Executive Summary: Rigs: The US total rig count decreased by 11 rigs for the July 7 week, down to 545 from 556. Flows: The US interstate gas sample is flat W-o-W. Infrastructure: Kinder Morgan’s (KMI) Double H crude pipeline conversion into an NGL pipe will set a new market dynamic in the Bakken and pose a challenge to ONEOK (OKE), the dominant midstream provider for the basin’s NGLs. Purity Product Spotlight: Export activities have not fully recovered as another incident occurred last Friday (July 19) at the Port of Houston, forcing the US Coast Guard to close the Houston Ship Channel.

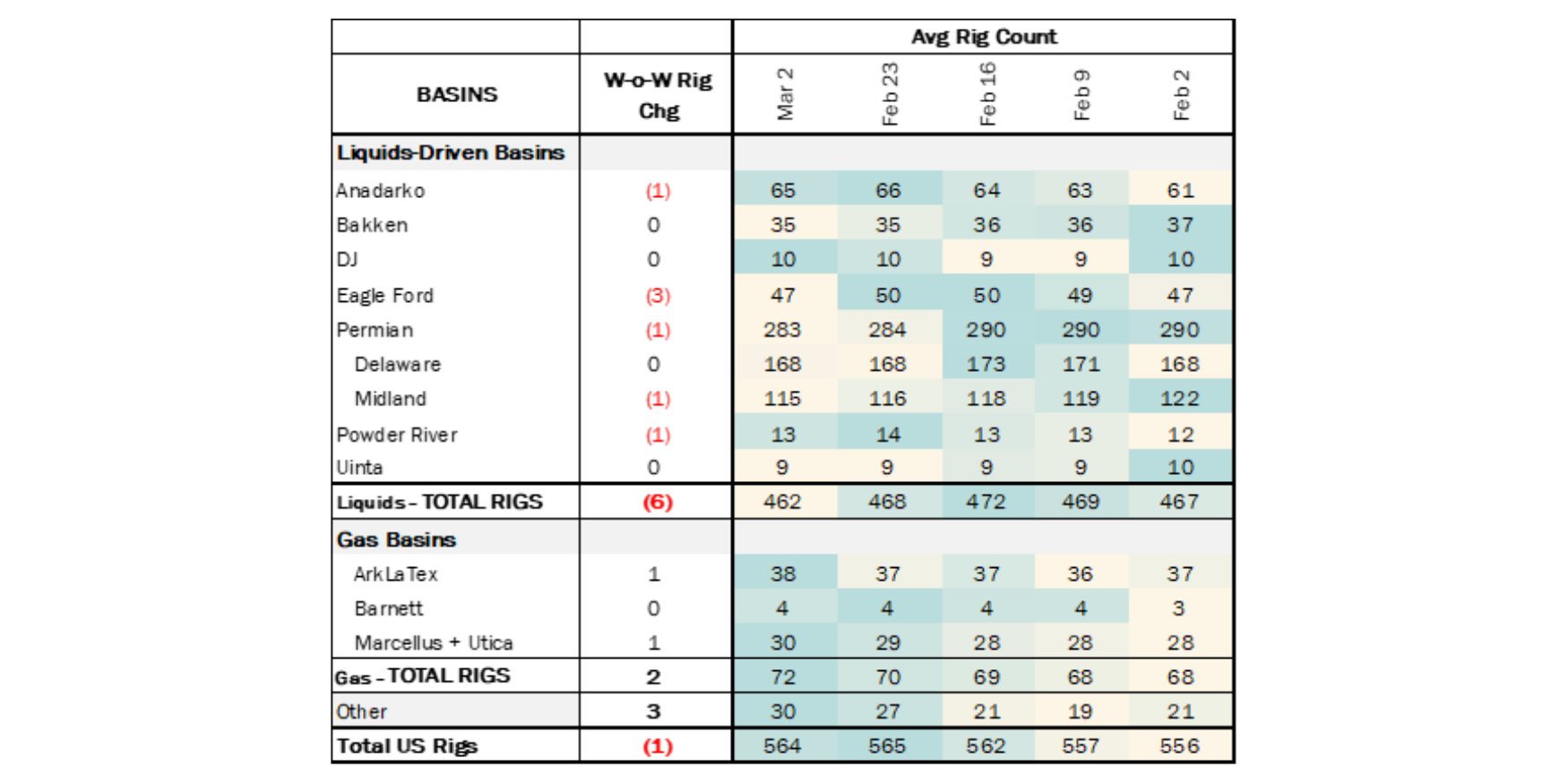

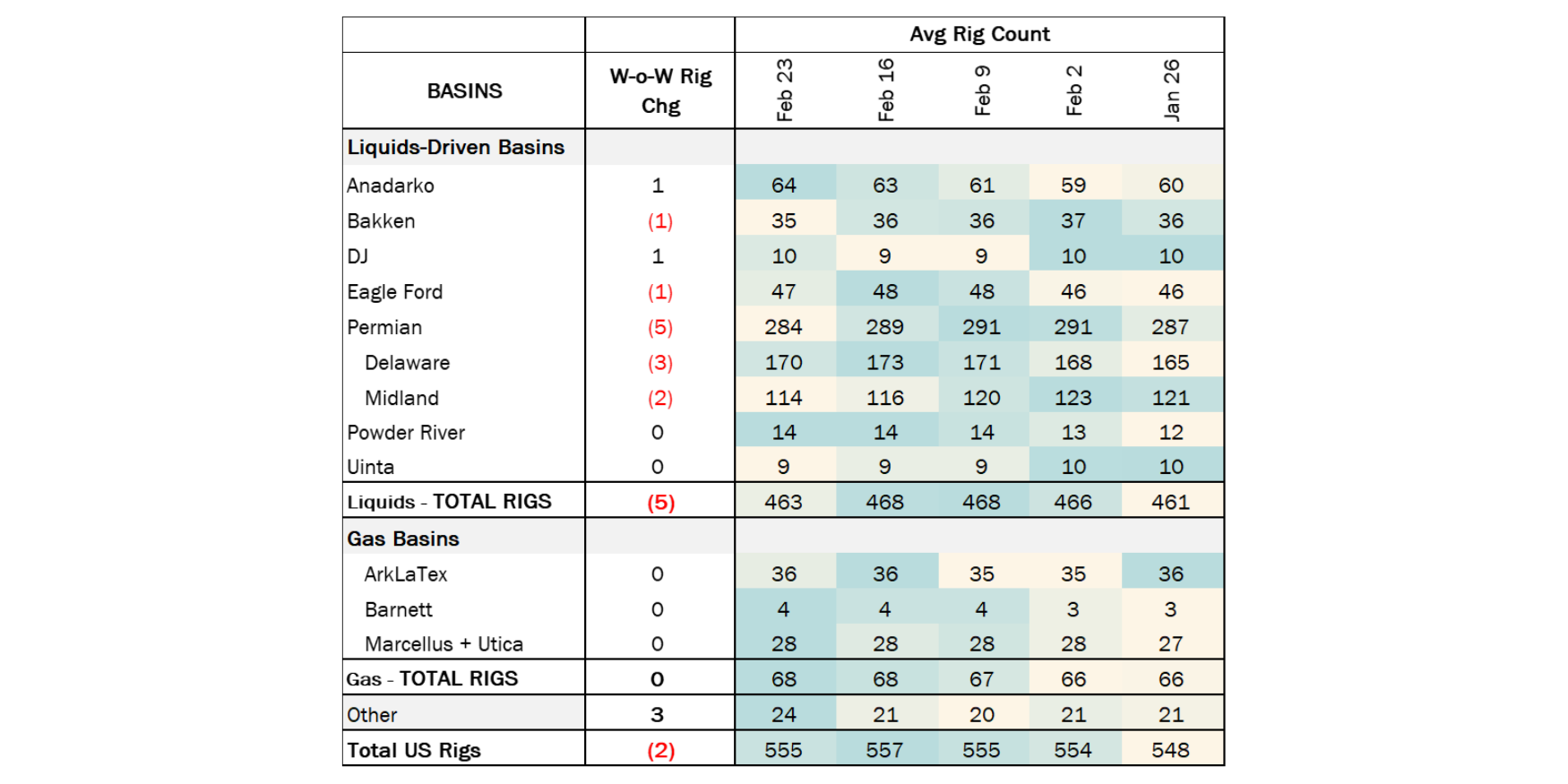

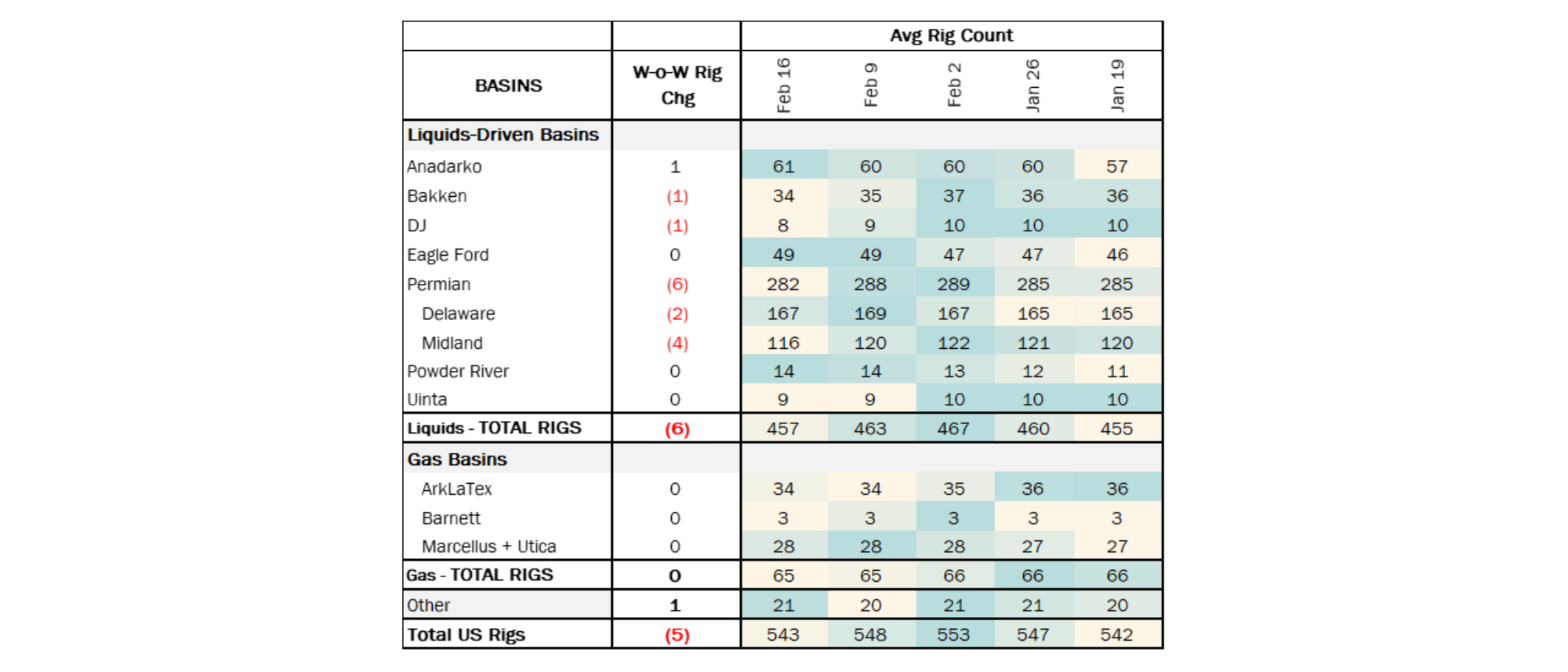

Rigs: The US total rig count decreased by 11 rigs for the July 7 week, down to 545 from 556. Liquids-driven basins saw a decrease of 7 rigs, moving the count from 451 to 444. The Anadarko Basin decreased by 3 rigs, the Bakken decreased by 1 rig, and the Permian Basin decreased by 6 rigs.

In the Anadarko, operators Mack Energy, Palomino Petroleum, and Courson Oil & Gas each removed 1 rig. In the Bakken, Chord Energy also removed 1 rig. In the Delaware, operator EOG Resources (EOG) decreased its rig count by 2, whereas Matador Resources (MTDR) and Mewbourne Oil both removed 1 rig. In the Midland Basin, ExxonMobil (XOM) and Birch Operations each removed 1 rig.

Flows: The US interstate gas sample is flat W-o-W. In liquid-driven basins, the Bakken sample declined 5% W-o-W due to ungoing outages on Alliance Pipeline, affecting delivery to the Midwest. The Eagle Ford sample is also down because of maintenance on the Transcontinental system, but volumes are expected to return to normal by the end of the month. In gas-focused basins, the gas sample is flat.

Infrastructure: Kinder Morgan’s (KMI) Double H crude pipeline conversion into an NGL pipe will set a new market dynamic in the Bakken and pose a challenge to ONEOK (OKE), the dominant midstream provider for the basin’s NGLs. The pipeline runs 462 miles from Dore in North Dakota to the Guernsey market in Wyoming and is adjacent to OKE’s Bakken/Elk Creek pipelines.

Upon conversion, we expect the battle to retain the barrel will be fierce as producers such as Devon (DVN), Chevron (CVX), Conoco (COP) and Continental Resources benefit from a new egress route for their NGLs. However, most G&P systems in the vicinity of the pipe in the Williston Basin are owned by OKE. This limits potential supply sources for Double H, especially since there is no petchem or fractionator demand in Guernsey.

ONEOK controls about 46% (~1.6 Bcf/d) of the 3.6 Bcf/d of gas processing capacity in the basin, accoridng to EDA’s Bakken Supply and Demand Forecast. OKE’s assets feed NGLs directly into its Bakken Line and Elk Creek pipes.

Kinder Morgan has several options to take market share. KMI owns 10% (~355 MMcf/d) of G&P capacity in th Bakken, which we expect to feed NGLs to Double H. Hess Midstream (HESS), Energy Transfer (ET), MPLX and Targa (TRGP) combine for 1.34 Bcf/d of processing capacity and could benefit from shipper diversification on Double H. Some “Other” capacity ownership includes Enbridge (ENB; 126 MMcf/d), True Oil (15 MMcf/d) and Exxon (XOM; 25 MMcf/d). Volumes that will be shipped on the converted Double H would have term commitments in order to retain barrels and compete with OKE’s integrated NGL system.

Purity Product Spotlight: Export activities have not fully recovered as another incident occurred last Friday (July 19) at the Port of Houston, forcing the US Coast Guard to close the Houston Ship Channel.

A tug boat sank in the channel, affecting vessel transits in the area. Port workers removed the sunken tug last Sunday, allowing activity to resume, yet overall US propane exports took a hit. According to latest weekly EIA data, propane exports dropped 8% after Hurricane Beryl and 7% last week.

EDA expects LPG exports to remain lower this week following the towboat capsizing. Propane stocks are high at 84.6 MMbbl, putting more pressure on prices at Mont Belvieu as slower exports cut into demand.

Data Points & Product Release Calendar:

.png?width=626&height=651&name=image%20(14).png)