Executive Summary: Rigs: The total rig count decreased by 4 for the September 8 week, down to 561 from 565. Flows: Constraints at the Waha hub persist, while operators eagerly await the startup of Matterhorn Express Pipeline. Infrastructure: East Daley believes ethane storage builds will lower ethane prices (vs the current forward curve as shown in the blue squares in the graph), incentivizing more ethane rejection at the end of 2024 and into 2025. Purity Product Spotlight: The EIA reported record ethane production in March, April and May ’24 before settling lower at 2,862 Mb/d in June.

Rigs: The total rig count decreased by 4 for the September 8 week, down to 561 from 565. Liquids-driven basins declined by 5 rigs.

- Midland (-4): Exxon and Vital down (2) each.

- Delaware (+3): Vital (+2) and Sundown Energy (+1)

- Bakken (-3): Rockport Energy Solutions, Hunt, Five States.

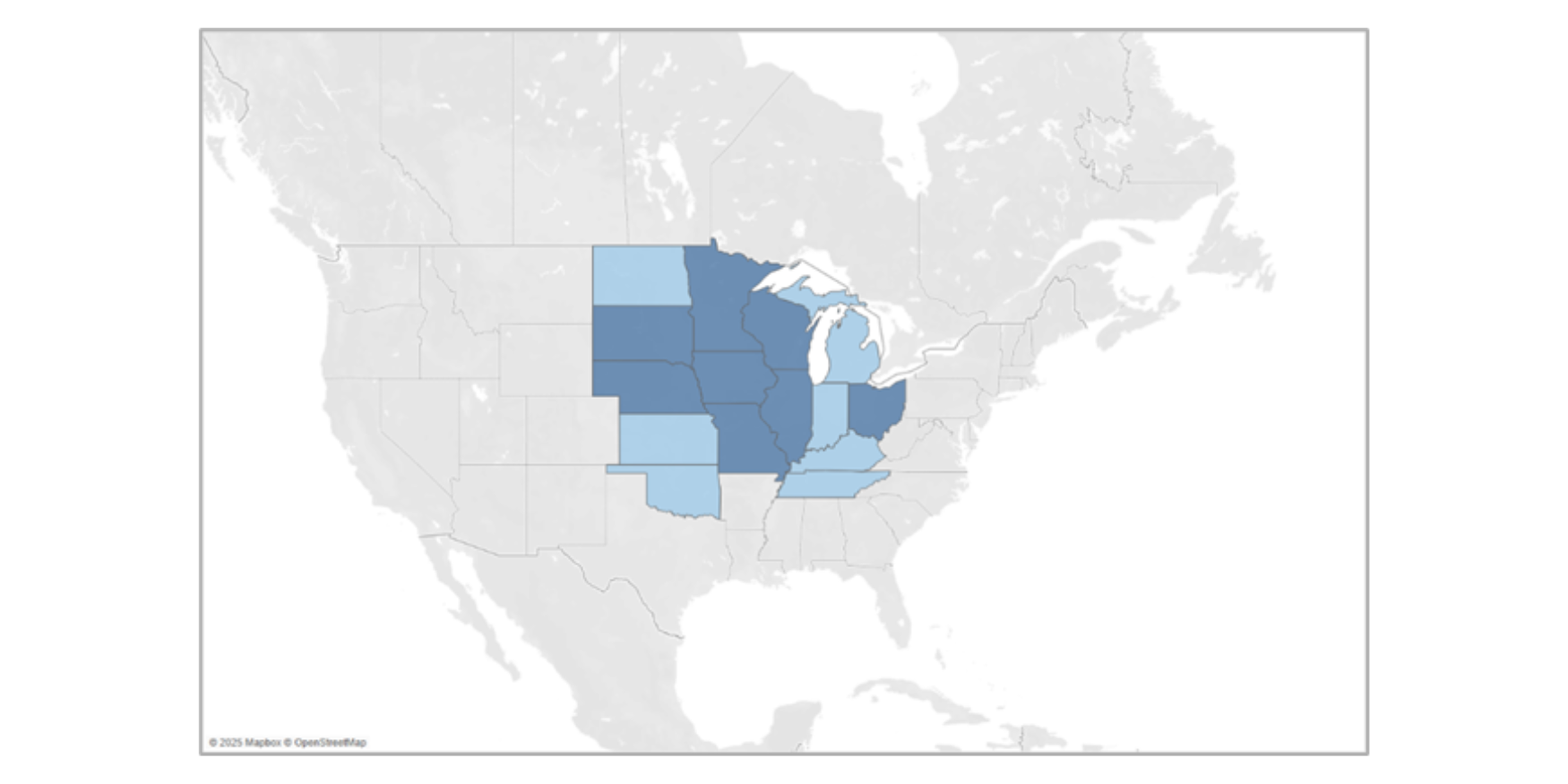

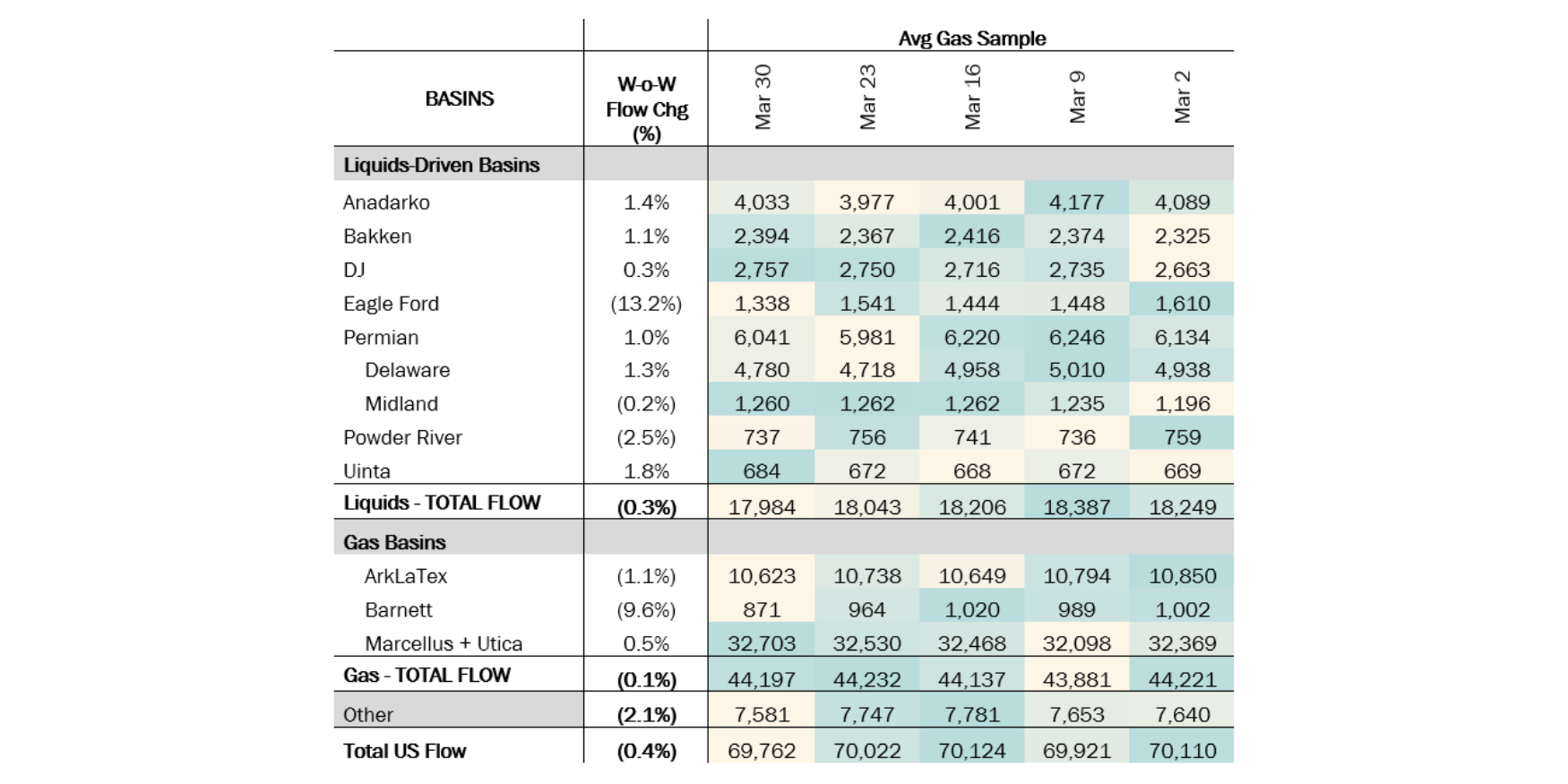

Flows: Constraints at the Waha hub persist, while operators eagerly await the startup of Matterhorn Express Pipeline. On its 2Q24 earnings call, EnLink Midstream (ENLC) said they “expect the pipeline to be in service in the month of September". East Daley has not yet seen a clear signal that Matterhorn is in service. Waha prices have strengthened, flow points into the Katy hub have increased, and some northbound pipeline flows have declined; however, these changes are not yet consistent enough or large enough to indicate Matterhorn has started.

Meanwhile, the ArkLaTex Basin remains flat W-o-W. However, on Monday (September 23), Natural Gas Pipeline of America (NGPL) announced that anomalies were found near Compressor Station 302 that require immediate repairs. NGPL has reduced maximum operating capacity eastbound from the station by ~35% of contracted monthly quantities.

*W-o-W change is for the two most recent weeks.

NGPL flows into Louisiana fell by 300 MMcf/d on Tuesday (September 24). The total capacity east through Station 302 is ~1.2 Bcf/d, while scheduled quantities were ~1.13 Bcf/d. Therefore, we expect ~400 MMcf/d of capacity to remain offline until further notice. NGPL has been conducting ongoing maintenance on the line for most of the summer and full capacity has only been available for about two weeks in early August.

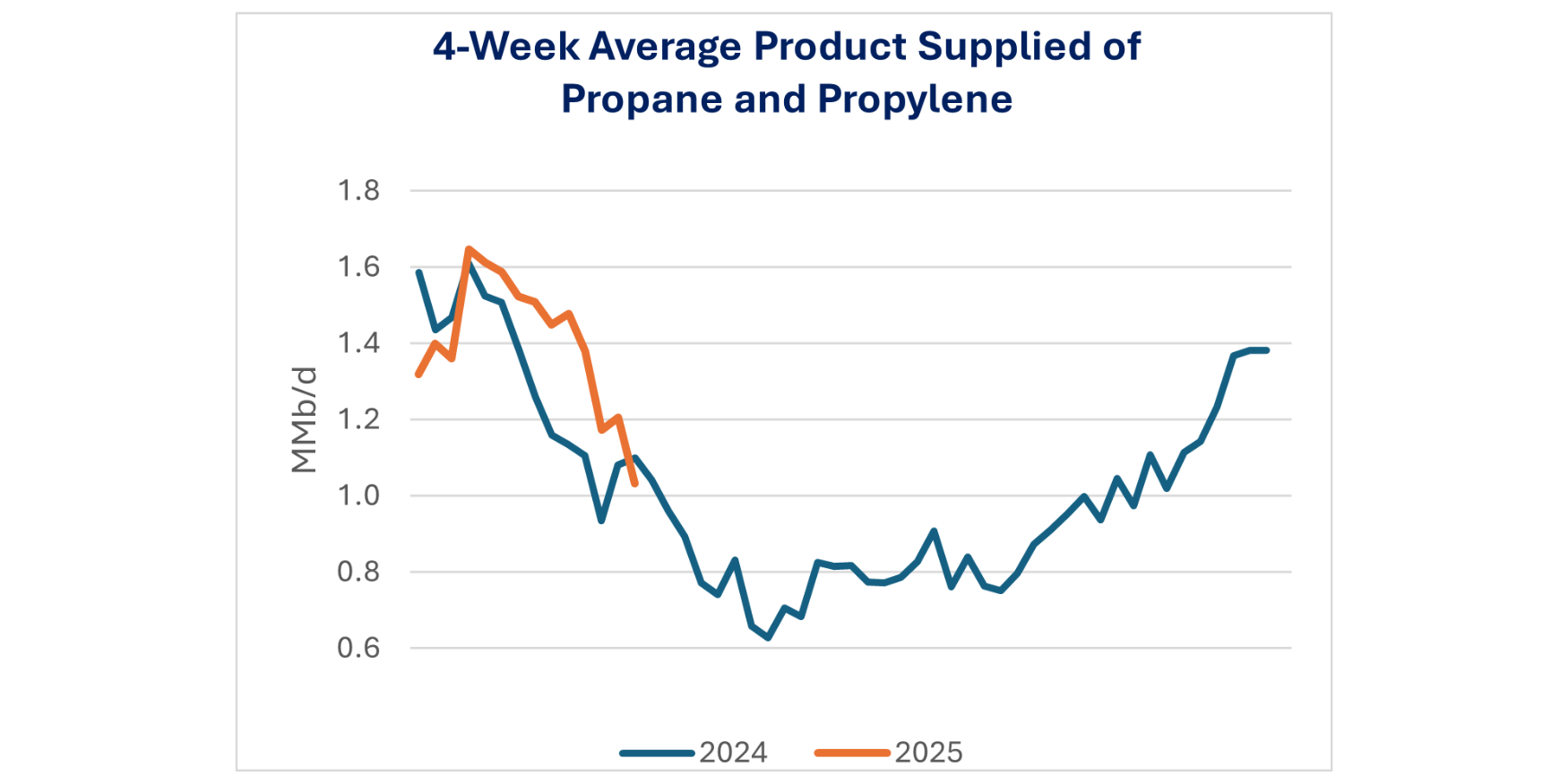

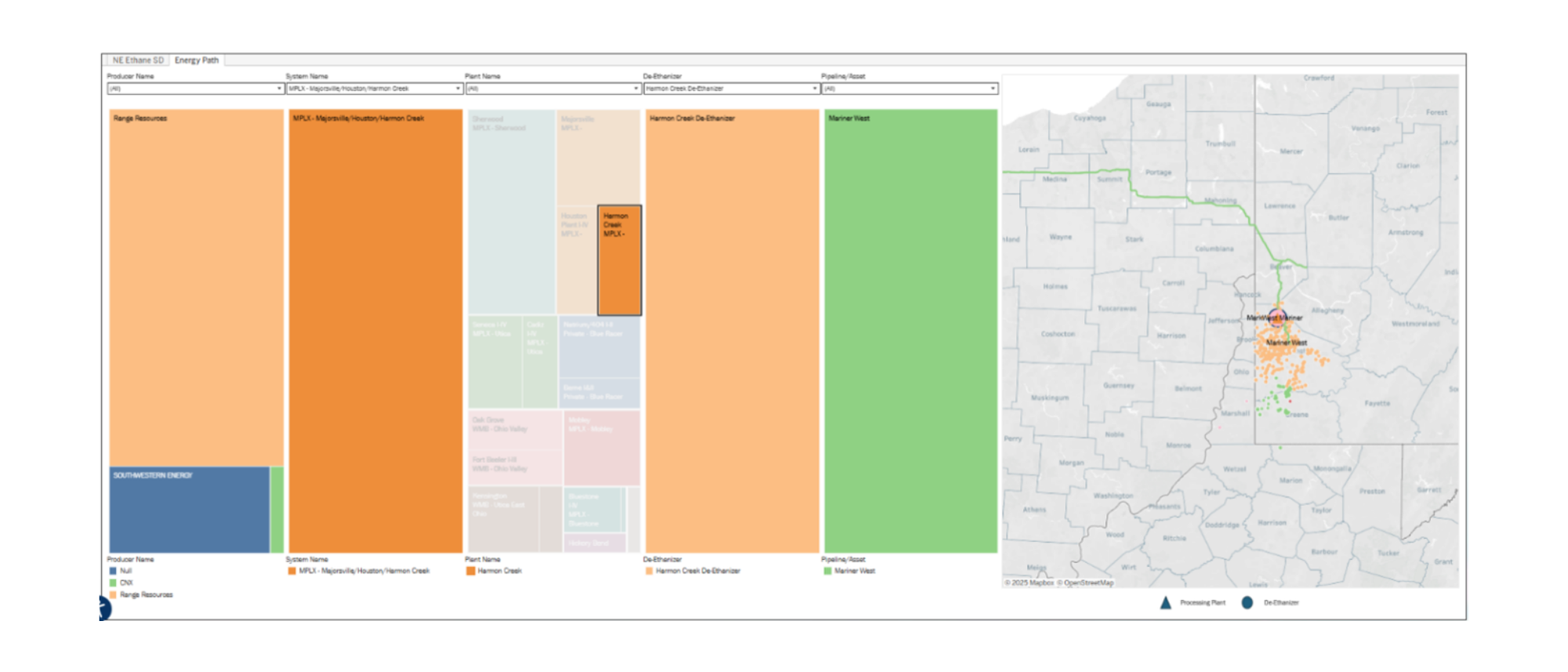

Infrastructure: East Daley believes ethane storage builds will lower ethane prices (vs the current forward curve as shown in the blue squares in the graph), incentivizing more ethane rejection at the end of 2024 and into 2025. The next meaningful capacity expansions on the demand side do not occur until late ‘25.

- The CP Chem / Qatar Golden Triangle Polymers plant in Orange County, TX has an assumed in-service date (ISD) of July ’26, with ethane demand ramping up to 120 Mb/d in mid-2027.

- The Enterprise Products (EPD) Neches River export facility can export up to 180 Mb/d with an assumed ISD in October ’25.

- We estimate the Energy Transfer (ET) Marcus Hook expansion totals 25 Mb/d from increased refrigeration capacity with an assumed ISD of July ’25. The details around this project have been sparse, so there is risk of a delay.

- The ShinTech (subsidiary of Japan’s Shin-Etsu Chemical) ethylene cracker project in Plaquemines, LA will consume about 30 Mb/d of ethane demand and has a tentative ISD of December ’27.

Purity Product Spotlight: The EIA reported record ethane production in March, April and May ’24 before settling lower at 2,862 Mb/d in June. We expect ethane supply to increase slightly from June to July ’24 based on plant data. We forecast a decline in ethane recovery in 4Q24 as more is rejected into the gas stream, coincident with Matterhorn pipeline becoming operational. It’s unclear why we are bullish supply vs the EIA; although high ethane production trends are expected to persist along with Permian production growth, even as some marginal ethane is rejected into new gas pipeline capacity in the Permian Basin.