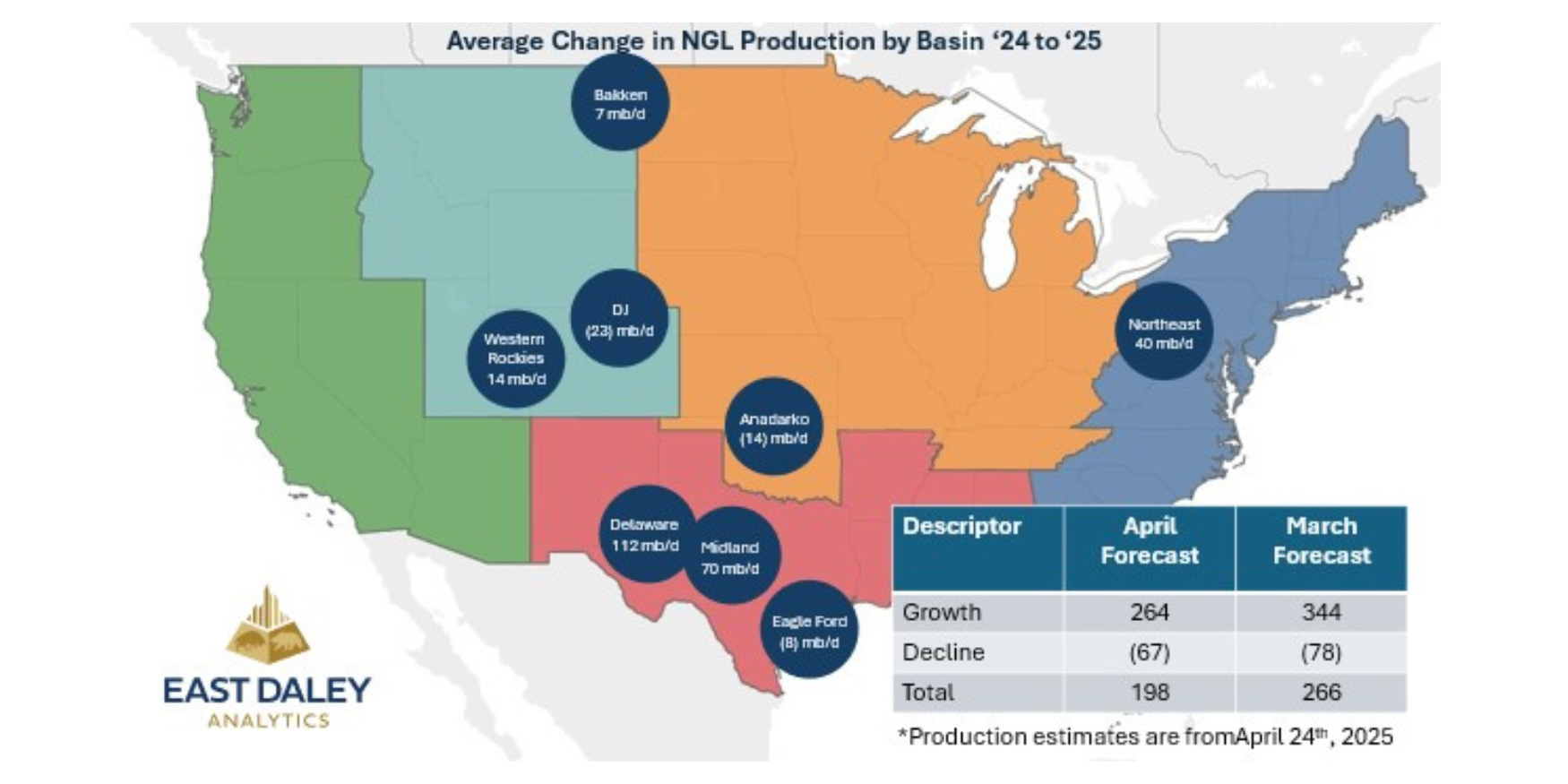

Executive Summary: Rigs: The total US rig count increased by 2 rigs W-o-W, up to 582 for the April 21 week from 580. Flows: The US interstate gas sample declined by 1.2 Bcf/d (2%) W-o-W for the week of May 5, continuing a trend of declining supply in reaction to low natural gas prices this spring. Infrastructure: Enterprise Products (EPD) has thrown a wrench into NGL markets. Purity Product: NGL prices have taken a beating over the past month.

Rigs:

The total US rig count increased by 2 rigs W-o-W, up to 582 for the April 21 week from 580. Liquids-driven basins increased by 1 rig W-o-W to a total of 476. The Permian and Uinta basins each added 1 rig, with the Permian’s add coming from the Midland. The DJ decreased by 1 rig W-o-W down to 8.

DJ operator Civitas Resources removed a rig, leaving 1 rig remaining. Permian Resources in the Midland and Rose Petroleum each added 1 rig W-o-W.

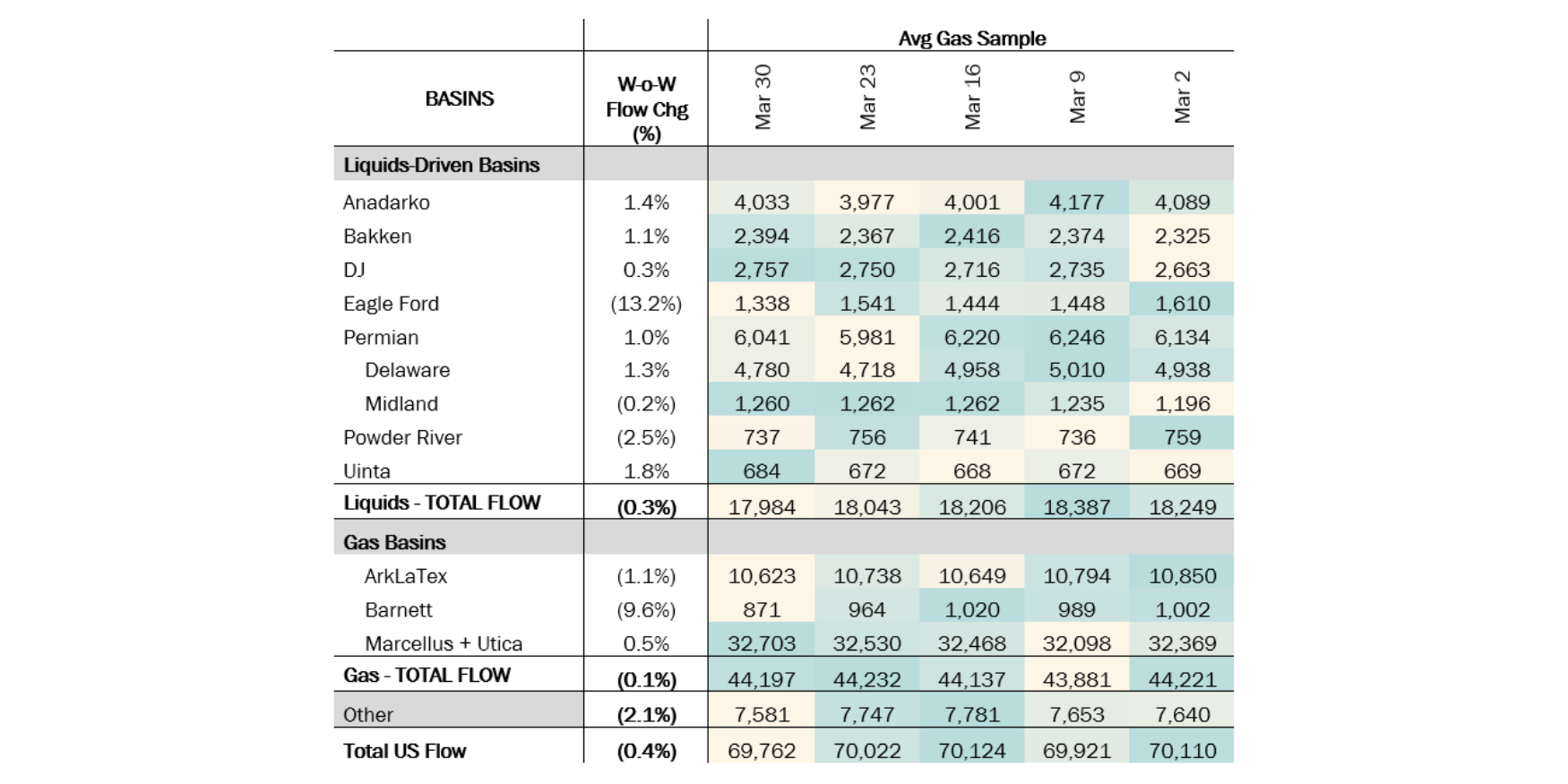

Flows:

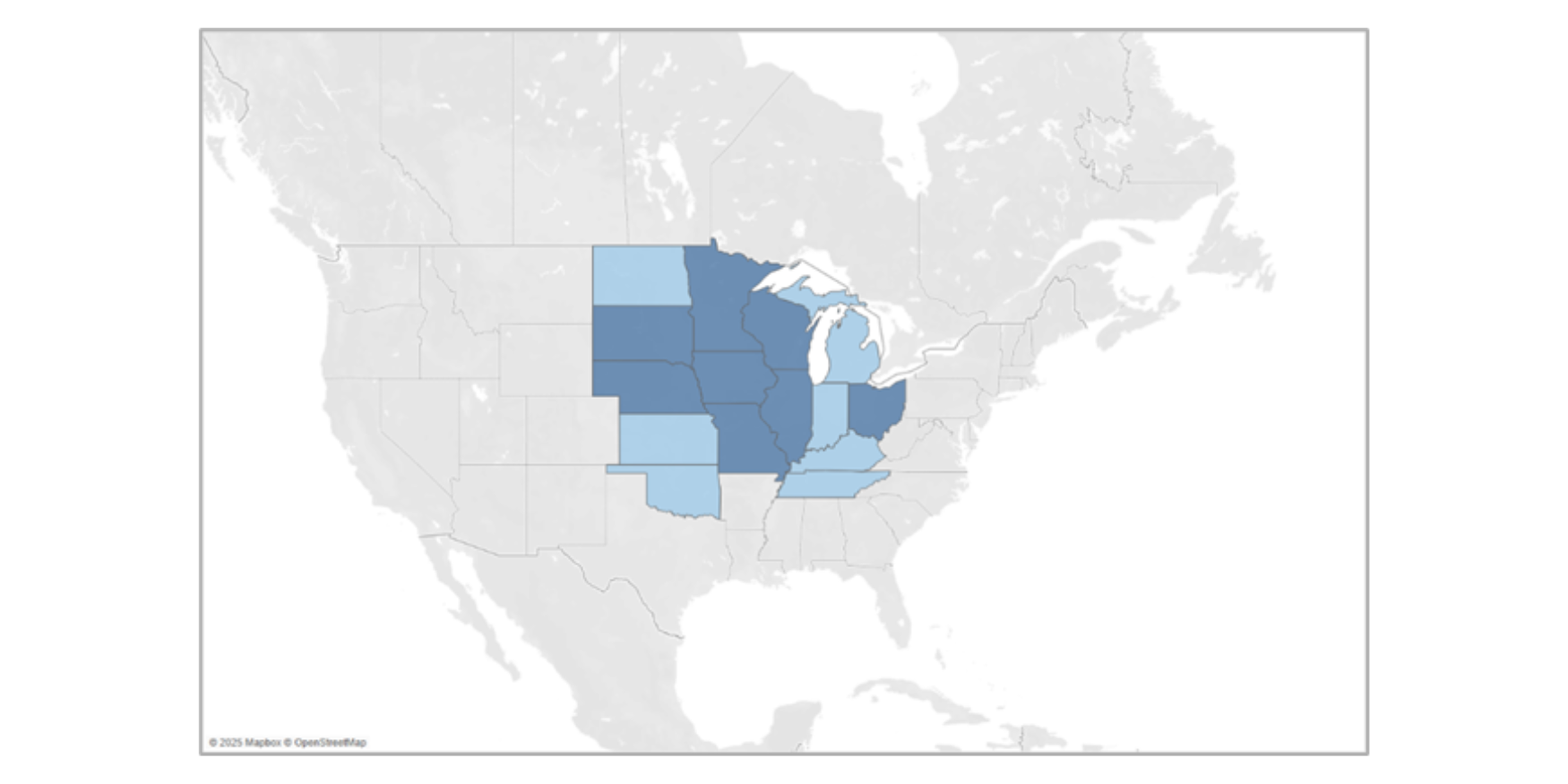

The US interstate gas sample declined by 1.2 Bcf/d (2%) W-o-W for the week of May 5, continuing a trend of declining supply in reaction to low natural gas prices this spring.

The Haynesville (ArkLaTex) and the Northeast (Marcellus+Utica) saw the largest W-o-W decreases, down 180 MMcf/d (-1.7%) and 370 MMcf/d (-1.2%). The decline in the Haynesville sample since March has been steeper than East Daley had expected after producers guided to deferred production earlier this year.

Samples in liquids-targeted basins were relatively flat W-o-W. The Permian Basin sample rose by 1.5%, suggesting some production may have recovered from recent pipeline maintenance in the basin. Waha gas has frequently traded below zero this spring as production growth has collided with shipping restrictions during maintenance events. There likely has been some rerouting of flows between interstate and intrastate pipelines as capacity constraints continue on some egress pipes. The restrictions should keep Waha trading at a steep discount until the new Matterhorn pipeline begins taking linefill.

Infrastructure:

Enterprise Products (EPD) has thrown a wrench into NGL markets. The company recently announced 450 Mb/d of ethane export commitments, scrambling the outlook in two ways.

First, the whopping 450 Mb/d of commitments imply that EPD’s new Neches River NGL export facility needs to be used exclusively for ethane, leaving overall LPG export capacity very tight.

East Daley tracks LPG exports in the NGL Hub Model and the new Ethane Supply and Demand Report. EPD is planning the Neches River project in two phases. Phase I includes a 120 Mb/d ethane refrigeration train, while Phase II is a flex facility that can export ethane (+180 Mb/d) or propane (+360 Mb/d).

EPD currently exports about 200 Mb/d from its Morgan’s Point facility on the Houston Ship Channel (see figure below). Morgan’s Point can export up to 240 Mb/d of ethane; the facility was underwritten with up to 180 Mb/d of commitments with India conglomerate Reliance as an anchor shipper when it went into service in September 2016.

Unless the contracts at Morgan’s Point roll off (possible, but not probable in our view, based on Reliance’s desire to have access to cheap ethane feedstock), the additional 270 Mb/d of commitments (450 Mb/d minus 180 Mb/d) would require the entire capacity at Neches River. This means the only LPG expansions in sight are 120 Mb/d from EPD (estimated ISD 1H25) and 250 Mb/d from Energy Transfer (estimated ISD mid-’25). This scenario would leave LPG export capacity (propane and butane) very tight.

The Enterprise announcement is important in another way. The 450 Mb/d of commitments introduces visibility into future international demand. As a result, East Daley is revising our outlook of the ethane supply and demand imbalance in 2026, which we will cover in more detail next week. To learn more, check out the new Ethane Supply and Demand Report and Data Set.

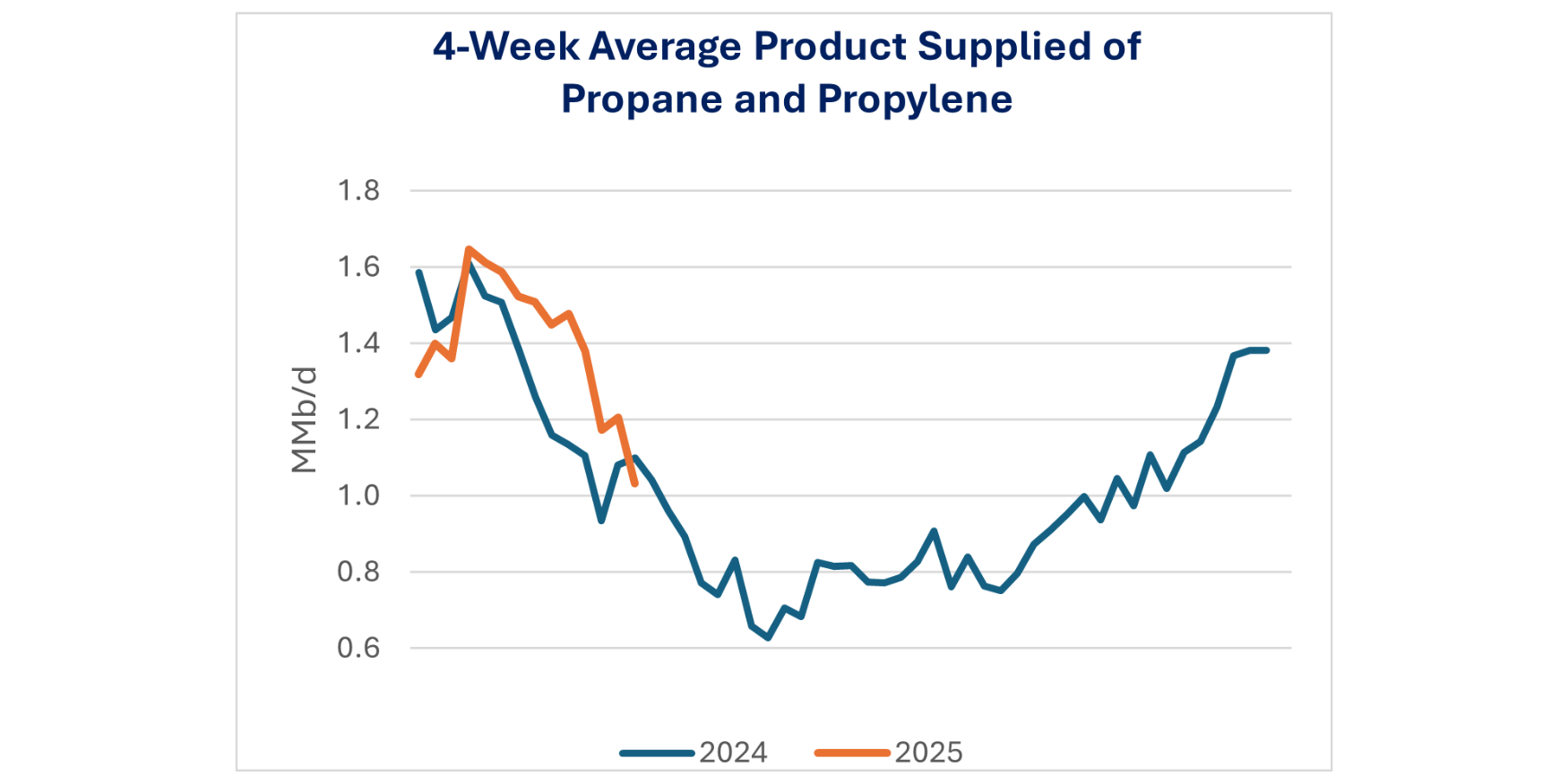

Purity Product Spotlight:

NGL prices have taken a beating over the past month. The weighted-average NGL barrel is down by 14% since early April. The biggest laggards include propane, lower by almost 20%, and Conway ethane is down 22%. The biggest downward movement is on normal butane, lower by 36% since April 4 (see figure below).

Soft international demand could be partly to blame for lower prices as we head into refinery maintenance season. There is relative seasonal strength in isobutane prices as refiners move from winter to summer blending specs, but that does not explain the entire Iso-Normal butane spread.

-1.png)