After the bankruptcy of its lead contractor, Golden Pass LNG is asking regulators for more time to complete construction. East Daley is watching the Texas LNG project closely in the Macro Supply & Demand Forecast for signs of further delay, though we see no cause for concern with the latest request.

Last Wednesday (August 28), Golden Pass LNG filed a request with the Federal Energy Regulatory Commission (FERC) seeking an extension of time until November 30, 2029 to fully enter service. If granted, this extension would give Golden Pass three additional years to complete the liquefaction project.

Zachry Holdings, the project’s lead engineering, procurement and construction (EPC) contractor, filed for bankruptcy in May. Golden Pass LNG cited the bankruptcy and the switch to new lead contractor CB&I as the causes for the delay, leading to the latest request.

Golden Pass said it plans to ask for a similar extension from the Department of Energy (DOE) to push back the deadline on its non-Free Trade Agreement (non-FTA) and FTA export authorizations to March 31, 2027. This would give Golden Pass until 1Q27 to begin commercial operations at Train 1.

These deadlines contrast to those established during ExxonMobil’s (XOM) 2Q24 earnings call earlier this month. XOM is the majority stakeholder in Golden Pass. During the call, CEO Darren Woods said the project was now “looking at probably the back end of 2025 for first LNG,” five quarters before the deadline in the DOE extension request.

However, this discrepancy is likely just a precaution. Golden Pass has requested extensions from FERC twice since the project was first authorized, and said the new deadline would avoid the need to come back to regulators with yet another request.

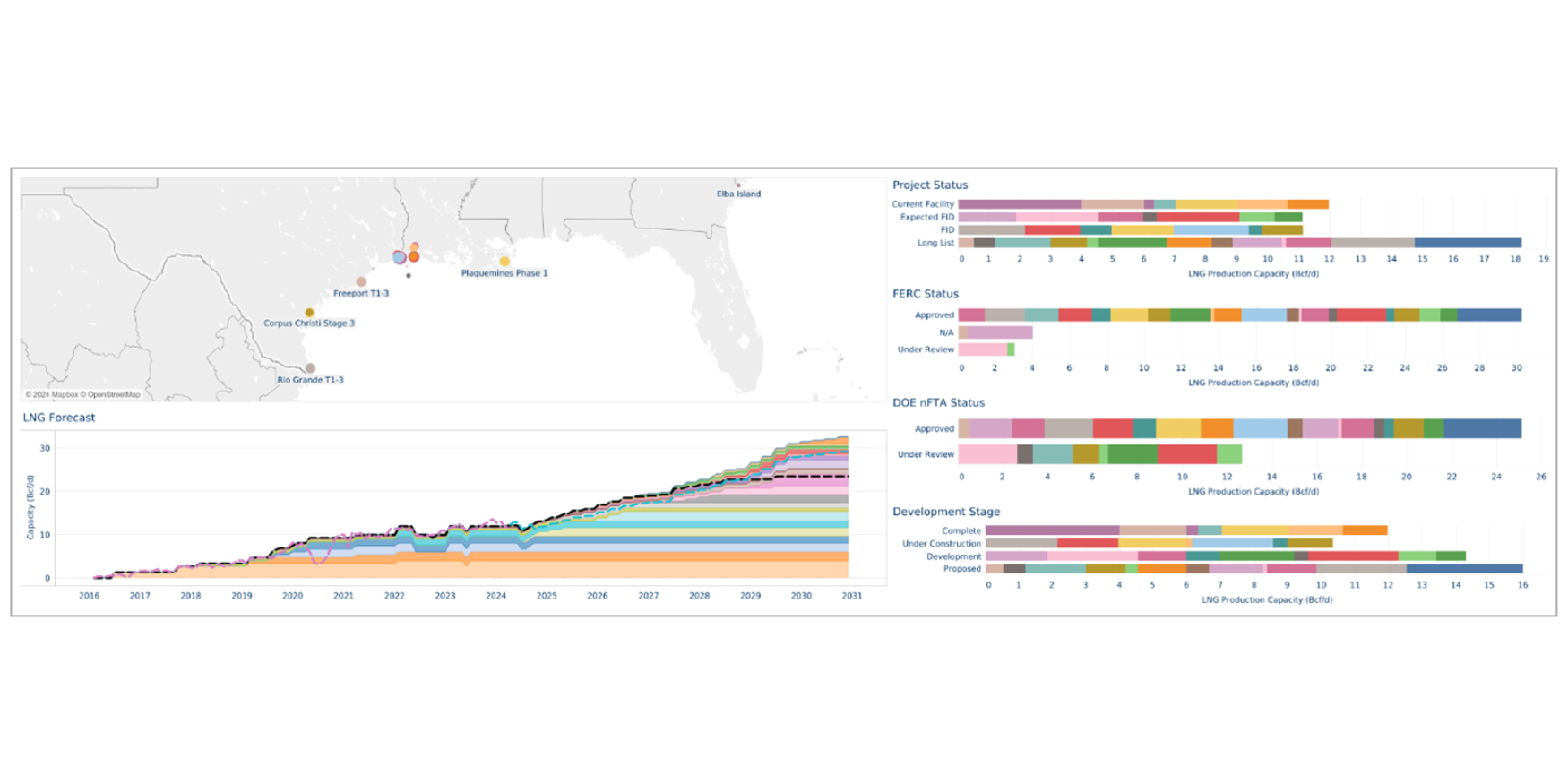

East Daley monitors Golden Pass LNG in the “LNG Tracker & Export Stack” dashboard in Energy Data Studio, available as part of the Macro Supply & Demand Forecast (see figure from the “LNG Tracker” dashboard). We had already pushed back the expected start date for Train 1 at Golden Pass to 1Q26 after the initial Zachry bankruptcy filing. While the latest extension request would give Golden Pass a longer runway, EDA does not currently believe this additional time would be necessary, and we are not adjusting Train 1’s in-service date from 1Q26. – Ian Heming Tickers: XOM.

NEW Webinar – Fast and Furious: Production, Constraints and Opportunity

East Daley will host our latest MCAP webinar on September 25th at 10 am MT. In “Fast and Furious: Production, Constraints and Opportunity,” we will look at opportunities across the energy complex:

- Crude: Double H Conversion’s impact on crude fundamentals, and who can capture that upside.

- Gas: What the Blackcomb pipeline means for TRGP’s G&P growth in the Permian.

- NGLs: The fight for barrels in the Permian, and the implications of OKE’s acquisition of ENLC.

Register here to join us.

Sign Up for the NGL Insider

East Daley NGL Insider provides weekly updates on the US NGLs market including supply and demand fundamentals, basin-level views, and analysis of market constraints and infrastructure proposals. We explore sub-basin dynamics and provide market insights on NGL flows, infrastructure, and purity products. Sign up now for the NGL Insider.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.