Executive Summary:

Infrastructure: NGLs have become one of the most strategic components of the global energy system, and now sit at the center of industrial demand, foreign policy and energy security.

Exports: Total NGL exports declined 23.6% W-o-W for the week ending Oct. 12.

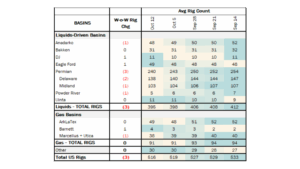

Rigs: The total US rig count decreased during the week of Oct. 12 to 516. Liquids-driven basins lost 3 rigs W-o-W from 398 to 395.

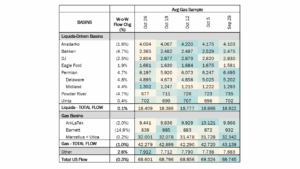

Flows: US natural gas volumes averaged 68.6 Bcf/d in pipeline samples for the week ending Oct. 26, down 0.3% W-o-W.

Infrastructure:

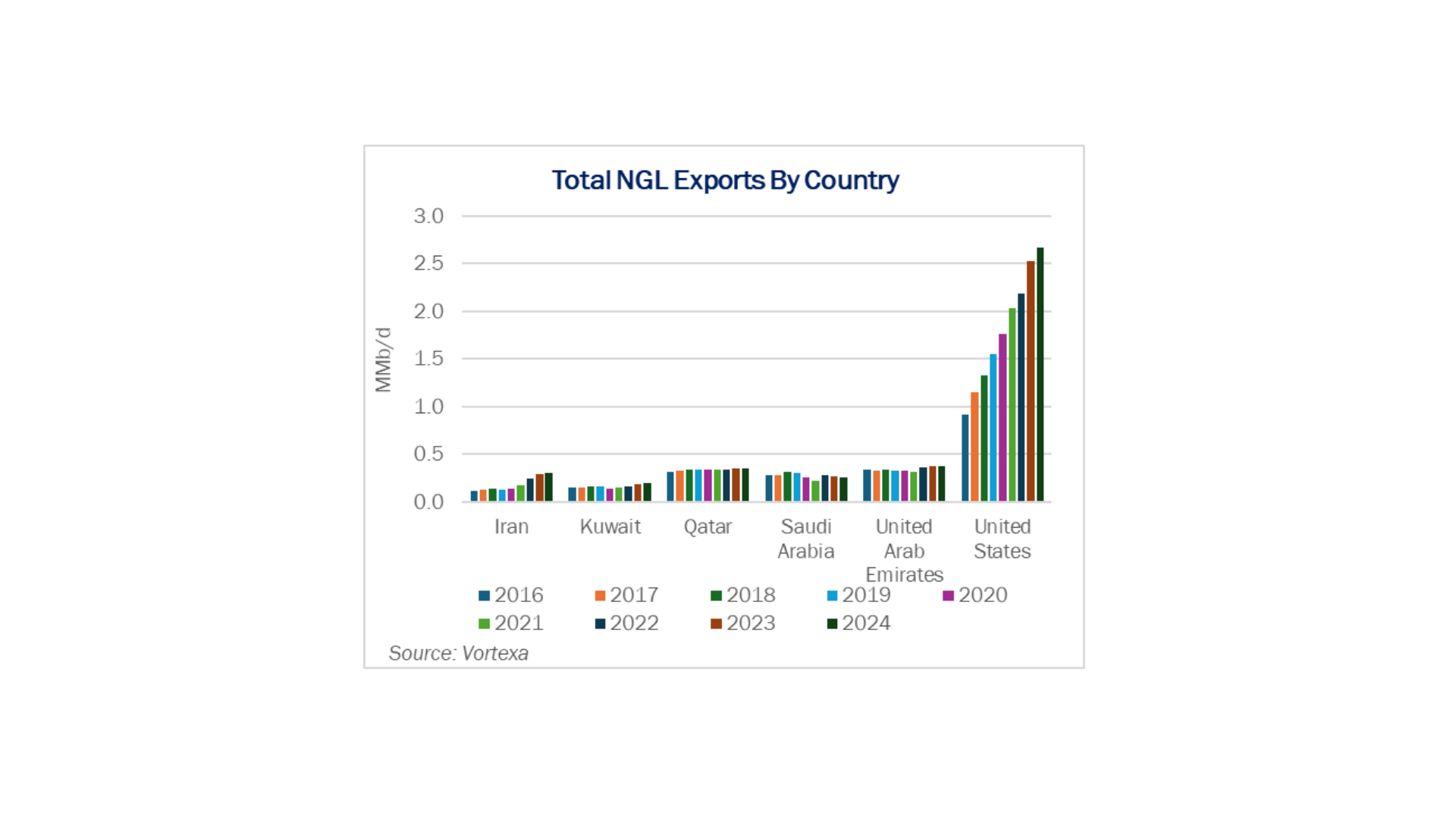

NGLs have quietly become one of the most strategic components of the global energy system. Once dismissed as a drilling byproduct, NGLs now sit at the center of industrial demand, foreign policy and energy security. The US’ rise as the dominant supplier of ethane and propane has redefined global trade flows — and increasingly, geopolitics.

Recent US–China trade tensions highlight this new reality. When Washington and Beijing escalated tariffs earlier this year, NGLs, specifically propane and ethane, were among the first commodities targeted. The move underscores how deeply integrated these molecules have become within global manufacturing supply chains.

Domestically, NGLs are capturing a growing share of total liquids. Since 2020, their share of liquids in storage has risen from roughly 30% to 35%. The Permian Basin provides the clearest example of this structural shift. East Daley forecast minimal crude production growth in the basin through decade-end, yet NGL supply is poised to grow by nearly 500 Mb/d over the same period.

NGLs are becoming the growth engine within the US liquids complex – an increasingly influential segment shaping flows, infrastructure investment and trade balances. As their share expands, NGLs are emerging not just as a byproduct of US energy production, but as a defining element of its global leadership.

The Permian Basin at a Crossroads: Download the Latest White Paper

The Permian Basin is the heart of the US energy industry, supplying half of crude oil and NGL production and nearly 20% of natural gas. Yet market pressures are forcing changes, prompting billions in new pipeline investments and reorienting how operators approach the storied basin. East Daley’s new white paper, The Permian Basin at a Crossroads, is the first of a 3-part series looking at the shifts underway in the Permian. In this series, we reveal how LNG demand and AI data centers could transform Permian gas into a primary revenue driver. We also review the multi-billion-dollar infrastructure needed to unlock this shift, and what’s at stake for oil, gas and midstream operators. — Click here to download the The Permian Basin at a Crossroads white paper!

Exports:

Total NGL exports declined 23.6% W-o-W for the week ending Oct. 12. LPG exports dropped sharply by 28.9%, with lower volumes reported across nearly all major docks except for EPD’s EHT, which saw a 2.5% W-o-W increase. Ethane exports also rose 2.5% W-o-W, though performance varied by dock. EPD’s Morgan’s Point fell 52%, while the Neches River terminal surged 400% to 149 Mb/d, roughly 29 Mb/d above its Phase 1 nameplate capacity of 120 Mb/d.

Rigs:

The total US rig count decreased during the week of Oct. 12 to 516. Liquids-driven basins lost 3 rigs W-o-W from 398 to 395.

- Permian:

- Delaware (-2): Petro-Hunt, ConocoPhillips

- Midland (-1): Fasken Oil & Ranch

- Powder River (-1): Occidental Petroleum

- Anadarko (-1): Shakespeare Oil

- DJ (+1): Chevron

- Eagle Ford (+1): Pursuit Oil & Gas

Flows:

US natural gas volumes averaged 68.6 Bcf/d in pipeline samples for the week ending Oct. 26, down 0.3% W-o-W.

Major gas basin samples declined 1.0% W-o-W to 42.3 Bcf/d. The Haynesville sample declined 2.0% to 9.4 Bcf/d, and the Marcellus+Utica sample slid 0.2% to 32.0 Bcf/d.

Samples in liquids-focused basins increased 0.1% to 18.4 Bcf/d. The Permian sample rose 4.75% to 6.2 Bcf/d, while the Bakken sample declined 4.7% W-o-W.

Calendar: