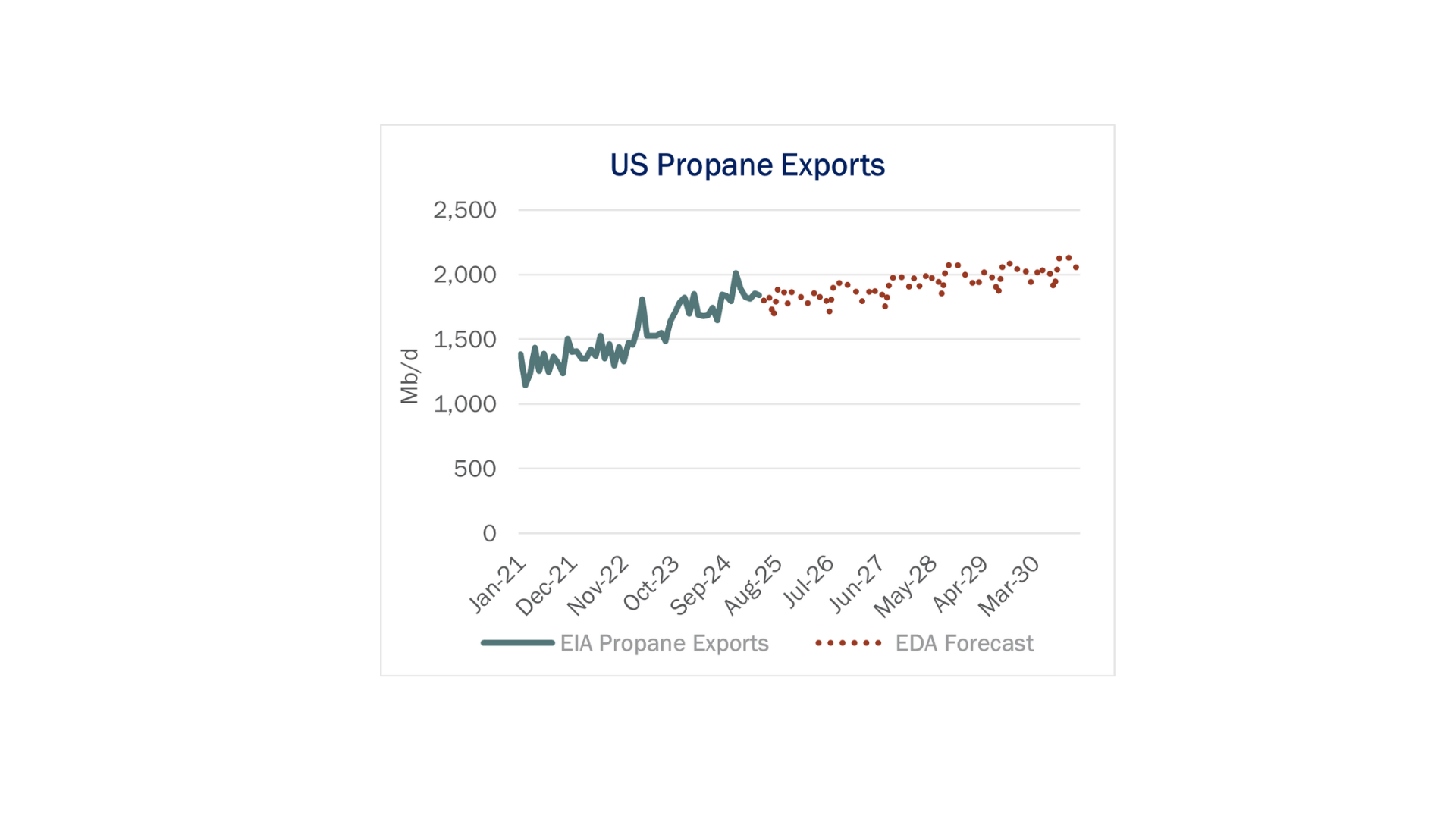

US propane exports have seen relatively steady growth, and East Daley forecasts growth to temper but continue trending higher. However, propane has recently fallen victim to the US-China trade conflict, and this may affect the trajectory over the long term.

The Trump administration in late May imposed restrictions on ethane exports to China, citing national security risks. The Department of Commerce lifted those restrictions in early July, but damage has already been done — China doubled its annual import quotas for naphtha in June, according to Reuters.

Naphtha is used as a petrochemical feedstock in crackers in the same way as ethane, although the yields and byproducts are different. Most newbuilds are geared towards ethane or propane, particularly in China where the petrochemicals industry has been on a building spree over the past few years. However, older units use naphtha as feedstock, while some others are mixed-feed, allowing operators to take whichever feedstock makes the highest profit.

With China comprising nearly 20% of US propane exports and its government incentivizing more naphtha use, this puts downward pressure on US propane. Whether the barrels make their way to other international markets, and command a lower price as a result, is something East Daley will continue to monitor.

Exports:

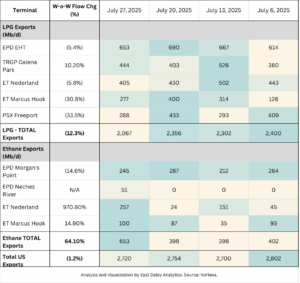

US LPG exports declined 1.2% W-o-W, with weaker volumes observed across nearly all major export terminals. The sole outlier was Enterprise’s (EPD) Galena Park, which posted a 10% increase in volumes, partially offsetting the broader downturn.

In contrast, ethane exports surged 64% W-o-W, propelled by a significant uptick in cargoes departing from Nederland/Orbit — all destined for China. This rebound in ethane volumes highlights renewed international demand and the strategic role of Gulf Coast infrastructure in facilitating these flows.

Additionally, EPD’s Neches River terminal has successfully loaded its first ethane cargo, marking a key milestone. East Daley explored the implications of this new outlet in this week’s Data Insights, detailing how it could reshape regional ethane dynamics and influence Gulf Coast and global supply chains.

Rigs:

The total US rig count decreased during the week of July 13 to 523. Liquids-driven basins decreased by 7 W-o-W from 402 to 395.

- Permian (-5):

-

- Midland (-3): Vital Energy, Firebird Energy II, Griffin Petroleum

- Delaware (-2): EOG Resources, Devon Energy

- Anadarko (-1): Validus Energy II Midcon LLC

- Bakken (-1): Hunt

- Denver-Julesburg (-1): Civitas

- Powder River (+1): Three Crown Petroleum LLC

Flows:

US natural gas volumes averaged 70.5 Bcf/d in pipeline samples for the week ending July 27, down 0.2% W-o-W from 70.7 Bcf/d the previous week.

Gas basins were unchanged at a 44.1 Bcf/d average. The Haynesville sample declined 0.7% to 11.0 Bcf/d. The Bakken sample increased 2.7% to 2.5 Bcf/d, while the DJ rose 1.3% to 2.8 Bcf/d.

Calendar: