Executive Summary: Rigs: The US total rig count decreased by 8 rigs for the July 14 week, down to 539 from 547. Flows: The US interstate gas sample is up 1.2% W-o-W (+0.8 Bcf/d) for the week of July 28. Infrastructure: The expected start-up of the Matterhorn Express Pipeline has been pushed to 4Q24, according to a recent update by the contractor building the project. Purity Product: Prompt-month ethane prices at Mont Belvieu reached a 5-year low on July 29 of $0.12/gal.

Rigs:

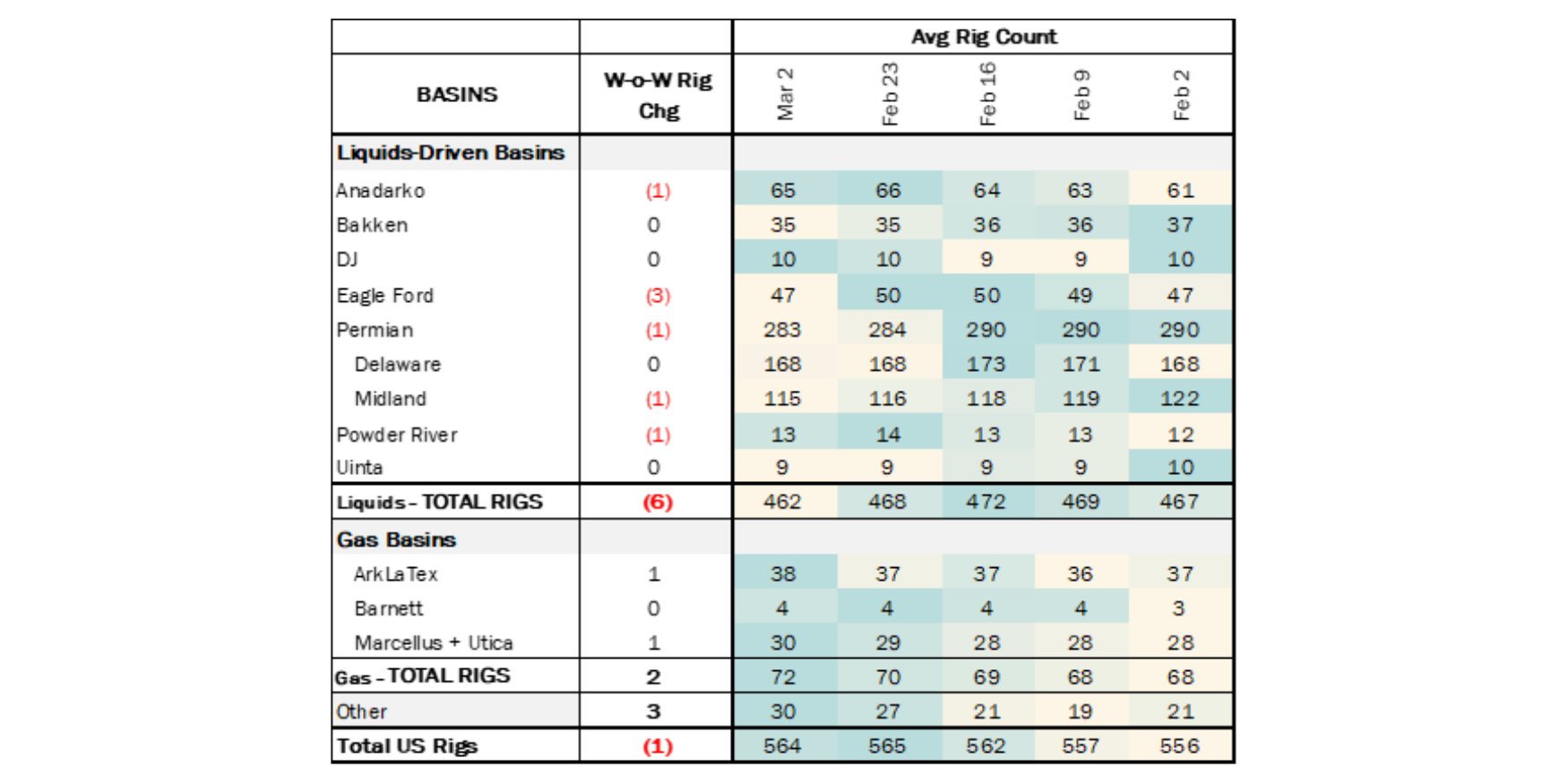

The US total rig count decreased by 8 rigs for the July 14 week, down to 539 from 547. Liquids-driven basins saw a decrease of 10 rigs, moving the count from 449 to 439. The Anadarko Basin decreased by 3 rigs, the Bakken fell by 1 rig, and the Eagle Ford rig count declined by 2. The Permian Basin count declined by 4 rigs, and the Powder River Basin saw a decrease of 1 rig.

In the Anadarko, operators Continental Resources, FG Holl, and Dixon Operating each removed 1 rig. In the Bakken, operator Chord Energy decreased its rig count by 1. In the Eagle Ford, Marathon Oil (MPC) and Baytex Energy each decreased their rigs by 1. In the Delaware basin, Devon Energy, Coterra Energy and Civitas Resources each dropped 1 rig. In the Midland, Double Eagle released 1 rig. Lastly, In the Powder River Basin, EMRE OIL decreased its rig counts by 1.

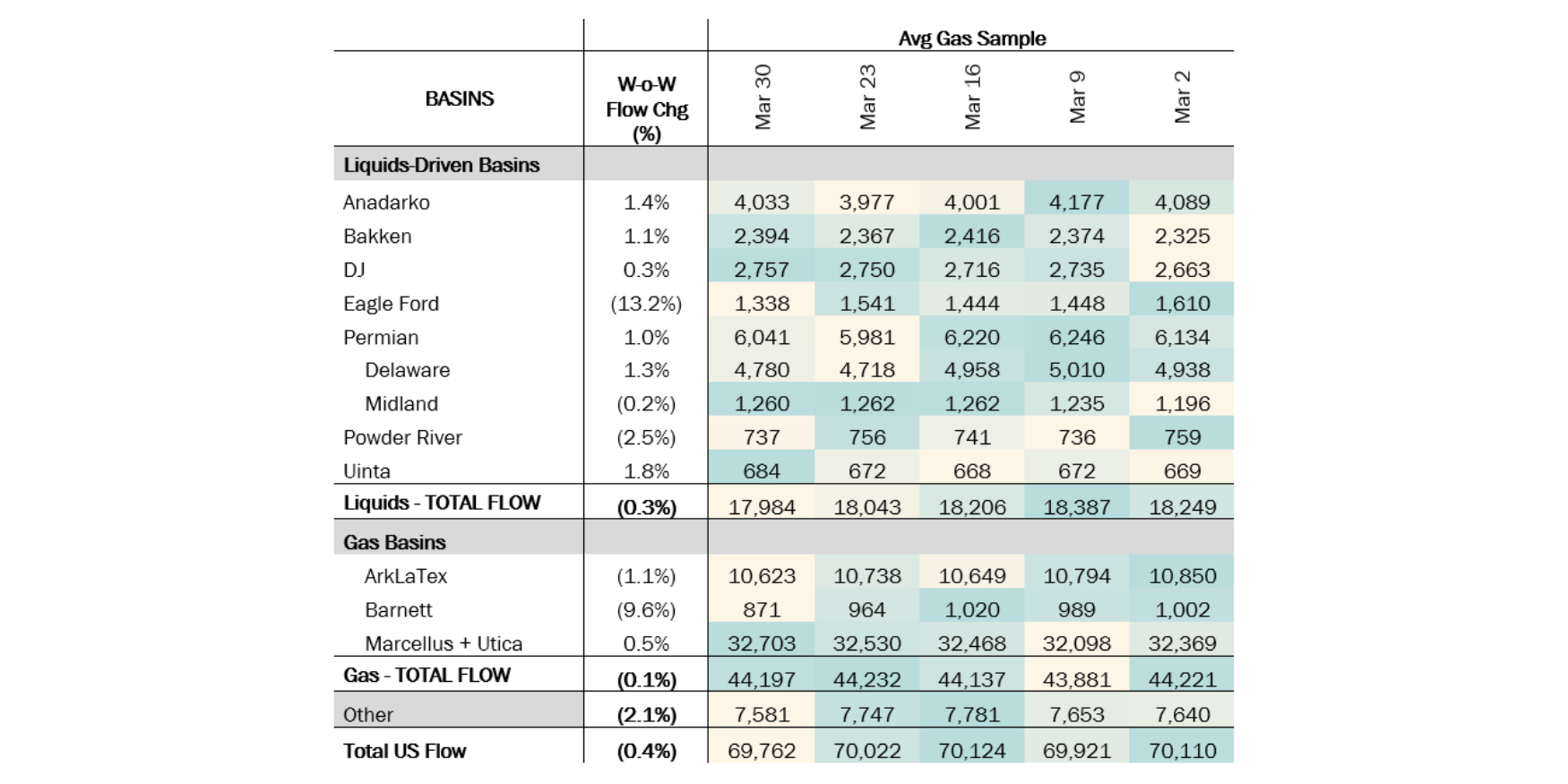

Flows: The US interstate gas sample is up 1.2% W-o-W (+0.8 Bcf/d) for the week of July 28. Leading the rise is liquid-driven basins. The flow sample increased in the Eagle Ford, indicating that Transcontinental Gas Pipeline has recovered from maintenance earlier in the month. Samples from gas-focused basins are up ~1% with flows continuing to improve in the Northeast (Marcellus+Utica) since EQT resumed production. Overall, gas samples were flat W-o-W across other basins.

*W-o-W change is for the two most recent week.

Infrastructure:

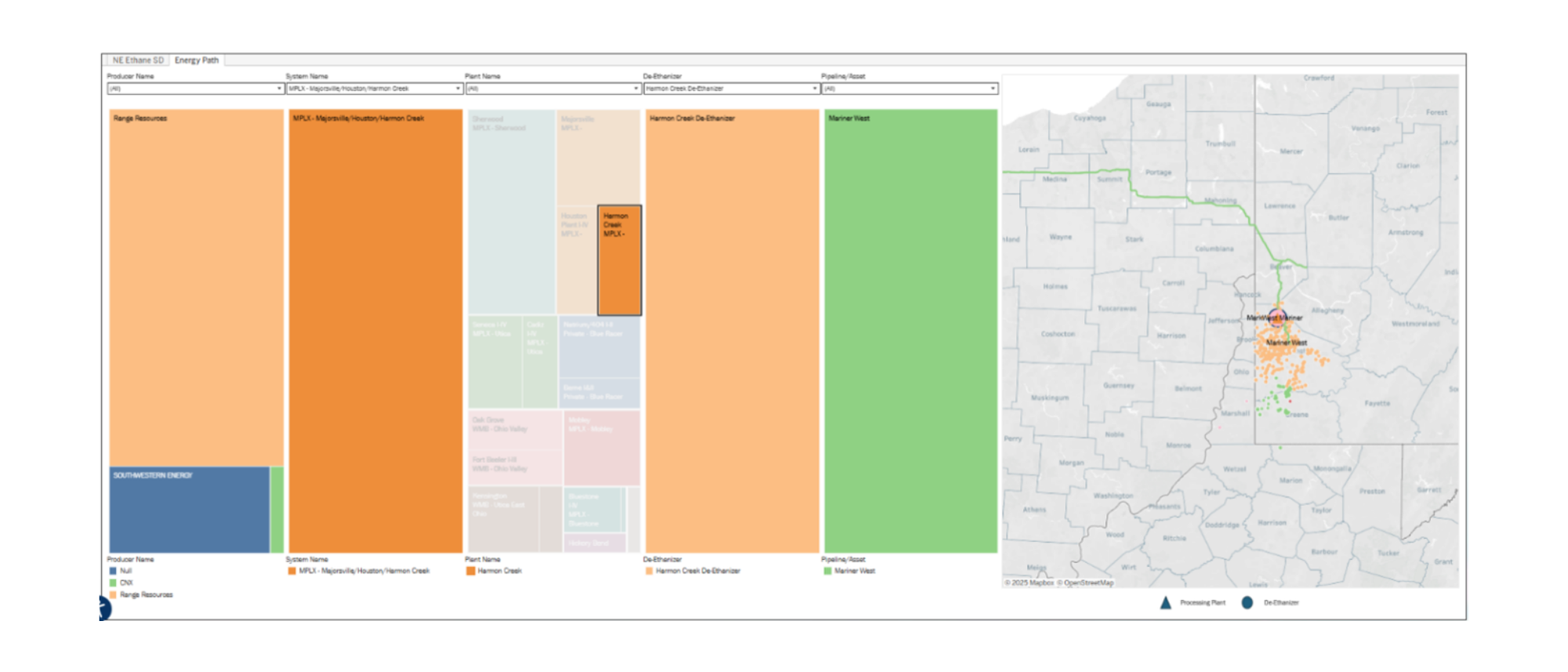

The expected start-up of the Matterhorn Express Pipeline has been pushed to 4Q24, according to a recent update by the contractor building the project. The revised construction schedule would delay by several months new gas volumes from the Permian and keep gas prices under pressure in the basin. This means ethane extraction is likely to continue at record volumes until the gas egress constraint is alleviated.

The timeline for the 2.5 Bcf/d Matterhorn project has been a subject of widespread industry speculation. Whitewater Midstream, the lead developer of the project, predicted a 3Q24 start-up date when Matterhorn reached FID in May 2022, but has been tight-lipped since on the project schedule.

With limited new information, market watchers have leaned on Gulf Companies, the EPC contractor building Matterhorn, for sporadic updates. Gulf Companies maintains a list of projects the company is building on its website, and recently posted a 4Q24 completion target for the 400-mile mainline from Waha to the Katy hub, according to a review by East Daley. By Friday, the language regarding Matterhorn start-up had been removed from the company’s website.

However, we have reviewed a revised construction schedule from Gulf Companies, updated as of mid-June ’24, predicting completion of the Matterhorn project on September 17. That schedule is no longer publicly available but would be consistent with the 4Q24 in-service target recently indicated on Gulf Companies’ website.

As a result, East Daley is pushing back the start of Matterhorn volumes to October ‘24. See our just released Ethane Supply & Demand report and data set for more insight into how this delay will impact storage and price throughout the rest of the year.

Purity Product Spotlight:

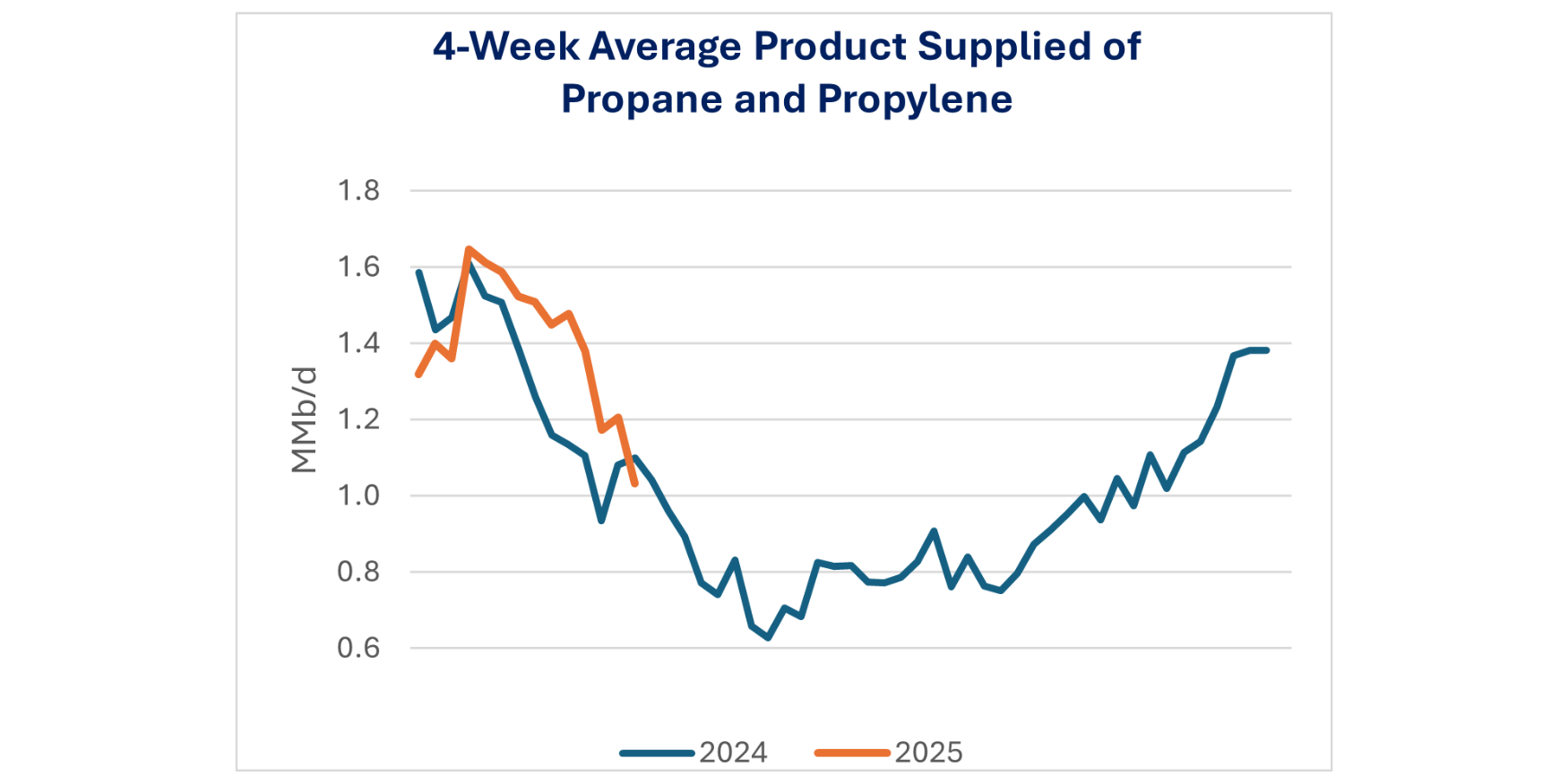

Prompt-month ethane prices at Mont Belvieu reached a 5-year low on July 29 of $0.12/gal. Several factors could explain ethane prices taking a hit: low natural gas prices in the Permian Basin, lingering disruptiions to exports from Hurricane Beryl, and probably the biggest reason, continued NGL and ethane supply growth. Storage levels are also high, short of an all-time high by 6 MMbbl.

-1.png)

-1.png)

-3.png)