Braskem Idesa is short ethane supply at its petrochemical complex in Coatzacoalcos, Mexico. Fortunately for the company, new expansions at US Gulf Coast terminals are timed well to fill the gap.

In East Daley’s 2Q24 webinar on ethane supply and demand, we pointed out that some ethane exports from the Gulf Coast end up in Mexico at the Braskem Idesa site, the largest petrochemical complex in Latin America. A new ethane import terminal is due to begin operations there in June ’25, around when Enterprise Products (EPD) will start its Neches River terminal expansion (planned in 3Q25). At least 15 Mb/d of additional ethane is needed for the plant in southern Mexico to operate at capacity.

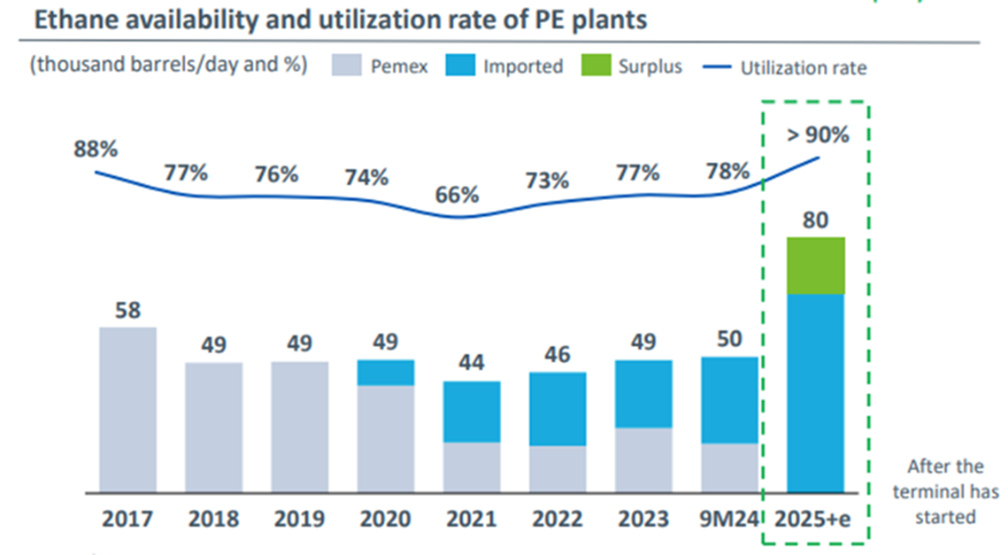

The US energy market is flush with ethane. The average Mont Belvieu ethane price was $0.14/gal in August ‘24, the lowest since April ’20, when the price fell to $0.13/gal during the throes of COVID. Since then, US ethane supply has grown by almost 50% (see the figure from East Daley’s Energy Data Studio, which includes ethane currently rejected into the gas stream in orange). Permian producers targeting liquids have led the growth, supported by newer processing plants more effective at extracting ethane from the associated rich gas stream.

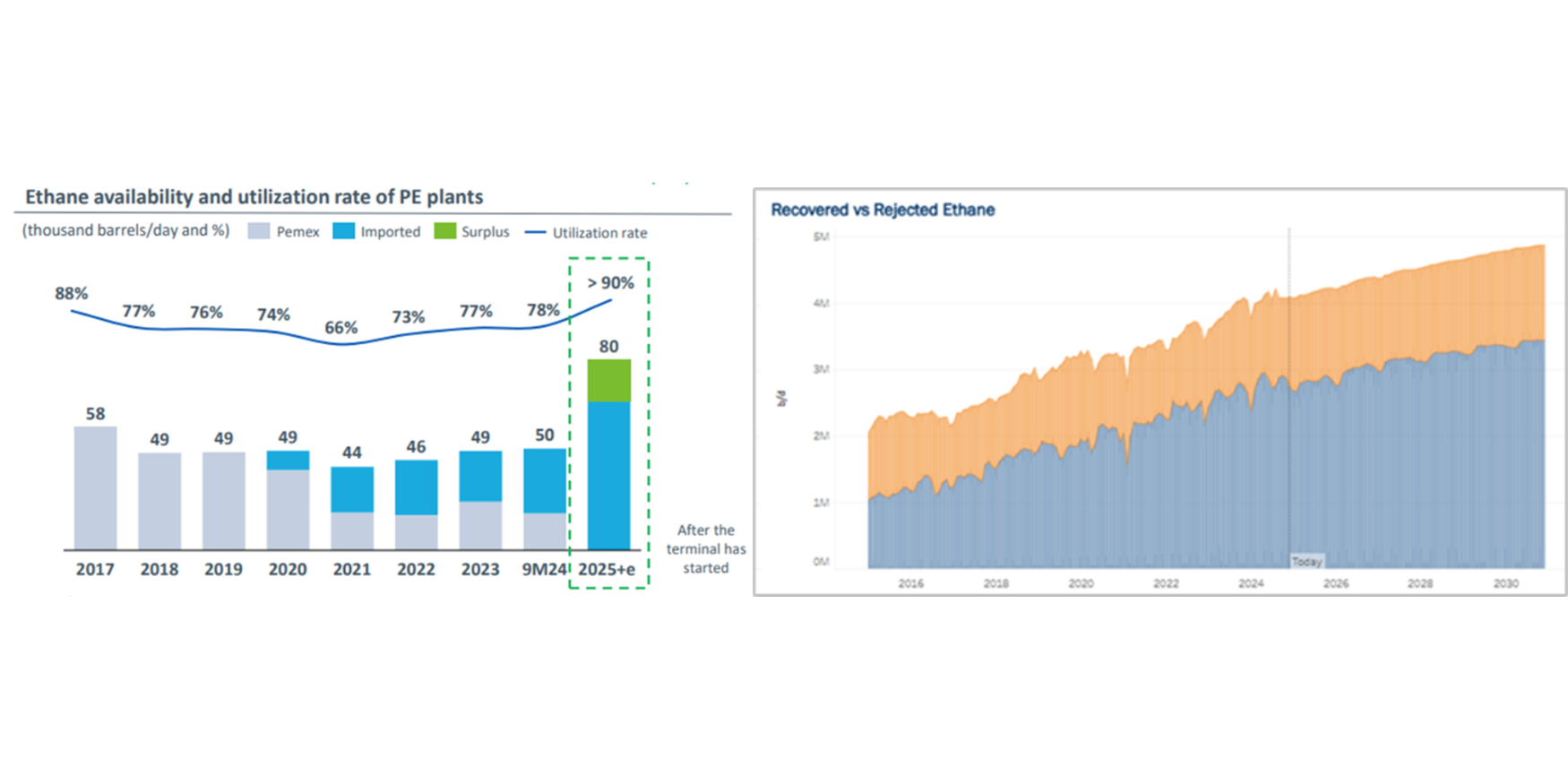

Meanwhile, the Braskem Idesa plant has a shortage crisis. The Braskem/Idesa JV (75%/25% ownership split) requires 66 Mb/d of ethane to operate at capacity, and therein lies the problem. An ethane shortage in Mexico has prevented it from operating above 78% since 2017.

Petroleos Mexicanos (Pemex) has historically supplied most of the plant’s ethane, but its capacity to feed the facility has diminished over time, as shown in the second figure (gray-shaded bar chart).

Mexico’s ethane production has suffered for several reasons. 1) The country’s oil production is in decline, and with it associated wet gas (i.e. ethane) 2) an increase in nitrogen contamination has also led to more gas flaring 3) high nitrogen content reduces operational efficiency at low-recovery plants and 4) inadequate maintenance has impaired production. Sergio Taborga explains the dynamics in more detail here: Mexico’s Petrochemical Industry Battles Ethane Supply Issues.

To solve for the ethane shortage, Braskem Idesa has partnered with Dutch company Advario to build an 80 Mb/d ethane import terminal. The terminal will include two cryogenic storage tanks with a capacity of 314 Mbbl (12 days of inventory) and is expected to start operations in June ’25. Braskem Idesa has two high-capacity ethane vessels under construction in China that will allow for scaled transportation. The first vessel in the water is undergoing testing for delivery in January ’25.

While Pemex has a 30 Mb/d ethane commitment to Braskem Idesa, the rest of the 15 Mb/d or more of ethane required to operate the plant at capacity will likely be sourced by EPD’s Neches River or Energy Transfer’s (ET) Nederland export facilities. – Rob Wilson, CFA Tickers: ET, EPD.

Year-End Sale! Sign up for the Macro S&D

We’re holding a sale on our Macro S&D monthly and yearly subscriptions to close out 2024. Buy online and gain access to our monthly Macro Supply & Demand and LNG Tracker & Export Stack, as well as our archived reports and data sets from previous months. The Macro connects producers through processing to pipelines, for a complete value chain analysis by basin. Gain a comprehensive macro-view with visibility into micro constraints and relationships. Access to our Macro Supply & Demand includes a monthly macro report, balanced and unbalanced data sets, LNG export data set, and three dashboards in Energy Data Studio to customize your view. Learn more here.

Request the Dirty Little Secrets 2025 Written Report

A full written report will be available in January for the 2025 Dirty Little Secrets. This report will go beyond the webinar discussions to provide a deeper analysis of the topics covered. Learn how commodities are intertwined and identify opportunities for profit from market dislocations. Request a copy of the Dirty Little Secrets report.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.