Executive Summary: Rigs: The total rig count decreased by 9 for the June 23 week, down to 554 from 563. Flows: The US interstate gas sample is up ~0.5% W-o-W for the week of July 7. Infrastructure: The Energy Information Administration (EIA) reported record NGL production of 6,832 Mb/d in March 2024, topping the prior record set in October ’23. Purity Product Spotlight: The Houston Port Bureau reported closure of the Houston Ship Channel this week due to Hurricane Beryl hitting the Gulf Coast Sunday.

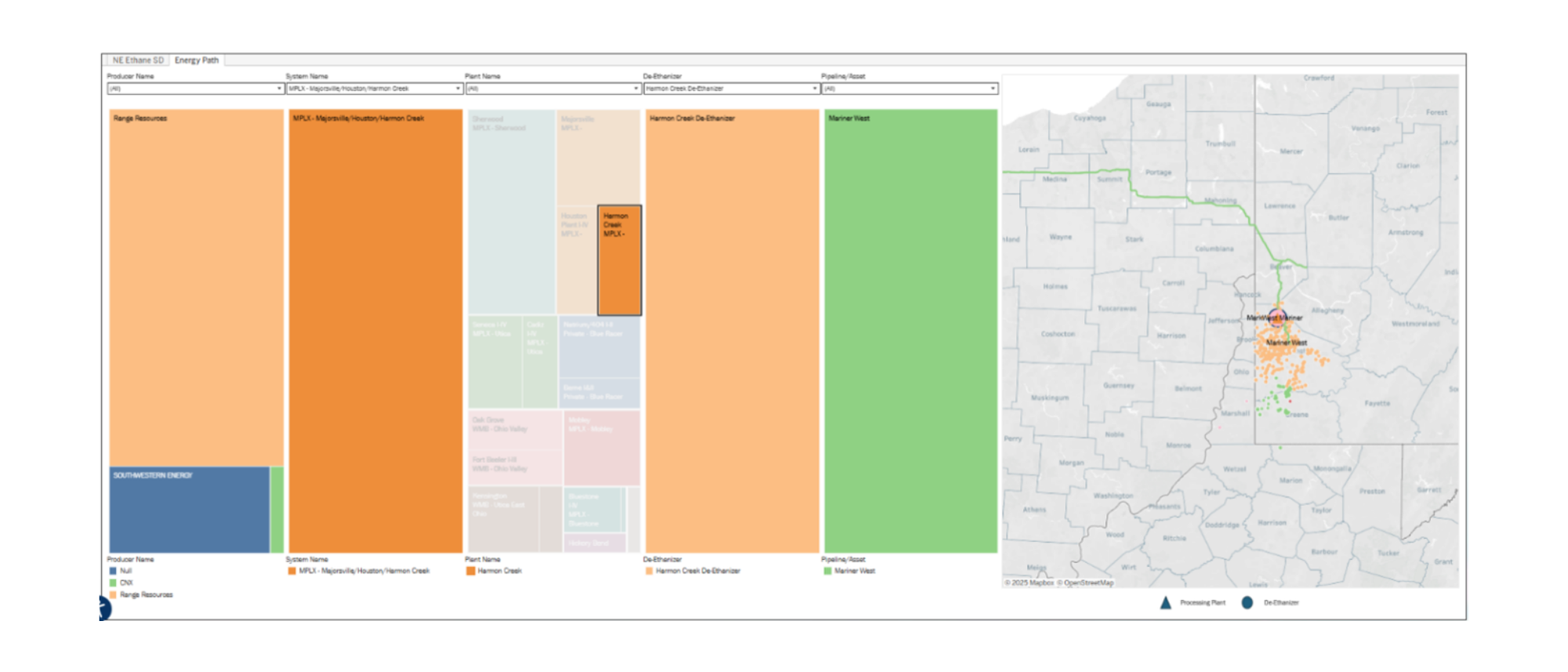

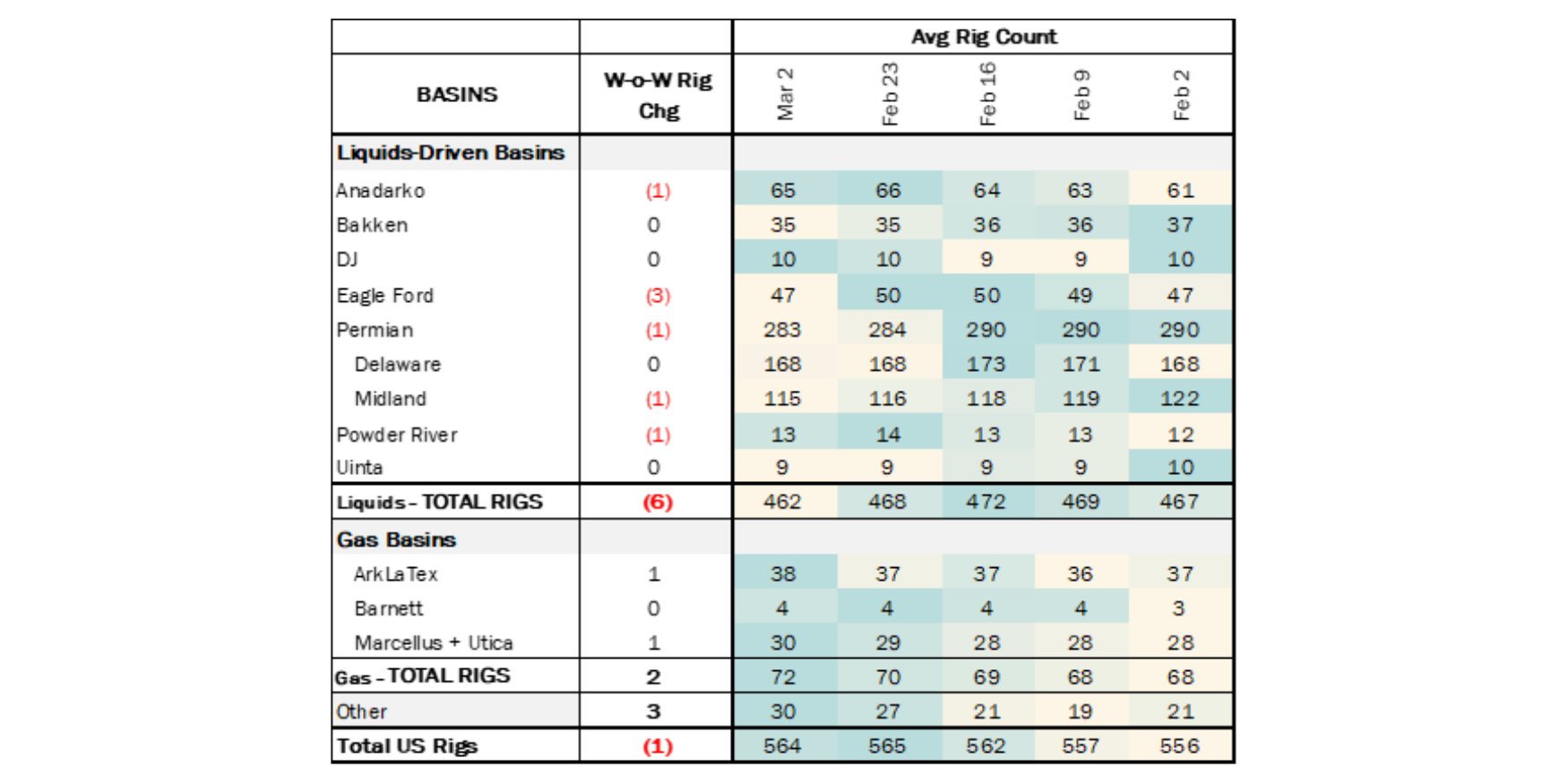

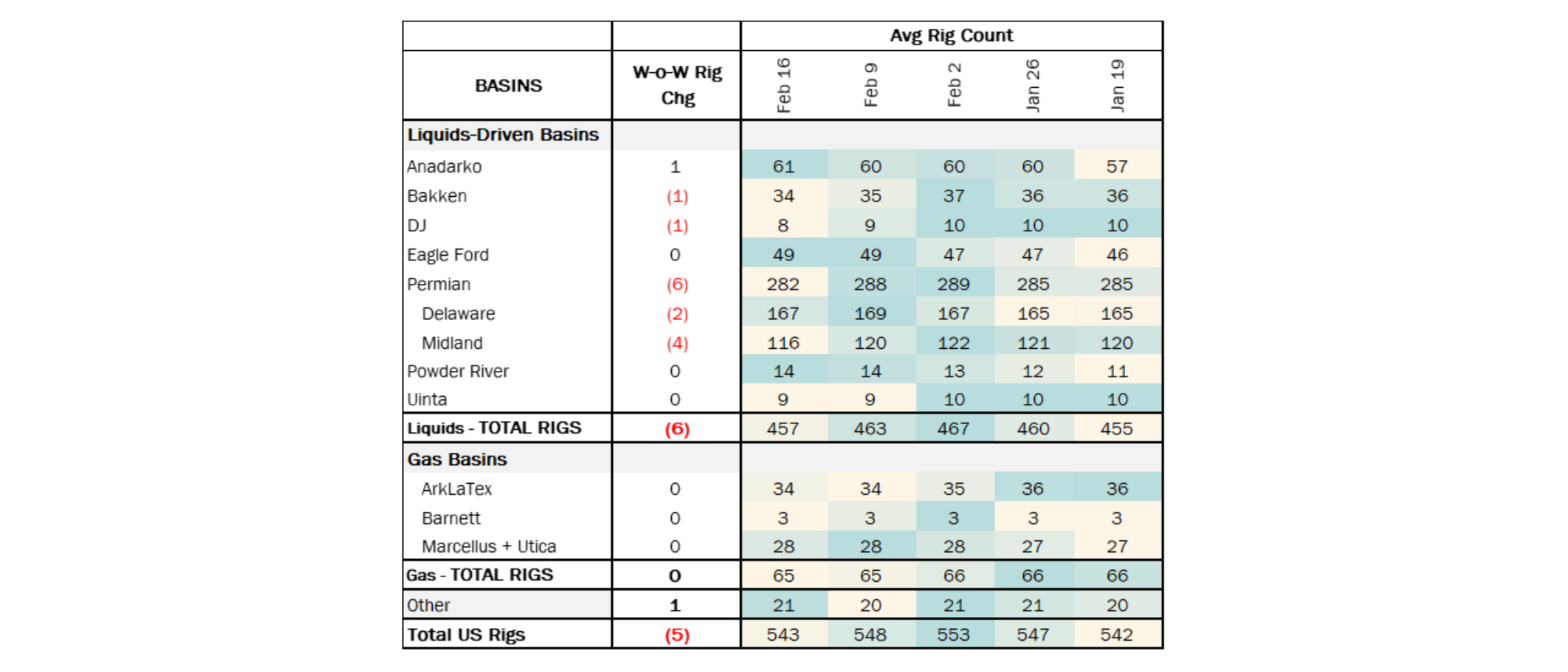

Rigs: The total rig count decreased by 9 for the June 23 week, down to 554 from 563. Liquids-driven basins saw a large decrease, falling by 11 rigs W-o-W and bringing the total count to 445 from 456. In the Anadarko, 2 rigs were removed from the basin. The Eagle Ford also saw a decrease of 2 rigs, while the Permian dropped 7 rigs W-o-W.

In the Anadarko Basin, operators Shakespear Oil and Raymond Oil each laid down 1 rig. In the Eagle Ford, Marathon Oil (MRO) and Auterra both decreased their rig counts by 1. In the Midland Basin, operators Occidental Petroleum (OXY) and Mewbourne Oil each dropped 1 rig while ConocoPhillips (COP) removed 2 rigs. Additionally, Endeavor Energy, Chevron (CVX) and Continental Resources also removed 1 rig each in the Midland while the Delaware stayed flat.

Flows: The US interstate gas sample is up ~0.5% W-o-W for the week of July 7. Leading the rise is gas-driven basins with about a 1% flow sample increase (+0.3 Bcf/d). In the Northest (Marcellus+Utica), the flow sample is up again by 1.2% W-o-W, suggesting that production continues to recover from EQT’s curtlailment in May and with the start-up of the Mountain Valley Pipeline. Flow samples in the ArkLaTex (Haynesville) have also been increasing for the past two weeks W-o-W, with wells being turned back on in response to increasing summer demand.

*W-o-W change is for the two most recent weeks

*W-o-W change is for the two most recent weeks

The flow sample in liquid-focused basins is flat W-o-W. In the Bakken, we saw flow sample recovering gradually from capacity constraints on Alliance Pipeline, which were resolved on June 30. Due to Hurricane Beryl hitting Texas last weekend, Permian flow sample dropped 3% W-o-W. Maintenance is also expected to occur on the Northen Natural Gas pipeline in July and August. In the the upcoming weeks, we expect flat flow sample levels in the Permian remain constrained until Matterhorn comes online. Overall, gas sample variation across all other regions was limited W-o-W.

Infrastructure: The Energy Information Administration (EIA) reported record NGL production of 6,832 Mb/d in March 2024, topping the prior record set in October ’23. The record month of NGL production is unique to NGLs – crude oil and natural gas hit peak production in December ’23.

The M-o-M increase of 191 Mb/d was driven by higher ethane recovery, accounting for 151 Mb/d (79%) of the increase in supply. The Anadarko Basin (PADD 2) and Northeast (PADD 1) drove a combined 64 Mb/d of the increase from February to March ’24. The biggest increase though came from the Texas Permian and Eagle Ford (Texas Inland of PADD 3) with 83 Mb/d of supply growth over the same period.

Additional ethane recovery from the Permian is not a surprise – as EDA wrote about in prior Ethane Supply and Demand reports, an extremely tight gas egress market is pummeling Waha gas prices, increasing the fractionation spread to Mont Belvieu (Mont Belvieu – Waha) and driving as much ethane recovery as the plants can extract. However, the amount of ethane recovered surpassed what we initially anticipated and therefore, EDA has revised the forecast upward slightly.

While state data remains incomplete for some midstream companies, West Texas Gas (recently acquired by Energy Transfer (ET)) and Targa Resources (TRGP) own two G&P systems that reported increased NGL production in the Permian from February to March, corroborating what we have seen in EIA Texas Inland data.

Since most of the additional ethane is being recovered in the Permian, owners of NGL pipes out of the basin stand to benefit the most. Permian NGL pipeline utilization will exceed 90% and reach as high as 95%+ in 3Q24, according to EDA’s NGL Hub Model. We expect companies like Enterprise Products (EPD), Phillips 66 (PSX), ET and TRGP will report strong (and in some cases record-high) throughput for the rest of 2024. High ethane recovery and record NGL production will persist until Matterhorn pipeline comes online as early as July and is fully operational by September ’24, per EDA estimates.

Purity Product Spotlight:

The Houston Port Bureau reported closure of the Houston Ship Channel this week due to Hurricane Beryl hitting the Gulf Coast Sunday. Vessel Transit Services (VTS) suffered significant damages, limiting their ability to monitor ship transits and reducing capacity of the channel to move vessels in and out of the market.

These disruptions will inevitably lead to reduced LPG and ethane exports, as well as terminals capacity for the duration of the recovery period. Although the Port of Houston has been most affected, activities at Freeport, Galveston, Sabine and Texas City ports have also been disrupted, leading to significant vessel draft reduction. EDA expects a substantial decrease in LPG exports this week, down to about 40% over the three days of disruption. We also expect propane inventories to continue to rise, putting more pressure on prices at Mont Belvieu.

Data Points & Product Release Calendar: