Executive Summary: Rigs: The total US rig count increased by 2 rigs for the May 19 week, up from 570 to 572. Flows: The US interstate gas sample is flat W-o-W for the week of June 2. Infrastructure: Rising global ethane demand is driving commercial agreements between midstream and downstream counterparties. Purity Product Spotlight: East Daley believes the robust ethane supply coming out of the Permian will put downward pressure on the forward curve through October ’25 given there is no meaningful incremental demand coming online until mid-2025.

Rigs:

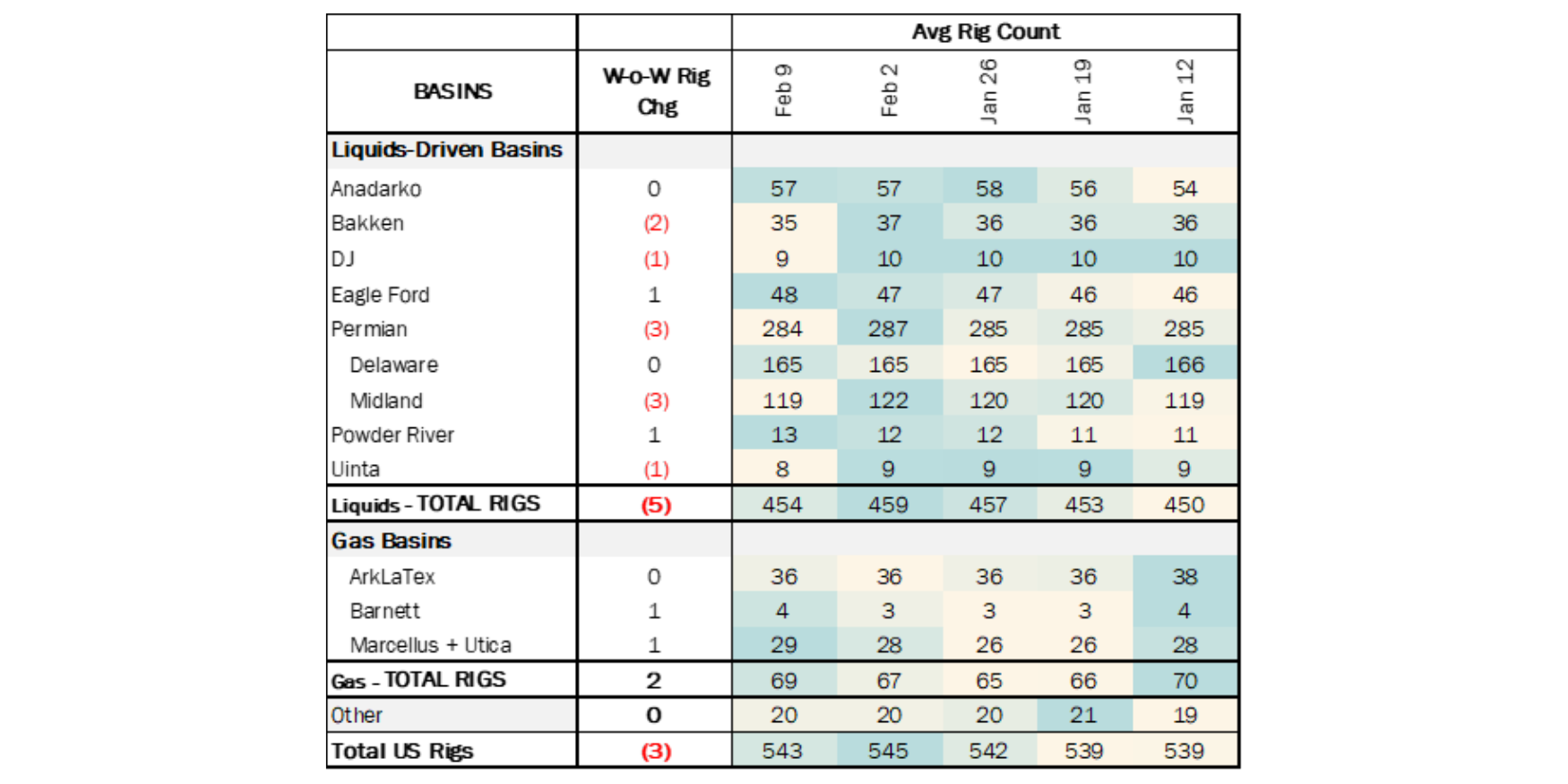

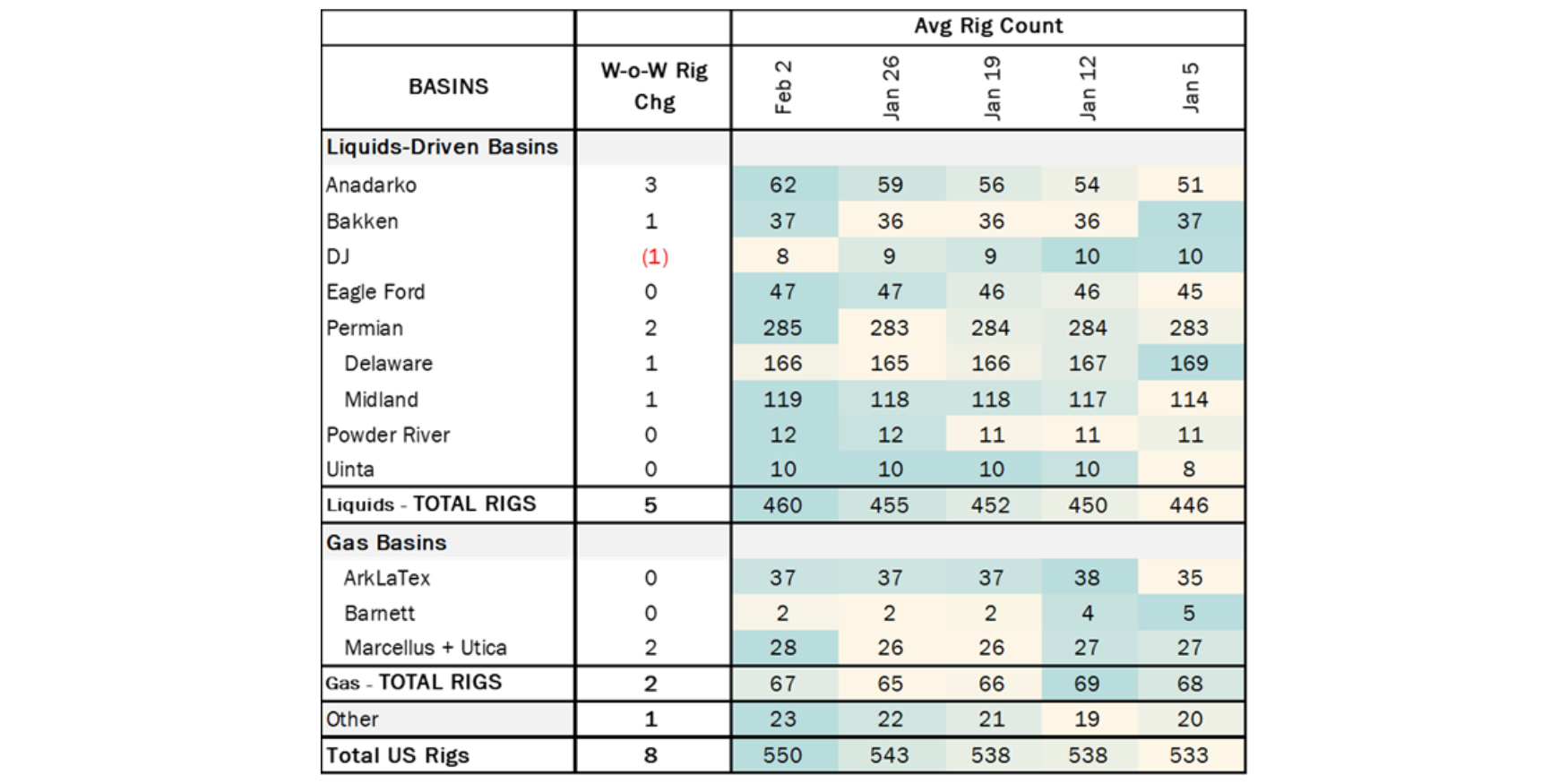

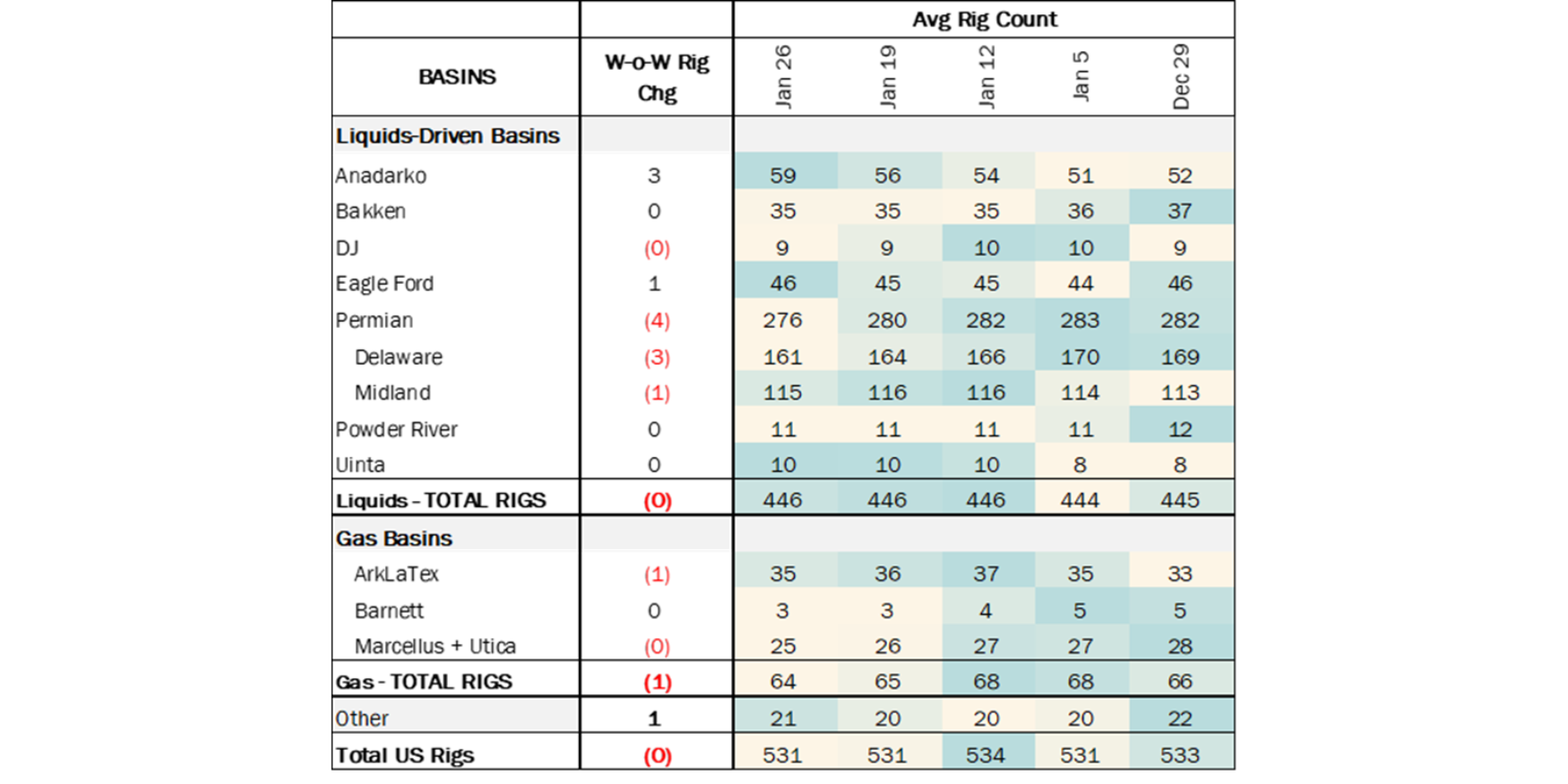

The total US rig count increased by 2 rigs for the May 19 week, up from 570 to 572. Liquids-driven basins lost 3 rigs W-o-W, as the rig count fell from 465 to 462. The Anadarko gained 4 rigs, and the Bakken lost 1 rig. The Eagle Ford lost 2 rigs, declining from 52 to 50 rigs. The Permian lost 3 rigs, including 2 rigs from the Delaware and 1 rig from the Midland sub-basins. The Powder River Basin rig count decreased by 1.

In the Anadarko, Downing-Nelson Oil and AGV Corp. each added 1 rig. Anadarko Basin operators DDD Exploration and Sanguine Gas Exploration also added a rig each. In the Bakken, Enerplus removed 1 rig for a total of 33 rigs. There were 2 rigs lost In the Eagle Ford as operators Texas American Resources and Overton Park Oil & Gas each dropped 1 rig. In the Permian, Delaware operators Marathon Oil and VTX Energy Operating each lost 1 rig, and Midland operator De IV Operating also dropped a rig. In the Powder River, the total rig count fell from 11 to 10 as Devon Energy dropped a rig.

Flows:

The US interstate gas sample is flat W-o-W for the week of June 2.

The flow sample in liquid-focused basins is up slighly with the Eagle Ford driving the rise. Last week, intrastate optionality in the basin allowed for gas flow to be switched from interstate to intrastate pipelines, decreasing the basin’s flow sample. The 1.6% increase W-o-W this week for the Eagle Ford could indicate less operational constraints with flow diverted back to interstate lines.

In gas-driven basins, the flow sample in the ArkLaTex continues to flatten. Producers in the region are curtailing production in response to low prices and the delay of some LNG demand until late 2H24-early’25, when we expect production to grow into new demand from the Plaquemines and Golden Pass projects. Overall, gas sample fluctations across all other gas and liquids-targeted basins were flat W-o-W.

Infrastructure:

Rising global ethane demand is driving commercial agreements between midstream and downstream counterparties. In East Daley’s 2Q24 NGL webinar, we noted several ethylene cracker projects, including the Dow Chemical Path2Zero project in Fort Saskatchewan, Canada (refer to the table below).

The Path2Zero project will have 1.8MM metric tons per year of ethylene capacity and plans a phased ramp-up through 2030. The facility will consume more than 100 Mb/d of ethane. In Pembina’s (PBA) May Investor Day presentation, the company announced a 50 Mb/d supply and transportation agreement to support Dow’s project. PPL expects to spend $300-500MM to extract an additional 50 Mb/d of ethane with deep-cut plant expansions, incremental de-ethanization towers, and existing system expansions.

Purity Product Spotlight:

East Daley believes the robust ethane supply coming out of the Permian will put downward pressure on the forward curve through October ’25 given there is no meaningful incremental demand coming online until mid-2025.

EDA reduces the ethane price to maintain a frac spread of about $0.14/gal on average from April-October ’24. This drives our forecast for ethane price lower than the forward curve, as shown in the figure below. The Ethane Supply & Demand Report and Data Set for June is now available.

-1.png)

.png)