Executive Summary: Rigs: The total US rig count increased by 2 during the week of March 30 to 573. Infrastructure: Keystone Pipeline suffered another oil spill that could prove costly for South Bow (SOBO), which no longer has the financial cushion of TC Energy’s (TRP) natural gas assets to absorb disruptions to Keystone service. Storage: East Daley expects a 1,225 Mbbl injection into commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending April 11.

Rigs:

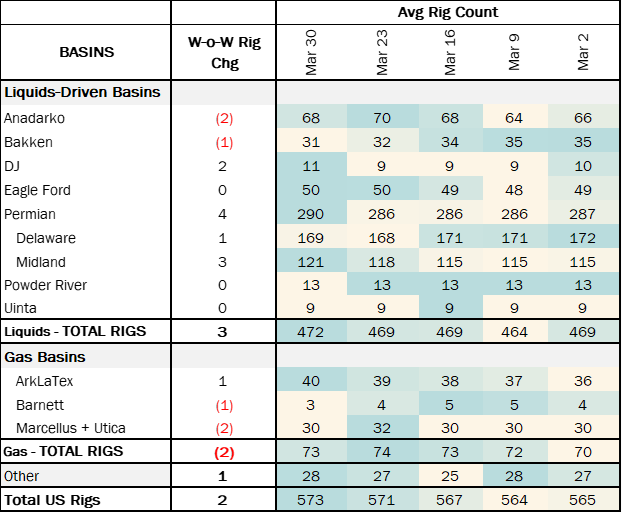

The total US rig count increased by 2 during the week of March 30 to 573. Liquids-driven basins increased by 3 W-o-W to 472.

- Permian (+4):

- Midland (+3): SOGC, LLC (+1), DE Central Operating, LLC (+2)

- Delaware (+1): Matador Resources

- DJ (+2): Creek Road Miners, Inc, Centennial Petroleum, Inc

- Anadarko (-2): Wavetech Helium, Inc, Grand Mesa Operating Co

- Bakken (-1): Silver Hill Energy

Infrastructure:

Keystone Pipeline suffered another oil spill that could prove costly for South Bow (SOBO), which no longer has the financial cushion of TC Energy’s (TRP) natural gas assets to absorb disruptions to Keystone service.

Last Tuesday (April 8), SOBO reported a ~3.5 Mbbl spill on its Keystone Pipeline at Milepost 171 near Fort Ransom, ND. The company said it shut down the pipeline and has contained the release.

Keystone’s stability has been a primary concern for investors. The pipeline has reported numerous leaks since starting operations in 2010. The most recent spill occurred in December ’22, when 14 Mbbl seeped into land and waterways in Washington County, KS.

That incident was an expensive setback for TRP, the former Keystone owner and operator. TRP saw a $72MM decline in liquids revenue from 3Q22 to 4Q22 and incurred ~$480MM in clean-up costs, according to EDA’s Financial Blueprint Models. The spill idled the line for 21 days, dropping quarterly throughput from ~600 Mb/d to ~524 Mb/d. The impacts also carried over to 1Q23 as reported liquids revenue dropped to $398MM (-$57MM Q-o-Q).

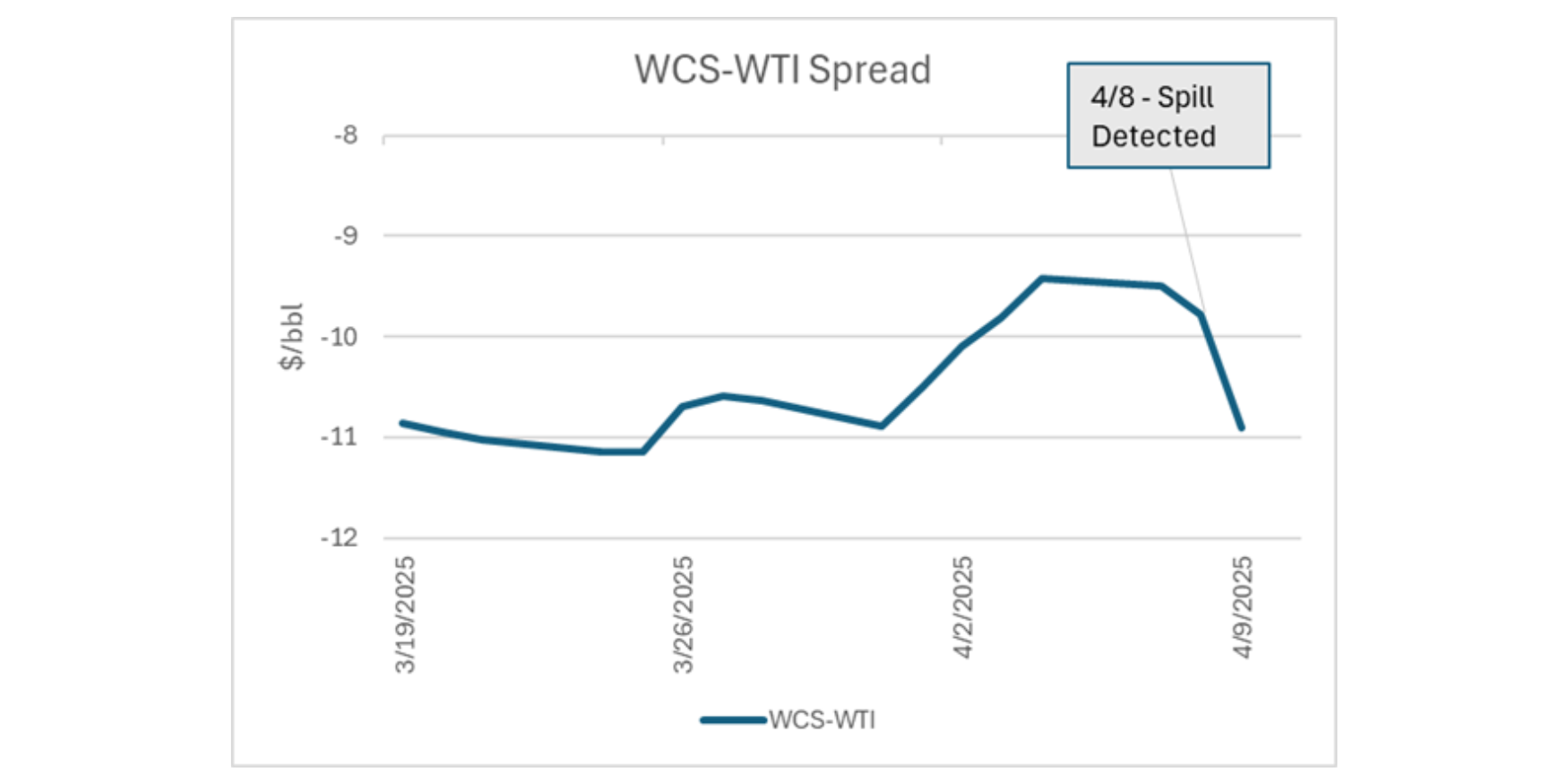

East Daley covered the pricing impact from the last major Keystone spill in 2022, and we will be monitoring impacts to the Western Canadian Select (WCS) – WTI price spread during the latest shutdown. On April 9, the second day of the outage, the WCS-WTI spread widened back toward -$11/bbl as WCS prices weakened (see figure above).

SOBO’s spinoff from TRP in 4Q24 saddled it with $5.8B in long-term debt, resulting in a net debt-to-EBITDA ratio of 4.5x. The company aims to decrease its leverage and increase its shareholder dividend over time. However, the recent spill will hinder SOBO’s progress as free cash flow is diverted to additional maintenance and remediation costs.

Storage:

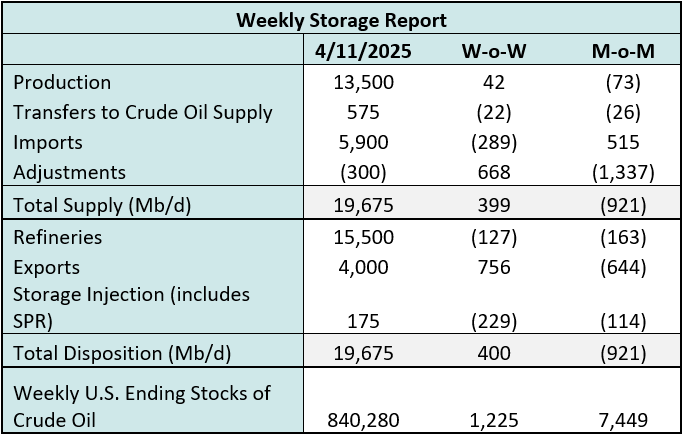

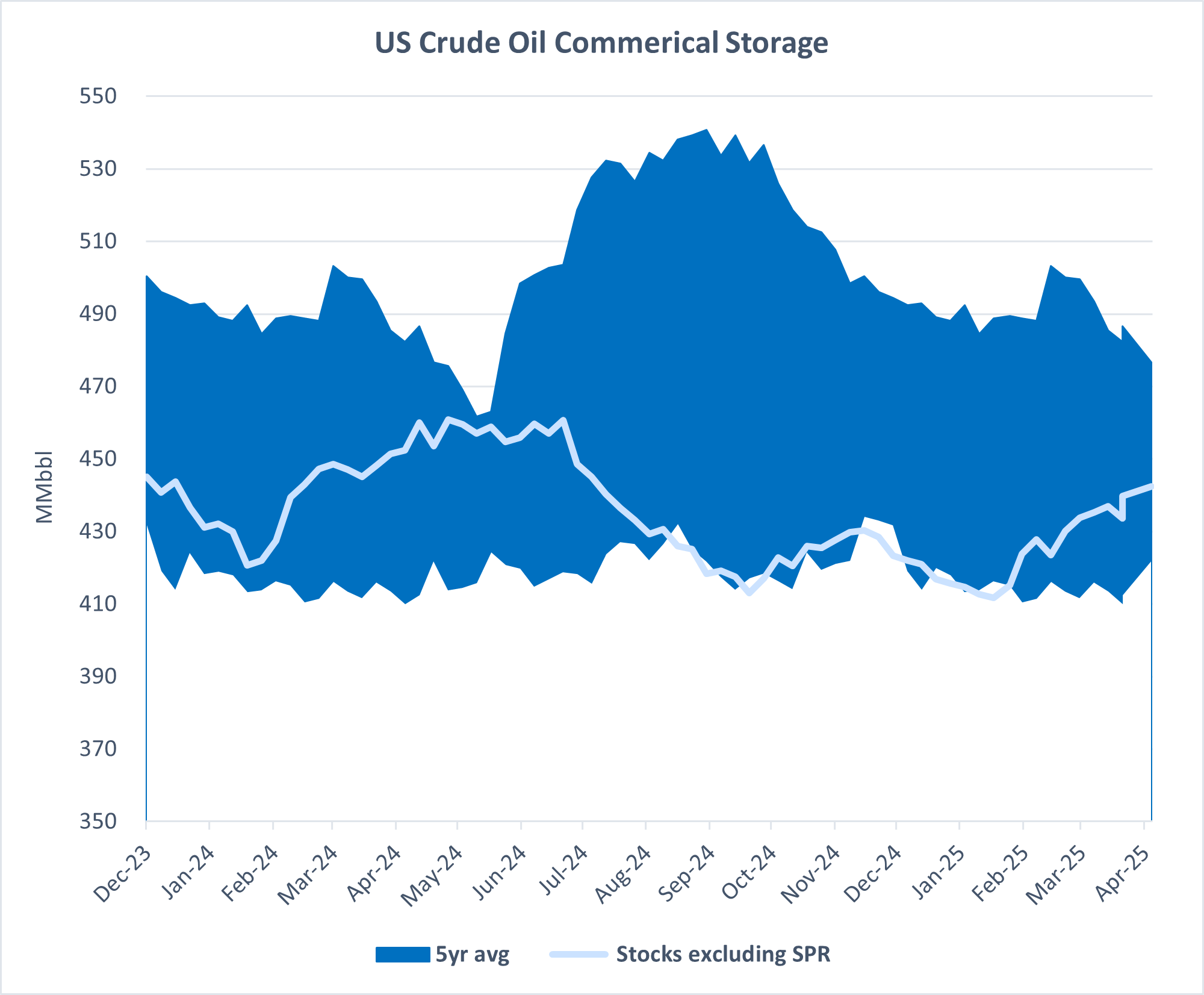

East Daley expects a 1,225 Mbbl injection into commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending April 11. We expect total US stocks, including the SPR, will close at 840 MMbbl.

The US natural gas pipeline sample, a proxy for change in oil production, increased 1.13% W-o-W across all liquids-focused basins. Samples increased 7.71% in the Eagle Ford, 2.16% in the Williston and decreased 0.68% in the Permian Basins. The Rockies and the Gulf of Mexico have a high correlation between gas volumes and crude oil volumes, whereas the Permian and Eagle Ford basins correlation is less than 45%.

We expect US crude production to be 13.5 MMb/d. According to US bill of lading data, US crude imports decreased to 5.9 MMb/d. More than 60% of the supply originated from Canadian pipelines and vessels into the US, with the remainder largely coming from vessels carrying crude from Mexico and Venezuela.

As of April 11 , there was ~1,130 Mb/d of refining capacity offline, including downtime for planned and unplanned maintenance. EDA expects gross crude input into refineries to increase, coming in at 15.5 MMb/d.

Vessel traffic monitored by EDA along the Gulf Coast increased W-o-W. There were 32 vessels loaded for the week ending April 11 and 22 the prior week. EDA expects US exports to be 4.0 MMb/d.

The SPR awarded contracts for 6.0 MMbbl to be delivered To Choctaw February –May 2025. The SPR has 397 MMbbl in storage as of April 4, 2025.

Regulatory and Tariffs:

Presented by ARBO

Tariffs:

Marketlink, LLC. The actual temporary volume incentive rates were extended, unchanged, through May 31, 2025. FERC No 2.86.0 IS25-276 (filed March 25, 2025) Effective May 1, 2025.

Seaway Crude Pipeline Company, LLC The temporary incentive rates were extended, unchanged, through April 30, 2025. FERC No 2.94.0 IS25-277 (filed March 28, 2025) Effective April 1, 2025.

The above information is provided by ARBO’s Oil Pipeline Tariff Monitor. For more information on regulatory proceedings or tariff rates, please contact please contact Corey Brill via email at [email protected] or phone at 202-505-5296. https://www.goarbo.com/