Executive Summary: Rigs: The total US rig count decreased by 5 for the June 9 week, down from 565 to 560. Flows: The US interstate gas sample is about 1% up W-o-W for the week of Jun 23 (+0.4 Bcf/d). Infrastructure: The Williams Companies (WMB) Cureton Front Range acquisition in Nov’23 included 260 miles of gas gathering and 60 MMcf/d of gas processing plant capacity (orange triangle in the map). Purity Product Spotlight: With only a couple of trading days left, the weighted average NGL price per gallon will be about $0.04/gal or about 5% lower Q-o-Q with propane having the greatest impact on the NGL barrel price.

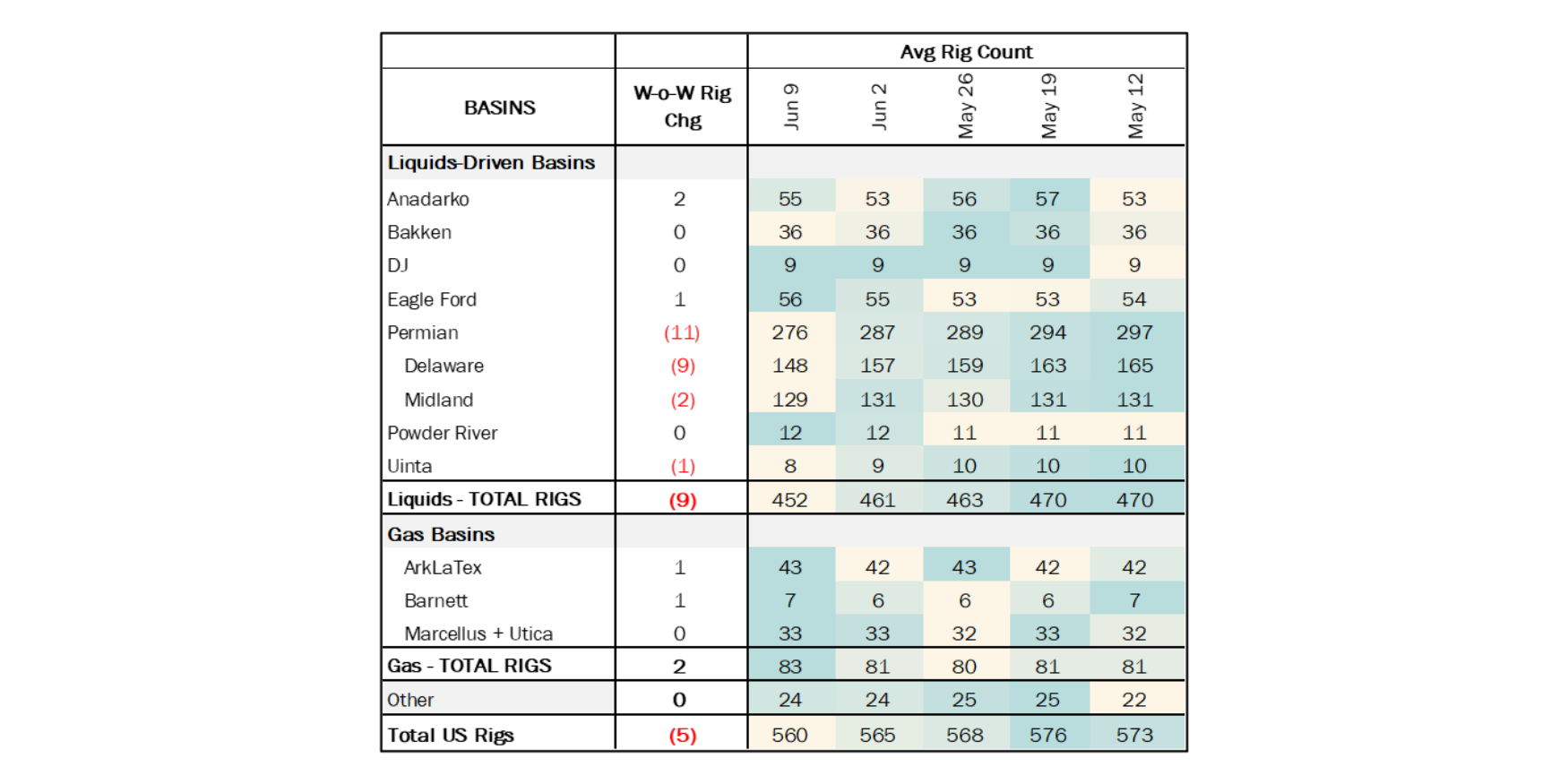

Rigs:

The total US rig count decreased by 5 for the June 9 week, down from 565 to 560. Liquids-Driven Basins saw the largest decrease, decreasing by 9 rigs w-o-w, moving from 461 rigs to 452. The Permian basin saw a large loss of rigs this week with a decrease off 11 rigs, 9 rigs removed from the Delaware basin and 2 rigs removed from the Midland basin. The Uinta basin also decreased their total rig count by 1. However, the Anadarko basin saw an increase of 2 rigs on their systems and the Eagle Ford basin also gained 1 rig.

In the Permian basin, Delaware basin operators EOG Resources decreased their rig count by 2 and Occidental Petroleum also removed 2 rigs from their systems. Also in the Delaware basin, Permian Resources, LLC lost 1 rig and Chevron Corporation lost 2 rigs. Delaware basin operators Exxon and APA Corp. both saw a decrease of 1 rig from their systems as well. In the Midland basin, operators Exxon and Highpeak Energy each decreased their rig counts by 1. In the Uinta basin, operator Koda Resources saw a decrease of 1 rig, decreasing the total rig count from 9 to 8.

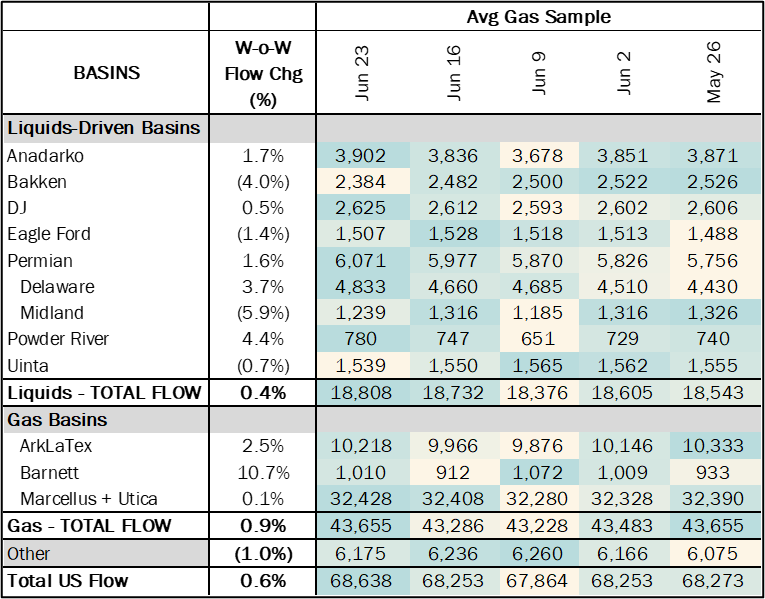

Flows: The US interstate gas sample is about 1% up W-o-W for the week of Jun 23 (+0.4 Bcf/d). In liquids-driven basins, the gas sample is relatively flat. The 4% flow drop in the Bakken is due to capacity constraints on Alliance Pipeline as a result of imbalance position, which is expected to be resolved by June 30. The sample in the Permian suggests flat production in the basin as it continues to manage gas egress capacity constraints.

The flow sample in gas-focused basins is up 1% W-o-W this week. In the Arklatex (Haynesville), the improvement we are seeing now in the sample W-o-W may suggest that they are turning wells back on in response to an expected increase in demand this summer. In the Northeast (Marcellus+Utica) the sample has been improving since EQT lifted curtailments last month. Overall, gas sample fluctuations across all other regions were flat W-o-W.

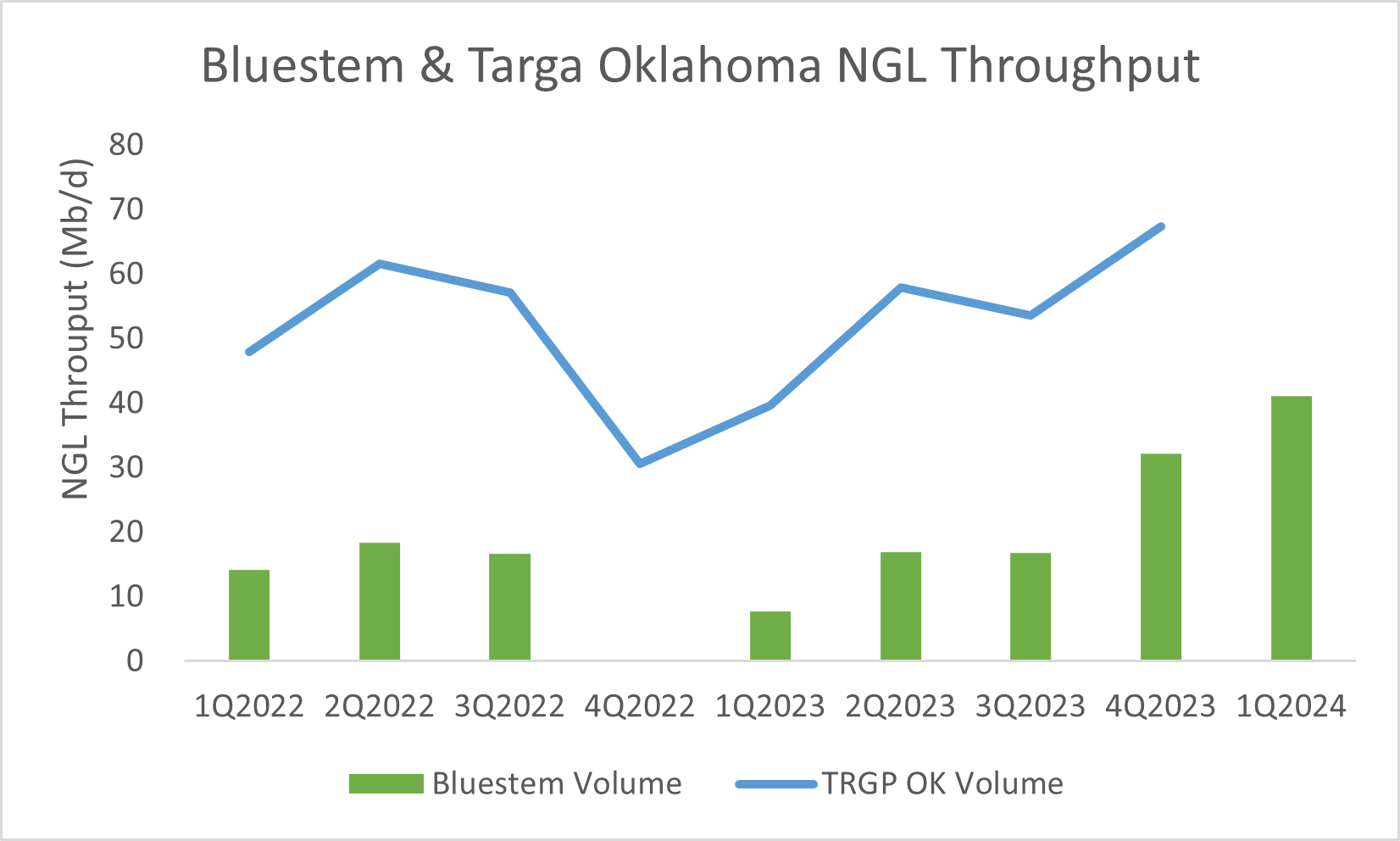

Infrastructure: The Williams Companies (WMB) Cureton Front Range acquisition in Nov’23 included 260 miles of gas gathering and 60 MMcf/d of gas processing plant capacity (orange triangle in the map). A big part of the strategic rationale for acquiring the plant was downstream integration. The Cureton plant was delivering NGL volumes down third-party pipelines instead of its 50% owned Overland Pass Pipeline (OPPL) which delivers NGLs to its fractionation facility in Conway, Kansas (green star). Alternatively, WMB can ship Cureton-produced NGL volumes all the way down to the Mt. Belvieu NGL market (red star) via WMB’s Bluestem pipeline (yellow line) and Targa’s (TRPG) Grand Prix pipeline (orange line) to TRGP’s Cedar Bayou frac train 7, which WMB has a 20% interest in.

WMB management noted in a Feb’24 call they were in the process of moving gas from a third-party plant to Cureton to capture NGLs for transportation on OPPL. We estimate Cureton produces ~12 Mb/d of NGLs, which translates to a $19MM annual gross revenue uplift on OPPL and Bluestem. The data supports the narrative as reflected in the figure below. According to FERC filings, Bluestem reported a 9 Mb/d increase in NGL throughput 4Q23 to 1Q24 and we expect the same increase in Targa’s Grand Prix Oklahoma volumes when they report their 1Q24 FERC financials on July 10th. The bump in Bluestem volumes has also boosted Targa’s Grand Prix asset system volumes that have plateaued for Permian egress due to capacity constraints there. As East Daley discusses in its Capital Intelligence webinar this week, past and future transactions will rely on NGL capture for value-chain economics with exposure to international demand growth.

Purity Product Spotlight: With only a couple of trading days left, the weighted average NGL price per gallon will be about $0.04/gal or about 5% lower Q-o-Q with propane having the greatest impact on the NGL barrel price. Propane was lower by 10%. Lower propane prices has expanded the Far East minus Mt. Belvieu spread incentivizing more LPG exports. The weekly data on propane and propylene exports suggests 2Q24 will be bullish LPG exports, up 15%+ in 2Q24 vs. 2Q23. That should translate to strong LPG exports – seasonally-adjusted – for EPD, ET, TRGP, and PSX.

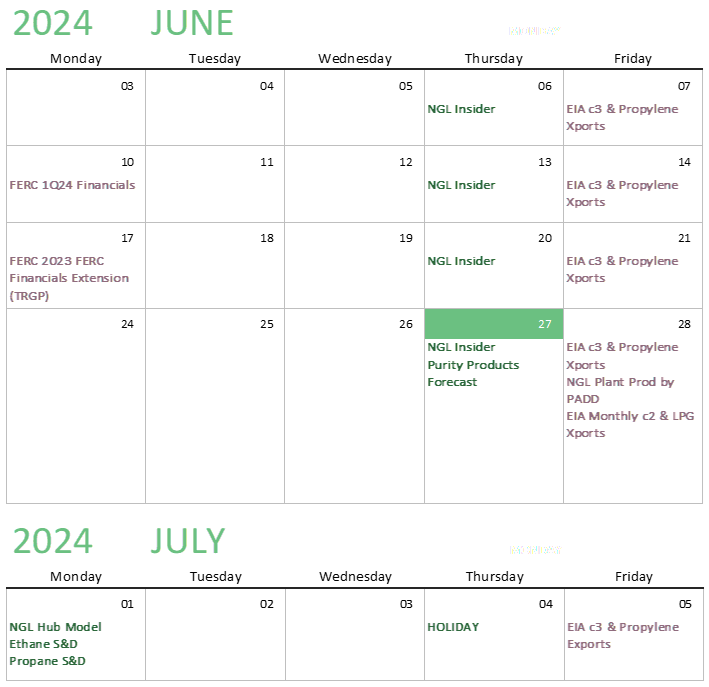

Data Points & Product Release Calendar: