As the Trans Mountain Pipeline Expansion (TMX) moves closer to start-up, the cost to US refiners and midstream operators is coming into sharper view. Refiners are set to pay $20MM more a day, or $1.8B per quarter, for Canadian imports as a result of the project.

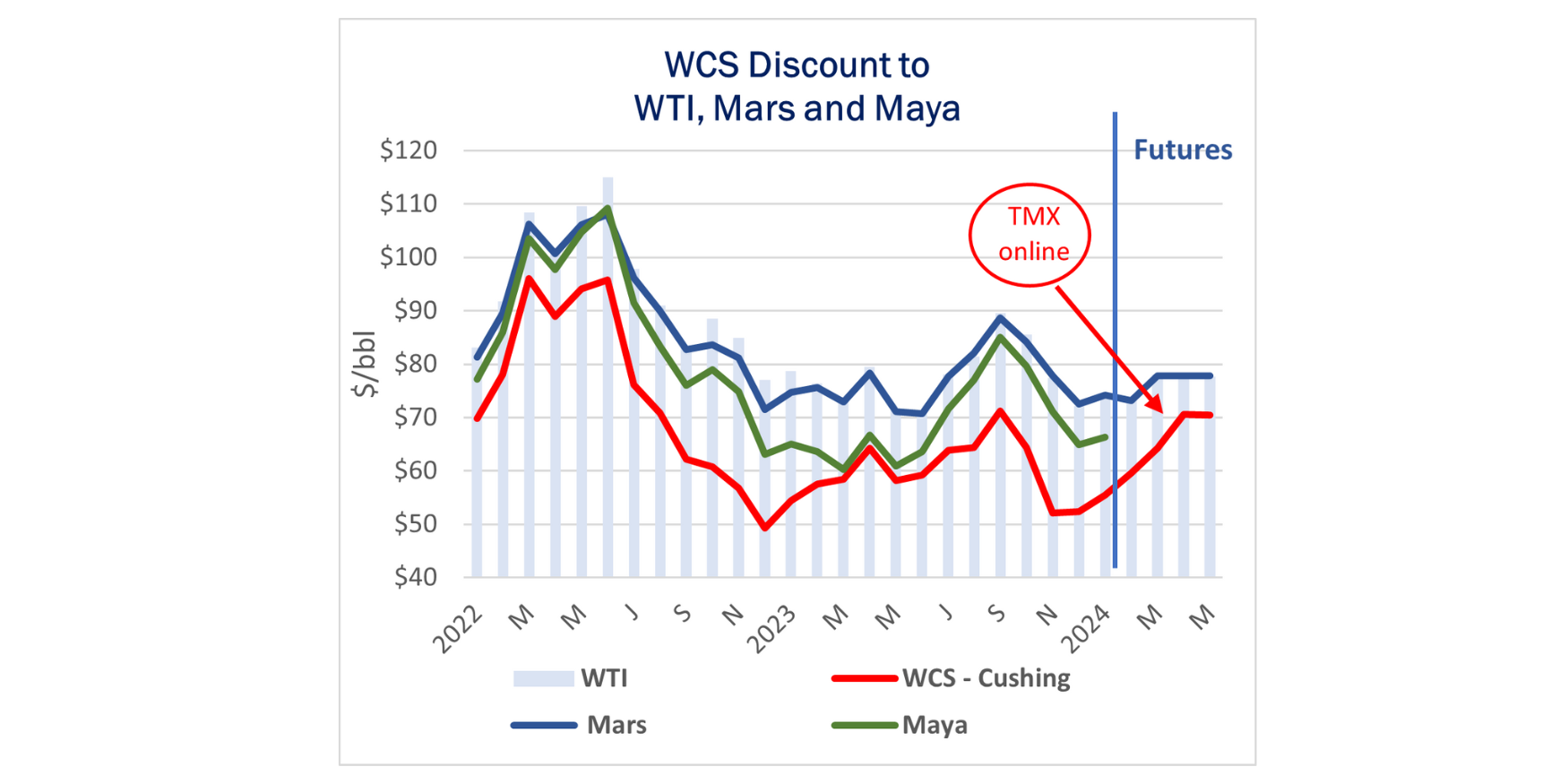

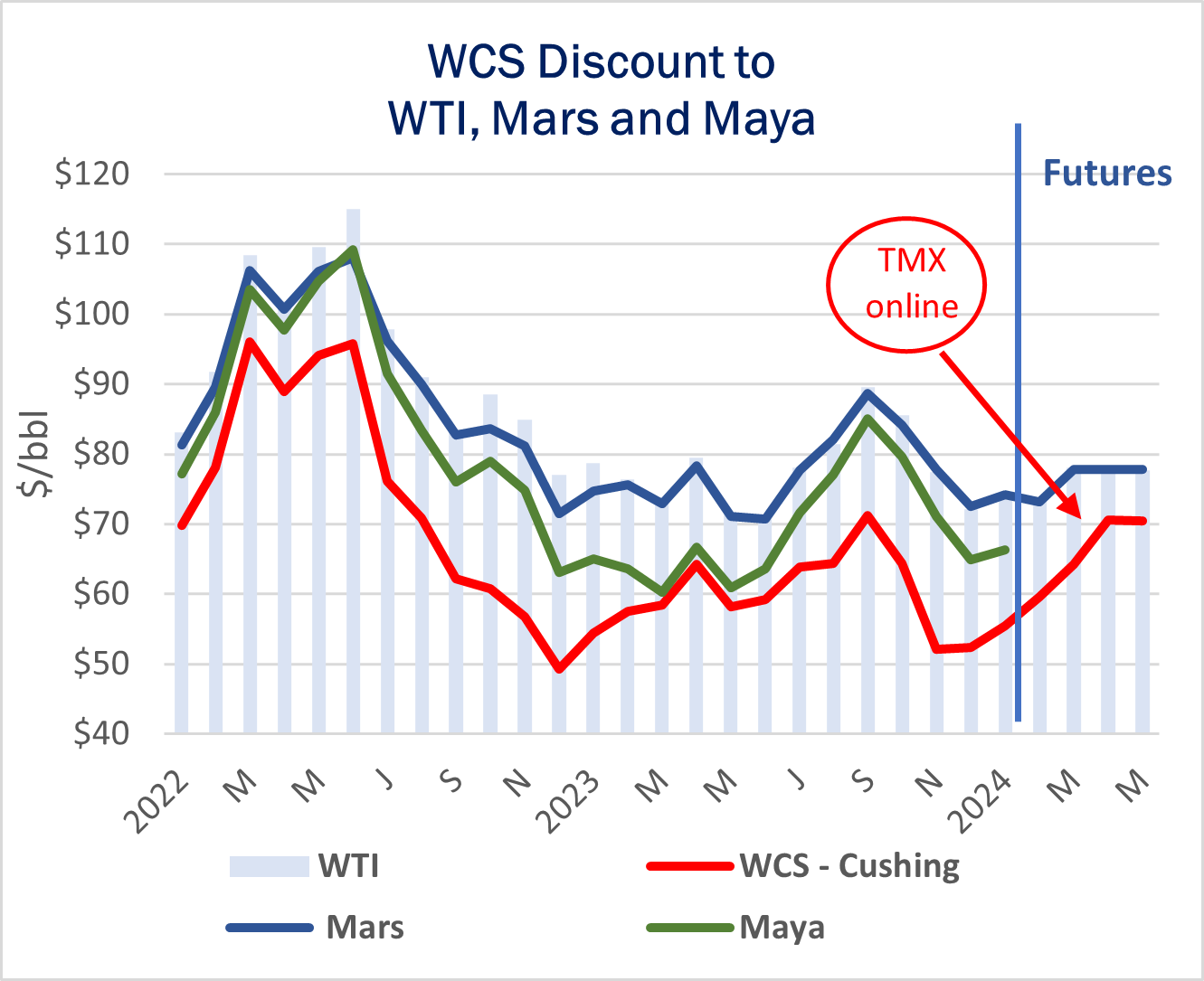

The forward curve for Western Canada Select (WCS), a Canadian heavy sour barrel, has increased by $6/bbl vs WTI prices in 2024 due to the expected start of TMX (see chart). The tightening spread reflects more competitive pricing for Canadian barrels as TMX opens more access to Pacific markets.

In the Crude Hub Model, East Daley models the 590 Mb/d pipeline expansion from Alberta to British Columbia will come online by the end of 1Q24. We expect TMX to initially displace about 470 Mb/d of heavy sour crude imports to the US market, lowering throughput at several pipelines and terminals. Just as important will be the project’s impact on Canadian crude prices. Futures are pricing in a gut punch for US refiners once prices increase for Canadian barrels.

US refiners import about 3.8 MMb/d from Canada. Assuming diversions to TMX are not replaced, the recent increase in WCS prices would force US buyers to pay $20MM more a day for the remaining ~3.3 MMb/d of imports from Canada, or $1.8B per quarter.

Historically, Canada has been a virtually captive market for Lower 48 crude oil buyers. TMX will loop the Tran Mountain line to the Westridge Marine Terminal out of Vancouver Bay, BC, opening the door for Canada’s industry to expand export markets. Two of the 11 committed shippers at the terminal expansion are Chinese companies, so we anticipate some deliveries to China. However, East Daley believes a significant portion of West Ridge’s exports will also ship to refiners on the US West Coast.

The price for a WCS barrel is typically heavily discounted to other crude oils of similar quality, including Mars and Poseidon (heavy sour barrels from the Gulf of Mexico), and Maya (Mexico heavy sour crude), as shown in the figure. The WCS barrel has a long journey to market, roughly 1,700 miles to reach PADD II area refiners in the Midwest, and another 300 miles to the Gulf Coast. Additionally, the lack of spare pipeline egress from Canada creates congestion and contributes to the heavy discounting of WCS. That advantage for US refiners will be curtailed once service begins on TMX. – Kristy Oleszek.

{% module_block module “widget_aae321b1-36f5-4723-87cd-68793ac63bbd” %}{% module_attribute “button_text” is_json=”true” %}{% raw %}”Request Crude Proucts”{% endraw %}{% end_module_attribute %}{% module_attribute “child_css” is_json=”true” %}{% raw %}null{% endraw %}{% end_module_attribute %}{% module_attribute “css” is_json=”true” %}{% raw %}null{% endraw %}{% end_module_attribute %}{% module_attribute “label” is_json=”true” %}{% raw %}null{% endraw %}{% end_module_attribute %}{% module_attribute “link” is_json=”true” %}{% raw %}{“url”:{“content_id”:null,”href”:”https://share.hsforms.com/1INpOOnRYTO6iwh1Yye_JoQ4x9p7″,”type”:”EXTERNAL”},”open_in_new_tab”:true,”no_follow”:false}{% endraw %}{% end_module_attribute %}{% module_attribute “module_id” is_json=”true” %}{% raw %}95364674432{% endraw %}{% end_module_attribute %}{% module_attribute “schema_version” is_json=”true” %}{% raw %}2{% endraw %}{% end_module_attribute %}{% module_attribute “tag” is_json=”true” %}{% raw %}”module”{% endraw %}{% end_module_attribute %}{% end_module_block %}

Join East Daley for mid-Winter Natural Gas Update

East Daley will review updates to our natural gas forecast and discuss the market outlook in a new online webinar on Wednesday, February 7. In “A Disjointed Winter Gives Way to a Volatile 2024,” EDA’s Natural Gas team looks at the effects of another mild winter on the gas market, and the potential for upside ahead from new LNG projects and higher power generation demand. How long will oversupply last? Join us Wednesday February 7 to discuss the road ahead for natural gas.

Dirty Little Secrets is Now Available

Dirty Little Secrets is now available. East Daley held our Dirty Little Secrets annual webinar on Wednesday, December 13. In “Volatility Will Continue Until Morale Improves,” we reviewed the factors likely to drive volatility ahead in oil, natural gas and NGL markets. We review the outlook for these markets and the midstream sector. Review the Dirty Little Secrets webinar here.

East Daley, Hart Bring NEW Gas & Midstream Weekly

East Daley is teaming up with Hart Energy on the NEW Gas & Midstream Weekly newsletter. This new report combines the strengths of Hart Energy’s journalistic reporting and analysis on natural gas, LNG, midstream energy and deal-making with EDA’s deep research and intelligence of hydrocarbons, storage and transportation.

Published every Thursday morning, this new powerhouse newsletter is an interactive and enlightening read highlighting breaking news, exclusive interviews, videos, charts, maps and more. The newsletter utilizes East Daley’s Energy Data Studio tools for natural gas predictive analytics with Hart Energy’s Rextag mapping tools to present a holistic view of pricing triggers, infrastructure growth, pipeline and processing bottlenecks, regulatory and legal hurdles, and the inevitable solutions.

Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact [email protected].

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.