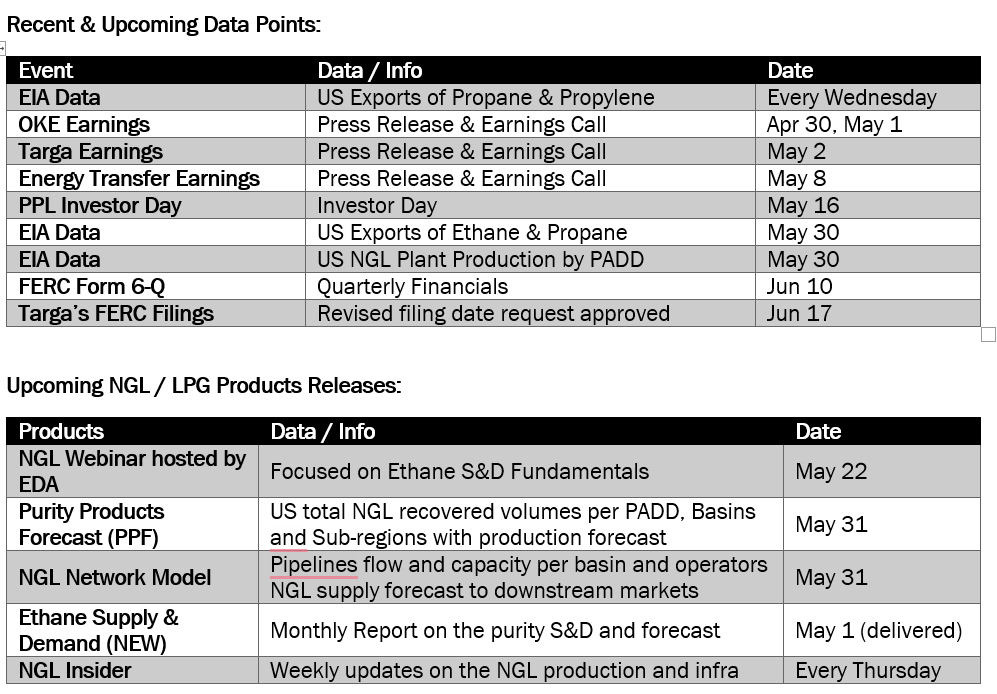

Executive Summary: Rigs: The total US rig count decreased by 7 rigs for the April 28 week, down to 574 from 581. Flows: The US interstate gas sample dropped 1% W-o-W for the week of May 12. Infrastructure: Global demand for plastics continues to rapidly change US ethane markets in a way that is not reflected in the forward price curve. Purity Product Spotlight: In EDA’s upcoming NGL 2Q24 webinar on May 22, we discuss the ethane supply and demand outlook, including several known ethylene crackers driving the need for ethane supply growth.

Rigs:

The total US rig count decreased by 7 rigs for the April 28 week, down to 574 from 581. Liquids-driven basins drove the decline, down 8 rigs W-o-W to a total of 467. The Permian and Eagle Ford basins each lost 3 rigs, with the Permian losses coming from the Delaware. The DJ decreased by 2 rigs W-o-W to 8.

In the Delaware, operators EOG Resources, Occidental, and Avant Operating each subtracted one rig from their systems. Crescent Energy, EOG Resources, and Rosewood operating in the Eagle Ford each removed one rig from their systems. Chevron and Verdad Resources each took away one rig.

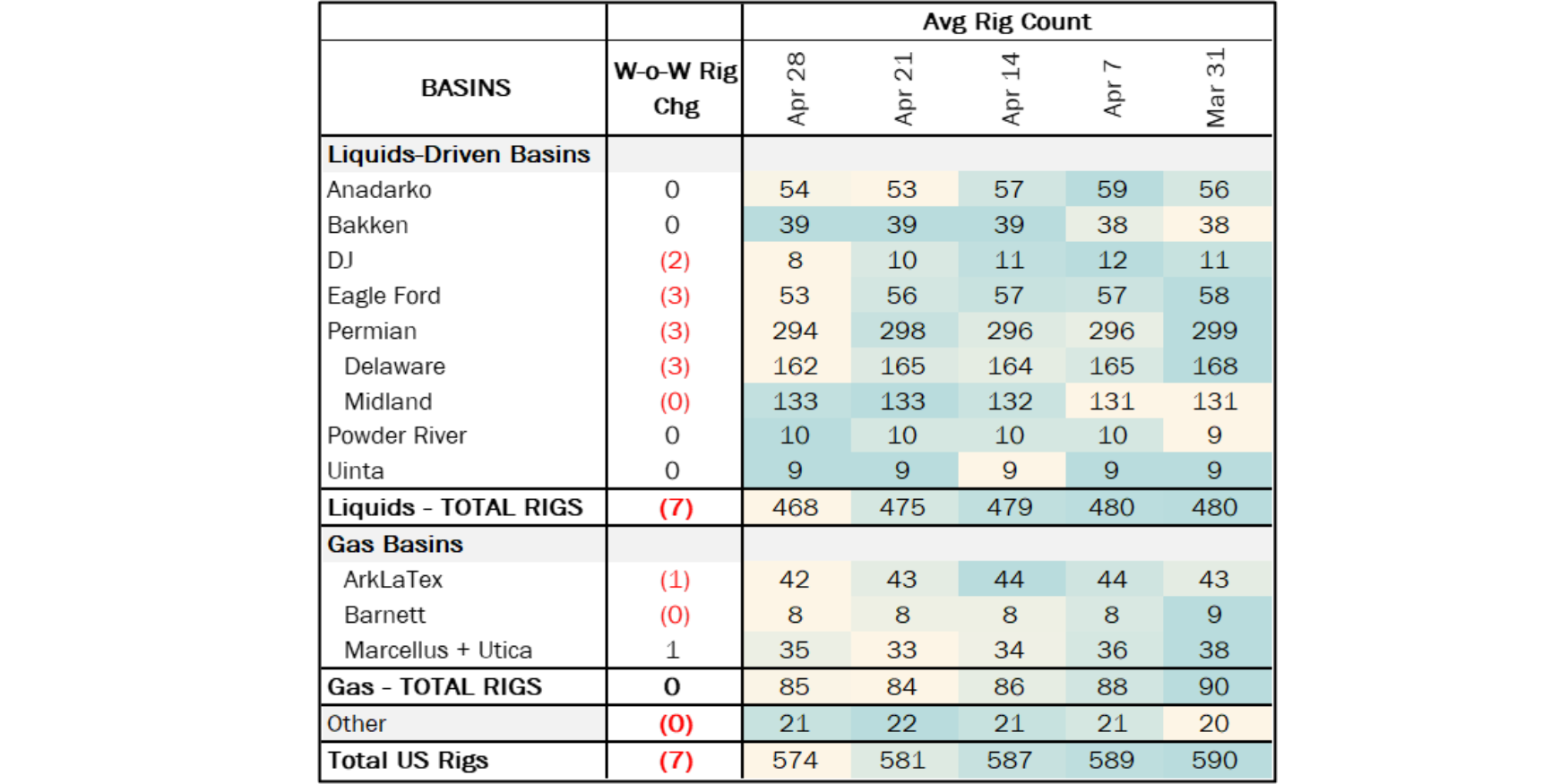

Flows:

The US interstate gas sample dropped 1% W-o-W for the week of May 12. In an unusual appearance to the NGL Insider, the interstate gas sample from the Green River and Gulf of Mexico drove the W-o-W decline. Specifically, volumes on Kern River in the Green River are down 656 MMcf/d, and volumes on Transcontinental Gas Pipe Line (Transco) in the Gulf of Mexico have declined 351 MMcf/d W-o-W. We are investigating the drop in volumes on Kern River in the Green River.

For Transco, the decline in volumes is related to planned maintenance at Williams’ (WMB) Mobile Bay processing plant on the Transco Mobile Lateral from May 1 to May 21. The plant is not available to process gas for that time period. The gas sample fluctuations across all other gas and liquids-targeted basins was flat W-o-W.

Infrastructure:

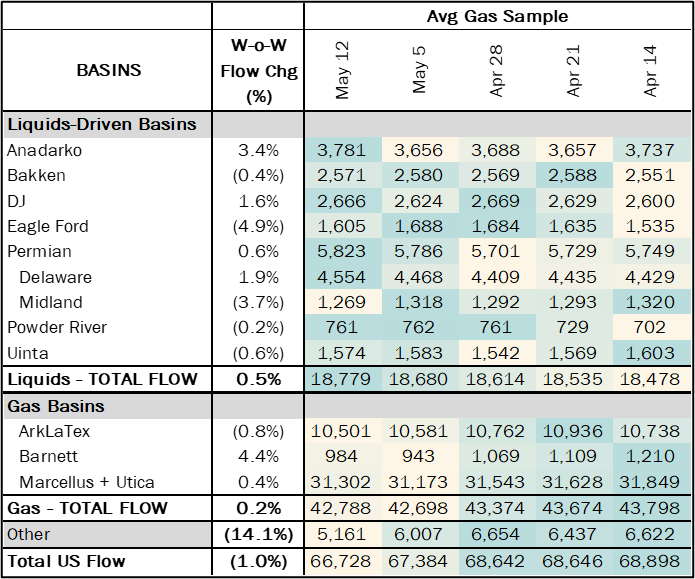

Global demand for plastics continues to rapidly change US ethane markets in a way that is not reflected in the forward price curve. Most ethane demand growth will come from new ethylene steam-crackers like the INEOS and Sinopec facility in Tianjin, China, the Project One INEOS cracker in Antwerp, and Q-Chem in Qatar, to name a few.

Ethylene crackers produce the building block for plastics using ethane or petroleum-based naphtha. Many new crackers are built to use ethane because it’s often the cheaper of the two feedstocks.

Reliance Industries regularly notes the economic benefits of its light-feed crackers given lower ethane prices vs naphtha. Reliance is a committed counterparty with Enterprise Products (EPD) for ethane shipments from its Morgan’s Point terminal on the Texas Gulf Coast.

Likewise, INEOS is a contracted buyer of ethane from EPD’s Morgan’s Point and Energy Transfer’s (ET) Marcus Hook ethane export dock near Philadelphia, PA.

Global investment in ethylene steam crackers has set the table for growth through both docks. EPD recently announced 450 Mb/d of total ethane commitments for existing and new facilities, implying growth of 270 Mb/d in ethane exports at the company’s new Neches River dock. Located north of Morgan’s Point, Neches River will enter service in two phases in 2H25 and 1H26. The 165 Mb/d of PADD 3 ethane exports that EDA forecasts from 2023-26 (see figure above) will be discussed more in the NGL 2Q24 webinar on May 22.

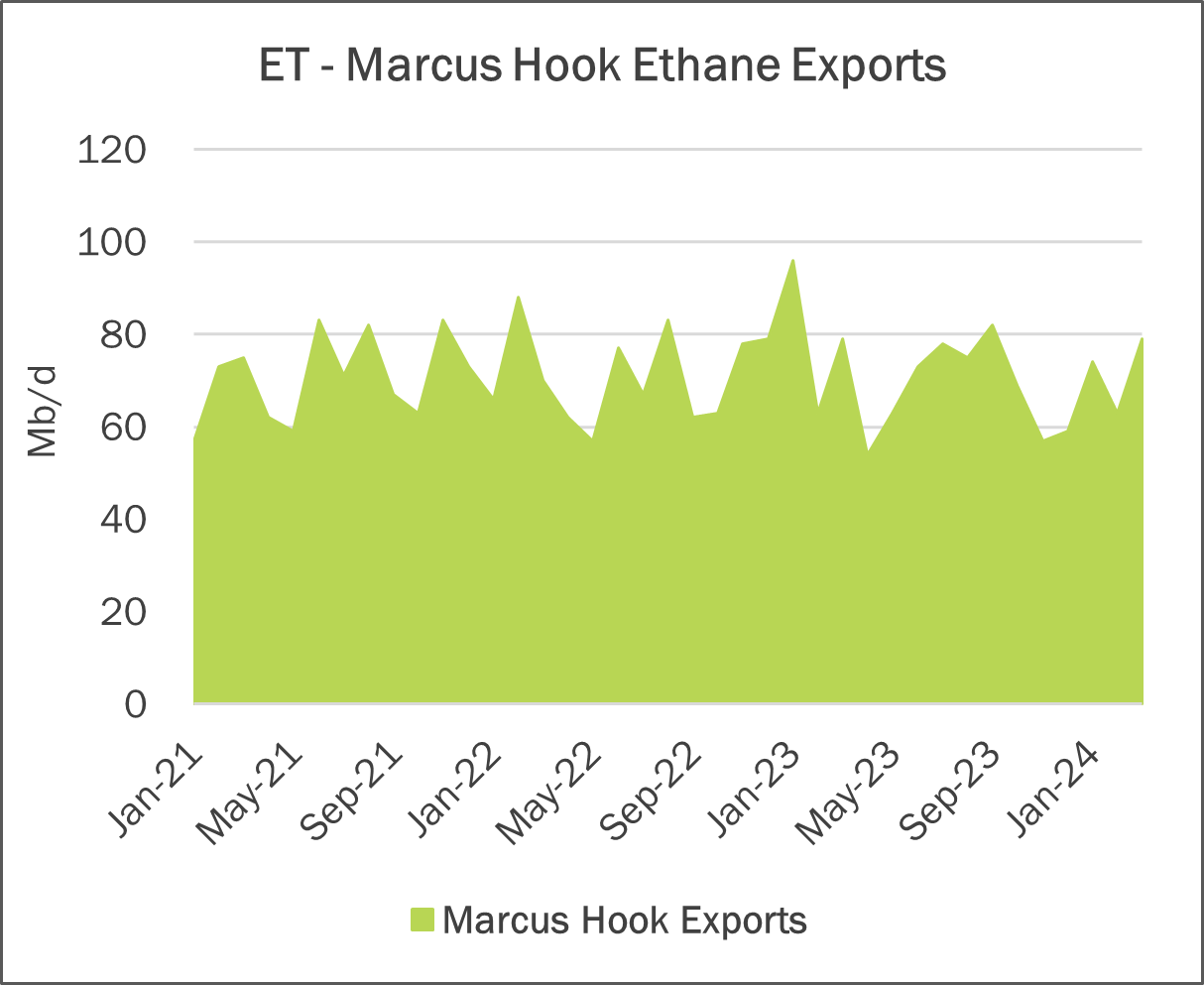

ET is also in discussions to expand refrigeration, storage and export capacity at its Marcus Hook facility. The ET pipeline that takes Marcellus and Utica NGL production to Marcus Hook has 250 Mb/d of capacity, but exports have averaged much less over the past year (about 70 Mb/d) due to refrigeration and storage constraints. An expansion project would only up the ante for US producers and midstream companies to supply enough ethane growth to keep the market in balance.

Based on EDA’s Ethane Supply and Demand Outlook, the US will be short supply by 2026. There are a few levers that could mitigate price risk to the upside, including more ethane extraction and storage, as we do not believe the forward curve is accounting for all the ethane demand from abroad.

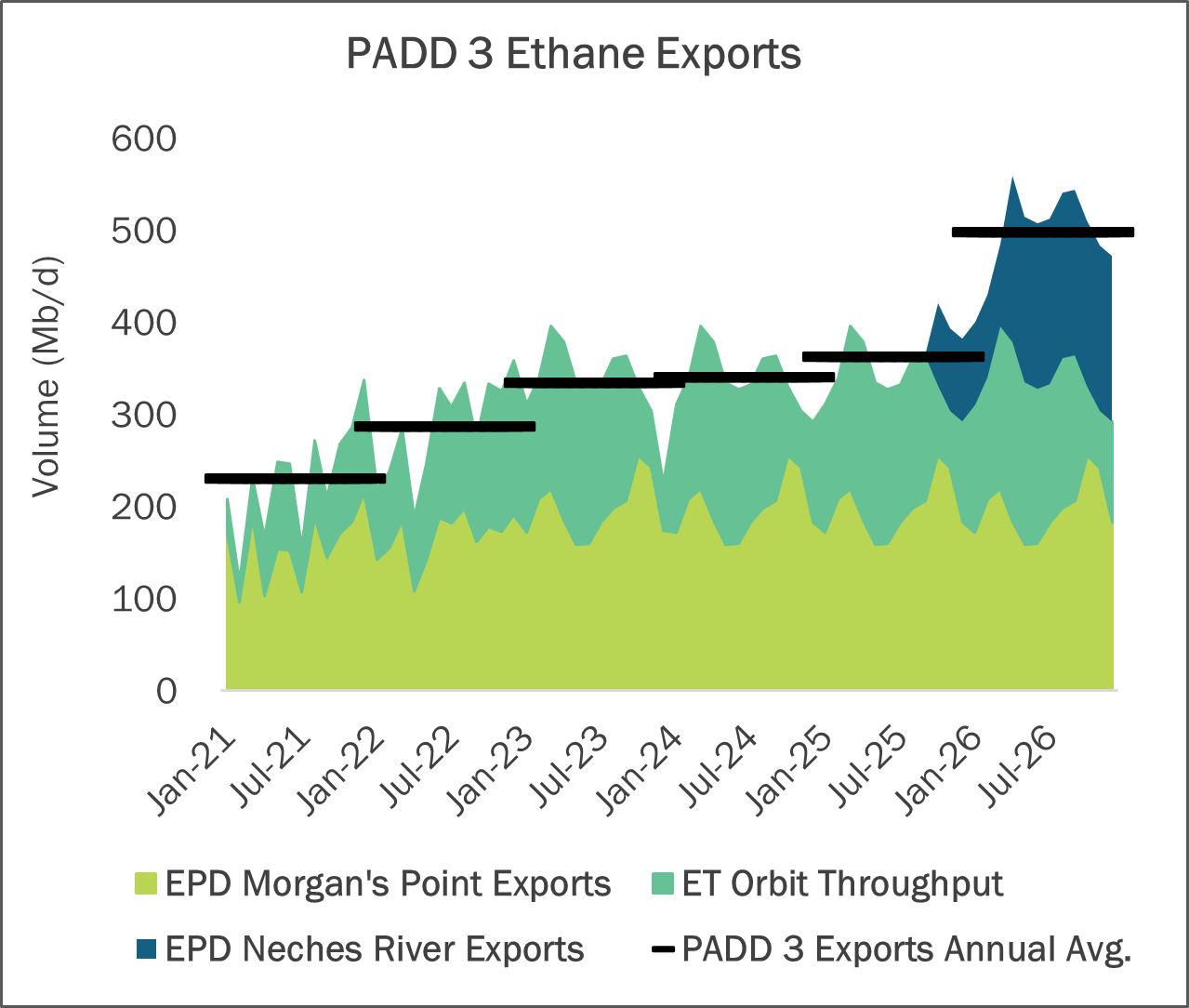

Purity Product Spotlight:

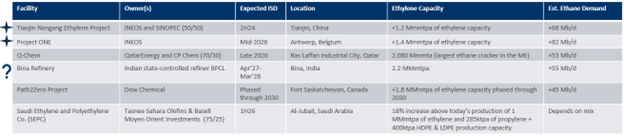

In EDA’s upcoming NGL 2Q24 webinar on May 22, we discuss the ethane supply and demand outlook, including several known ethylene crackers driving the need for ethane supply growth (see table below).

The two starred projects below are likely supporting the Neches River expansion dock that Enterprise Products is developing. The source of ethane for the Bina refinery in India is in quesiton. For the Dow Chemical Path2Zero project, Pembina (PBA) noted it had secured a 50 Mb/d long-term agreement to supply the Path2Zero steam cracker in Fort Saskatchewan. Pembina owns the Vantage ethane pipeline that exports US ethane to Alberta. It’s currently unknown where the ethane growth will be sourced, but PBA has its analyst day presentation today (May 16) and may divulge more details about that commitment.