Enbridge (ENB) Mainline, Canada’s largest crude oil egress pipeline, is lowering spot rates in joint tariffs to incentivize deliveries to the Gulf Coast, an acknowledgement of new competition from Trans Mountain Pipeline for heavy barrels. East Daley Analytics anticipates softer earnings ahead for ENB’s largest asset.

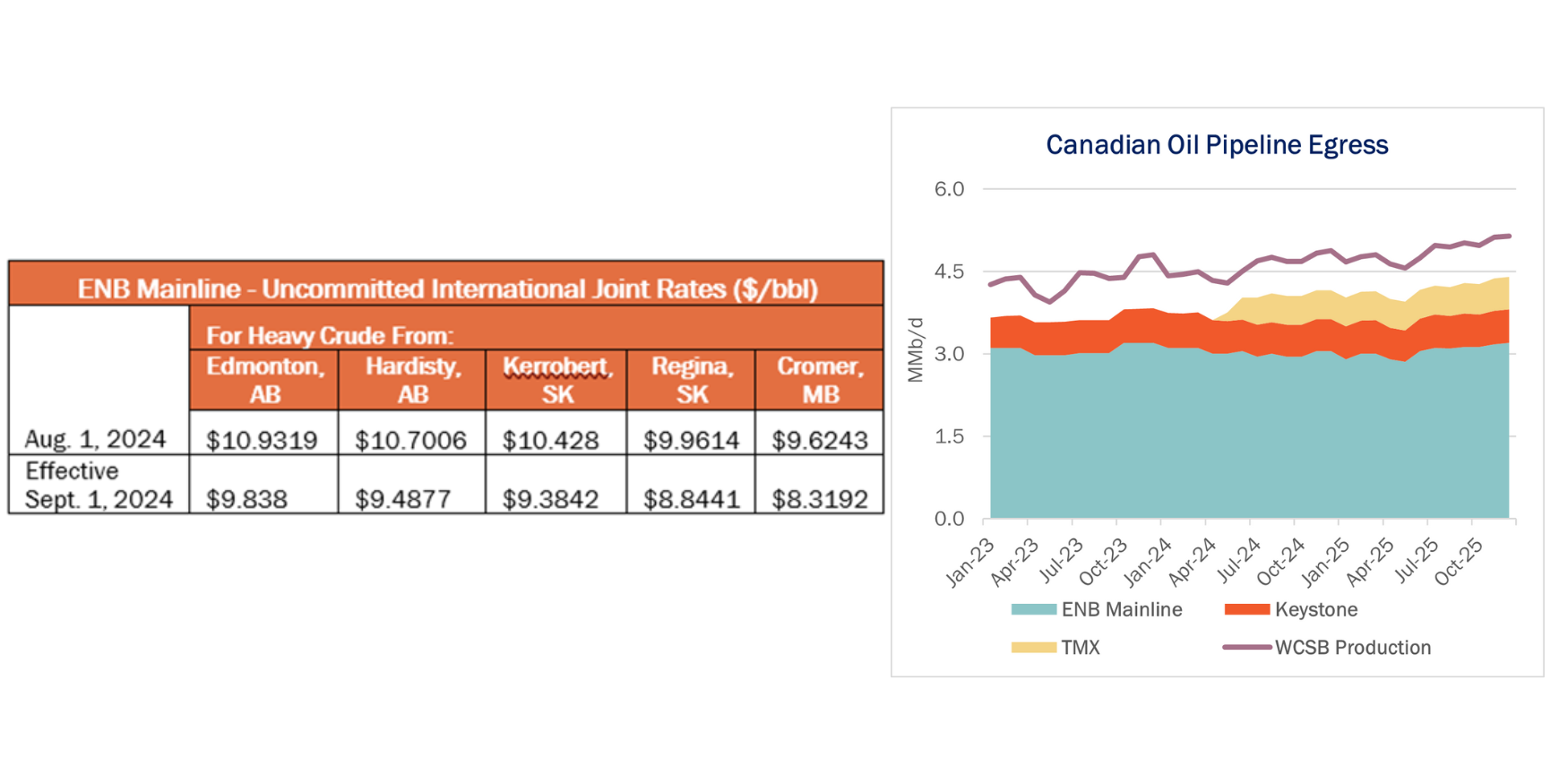

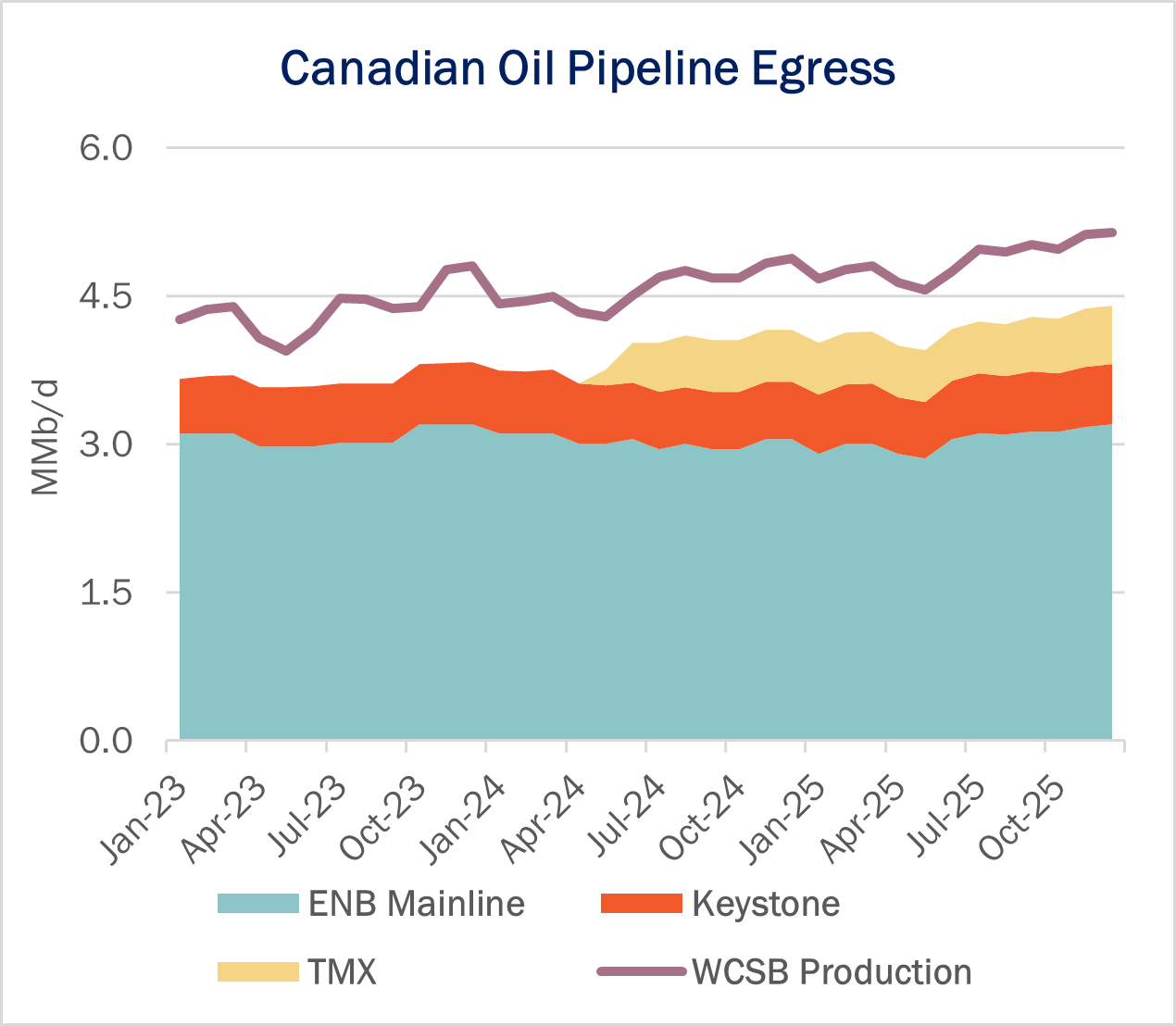

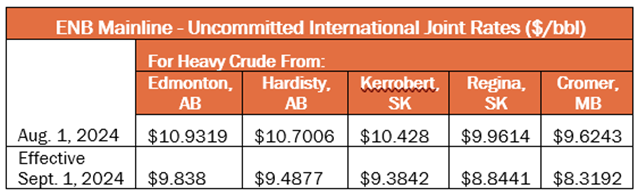

Effective September 1, 2024, uncommitted heavy crude tolls decreased for joint tariffs with the Flanagan South and Seaway pipelines. The Mainline can transport up to 3.2 MMb/d from Western Canada to the Midwest and, using the joint pipeline tariffs, move up to 720 Mb/d all the way to the Gulf Coast. Notably, ENB has cut heavy crude spot rates in the joint tariffs from Edmonton, AB to Houston, TX (Harris County) from $10.9319 to $9.8380/bbl (see table).

The Mainline has been running effectively full, and the lower uncommitted joint rates will help keep throughput high. The new rates only apply to joint services with the downstream pipes and do not affect Mainline tolls from Alberta to Chicago.

The move by ENB follows start-up of the Trans Mountain Expansion (TMX) in May ’24, adding 590 Mb/d of takeaway to Pacific markets. East Daley predicted a fight for heavy Canadian barrels once TMX started, and the lower joint tariffs reflect the new market reality. With minimum volume commitments totaling 525 Mb/d, the expanded Trans Mountain is primarily shipping heavy sour crude to Burnaby, BC with some batching of syncrude.

Tolls for TMX have not been finalized (the Canadian Energy Regulator (CER) is aiming to finalize rates in 2025), but the current benchmark toll for shippers with a 15-year contract transporting less than 75 Mb/d from Edmonton, AB to Burnaby, BC is $11.46/bbl, consisting of a fixed $10.88 plus $0.58/bbl variable rate. The fixed rate is lower than the uncommitted joint tariff on Mainline to the Gulf Coast, making it a more attractive egress route for Canadian producers.

However, this cost advantage for TMX will not last much longer. Trans Mountain experienced lengthy delays and severe overages during its construction, which will increase tolls. Benchmark fixed rates increased from $5.76 to $10.88/bbl based on a May 2023 project cost estimate of $30.9B. The most recent update suggests a total cost of ~$34B, which will be reflected in the CER’s finalized rates next year.

TC Energy’s (TRP) Keystone Pipeline is another competitor. According to East Daley’s Crude Hub Model, Keystone is fully utilized. The pipeline moved average 1Q24 volumes of ~637 Mb/d, above its stated 620 Mb/d nameplate capacity. TRP is likely using drag reducing agents (DRA) on Keystone due to the high ratio of heavy sour to light crude oil. Furthermore, Keystone is 94% contracted, TRP executives said on its 2Q24 earnings call. With a market-low committed heavy crude rate of $2.508/bbl, Keystone throughput is likely to see little impact from TMX and the lower Mainline joint rates.

The Mainline is ENB’s largest asset and generated EBITDA of C$1,317MM in 2Q24. The system was apportioned through 2Q24, but the new incentive rates confirm more competition. While strategic for ENB to maximize volumes, EDA forecasts lower EBITDA ahead from the combination of lower rates and lower near-term throughput. In the ENB Financial Blueprint, Mainline EBITDA is forecast to average C$1,284MM in 2H24 and C$1,282MM in 1H25.

Despite the near-term downside, Mainline volumes and EBITDA will recover as Western Canadian Sedimentary Basin (WCSB) production continues to increase. Our WCSB outlook in Energy Data Studio predicts crude oil production will grow to 4.8 MMb/d by YE24 and 5.1 MMb/d by YE25. The additional growth tied to TMX overages supports a positive outlook for Mainline. – Gage Dwan Tickers: ENB, TRP.

NEW Webinar – Fast and Furious: Production, Constraints and Opportunity

East Daley will host our latest MCAP webinar on September 25th at 10 am MT. In “Fast and Furious: Production, Constraints and Opportunity,” we will look at opportunities across the energy complex:

- Crude: Double H Conversion’s impact on crude fundamentals, and who can capture that upside.

- Gas: What the Blackcomb pipeline means for TRGP’s G&P growth in the Permian.

- NGLs: The fight for barrels in the Permian, and the implications of OKE’s acquisition of ENLC.

Register here to join us.

Sign Up for the NGL Insider

East Daley NGL Insider provides weekly updates on the US NGLs market including supply and demand fundamentals, basin-level views, and analysis of market constraints and infrastructure proposals. We explore sub-basin dynamics and provide market insights on NGL flows, infrastructure, and purity products. Sign up now for the NGL Insider.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term