Executive Summary: Rigs: The total rig count increased by 6 for the November 24 week, up to 570 from 564. Flows: Gas production as measured by the interstate gas meter sample was flat W-o-W, with some minor puts and takes. Infrastructure: Ethane supply from the Northeast to the Gulf Coast on Enterprise Products’ (EPD) ATEX pipeline has declined by 17 Mb/d (-10%) from 2023 to ’24 YTD 9/30/24 (refer to the chart).

Rigs:

The total rig count increased by 6 for the November 24 week, up to 570 from 564. Liquids-driven basins increased by 3 rigs W-o-W.

- Anadarko (+2): Validus Energy, Murfin Drilling Co.

- DJ (+1): Carbon Storage Solutions

- Permian (-1):

- Midland (-2): Surge Operating, Ring Energy

- Delaware (+1): Coterra Energy

- Uinta (+1): WEM Operating

Flows:

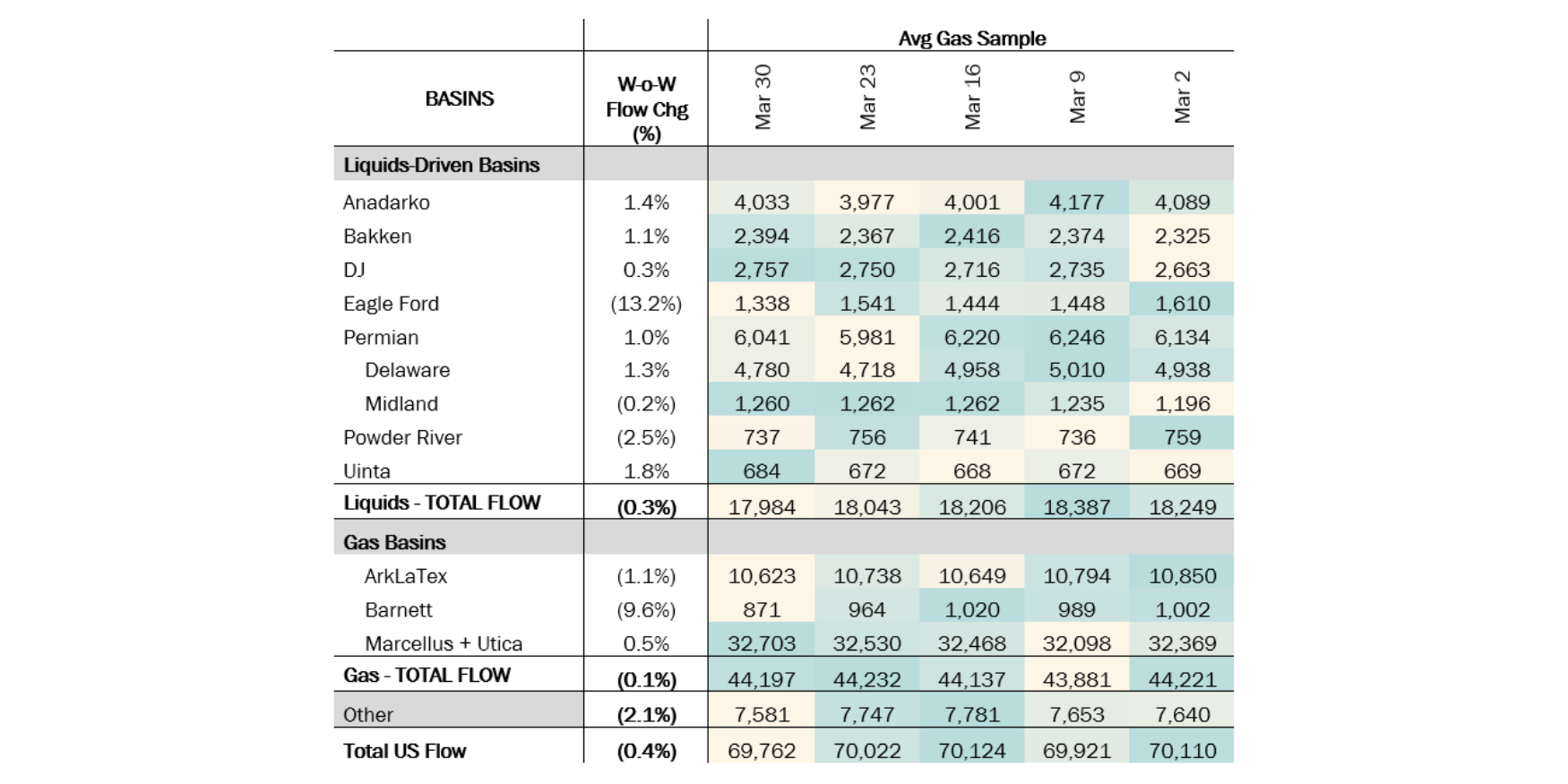

- Gas production as measured by the interstate gas meter sample was flat W-o-W, with some minor puts and takes.

- The Powder River sample rebounded 7% from a decrease in the residue sample due to maintenance on Wyoming Interstate (WIC). This is a resumption to normal volumes, not organic growth.

- The Permian Basin has about 7-8 Bcf/d of gas pipeline egress capacity coming online over the next few years. The latest entrant to the party is Energy Transfer’s (ET) FID of its Hugh Brinson Pipeline (formerly the Warrior Pipeline). This project will consist of two phases and include 400 miles of newbuild 42” pipe from Waha to Maypearl. ET expects an in-service date by YE26.

*W-o-W change is for the two most recent weeks.

Infrastructure:

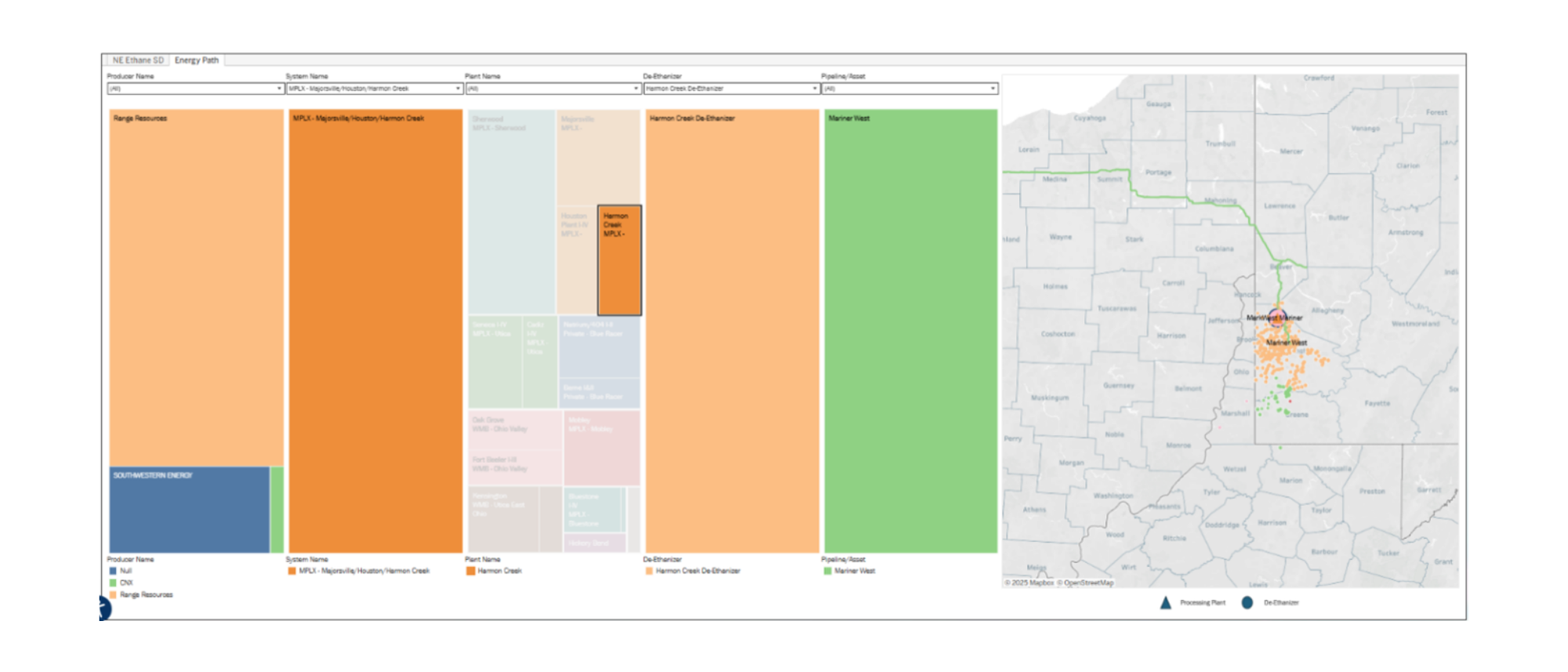

Ethane supply from the Northeast to the Gulf Coast on Enterprise Products’ (EPD) ATEX pipeline has declined by 17 Mb/d (-10%) from 2023 to ’24 YTD 9/30/24 (refer to the chart). This decline is despite Northeast producers like Antero Resources (AR), Range Resources (RRC) and EQT increasing ethane production by 33 Mb/d (+10%) over the same period. As EDA has written about, increased local demand (Shell’s Monaca petchem facility) and Canadian demand (NOVA Chem’s Corunna cracker) have pulled more ethane from increased plant utilization and an expansion project that became fully operational in early ’24.

In a sense, ATEX has become the swing outlet out of the Northeast. Based on EDA research, there are at least 95 Mb/d of contractual commitments with AR and Expand Energy (EXE) on ATEX supporting southbound ethane flows. ATEX could incentivize more spot volumes, but the pipeline would need to reduce the tariff rate to offer netback pricing.

AR notes its firm sales contracts are linked 50% to gas and 50% to Mont Belvieu prices. Range Resources (RRC) discloses its realized ethane price is linked to oil, gas and Mont Belvieu. These pricing mechanisms at times provide a slight premium to Gulf Coast markets, but the real hurdle is the ATEX tariff rate to move ethane south to the Mont Belvieu market, which is more than 3x the price to ship ethane to European markets on Energy Transfer’s (ET) Mariner East pipeline. Forward gas and ethane price curves suggest ATEX volumes in 2025 will resemble what we have seen in ’24 more than ’23.

East Daley’s Northeast Ethane S&D product on Energy Data Studio will be available in 1Q25 detailing supply and demand dynamics from wellhead to demand markets.

Data Points & Product Release Calendar: