Gas pipelines out of North Dakota’s Williston Basin are filling up, to the point where growth in crude oil production could become constrained.

Crude oil is the primary economic driver in the Bakken, but operators must also find markets for the associated natural gas and NGLs. Our basin forecast shows those tasks growing more complicated as natural gas production continues to grow.

In the latest Bakken Supply and Demand Forecast, East Daley Analytics raised our 2024 outlook for gas supply by an average of 120 MMcf/d. We forecast gross gas production to average 3.6 Bcf/d in 2024, a gain of 210 MMcf/d vs 3.39 Bcf/d in 2023.

Several factors are supporting growth in Bakken gas output. Initial production (IP) rates for new wells remain strong, supported by improved recovery from longer laterals. In its 1Q24 update last week, ONEOK (OKE) noted that 30% of the Bakken wells the company services now have 3-mile laterals.

Bakken production also shows rising a gas-to-oil ratio (GOR), which measures the amount of natural gas produced from wells compared to crude oil. Gas output tends to hold more steady than liquids as Bakken wells mature, resulting in a flatter decline curve for gas.

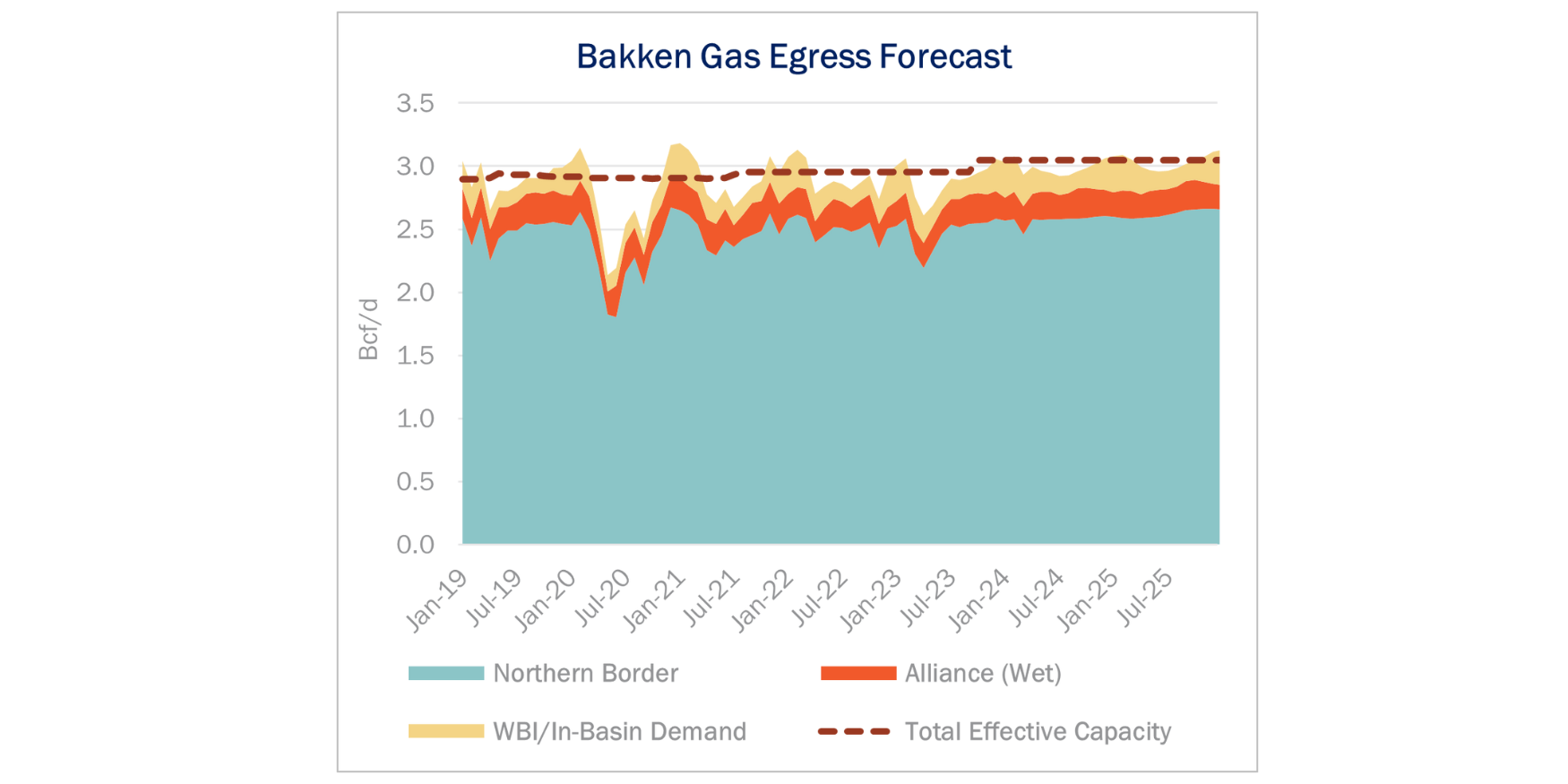

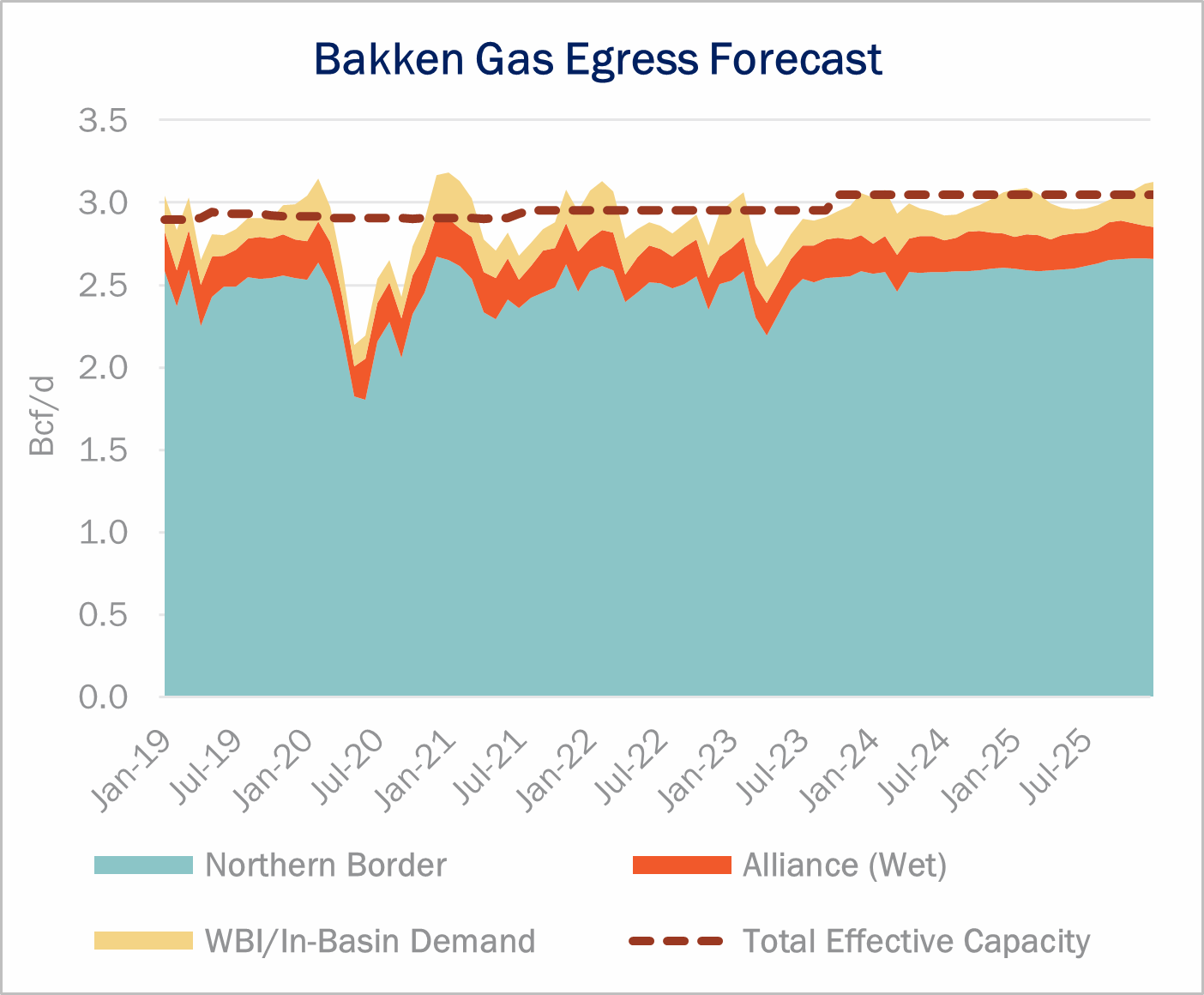

Increased ethane ‘rejection’ is also filling pipeline capacity from the Williston Basin. The rejection of ethane into the gas stream is a particular concern for pipelines due to its impact on gas quality, sometimes forcing them to impose limits on gas receipts. Our regional Bakken Forecast shows a key route to move natural gas out of the Bakken, Northern Border Pipeline, will run effectively full for the rest of 2024 (see figure).

Leaving ethane in the natural gas stream raises the heat content, allowing shippers to sell more Btus while increasing the volumes sent to pipelines. This higher-Btu gas is displacing leaner gas from Western Canada on pipelines like Northern Border and Alliance, creating reliability concerns for downstream markets. While recovering more ethane could mitigate some of these issues, economic factors such as transportation costs to Gulf Coast fractionators present challenges. Additionally, expansion of projects like ONEOK’s (OKE) Elk Creek (+100 Mb/d) remains uncertain, adding some uncertainty to the situation.

North Dakota state regulation allows gas produced with crude oil to be flared for up to one year from the date of first production. While not a long-term solution, oil producers are currently flaring associated gas from wells while suing to block a Bureau of Land Management methane regulation they say will hinder oil and gas production.

Despite the potential for constraints on the gas side, East Daley forecasts ~40 Mb/d of crude oil production growth from 2024–25 (avg to avg). IP rates from Bakken wells remain steady, while our forecasts for rigs and wells drilled have increased.

While recovering more ethane could mitigate some of these issues, economic factors such as transportation costs to Gulf Coast fractionators present challenges. Additionally, expansion of projects like ONEOK’s (OKE) Elk Creek (+100 Mb/d) remains uncertain, adding some uncertainty to the situation. – Gage Dwan Tickers: OKE.

East Daley is Attending EIC Investor Conference

East Daley is heading to the Energy Infrastructure Council Investor conference in Aventura, Florida on May 21 – 23! Come see Rob Wilson, VP of Analytics, speak on May 23. Want to connect while we are at EIC? Request a meeting.

Available Now: Ethane Supply & Demand Report + Data Set

The new Ethane Supply & Demand Report + Data Set is a comprehensive data file and report providing valuable insights into historical and forecasted supply and demand components for ethane. The report covers crucial metrics such as ethane supply from US gas processing plants, and demand from domestic ethylene steam crackers and ethane exports. Learn more about the Ethane Supply & Demand Report and Data Set.

Access the NEW G&P System Financial Dashboard

We are thrilled to introduce a groundbreaking addition to East Daley’s suite of energy management tools: the G&P System Financial dashboard. This dynamic tool will revolutionize how you scope and analyze multiple financial metrics and throughput forecasts for individual G&P systems across the US. Clients can log in to Energy Data Studio to review the G&P System Financial dashboard protype. Learn more here.

Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact [email protected].

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.