The Biden administration is temporarily pausing export licenses for LNG projects while it studies the climate impacts of additional exports. The policy change injects more uncertainty in the outlook for natural gas, putting 5+ Bcf/d of LNG exports in question in East Daley Analytics’ long-term forecast.

The new policy, announced last Friday (January 26) by the White House, affects review by the Department of Energy (DOE) of applications to export LNG to countries without US free trade agreements (non-FTA). The agency will use the timeout to update its economic and environmental analyses on the impacts of LNG exports.

The new DOE study will look at contributions to climate change from LNG exports, including methane emissions from natural gas development. The agency will also look at local community impacts where liquefaction plants operate.

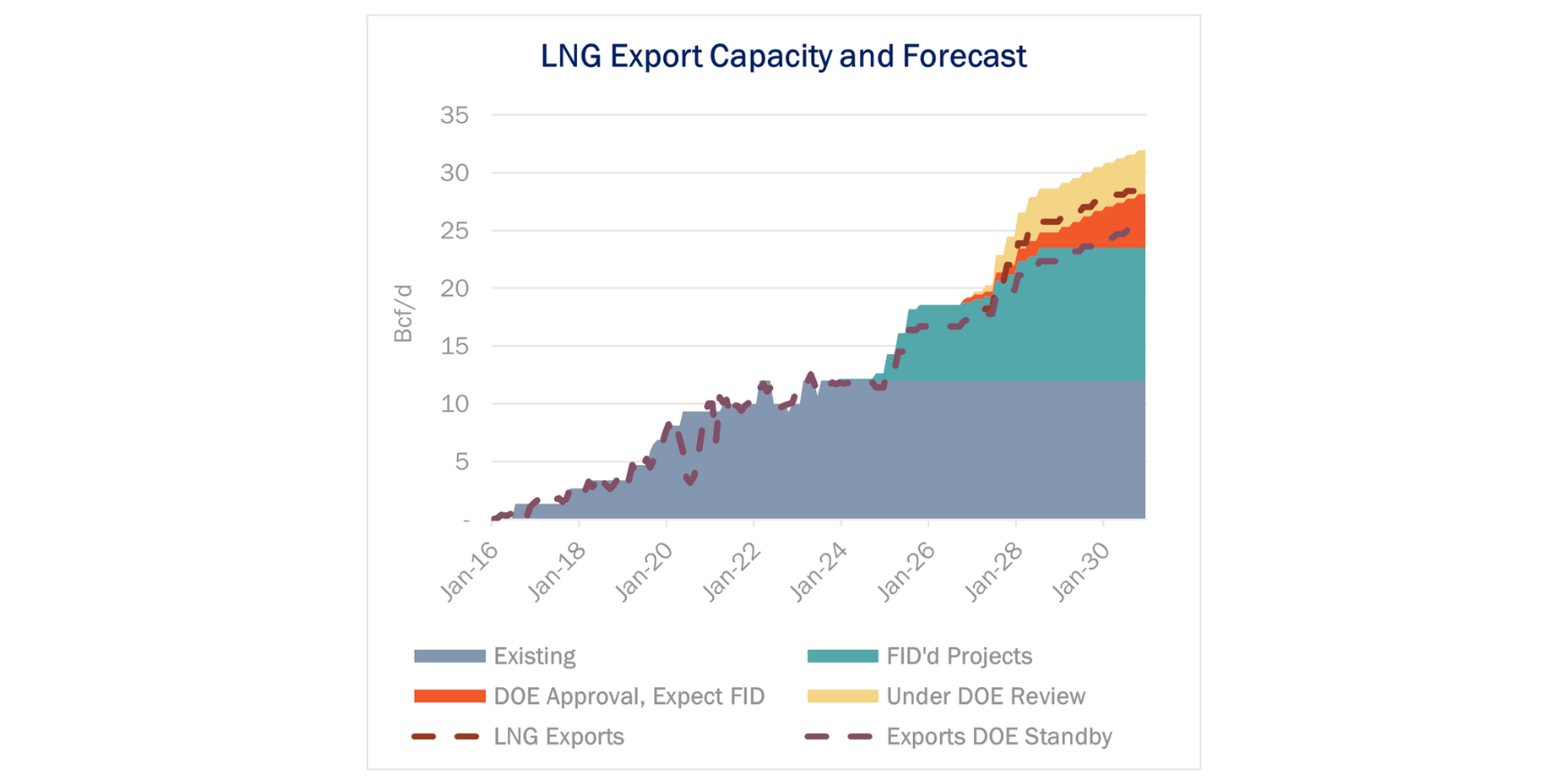

EDA tracks LNG projects and models LNG capacity and exports as part of the Macro Gas Supply and Demand Forecast. Our LNG export capacity stack includes Golden Pass, Plaquemines Phases 1 & 2, Corpus Christi III, Delfin LNG and Port Arthur Phases 1 & 2. These projects are past the DOE approval phase and expected to start service in the 2024-26 period. Later-stage projects including Rio Grande LNG , Cameron Train 4 and Texas LNG also already have non-FTA permits and are not impacted by the new policy. Together, these projects represent 14 Bcf/d of incremental LNG export capacity.

However, DOE’s licensing pause will directly impact the review of Phase 2 of Global Venture’s CP 2 LNG, Commonwealth LNG, and Cheniere Energy’s Sabine Pass Expansion. Together, these projects account for 6.3 Bcf/d of planned export capacity between 2027 and 2031.

The new policy could depress natural gas demand during if the pause drags on and delays development of these projects. Producers would have fewer new markets later this decade, lowering prices and stunting growth. Next-wave LNG projects have continued to attract new customers, but this commercial progress is likely to slow.

In a worst case, DOE could reach an adverse conclusion and permanently pause additional exports. In East Daley’s Macro Gas Supply and Demand Forecast, 5.3 Bcf/d of gas demand is at risk through 2030 as a result of the licensing pause.

As highlighted in the 2024 Dirty Little Secrets outlook, EDA expects additional supply from Tier 2 basins to meet much of the big jump ahead in export demand. The new DOE policy puts 2.0 Bcf/d of Tier 2 growth at risk through 2030 in our base case. Tier 1 production would also fall by 2-3 Bcf/d from the base case, primarily impacting the Haynesville and Eagle Ford basins. A worst-case scenario removes much of the price premium we expect from the LNG demand ramp in our base case.

We expect the DOE policy to create more volatility in natural gas. Developers, financers, and producers will have less surety of demand, impacting plans to develop new supplies and affecting returns on industry investments. – Jack Weixel.

Join East Daley for mid-Winter Natural Gas Update

East Daley will review updates to our natural gas forecast and discuss the market outlook in a new online webinar on Wednesday, February 7. In “A Disjointed Winter Gives Way to a Volatile 2024,” EDA’s Natural Gas team looks at the effects of another mild winter on the gas market, and the potential for upside ahead from new LNG projects and higher power generation demand. How long will oversupply last? Join us Wednesday February 7 to discuss the road ahead for natural gas.

Dirty Little Secrets is Now Available

Dirty Little Secrets is now available. East Daley held our Dirty Little Secrets annual webinar on Wednesday, December 13. In “Volatility Will Continue Until Morale Improves,” we reviewed the factors likely to drive volatility ahead in oil, natural gas and NGL markets. We review the outlook for these markets and the midstream sector. Review the Dirty Little Secrets webinar here.

East Daley, Hart Bring NEW Gas & Midstream Weekly

East Daley is teaming up with Hart Energy on the NEW Gas & Midstream Weekly newsletter. This new report combines the strengths of Hart Energy’s journalistic reporting and analysis on natural gas, LNG, midstream energy and deal-making with EDA’s deep research and intelligence of hydrocarbons, storage and transportation.

Published every Thursday morning, this new powerhouse newsletter is an interactive and enlightening read highlighting breaking news, exclusive interviews, videos, charts, maps and more. The newsletter utilizes East Daley’s Energy Data Studio tools for natural gas predictive analytics with Hart Energy’s Rextag mapping tools to present a holistic view of pricing triggers, infrastructure growth, pipeline and processing bottlenecks, regulatory and legal hurdles, and the inevitable solutions. Subscribe

Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact [email protected].

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.