Leading gas producer EQT appears to be restoring ~1 Bcf/d of production the operator first shuttered back in February. We expect the development to benefit Equitrans Midstream (ETRN), which is working to keep start-up of Mountain Valley Pipeline (MVP) on track out of the Appalachian Basin.

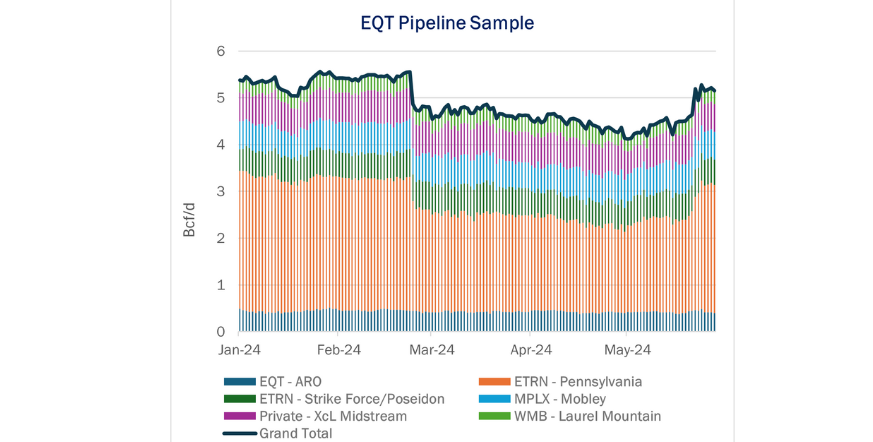

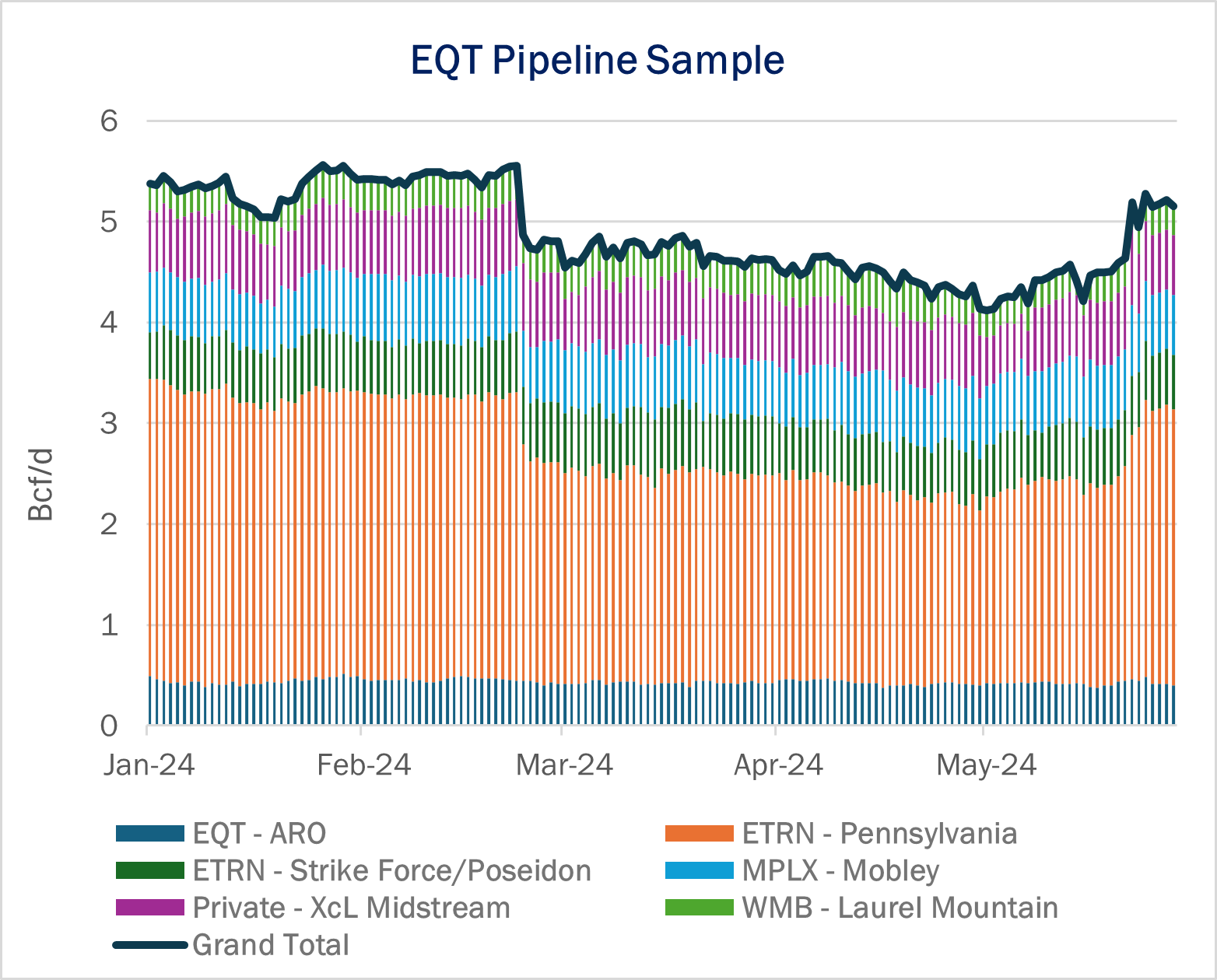

Pipeline samples for G&P systems that serve EQT jumped last week, up ~700 MMcf/d from levels over the last three months after EQT shut-in some production in late February (see figure). Flows remain higher earlier this week on the systems tracked by East Daley Analytics. The timeline would line up with our prediction for EQT to return its gas production in June ‘24, based on the expected start of MVP and higher seasonal demand.

Flows rose on systems in the Southwest Pennsylvania (SW-PA) region of the Marcellus, the same systems that took a hit when EQT curtailed its production. EDA estimates that the bulk of this lost production has come from ETRN’s Pennsylvania gathering system.

The restart of volumes suggests a price floor over which EQT will run its wells closer to full capacity. Dominion South prices have averaged just above $1.50/MMBtu in May ’24 and DomSouth futures have traded at $1.70 for June ’24. In 2020, EQT also shut down some wells when Appalachian prices fell below $1.50.

The higher volumes coincide with ETRN’s earlier plan to begin flowing gas on MVP by May 22, according to an earlier request filed with the Federal Energy Regulatory Commission (FERC). In April, the pipeline predicted it would be ready to start tariffs by June 1. However, MVP pushed back that timeline last week.

In a supplemental filing with FERC, MVP said that as of May 21, the pipeline is not yet mechanically completed. MVP said 99% of the new pipe has been hydrotested, but the pipeline has 10 welds remaining before the last segment can undergo hydrostatic testing. While MVP had targeted a June 1 start date, the pipeline now plans to start in “early June,” according to the filing. The delay is likely linked to a rupture MVP experienced on May 1 during hydrostatic testing.

The increased supply will likely put some pressure on natural gas prices. Nevertheless, the move makes sense for EQT. The producer is the largest capacity holder on MVP and will realize premium Zone 5 prices on the Transcontinental (Transco) system once the new 2 Bcf/d pipeline begins service. – Alex Gafford Tickers: EQT, ETRN.

New Product: EDA’s LNG Stack

East Daley has added the new LNG Stack to our monthly gas Macro report and data set. The LNG Stack connects LNG export demand to producers through pipelines and processing, for a comprehensive view of the market. Build our LNG data into your own demand forecasts, or use it to validate against your own view of the coming LNG super-build. Learn more about the LNG Stack and Macro.

Sign Up for the Crude Oil Edge

East Daley’s Crude Oil Edge provides weekly updates on the US crude oil market including supply and demand fundamentals, basin-level views, and analysis of market constraints and infrastructure proposals. We explore sub-basin dynamics and provide market insights on crude oil flows, production growth, and import and export characteristics. Sign up now for the Crude Oil Edge.

Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact [email protected].

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.